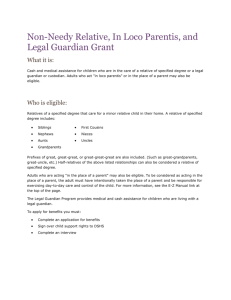

Guardian Plan Summary

advertisement

COLUMBIA COLLEGE Dental Benefit Summary Group Number: 00463298 About Your Benefits: A visit to your dentist can help you keep a great smile and prevent many health issues. But dental care can be costly and you can be faced with unforeseen expenses. Did you know, a crown can cost as much as $1,4001? Guardian dental insurance will help you pay for it. With access to one of the largest network of dental providers in the country, who agreed to charge negotiated fees for their services of up to 30% less than average charges in the same community, you will benefit from lower out-of-pocket costs, quality care from screened and reviewed dentist, no claim forms to file, and excellent customer service. Enroll today and smile next time you see your dentist! 1 http://health.costhelper.com/dental-crown.html. With your PPO plan, you can visit any dentist; but you pay less out-of-pocket when you choose a PPO dentist. Your Dental Plan PPO Your Network is DentalGuard Preferred Calendar year deductible Individual Family limit Waived for In-Network Out-of-Network $50 $50 3 per family Preventive Preventive Charges covered for you (co-insurance) Preventive Care Basic Care Major Care Orthodontia In-Network 100% 80% 50% 50% Out-of-Network 100% 80% 50% 50% Annual Maximum Benefit $1000 $1000 Maximum Rollover Rollover Threshold Rollover Amount Rollover In-network Amount Rollover Account Limit Yes $500 $250 $350 $1000 Lifetime Orthodontia Maximum $1500 Dependent Age Limits Planholder Determines Benefit information illustrated within this material reflects the plan covered by Guardian as of 11/05/2015 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 1 A Sample of Services Covered by Your Plan: Preventive Care Cleaning (prophylaxis) Frequency: Fluoride Treatments Limits: Oral Exams Sealants (per tooth) X-rays PPO Plan pays (on average) In-network Out-of-network 100% 100% Once Every 6 Months 100% 100% Under Age 14 100% 100% 100% 100% 100% 100% Basic Care Fillings‡ 80% Perio Surgery Periodontal Maintenance Frequency: 80% 80% Root Canal Scaling & Root Planing (per quadrant) Simple Extractions Surgical Extractions 80% 80% 80% 80% 80% 80% 80% Once Every 6 Months (Enhanced) 80% 80% 80% 80% Major Care Anesthesia* 50% 50% Bridges and Dentures 50% 50% Dental Implants 50% 50% Inlays, Onlays, Veneers** 50% 50% Repair & Maintenance of 50% 50% Crowns, Bridges & Dentures Single Crowns 50% 50% Orthodontia Orthodontia 50% 50% Limits: Adults & Child(ren) This is only a partial list of dental services. Your certificate of benefits will show exactly what is covered and excluded. **For PPO and or Indemnity members, Crowns, Inlays, Onlays and Labial Veneers are covered only when needed because of decay or injury or other pathology when the tooth cannot be restored with amalgam or composite filing material. When Orthodontia coverage is for "Child(ren)" only, the orthodontic appliance must be placed prior to the age limit set by your plan; If full-time status is required by your plan in order to remain insured after a certain age; then orthodontic maintenance may continue as long as full-time student status is maintained. If Orthodontia coverage is for "Adults and Child(ren)" this limitation does not apply. The total number of cleanings and periodontal maintenance procedures are combined in a 12 month period. *General Anesthesia – restrictions apply. ‡For PPO and or Indemnity members, Fillings – restrictions may apply to composite fillings. This handout is for illustrative purposes only and is an approximation. If any discrepancies between this handout and your paycheck stub exist, your paycheck stub prevails. Manage Your Benefits: Find A Dentist: Go to www.GuardianAnytime.com to access secure information about your Guardian benefits including access to an image of your ID Card. Your on-line account will be set up within 30 days after your plan effective date.. Visit www.GuardianAnytime.com Click on “Find A Provider”; You will need to know your plan and dental network, which can be found on the first page of your dental benefit summary. EXCLUSIONS AND LIMITATIONS n Important Information about Guardian’s DentalGuard Indemnity and DentalGuard Preferred PPO plans: This policy provides dental insurance only. Coverage is limited to those charges that are necessary to prevent, diagnose or treat dental disease, defect, or injury. Deductibles apply. The plan does not pay for: oral hygiene services (except as covered under preventive services), orthodontia (unless expressly provided for), cosmetic or experimental treatments (unless they are expressly provided for), any treatments to the extent benefits are payable by any other payor or for which no charge is made, prosthetic devices unless certain conditions are met, and services ancillary to surgical treatment. The plan limits benefits for diagnostic consultations and for preventive, restorative, endodontic, periodontic, and prosthodontic services. The services, exclusions and limitations listed above do not constitute a contract and are a summary only. The Guardian plan documents are the final arbiter of coverage. Contract # GP-1-DG2000 et al. n PPO and or Indemnity Special Limitation: Teeth lost or missing before a covered person becomes insured by this plan. A covered person may have one or more congenitally missing teeth or have lost one or more teeth before he became insured by this plan. We won’t pay for a prosthetic device which replaces such teeth unless the device also replaces one or more natural teeth lost or extracted after the covered person became insured by this plan. R3 – DG2000 2 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Dental Maximum Rollover Save Your Unused Claims Dollars For When You Need Them Most Guardian will roll over a portion of your unused annual maximum into your personal Maximum Rollover Account (MRA). If you reach your Plan Annual Maximum in future years, you can use money from your MRA. To qualify for an MRA, you must have a paid claim (not just a visit) and must not have exceeded the paid claims threshold during the benefit year. Your MRA may not exceed the MRA limit. You can view your annual MRA statement detailing your account and those of your dependents on www.GuardianAnytime.com. Please note that actual maximum limitations and thresholds vary by plan. Your plan may vary from the one used below as an example to illustrate how the Maximum Rollover functions. Plan Annual Maximum* $1000 Maximum claims reimbursement Threshold Maximum Rollover Amount $500 $250 Claims amount that determines rollover eligibility Additional dollars added to Plan Annual Maximum for future years In-Network Only Rollover Amount $350 Maximum Rollover Account Limit $1000 Additional dollars added to Plan Annual Maximum for future years if only in-network providers were used during the benefit year Plan Annual Maximum plus Maximum Rollover cannot exceed $2,000 in total * If a plan has a different annual maximum for PPO benefits vs. non-PPO benefits, ($1500 PPO/$1000 non-PPO for example) the non-PPO maximum determines the Maximum Rollover plan. Heres how the benefits work: YEAR ONE: Jane starts with a $1,000 Plan Annual Maximum. She submits $150 in dental claims. Since she did not reach the $500 Threshold, she receives a $250 rollover that will be applied to Year Two. YEAR TWO: Jane now has an increased Plan Annual Maximum of $1,250. This year, she submits $50 in claims and receives an additional $250 rollover added to her Plan Annual Maximum. YEAR THREE: Jane now has an increased Plan Annual Maximum of $1,500. This year, she submits $1,200 in claims. All claims are paid due to the amount accumulated in her Maximum Rollover Account. YEAR FOUR: Janes Plan Annual Maximum is $1,300 ($1,000 Plan Annual Maximum + $300 remaining in her Maximum Rollover Account). For Overview of your Dental Benefits, please see About Your Benefit Section of this Enrollment