Financial Solutions for International Clients

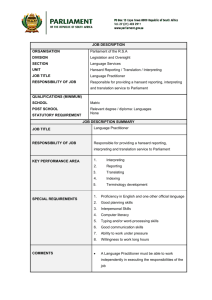

advertisement