Limiano, the cheese that is part of the Family

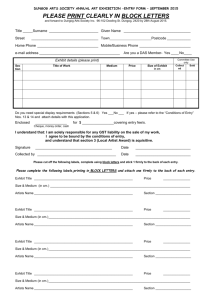

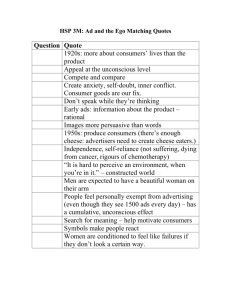

advertisement