Booklet. NOTES: You and your insured dependents maintain separate MRAs based on your own claim activity. Each MRA may not exceed the MRA limit. Cases on either a calendar year or policy year accumulation basis qualify for the Maximum Rollover feature. For calendar year cases with an effective date in October, November or December, the Maximum Rollover feature starts as of the first full benefit year. For example, if a plan starts in November of 2013, the claim activity in 2014 will be used and applied to MRAs for use in 2015. Under either benefit year set up (calendar year or policy year), Maximum Rollover for new entrants joining with 3 months or less remaining in the benefit year, will not begin until the start of the next full benefit year. Maximum Rollover is deferred for members who have coverage of Major services deferred. For these members, Maximum Rollover starts when coverage of Major services starts, or the start of the next benefit year if 3 months or less remain until the next benefit year. (Actual eligibility timeframe may vary. See your Plan Details for the most accurate information.) Guardian's Dental Insurance is underwritten and issued by The Guardian Life Insurance Company of America or its subsidiaries, New York, NY. Products are not available in all states. Policy limitations and exclusions apply. Optional riders and/or features may incur additional costs. Plan documents are the final arbiter of coverage. Policy Form #GP-1-DG2000, et al. 3 4 Finding a dentist or vision care provider is easy Go online it just takes minutes! The best way to save money through your dental or vision plan is by seeing a provider in your plans network. Guardians Find a Provider site makes it easy for you to search for a dental or vision provider meets your needs. Guardians Find a Provider site is available to you 24 hours a day, 7 days a week. Here are just a few things you can do online: • Customize your search by specialty, languages spoken and more • Get side-by-side comparisons of provider information (ie. office status, distance) • Create a quick-list of favorite providers for easy reference online • Get maps and directions to a providers office location • View your results online or have them faxed or emailed to you • Save your search criteria for easy access when you revisit the site • Create a customized provider directory • Nominate a dentist to be included in a network Just go to www.GuardianAnytime.com and click on Find a Provider. You can also find a provider on the go from your smart phone simply download our app. 5 THIS PAGE INTENTIONALLY LEFT BLANK 6 COLUMBIA COLLEGE Vision Benefit Summary Group Number: 00463298 About Your Benefits: Eye care is a vital component of a healthy lifestyle. With vision insurance, having regular exams and purchasing contacts or glasses is simple and affordable. The coverage is inexpensive, yet the benefits can be significant! Guardian provides rich, flexible plans that allow you to safeguard your health while saving you money. Review your plan options and see why vision insurance may be a great benefit for you. Visit any doctor with your Full Feature plan, but save by visiting any of the 50,000+ locations in the nation's largest vision network. Your Vision Plan Full Feature‡ Your Network is VSP Network Signature Plan Your Semi-monthly premium $ 6.66 You and spouse/domestic partner $ 10.65 You and child(ren) $ 10.88 You, spouse/domestic partner and child(ren) $ 17.53 Copay Copay (applies to first service provided; exams or materials) $ 20 Sample of Covered Services You pay (after copay if applicable): In-network Out-of-network Eye Exams $0 Amount over $50 Single Vision Lenses $0 Amount over $48 Lined Bifocal Lenses $0 Amount over $67 Lined Trifocal Lenses $0 Amount over $86 Lenticular Lenses $0 Amount over $126 Frames 80% of amount over $130 Amount over $48 Contact Lenses (Elective) Amount over $130 Amount over $130 Contact Lenses (Medically Necessary) $0 Amount over $210 Contact Lenses (Evaluation and fitting) 15% off UCR No discounts Cosmetic Extras Avg. 30% off retail price No discounts Glasses (Additional pair of frames and lenses) 20% off retail price^ No discounts Laser Correction Surgery Discount Up to 15% off the usual charge or 5% No discounts off promotional price Service Frequencies Exams Every calendar year Lenses (for glasses or contact lenses)‡‡ Every calendar year Frames Every calendar year Network discounts (cosmetic extras, glasses and contact lens professional service) Limitless within 12 months of exam. Dependent Age Limits 26 ‡Please note your plan has a two year lock in/out period. ‡‡Benefit includes coverage for glasses or contact lenses, not both. Benefit information illustrated within this material reflects the plan covered by Guardian as of 11/05/2015 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 7 This is only a partial list of vision services. Your certificate of benefits will show exactly what is covered and excluded. ^ For the discount to apply your purchase must be made within 12 months of the eye exam. In addition Full-Feature plans offer 30% off additional prescription glasses and nonprescription sunglasses, including lens options, if purchased on the same day as the eye exam from the same VSP doctor who provided the exam. For VSP, only charges for an initial purchase can be used toward the material allowance. Any unused balance remaining after the initial purchase cannot be banked for future use. The only exception would be if a member purchases contact lenses from an out of network provider, members can use the balance towards additional contact lenses within the same benefit period. This handout is for illustrative purposes only and is an approximation. If any discrepancies between this handout and your paycheck stub exist, your paycheck stub prevails. Manage Your Benefits: Find A Vision Provider Go to www.GuardianAnytime.com to access secure information about your Guardian benefits including access to an image of your ID Card. Your on-line account will be set up within 30 days after your plan effective date. Visit www.GuardianAnytime.com Click on “Find A Provider”; You will need to know your plan and vision network, which can be found on the first page of your vision benefit summary. EXCLUSIONS AND LIMITATIONS Important Information: This policy provides vision care limited benefits health insurance only. It does not provide basic hospital, basic medical or major medical insurance as defined by the New York State Insurance Department. Coverage is limited to those charges that are necessary for a routine vision examination. Co-pays apply. The plan does not pay for: orthoptics or vision training and any associated supplemental testing; medical or surgical treatment of the eye; and eye examination or corrective eyewear required by an employer as a condition of employment; replacement of lenses and frames that are furnished under this plan, which are lost or broken (except at normal intervals when services are otherwise available or a warranty exists). The plan limits benefits for blended lenses, oversized lenses, photochromic lenses, tinted lenses, progressive multifocal lenses, coated or laminated lenses, a frame that exceeds plan allowance, cosmetic lenses; U-V protected lenses and optional cosmetic processes. The services, exclusions and limitations listed above do not constitute a contract and are a summary only. The Guardian plan documents are the final arbiter of coverage. Contract #GP-1-VSN-96-VIS et al. Laser Correction Surgery: On average, 15% off the usual charge or 5% off promotional price for vision laser surgery. Members’ out-of-pocket costs are limited to $1,800 per eye for LASIK and $1,500 per eye for PRK. Laser surgery is not an insured benefit. The surgery is available at a discounted fee. The covered person must pay the entire discounted fee. In addition, the laser surgery discount may not be available in all states. 8 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 COLUMBIA COLLEGE Life Benefit Summary Group Number: 00463298 About Your Benefits: Your family depends on you in many ways and you’ve worked hard to ensure their financial security. But if something happened to you, will your family be protected? Will your loved ones be able to stay in their home, pay bills, and prepare for the future. Life insurance provides a financial benefit that your family can depend on. And getting it at work is easier, more convenient and more affordable than doing it on your own. If you have financial dependents- a spouse, children or aging parents, having life insurance is a responsible and a smart decision. Enroll today to secure their future! What Your Benefits Cover: BASIC LIFE VOLUNTARY TERM LIFE Employee Benefit Your employer provides Basic Life Coverage for all full time employees in the amount of 200% of your annual salary, to a maximum of $250,000 with a minimum amount of $10,000. $10,000 increments to a maximum of $500,000. See Cost Illustration page for details. Accidental Death and Dismemberment Your Basic Life coverage includes Accidental Death and Dismemberment coverage equal to one times the employee's life benefits. Employee, Spouse & Child(ren) coverage. Maximum 1 times life amount. Spouse/Domestic Partner‡ Benefit N/A $5,000 increments to a maximum of $250,000. See Cost Illustration page for details. Child Benefit N/A Your dependent children age 14 days to 26 years. You may elect one of the following benefit options: $1,000, $5,000, $10,000. Subject to state limits. See Cost Illustration page for details. Guarantee Issue: The ‘guarantee’ means you are not required to answer health questions to qualify for coverage up to and including the specified amount, when you sign up for coverage during the initial enrollment period. Underwriting may be required, depending on amount and/or age We Guarantee Issue coverage up to: Employee $150,000. Spouse $50,000. Dependent children $10,000. Premiums Covered by your company if you meet eligibility requirements Increase on plan anniversary after you enter next five-year age group Benefit information illustrated within this material reflects the plan covered by Guardian as of 11/05/2015 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 9 BASIC LIFE VOLUNTARY TERM LIFE Portability: Allows you to take your coverage with you if you terminate employment. Yes, with age and other restrictions, including evidence of insurability Yes, with age and other restrictions Conversion: Allows you to continue your coverage after your group plan has terminated. Yes, with restrictions; see certificate of benefits Yes, with restrictions; see certificate of benefits Accelerated Life Benefit: A lump sum benefit is paid to you if you are diagnosed with a terminal condition, as defined by the plan. Yes Yes Waiver of Premiums: Premium will not need to be paid if you are totally disabled. For employees disabled prior to age 60, with premiums waived until age 65, if conditions are met For employees disabled prior to age 60, with premiums waived until age 65, if conditions met Benefit Reductions: Benefits are reduced by a certain percentage as an employee ages. 50% at age 70 35% at age 65, 60% at age 70, 75% at age 75, 85% at age 80 Subject to coverage limits Spouse coverage terminates at age 70. Manage Your Benefits: Go to www.GuardianAnytime.com to access secure information about your Guardian benefits. Your on-line account will be set up within 30 days after your plan effective date. 10 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Voluntary Life Cost Illustration: To determine the most appropriate level of coverage, as a rule of thumb, you should consider about 6 - 10 times your annual income, factoring in projected costs to help maintain your family’s current life style. To help you assess your needs, you can also go to Guardian Anytime and use our Life Insurance Explorer Tool. Policy Election Amount Employee < 30 Semi-monthly premiums displayed. Cost of AD&D is included. Policy Election Cost Per Age Bracket 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69† $20,000 Preferred Standard $1.20 $1.80 $1.30 $1.90 $1.60 $2.40 $2.30 $3.60 $3.10 $6.20 $4.80 $9.70 $8.00 $17.20 $12.30 $20.90 $19.10 $33.30 $30,000 Preferred Standard $1.80 $2.70 $1.95 $2.85 $2.40 $3.60 $3.45 $5.40 $4.65 $9.30 $7.20 $14.55 $12.00 $25.80 $18.45 $31.35 $28.65 $49.95 $40,000 Preferred Standard $2.40 $3.60 $2.60 $3.80 $3.20 $4.80 $4.60 $7.20 $6.20 $12.40 $9.60 $19.40 $16.00 $34.40 $24.60 $41.80 $38.20 $66.60 $50,000 Preferred Standard $3.00 $4.50 $3.25 $4.75 $4.00 $6.00 $5.75 $9.00 $7.75 $15.50 $12.00 $24.25 $20.00 $43.00 $30.75 $52.25 $47.75 $83.25 $60,000 Preferred Standard $3.60 $5.40 $3.90 $5.70 $4.80 $7.20 $6.90 $10.80 $9.30 $18.60 $14.40 $29.10 $24.00 $51.60 $36.90 $62.70 $57.30 $99.90 $70,000 Preferred Standard $4.20 $6.30 $4.55 $6.65 $5.60 $8.40 $8.05 $12.60 $10.85 $21.70 $16.80 $33.95 $28.00 $60.20 $43.05 $73.15 $66.85 $116.55 $80,000 Preferred Standard $4.80 $7.20 $5.20 $7.60 $6.40 $9.60 $9.20 $14.40 $12.40 $24.80 $19.20 $38.80 $32.00 $68.80 $49.20 $83.60 $76.40 $133.20 $90,000 Preferred Standard $5.40 $8.10 $5.85 $8.55 $7.20 $10.80 $10.35 $16.20 $13.95 $27.90 $21.60 $43.65 $36.00 $77.40 $55.35 $94.05 $85.95 $149.85 $100,000 Preferred Standard $6.00 $9.00 $6.50 $9.50 $8.00 $12.00 $11.50 $18.00 $15.50 $31.00 $24.00 $48.50 $40.00 $86.00 $61.50 $104.50 $95.50 $166.50 $110,000 Preferred Standard $6.60 $9.90 $7.15 $10.45 $8.80 $13.20 $12.65 $19.80 $17.05 $34.10 $26.40 $53.35 $44.00 $94.60 $67.65 $114.95 $105.05 $183.15 $120,000 Preferred Standard $7.20 $10.80 $7.80 $11.40 $9.60 $14.40 $13.80 $21.60 $18.60 $37.20 $28.80 $58.20 $48.00 $103.20 $73.80 $125.40 $114.60 $199.80 $130,000 Preferred Standard $7.80 $11.70 $8.45 $12.35 $10.40 $15.60 $14.95 $23.40 $20.15 $40.30 $31.20 $63.05 $52.00 $111.80 $79.95 $135.85 $124.15 $216.45 $140,000 Preferred Standard $8.40 $12.60 $9.10 $13.30 $11.20 $16.80 $16.10 $25.20 $21.70 $43.40 $33.60 $67.90 $56.00 $120.40 $86.10 $146.30 $133.70 $233.10 $150,000 Preferred Standard $9.00 $13.50 $9.75 $14.25 $12.00 $18.00 $17.25 $27.00 $23.25 $46.50 $36.00 $72.75 $60.00 $129.00 $92.25 $156.75 $143.25 $249.75 $160,000 Preferred Standard $9.60 $14.40 $10.40 $15.20 $12.80 $19.20 $18.40 $28.80 $24.80 $49.60 $38.40 $77.60 $64.00 $137.60 $98.40 $167.20 $152.80 $266.40 $170,000 Preferred Standard $10.20 $15.30 $11.05 $16.15 $13.60 $20.40 $19.55 $30.60 $26.35 $52.70 $40.80 $82.45 $68.00 $146.20 $104.55 $177.65 $162.35 $283.05 $180,000 Preferred Standard $10.80 $16.20 $11.70 $17.10 $14.40 $21.60 $20.70 $32.40 $27.90 $55.80 $43.20 $87.30 $72.00 $154.80 $110.70 $188.10 $171.90 $299.70 $190,000 Preferred Standard $11.40 $17.10 $12.35 $18.05 $15.20 $22.80 $21.85 $34.20 $29.45 $58.90 $45.60 $92.15 $76.00 $163.40 $116.85 $198.55 $181.45 $316.35 $200,000 Preferred Standard $12.00 $18.00 $13.00 $19.00 $16.00 $24.00 $23.00 $36.00 $31.00 $62.00 $48.00 $97.00 $80.00 $172.00 $123.00 $209.00 $191.00 $333.00 $210,000 Preferred Standard $12.60 $18.90 $13.65 $19.95 $16.80 $25.20 $24.15 $37.80 $32.55 $65.10 $50.40 $101.85 $84.00 $180.60 $129.15 $219.45 $200.55 $349.65 $220,000 Preferred Standard $13.20 $19.80 $14.30 $20.90 $17.60 $26.40 $25.30 $39.60 $34.10 $68.20 $52.80 $106.70 $88.00 $189.20 $135.30 $229.90 $210.10 $366.30 $230,000 Preferred Standard $13.80 $20.70 $14.95 $21.85 $18.40 $27.60 $26.45 $41.40 $35.65 $71.30 $55.20 $111.55 $92.00 $197.80 $141.45 $240.35 $219.65 $382.95 11 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Voluntary Life Cost Illustration continued < 30 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69† $240,000 Preferred Standard $14.40 $21.60 $15.60 $22.80 $19.20 $28.80 $27.60 $43.20 $37.20 $74.40 $57.60 $116.40 $96.00 $206.40 $147.60 $250.80 $229.20 $399.60 $250,000 Preferred Standard $15.00 $22.50 $16.25 $23.75 $20.00 $30.00 $28.75 $45.00 $38.75 $77.50 $60.00 $121.25 $100.00 $215.00 $153.75 $261.25 $238.75 $416.25 $260,000 Preferred Standard $15.60 $23.40 $16.90 $24.70 $20.80 $31.20 $29.90 $46.80 $40.30 $80.60 $62.40 $126.10 $104.00 $223.60 $159.90 $271.70 $248.30 $432.90 $270,000 Preferred Standard $16.20 $24.30 $17.55 $25.65 $21.60 $32.40 $31.05 $48.60 $41.85 $83.70 $64.80 $130.95 $108.00 $232.20 $166.05 $282.15 $257.85 $449.55 $280,000 Preferred Standard $16.80 $25.20 $18.20 $26.60 $22.40 $33.60 $32.20 $50.40 $43.40 $86.80 $67.20 $135.80 $112.00 $240.80 $172.20 $292.60 $267.40 $466.20 $290,000 Preferred Standard $17.40 $26.10 $18.85 $27.55 $23.20 $34.80 $33.35 $52.20 $44.95 $89.90 $69.60 $140.65 $116.00 $249.40 $178.35 $303.05 $276.95 $482.85 $300,000 Preferred Standard $18.00 $27.00 $19.50 $28.50 $24.00 $36.00 $34.50 $54.00 $46.50 $93.00 $72.00 $145.50 $120.00 $258.00 $184.50 $313.50 $286.50 $499.50 $310,000 Preferred Standard $18.60 $27.90 $20.15 $29.45 $24.80 $37.20 $35.65 $55.80 $48.05 $96.10 $74.40 $150.35 $124.00 $266.60 $190.65 $323.95 $296.05 $516.15 $320,000 Preferred Standard $19.20 $28.80 $20.80 $30.40 $25.60 $38.40 $36.80 $57.60 $49.60 $99.20 $76.80 $155.20 $128.00 $275.20 $196.80 $334.40 $305.60 $532.80 $330,000 Preferred Standard $19.80 $29.70 $21.45 $31.35 $26.40 $39.60 $37.95 $59.40 $51.15 $102.30 $79.20 $160.05 $132.00 $283.80 $202.95 $344.85 $315.15 $549.45 $340,000 Preferred Standard $20.40 $30.60 $22.10 $32.30 $27.20 $40.80 $39.10 $61.20 $52.70 $105.40 $81.60 $164.90 $136.00 $292.40 $209.10 $355.30 $324.70 $566.10 $350,000 Preferred Standard $21.00 $31.50 $22.75 $33.25 $28.00 $42.00 $40.25 $63.00 $54.25 $108.50 $84.00 $169.75 $140.00 $301.00 $215.25 $365.75 $334.25 $582.75 $360,000 Preferred Standard $21.60 $32.40 $23.40 $34.20 $28.80 $43.20 $41.40 $64.80 $55.80 $111.60 $86.40 $174.60 $144.00 $309.60 $221.40 $376.20 $343.80 $599.40 $370,000 Preferred Standard $22.20 $33.30 $24.05 $35.15 $29.60 $44.40 $42.55 $66.60 $57.35 $114.70 $88.80 $179.45 $148.00 $318.20 $227.55 $386.65 $353.35 $616.05 $380,000 Preferred Standard $22.80 $34.20 $24.70 $36.10 $30.40 $45.60 $43.70 $68.40 $58.90 $117.80 $91.20 $184.30 $152.00 $326.80 $233.70 $397.10 $362.90 $632.70 $390,000 Preferred Standard $23.40 $35.10 $25.35 $37.05 $31.20 $46.80 $44.85 $70.20 $60.45 $120.90 $93.60 $189.15 $156.00 $335.40 $239.85 $407.55 $372.45 $649.35 $400,000 Preferred Standard $24.00 $36.00 $26.00 $38.00 $32.00 $48.00 $46.00 $72.00 $62.00 $124.00 $96.00 $194.00 $160.00 $344.00 $246.00 $418.00 $382.00 $666.00 $410,000 Preferred Standard $24.60 $36.90 $26.65 $38.95 $32.80 $49.20 $47.15 $73.80 $63.55 $127.10 $98.40 $198.85 $164.00 $352.60 $252.15 $428.45 $391.55 $682.65 $420,000 Preferred Standard $25.20 $37.80 $27.30 $39.90 $33.60 $50.40 $48.30 $75.60 $65.10 $130.20 $100.80 $203.70 $168.00 $361.20 $258.30 $438.90 $401.10 $699.30 $430,000 Preferred Standard $25.80 $38.70 $27.95 $40.85 $34.40 $51.60 $49.45 $77.40 $66.65 $133.30 $103.20 $208.55 $172.00 $369.80 $264.45 $449.35 $410.65 $715.95 $440,000 Preferred Standard $26.40 $39.60 $28.60 $41.80 $35.20 $52.80 $50.60 $79.20 $68.20 $136.40 $105.60 $213.40 $176.00 $378.40 $270.60 $459.80 $420.20 $732.60 $450,000 Preferred Standard $27.00 $40.50 $29.25 $42.75 $36.00 $54.00 $51.75 $81.00 $69.75 $139.50 $108.00 $218.25 $180.00 $387.00 $276.75 $470.25 $429.75 $749.25 $460,000 Preferred Standard $27.60 $41.40 $29.90 $43.70 $36.80 $55.20 $52.90 $82.80 $71.30 $142.60 $110.40 $223.10 $184.00 $395.60 $282.90 $480.70 $439.30 $765.90 12 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Voluntary Life Cost Illustration continued < 30 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69† $470,000 Preferred Standard $28.20 $42.30 $30.55 $44.65 $37.60 $56.40 $54.05 $84.60 $72.85 $145.70 $112.80 $227.95 $188.00 $404.20 $289.05 $491.15 $448.85 $782.55 $480,000 Preferred Standard $28.80 $43.20 $31.20 $45.60 $38.40 $57.60 $55.20 $86.40 $74.40 $148.80 $115.20 $232.80 $192.00 $412.80 $295.20 $501.60 $458.40 $799.20 $490,000 Preferred Standard $29.40 $44.10 $31.85 $46.55 $39.20 $58.80 $56.35 $88.20 $75.95 $151.90 $117.60 $237.65 $196.00 $421.40 $301.35 $512.05 $467.95 $815.85 $500,000 Preferred Standard $30.00 $45.00 $32.50 $47.50 $40.00 $60.00 $57.50 $90.00 $77.50 $155.00 $120.00 $242.50 $200.00 $430.00 $307.50 $522.50 $477.50 $832.50 $5,000 Preferred Standard $.30 $.13 $.33 $.48 $.40 $.60 $.58 $.90 $.78 $1.55 $1.20 $2.43 $2.00 $4.30 $3.08 $5.23 $4.78 $8.33 $10,000 Preferred Standard $.60 $.25 $.65 $.95 $.80 $1.20 $1.15 $1.80 $1.55 $3.10 $2.40 $4.85 $4.00 $8.60 $6.15 $10.45 $9.55 $16.65 $15,000 Preferred Standard $.90 $.38 $.98 $1.43 $1.20 $1.80 $1.73 $2.70 $2.33 $4.65 $3.60 $7.28 $6.00 $12.90 $9.23 $15.68 $14.33 $24.98 $20,000 Preferred Standard $1.20 $.50 $1.30 $1.90 $1.60 $2.40 $2.30 $3.60 $3.10 $6.20 $4.80 $9.70 $8.00 $17.20 $12.30 $20.90 $19.10 $33.30 $25,000 Preferred Standard $1.50 $.63 $1.63 $2.38 $2.00 $3.00 $2.88 $4.50 $3.88 $7.75 $6.00 $12.13 $10.00 $21.50 $15.38 $26.13 $23.88 $41.63 $30,000 Preferred Standard $1.80 $.75 $1.95 $2.85 $2.40 $3.60 $3.45 $5.40 $4.65 $9.30 $7.20 $14.55 $12.00 $25.80 $18.45 $31.35 $28.65 $49.95 $35,000 Preferred Standard $2.10 $.88 $2.28 $3.33 $2.80 $4.20 $4.03 $6.30 $5.43 $10.85 $8.40 $16.98 $14.00 $30.10 $21.53 $36.58 $33.43 $58.28 $40,000 Preferred Standard $2.40 $1.00 $2.60 $3.80 $3.20 $4.80 $4.60 $7.20 $6.20 $12.40 $9.60 $19.40 $16.00 $34.40 $24.60 $41.80 $38.20 $66.60 $45,000 Preferred Standard $2.70 $1.13 $2.93 $4.28 $3.60 $5.40 $5.18 $8.10 $6.98 $13.95 $10.80 $21.83 $18.00 $38.70 $27.68 $47.03 $42.98 $74.93 $50,000 Preferred Standard $3.00 $1.25 $3.25 $4.75 $4.00 $6.00 $5.75 $9.00 $7.75 $15.50 $12.00 $24.25 $20.00 $43.00 $30.75 $52.25 $47.75 $83.25 $55,000 Preferred Standard $3.30 $1.38 $3.58 $5.23 $4.40 $6.60 $6.33 $9.90 $8.53 $17.05 $13.20 $26.68 $22.00 $47.30 $33.83 $57.48 $52.53 $91.58 $60,000 Preferred Standard $3.60 $1.50 $3.90 $5.70 $4.80 $7.20 $6.90 $10.80 $9.30 $18.60 $14.40 $29.10 $24.00 $51.60 $36.90 $62.70 $57.30 $99.90 $65,000 Preferred Standard $3.90 $1.63 $4.23 $6.18 $5.20 $7.80 $7.48 $11.70 $10.08 $20.15 $15.60 $31.53 $26.00 $55.90 $39.98 $67.93 $62.08 $108.23 $70,000 Preferred Standard $4.20 $1.75 $4.55 $6.65 $5.60 $8.40 $8.05 $12.60 $10.85 $21.70 $16.80 $33.95 $28.00 $60.20 $43.05 $73.15 $66.85 $116.55 $75,000 Preferred Standard $4.50 $1.88 $4.88 $7.13 $6.00 $9.00 $8.63 $13.50 $11.63 $23.25 $18.00 $36.38 $30.00 $64.50 $46.13 $78.38 $71.63 $124.88 $80,000 Preferred Standard $4.80 $2.00 $5.20 $7.60 $6.40 $9.60 $9.20 $14.40 $12.40 $24.80 $19.20 $38.80 $32.00 $68.80 $49.20 $83.60 $76.40 $133.20 $85,000 Preferred Standard $5.10 $2.13 $5.53 $8.08 $6.80 $10.20 $9.78 $15.30 $13.18 $26.35 $20.40 $41.23 $34.00 $73.10 $52.28 $88.83 $81.18 $141.53 $90,000 Preferred Standard $5.40 $2.25 $5.85 $8.55 $7.20 $10.80 $10.35 $16.20 $13.95 $27.90 $21.60 $43.65 $36.00 $77.40 $55.35 $94.05 $85.95 $149.85 Policy Election Amount Spouse/DP 13 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Voluntary Life Cost Illustration continued < 30 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69† $95,000 Preferred Standard $5.70 $2.38 $6.18 $9.03 $7.60 $11.40 $10.93 $17.10 $14.73 $29.45 $22.80 $46.08 $38.00 $81.70 $58.43 $99.28 $90.73 $158.18 $100,000 Preferred Standard $6.00 $2.50 $6.50 $9.50 $8.00 $12.00 $11.50 $18.00 $15.50 $31.00 $24.00 $48.50 $40.00 $86.00 $61.50 $104.50 $95.50 $166.50 $105,000 Preferred Standard $6.30 $2.63 $6.83 $9.98 $8.40 $12.60 $12.08 $18.90 $16.28 $32.55 $25.20 $50.93 $42.00 $90.30 $64.58 $109.73 $100.28 $174.83 $110,000 Preferred Standard $6.60 $2.75 $7.15 $10.45 $8.80 $13.20 $12.65 $19.80 $17.05 $34.10 $26.40 $53.35 $44.00 $94.60 $67.65 $114.95 $105.05 $183.15 $115,000 Preferred Standard $6.90 $2.88 $7.48 $10.93 $9.20 $13.80 $13.23 $20.70 $17.83 $35.65 $27.60 $55.78 $46.00 $98.90 $70.73 $120.18 $109.83 $191.48 $120,000 Preferred Standard $7.20 $3.00 $7.80 $11.40 $9.60 $14.40 $13.80 $21.60 $18.60 $37.20 $28.80 $58.20 $48.00 $103.20 $73.80 $125.40 $114.60 $199.80 $125,000 Preferred Standard $7.50 $3.13 $8.13 $11.88 $10.00 $15.00 $14.38 $22.50 $19.38 $38.75 $30.00 $60.63 $50.00 $107.50 $76.88 $130.63 $119.38 $208.13 $130,000 Preferred Standard $7.80 $3.25 $8.45 $12.35 $10.40 $15.60 $14.95 $23.40 $20.15 $40.30 $31.20 $63.05 $52.00 $111.80 $79.95 $135.85 $124.15 $216.45 $135,000 Preferred Standard $8.10 $3.38 $8.78 $12.83 $10.80 $16.20 $15.53 $24.30 $20.93 $41.85 $32.40 $65.48 $54.00 $116.10 $83.03 $141.08 $128.93 $224.78 $140,000 Preferred Standard $8.40 $3.50 $9.10 $13.30 $11.20 $16.80 $16.10 $25.20 $21.70 $43.40 $33.60 $67.90 $56.00 $120.40 $86.10 $146.30 $133.70 $233.10 $145,000 Preferred Standard $8.70 $3.63 $9.43 $13.78 $11.60 $17.40 $16.68 $26.10 $22.48 $44.95 $34.80 $70.33 $58.00 $124.70 $89.18 $151.53 $138.48 $241.43 $150,000 Preferred Standard $9.00 $3.75 $9.75 $14.25 $12.00 $18.00 $17.25 $27.00 $23.25 $46.50 $36.00 $72.75 $60.00 $129.00 $92.25 $156.75 $143.25 $249.75 $155,000 Preferred Standard $9.30 $3.88 $10.08 $14.73 $12.40 $18.60 $17.83 $27.90 $24.03 $48.05 $37.20 $75.18 $62.00 $133.30 $95.33 $161.98 $148.03 $258.08 $160,000 Preferred Standard $9.60 $4.00 $10.40 $15.20 $12.80 $19.20 $18.40 $28.80 $24.80 $49.60 $38.40 $77.60 $64.00 $137.60 $98.40 $167.20 $152.80 $266.40 $165,000 Preferred Standard $9.90 $4.13 $10.73 $15.68 $13.20 $19.80 $18.98 $29.70 $25.58 $51.15 $39.60 $80.03 $66.00 $141.90 $101.48 $172.43 $157.58 $274.73 $170,000 Preferred Standard $10.20 $4.25 $11.05 $16.15 $13.60 $20.40 $19.55 $30.60 $26.35 $52.70 $40.80 $82.45 $68.00 $146.20 $104.55 $177.65 $162.35 $283.05 $175,000 Preferred Standard $10.50 $4.38 $11.38 $16.63 $14.00 $21.00 $20.13 $31.50 $27.13 $54.25 $42.00 $84.88 $70.00 $150.50 $107.63 $182.88 $167.13 $291.38 $180,000 Preferred Standard $10.80 $4.50 $11.70 $17.10 $14.40 $21.60 $20.70 $32.40 $27.90 $55.80 $43.20 $87.30 $72.00 $154.80 $110.70 $188.10 $171.90 $299.70 $185,000 Preferred Standard $11.10 $4.63 $12.03 $17.58 $14.80 $22.20 $21.28 $33.30 $28.68 $57.35 $44.40 $89.73 $74.00 $159.10 $113.78 $193.33 $176.68 $308.03 $190,000 Preferred Standard $11.40 $4.75 $12.35 $18.05 $15.20 $22.80 $21.85 $34.20 $29.45 $58.90 $45.60 $92.15 $76.00 $163.40 $116.85 $198.55 $181.45 $316.35 $195,000 Preferred Standard $11.70 $4.88 $12.68 $18.53 $15.60 $23.40 $22.43 $35.10 $30.23 $60.45 $46.80 $94.58 $78.00 $167.70 $119.93 $203.78 $186.23 $324.68 $200,000 Preferred Standard $12.00 $5.00 $13.00 $19.00 $16.00 $24.00 $23.00 $36.00 $31.00 $62.00 $48.00 $97.00 $80.00 $172.00 $123.00 $209.00 $191.00 $333.00 $205,000 Preferred Standard $12.30 $5.13 $13.33 $19.48 $16.40 $24.60 $23.58 $36.90 $31.78 $63.55 $49.20 $99.43 $82.00 $176.30 $126.08 $214.23 $195.78 $341.33 14 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Voluntary Life Cost Illustration continued < 30 30–34 35–39 40–44 45–49 50–54 55–59 60–64 65–69† $210,000 Preferred Standard $12.60 $5.25 $13.65 $19.95 $16.80 $25.20 $24.15 $37.80 $32.55 $65.10 $50.40 $101.85 $84.00 $180.60 $129.15 $219.45 $200.55 $349.65 $215,000 Preferred Standard $12.90 $5.38 $13.98 $20.43 $17.20 $25.80 $24.73 $38.70 $33.33 $66.65 $51.60 $104.28 $86.00 $184.90 $132.23 $224.68 $205.33 $357.98 $220,000 Preferred Standard $13.20 $5.50 $14.30 $20.90 $17.60 $26.40 $25.30 $39.60 $34.10 $68.20 $52.80 $106.70 $88.00 $189.20 $135.30 $229.90 $210.10 $366.30 $225,000 Preferred Standard $13.50 $5.63 $14.63 $21.38 $18.00 $27.00 $25.88 $40.50 $34.88 $69.75 $54.00 $109.13 $90.00 $193.50 $138.38 $235.13 $214.88 $374.63 $230,000 Preferred Standard $13.80 $5.75 $14.95 $21.85 $18.40 $27.60 $26.45 $41.40 $35.65 $71.30 $55.20 $111.55 $92.00 $197.80 $141.45 $240.35 $219.65 $382.95 $235,000 Preferred Standard $14.10 $5.88 $15.28 $22.33 $18.80 $28.20 $27.03 $42.30 $36.43 $72.85 $56.40 $113.98 $94.00 $202.10 $144.53 $245.58 $224.43 $391.28 $240,000 Preferred Standard $14.40 $6.00 $15.60 $22.80 $19.20 $28.80 $27.60 $43.20 $37.20 $74.40 $57.60 $116.40 $96.00 $206.40 $147.60 $250.80 $229.20 $399.60 $245,000 Preferred Standard $14.70 $6.13 $15.93 $23.28 $19.60 $29.40 $28.18 $44.10 $37.98 $75.95 $58.80 $118.83 $98.00 $210.70 $150.68 $256.03 $233.98 $407.93 $250,000 Preferred Standard $15.00 $6.25 $16.25 $23.75 $20.00 $30.00 $28.75 $45.00 $38.75 $77.50 $60.00 $121.25 $100.00 $215.00 $153.75 $261.25 $238.75 $416.25 $1,000 $0.12 $0.12 $0.12 $0.12 $0.12 $0.12 $0.12 $0.12 $0.12 $5,000 $0.58 $0.58 $0.58 $0.58 $0.58 $0.58 $0.58 $0.58 $0.58 $10,000 $1.16 $1.16 $1.16 $1.16 $1.16 $1.16 $1.16 $1.16 $1.16 Policy Election Amount Child(ren) Refer to Guarantee Issue row on page above for Voluntary Life GI amounts. Premiums for Voluntary Life Increase in five-year increments ‡Spouse/DP coverage premium is based on Employee age. Coverage for the spouse terminates at spouse’s age 70. †Benefit reductions apply. Preferred rates apply to premium for non-tobacco usage and/or health history. Standard rates apply to premium for tobacco usage and/or health history. Manage Your Benefits: Go to www.GuardianAnytime.com to access secure information about your Guardian benefits. Your on-line account will be set up within 30 days after your plan effective date. 15 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 LIMITATIONS AND EXCLUSIONS: A SUMMARY OF PLAN LIMITATIONS AND EXCLUSIONS FOR LIFE AND AD&D COVERAGE: You must be working full-time on the effective date of your coverage; otherwise, your coverage becomes effective after you have completed a specific waiting period. Employees must be legally working in the United States in order to be eligible for coverage. Underwriting must approve coverage for employees on temporary assignment: (a) exceeding one year; or (b) in an area under travel warning by the US Department of State. Subject to state specific variations. Evidence of Insurability is required on all late enrollees. This coverage will not be effective until approved by a Guardian underwriter. This proposal is hedged subject to satisfactory financial evaluation. Please refer to certificate of coverage for full plan description. Dependent life insurance will not take effect if a dependent, other than a newborn, is confined to the hospital or other health care facility or is unable to perform the normal activities of someone of like age and sex. Accelerated Life Benefit is not paid to an employee under the following circumstances: one who is required by law to use the benefit to pay creditors; is required by court order to pay the benefit to another person; is required by a government agency to use the payment to receive a government benefit; or loses his or her group coverage before an accelerated benefit is paid. Voluntary Life Only: We pay no benefits if the insured’s death is due to suicide within two years from the insured’s original effective date. This two year limitation also applies to any increase in benefit. This exclusion may vary according to state law. Late entrants and benefit increases require underwriting approval. GP-1-R-LB-90, GP-1-R-EOPT-96 Guarantee Issue/Conditional Issue amounts may vary based on age and case size. See your Plan Administrator for details. Late entrants and benefit increases require underwriting approval. For AD&D: We pay no benefits for any loss caused: by willful self-injury; sickness, disease or medical treatment; by participating in a civil disorder or committing a felony; Traveling on any type of aircraft while having duties er on that aircraft; by declared or undeclared act of war or armed aggression; while a member of any armed force (May vary by state); while driving a motor vehicle without a current, valid driver’s license; by legal intoxication; or by voluntarily using a non-prescription controlled substance. Contract #GP-1-R-ADCL1-00 et al. We won't pay more than 100% of the Insurance amount for all losses due to the same accident, except as stated. The loss must occur within a specified period of time of the accident. Please see contract for specific definition; definition of loss may vary depending on the benefit payable. This handout is for illustrative purposes only and is an approximation. If any discrepancies between this handout and your paycheck stub exist, your paycheck stub prevails. 16 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 COLUMBIA COLLEGE Disability Benefit Summary Group Number: 00463298 About Your Benefits: You probably have insurance for your car or home, but what about the source of income that pays for it? You rely on your paycheck for so many things, but what if you were suddenly unable to work due to an accident or illness? How will you put food on the table, pay your mortgage or heat your home? Disability insurance can help replace lost income and make a difficult time a little easier. Protect your most valuable asset, your paycheck-enroll today! What Your Benefits Cover: Short-Term Disability Long-Term Disability . Coverage amount Choose weekly benefit amount from $200 to $1500. See cost illustration page for weekly benefit offerings. 60% of salary to maximum $7500/month Maximum payment period: Maximum length of time you can receive disability benefits. 13 weeks Social Security Normal Retirement Age Accident benefits begin: The length of time you must be disabled before benefits begin. Day 7 Day 91 Illness benefits begin: The length of time you must be disabled before benefits begin. Day 7 Day 91 Evidence of Insurability: A health statement requiring you to answer a few medical history questions. Health Statement not required Health Statement may be required Guarantee Issue: The ‘guarantee’ means you are not required to answer health questions to qualify for coverage up to and including the specified amount, when applicant signs up for coverage during the initial enrollment period. Not Applicable We Guarantee Issue $7500 in coverage Minimum work hours/week: Minimum number of hours you must regularly work each week to be eligible for coverage. Planholder Determines 30 Pre-existing conditions: A pre-existing condition includes any condition/symptom for which you, in the specified time period prior to coverage in this plan, consulted with a physician, received treatment, or took prescribed drugs. 3 months look back; 12 months after 2 week limitation 3 months look back; 12 months after exclusion Premium waived if disabled: Premium will not need to be paid when you are receiving benefits. Yes Yes Survivor benefit: Additional benefit payable to your family if you die while disabled. No 3 months Benefit information illustrated within this material reflects the plan covered by Guardian as of 11/05/2015 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 17 UNDERSTANDING YOUR BENEFITS—DISABILITY (Some information may vary by state) l l l l Disability (long-term): For first three years of disability, you will receive benefit payments while you are unable to work in your own occupation. After three years, you will continue to receive benefits if you cannot work in any occupation based on training, experience and education. Earnings definition: Your covered salary excludes bonuses and commissions. Special limitations: Provides a 24-month benefit limit for specific conditions including mental health and substance abuse. Other conditions such as chronic fatigue are also included in this limitation. Refer to contract for details. Work incentive: Plan benefit will not be reduced for a specified amount of months so that you have part-time earnings while you remain disabled, unless the combined benefit and earnings exceed 100% of your previous earnings. 18 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Short-Term Disability Plan Semi-monthly Cost Illustration: To determine the most appropriate level of coverage, you should consider your current basic monthly expenses. To help you assess your needs, you can also go to Guardian Anytime and use our Disability Insurance Explorer Tool. Election Cost Per Age Bracket 35–39 40–44 45–49 < 25 25–29 30–34 50–54 55–59 60+ $17,333 Minimum Annual Salary $200 Weekly Benefit $6.14 $6.14 $8.43 $5.92 $3.97 $3.74 $4.03 $4.49 $7.01 $26,000 Minimum Annual Salary $300 $9.21 $9.21 $12.65 $8.88 $5.96 $5.61 $6.05 $6.74 $10.52 $34,667 Minimum Annual Salary $400 $12.28 $12.28 $16.86 $11.84 $7.94 $7.48 $8.06 $8.98 $14.02 $43,333 Minimum Annual Salary $500 $15.35 $15.35 $21.08 $14.80 $9.93 $9.35 $10.08 $11.23 $17.53 $52,000 Minimum Annual Salary $600 $18.42 $18.42 $25.29 $17.76 $11.91 $11.22 $12.09 $13.47 $21.03 $60,667 Minimum Annual Salary $700 $21.49 $21.49 $29.51 $20.72 $13.90 $13.09 $14.11 $15.72 $24.54 $69,333 Minimum Annual Salary $800 $24.56 $24.56 $33.72 $23.68 $15.88 $14.96 $16.12 $17.96 $28.04 $78,000 Minimum Annual Salary $900 $27.63 $27.63 $37.94 $26.64 $17.87 $16.83 $18.14 $20.21 $31.55 $86,667 Minimum Annual Salary $1,000 $30.70 $30.70 $42.15 $29.60 $19.85 $18.70 $20.15 $22.45 $35.05 $95,333 Minimum Annual Salary $1,100 $33.77 $33.77 $46.37 $32.56 $21.84 $20.57 $22.17 $24.70 $38.56 $104,000 Minimum Annual Salary $1,200 $36.84 $36.84 $50.58 $35.52 $23.82 $22.44 $24.18 $26.94 $42.06 $112,667 Minimum Annual Salary $1,300 $39.91 $39.91 $54.80 $38.48 $25.81 $24.31 $26.20 $29.19 $45.57 $121,333 Minimum Annual Salary $1,400 $42.98 $42.98 $59.01 $41.44 $27.79 $26.18 $28.21 $31.43 $49.07 $130,000 Minimum Annual Salary $1,500 $46.05 $46.05 $63.23 $44.40 $29.78 $28.05 $30.23 $33.68 $52.58 *This benefit may not exceed 60% of your weekly salary. Manage Your Benefits: Go to www.GuardianAnytime.com to access secure information about your Guardian benefits. Your on-line account will be set up within 30 days after your plan effective date. 19 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 A SUMMARY OF DISABILITY PLAN LIMITATIONS AND EXCLUSIONS n n n n n n Evidence of Insurability is required on all late enrollees. This coverage will not be effective until approved by a Guardian underwriter. This proposal is hedged subject to satisfactory financial evaluation. Please refer to certificate of coverage for full plan description. felony or taking part in any riot or other civil disorder or intentionally injuring themselves or attempting suicide while sane or insane. We do not pay benefits for charges relating to legal intoxication, including but not limited to the operation of a motor vehicle, and for the voluntary use of any poison, chemical, prescription or non-prescription drug or controlled substance unless it has been prescribed by a doctor and is used as prescribed. We limit the duration of payments for long term disabilities caused by mental or emotional conditions, or alcohol or drug abuse. We do not pay benefits during any period in which a covered person is confined to a correctional facility, an employee is not under the care of a doctor, an employee is receiving treatment outside of the US or Canada, and the employee’s loss of earnings is not solely due to disability. You must be working full-time on the effective date of your coverage; otherwise, your coverage becomes effective after you have completed a specific waiting period. Employees must be legally working in the United States in order to be eligible for coverage. Underwriting must approve coverage for employees on temporary assignment: (a) exceeding one year; or (b) in an area under travel warning by the US Department of State. Subject to state specific variations. For Long-Term Disability coverage, we pay no benefits for a disability caused or contributed to by a pre-existing condition unless the disability starts after you have been insured under this plan for a specified period of time. We limit the duration of payments for long term disabilities caused by mental or emotional conditions, or alcohol or drug abuse. For Short-Term Disability coverage, benefits for a disability caused or contributed to by a pre-existing condition are limited, unless the disability starts after you have been insured under this plan for a specified period of time. We do not pay short term disability benefits for any job-related or on-the-job injury, or conditions for which Workers' Compensation benefits are payable. n n n This policy provides disability income insurance only. It does not provide "basic hospital", "basic medical", or "medical" insurance as defined by the New York State Insurance Department. If this plan is transferred from another insurance carrier, the time an insured is covered under that plan will count toward satisfying Guardian's pre-existing condition limitation period. State variations may apply. When applicable, this coverage will integrate with NJ TDB, NY DBL, CA SDI, RI TDI, Hawaii TDI and Puerto Rico DBA. Contract #.s GP-1-LTD94-A,B,C-1.0 et al.; GP-1-LTD2K-1.0 et al; GP-1-LTD07-1.0 et al. Contract #.s GP-1-STD94-1.0 et al; GP-1-STD2K-1.0 et al; , GP-1-STD07-1.0 et al. We do not pay benefits for charges relating to a covered person: taking part in any war or act of war (including service in the armed forces) committing a This handout is for illustrative purposes only and is an approximation. If any discrepancies between this handout and your paycheck stub exist, your paycheck stub prevails. 20 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 COLUMBIA COLLEGE Critical Illness Benefit Summary Group Number: 00463298 About Your Benefits: It takes a lot to beat a serious illness. Unfortunately, it can also cost a lot. When you or a family member suffers a serious illness like a stroke or heart attack, Critical Illness Insurance can help with expenses that medical insurance doesn't cover like deductibles or out of pocket costs, or services like experimental treatment. Critical Illness supplements your medical and your disability income insurance. The lump sum benefit is paid when you need it most, upon diagnosis, so you can rest assured that you will have funds to offset upcoming out of pocket costs, and that you'll have the flexibility to elect treatments with less worry about the cost. Review your options and enroll today! What Your Benefits Cover: CRITICAL ILLNESS Benefit Amount(s) Employee may choose a lump sum benefit of $5,000 to $25,000 in $5,000 increments. CONDITIONS 1st OCCURRENCE 2nd OCCURRENCE Invasive Cancer 100% 100% Carcinoma In Situ 30% 0% Benign Brain Tumor 75% 0% $250 per lifetime Not Covered Heart Attack 100% 100% Stroke 100% 100% Heart Failure 100% 100% Arteriosclerosis 30% 0% Organ Failure 100% 100% Kidney Failure 100% 100% Cancer Skin Cancer Vascular Other Spouse/Domestic Partner Benefit May choose a lump sum benefit of $2,500 to $12,500 in $2,500 increments up to 50% of the employee's lump sum benefit. Child Benefit- children age Birth to 26 years 25% of employee's lump sum benefit Benefit Reductions: Benefits are reduced by a certain percentage as an employee ages 50% at age 70 Guarantee Issue/ Conditional Issue We Guarantee Issue up to: Less than age 70 $20,000 For a spouse: Less than age 70 $10,000 For a child: All Amounts Health questions are required if the elected amount exceeds the Guarantee Issue, as well as for all applicants age 70+ regardless of elected amount. Benefit information illustrated within this material reflects the plan covered by Guardian as of 11/05/2015 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 21 CRITICAL ILLNESS Portability: Allows you to take your Critical Illness coverage with you if you terminate employment. Included Pre-Existing Condition Limitation: A pre-existing condition 3 months prior, 12 months after includes any condition for which you, in the specified time period prior to coverage in this plan, consulted with a physician, received treatment, or took prescribed drugs. Cancer Vaccine Benefit $50 per lifetime for receiving a cancer vaccine WELLNESS BENEFIT Employee Per Year Limit $50 Spouse Per Year Limit $50 Child Per Year Limit $50 22 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Critical Illness Cost Illustration To determine the most appropriate level of coverage, you should consider your current basic monthly expenses and expected financial needs during a critical illness. Your premium will not increase as you age. Child cost is included with employee election. Semi-monthly Premiums Displayed Election Cost Per Age Bracket Benefit Amount Issue Age < 30 30-39 40-49 50-59 60-69 70+† Employee $5,000 Non-tobacco Tobacco $1.67 $0.91 $2.45 $3.67 $4.20 $8.00 $6.99 $13.25 $10.75 $20.75 $10.75 $20.75 $10,000 Non-tobacco Tobacco $2.59 $1.06 $4.15 $6.59 $7.65 $15.25 $13.23 $25.75 $20.75 $40.75 $20.75 $40.75 $15,000 Non-tobacco Tobacco $3.51 $1.22 $5.85 $9.51 $11.10 $22.50 $19.47 $38.25 $30.75 $60.75 $30.75 $60.75 $20,000 Non-tobacco Tobacco $4.43 $1.37 $7.55 $12.43 $14.55 $29.75 $25.71 $50.75 $40.75 $80.75 $40.75 $80.75 $25,000 Non-tobacco Tobacco $5.35 $1.53 $9.25 $15.35 $18.00 $37.00 $31.95 $63.25 $50.75 $100.75 $50.75 $100.75 $30,000 Non-tobacco Tobacco $6.27 $1.68 $10.95 $18.27 $21.45 $44.25 $38.19 $75.75 $60.75 $120.75 $60.75 $120.75 $35,000 Non-tobacco Tobacco $7.19 $1.84 $12.65 $21.19 $24.90 $51.50 $44.43 $88.25 $70.75 $140.75 $70.75 $140.75 $40,000 Non-tobacco Tobacco $8.11 $1.99 $14.35 $24.11 $28.35 $58.75 $50.67 $100.75 $80.75 $160.75 $80.75 $160.75 $45,000 Non-tobacco Tobacco $9.03 $2.15 $16.05 $27.03 $31.80 $66.00 $56.91 $113.25 $90.75 $180.75 $90.75 $180.75 $50,000 Non-tobacco Tobacco $9.95 $2.30 $17.75 $29.95 $35.25 $73.25 $63.15 $125.75 $100.75 $200.75 $100.75 $200.75 $2.48 $4.38 $4.20 $8.00 $5.93 $11.63 $7.65 $15.25 $9.38 $18.88 $3.87 $7.00 $6.99 $13.25 $10.11 $19.50 $13.23 $25.75 $16.35 $32.00 $5.75 $10.75 $10.75 $20.75 $15.75 $30.75 $20.75 $40.75 $25.75 $50.75 $5.75 $10.75 $10.75 $20.75 $15.75 $30.75 $20.75 $40.75 $25.75 $50.75 Benefit Amount Up To 50% of Employee Amount to a Maximum of $12,500 Spouse $2,500 $5,000 $7,500 $10,000 $12,500 †Benefit Non-tobacco Tobacco Non-tobacco Tobacco Non-tobacco Tobacco Non-tobacco Tobacco Non-tobacco Tobacco $1.21 $1.53 $1.67 $2.30 $2.13 $3.08 $2.59 $3.85 $3.05 $4.63 $1.60 $2.21 $2.45 $3.67 $3.30 $5.13 $4.15 $6.59 $5.00 $8.05 reductions may apply. See plan details. Manage Your Benefits: Go to www.GuardianAnytime.com to access secure information about your Guardian benefits. Your on-line account will be set up within 30 days after your plan effective date. 23 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 EXCLUSIONS AND LIMITATIONS A SUMMARY OF PLAN LIMITATIONS AND EXCLUSIONS FOR CRITICAL ILLNESS: We will not pay benefits for the First Occurrence of a Critical Illness if it occurs less than 3 months after the First Occurrence of a related Critical Illness for which this Plan paid benefits. By related we mean either: (a) both Critical Illnesses are contained within the Cancer Related Conditions category; or (b) both Critical Illnesses are contained within the Vascular Conditions category. We will not pay benefits for a Second occurrence (recurrence) of a Critical Illness unless the Covered Person has not exhibited symptoms or received care or treatment for that Critical Illness for at least 12 months in a row prior to the recurrence. For purposes of this exclusion, care or treatment does not include: (1) preventive medications in the absence of disease; and (2) routine scheduled follow-up visits to a Doctor. We do not pay benefits for claims relating to a covered person: taking part in any war or act of war (including service in the armed forces) committing a felony or taking part in any riot or other civil disorder or intentionally injuring themselves or attempting suicide while sane or insane. Employees must be legally working in the United States in order to be eligible for coverage. Underwriting must approve coverage for employees on temporary assignment: (a) exceeding 1 year; or (b) in an area under travel warning by the US Department of State, subject to state specific variations. If the plan is new (not transferred): During the exclusion period, this Critical Illness plan does not pay charges relating to a pre-existing condition. If this plan is transferred from another insurance carrier, the time an insured is covered under that plan will count toward satisfying Guardian’s pre-existing condition limitation period. A pre-existing condition includes any condition for which an employee, in a specified time period prior to coverage in this plan, consults with a physician, receives treatment, or takes prescribed drugs. Please refer to the plan documents for specific time periods. State variations may apply. Guardian’s Critical Illness plan does not provide comprehensive medical coverage. It is a basic or limited benefit and is not intended to cover all medical expenses. It does not provide “basic hospital,” “basic medical,” or “ medical” insurance as defined by the New York State Insurance Department. Health questions are required on 1) late enrollees and 2) enrollees over age 69 (not applicable in FL). This coverage will not be effective until approved by a Guardian underwriter. The policy has exclusions and limitations that may impact the eligibility for or entitlement to benefits under each covered condition. See your certificate booklet for a full listing of exclusions & limitations.. If Critical Illness insurance premium is paid for on a pre tax basis, the benefit may be taxable. Please contact your tax or legal advisor regarding the tax treatment of your policy benefits.. This handout is for illustrative purposes only and is an approximation. If any discrepancies between this handout and your paycheck stub exist, your paycheck stub prevails. Your company has selected Guardian to provide Critical Illness coverage to eligible employees & dependents according to plan terms which have been mutually agreed upon. As an eligible employee, you can purchase this coverage at the group premium levels illustrated above. 24 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 COLUMBIA COLLEGE Group Number: 00463298 Accident Benefit Summary About Your Benefits: Accidents happen every day. Did you know almost 39 Million emergency room visits a year are due to an injury?¹ If you were injured from an accident, chances are you will have expenses that you were not anticipating-will you be prepared? Accident Insurance can help you deal with those expenses. Benefit payments can help you with your medical deductibles and co-pays, and cover household expenses like groceries, mortgage payments and childcare, which can begin to pile up if you have to take some time off from work. You are guaranteed coverage, so please enroll today! 1 Injury Facts, 2011 Edition, National Safety Council. What Your Benefits Cover: ACCIDENT COVERAGE - DETAILS Your Semi-monthly premium $8.10 You and Spouse $11.58 You and Child(ren) $15.45 You, Spouse and Child(ren) $18.93 Accident Coverage Type On and Off Job Portability - Allows you to take your Accident coverage with you if you terminate employment. Ported Accident plan terminates at age 70. Included ACCIDENTAL DEATH AND DISMEMBERMENT Benefit Amount(s) Employee $50,000 Spouse $25,000 Child $5,000 Common Carrier Quadriplegia, Loss of speech & hearing (both ears), Loss of Cognitive function: 100% of AD&D Hemiplegia & Paraplegia: 50% of AD&D 200% of AD&D benefit Common Disaster 200% of Spouse AD&D benefit Dismemberment - Hand, Foot, Sight Single: 50% of AD&D benefit Multiple: 100% of AD&D benefit Catastrophic Loss Dismemberment - Thumb/Index Finger Same Hand, Four Fingers Same Hand, All Toes Same Foot Seatbelts and Airbags 25% of AD&D benefit Reasonable Accommodation to Home or Vehicle $2,500 Seatbelts: $10,000 & Airbags: $15,000 WELLNESS BENEFIT - Per Year Limit $50 Child(ren) Age Limits Children age birth to 26 years FEATURES Accident Emergency Room Treatment $175 Accident Follow-Up Visit - Doctor $50 up to 6 treatments Air Ambulance $1,000 Ambulance $150 Appliance - Wheelchair, leg or back brace, crutches, walker, walking boot that extends above the ankle or brace for the neck. $125 Benefit information illustrated within this material reflects the plan covered by Guardian as of 11/05/2015 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 25 FEATURES (Cont.) Blood/Plasma/Platelets Burns (2nd Degree/3rd Degree) Burn - Skin Graft $300 9 sq inches to 18 sq inches: $0/$2,000 18 sq inches to 35 sq inches: $1,000/$4,000 Over 35 sq inches: $3,000/$12,000 50% of burn benefit Child Organized Sport - Benefit is paid if the covered accident occurred while your covered child is participating in an organized sport that is governed by an organization and requires formal registration to participate. 20% increase to child benefits Chiropractic Visits $25 per visit up to 6 visits Coma $10,000 Concussions $75 Dislocations Schedule up to $4,400 Diagnostic Exam (Major) $150 Emergency Dental Work $300/Crown, $75/Extraction Epidural pain management $100, 2 times per accident Eye Injury $300 Family Care $20/day up to 30 days Fracture Schedule up to $5,500 Hospital Admission $1,000 Hospital Confinement $225/day - up to 1 year Hospital ICU Admission $2,000 Hospital ICU Confinement $450/day - up to 15 days Initial Physician's office/Urgent Care Facility Treatment $75 Joint Replacement (hip/knee/shoulder) $2,500/$1,250/$1,250 Knee Cartilage $500 Laceration Schedule up to $400 Lodging - The hospital must be more than 50 miles from the insured's residence. Occupational or Physical Therapy $125/day, up to 30 days for companion hotel stay $25/day up to 10 days Rehabilitation Unit Confinement 1: $500 2 or more: $1,000 $150/day up to 15 days Ruptured Disc With Surgical Repair $500 Prosthetic Device/Artificial Limb Surgery Surgery - Exploratory or Arthroscopic Tendon/Ligament/Rotator Cuff Transportation - Benefit is paid if you have to travel more than 50 miles one way to receive special treatment at a hospital or facility due to a covered accident. X - Ray Schedule up to $1,250 Hernia: $150 $250 1: $500 2 or more: $1,000 $500, 3 times per accident $30 UNDERSTANDING YOUR BENEFITS: • Common Carrier – Benefit is paid if an insured's death occurs due to an accident while riding as a fare-paying passanger in a public conveyance. If this is paid, we do not pay the Accidental Death benefit. • Common Disaster – Benefit is paid if both you & your spouse die in a covered accident or separate covered accidents within the same 24 hour period. • Reasonable Accomodation – Benefit is payable if a modification is required to an insured's place of residence or vehicle due to an Accidental Dismemberment or Catastrophic loss. This handout is for illustrative purposes only and is an approximation. If any discrepancies between this handout and your paycheck stub exist, your paycheck stub prevails. 26 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 Manage Your Benefits: Go to www.GuardianAnytime.com to access secure information about your Guardian benefits. Your on-line account will be set up within 30 days after your plan effective date. LIMITATIONS AND EXCLUSIONS: A SUMMARY OF ACCIDENT LIMITATIONS AND EXCLUSIONS: Employees must be working in the United States in order to be eligible for coverage. Underwriting must approve coverage for employees on temporary assignment: (a) exceeding 1 year; or (b) in an area under travel warning by the US Department of State, subject to state specific variations. This proposal summarizes the major features of the Guardian Accident benefit plan. It is not intended to be a complete representation of the proposed plan. For full plan features, including exclusions and limitations, please refer to your Policy. This proposal is hedged subject to satisfactory financial evaluation. This plan will not pay benefits for any injury caused by or related to: declared or undeclared war, act of war or armed aggression; taking part in a riot or civil disorder; or commission of, or attempt to commit a felony; intentionally self inflicted injury, while sane or insane; suicide, while sane or insane. The covered person being legally intoxicated. Treatment rendered or hospital confinement outside the United States or Canada. Travel of flight in any kind of aircraft including any aircraft owned by or for the employer except as a fare paying passenger on a common carrier. Participation in any kind of sporting activity for compensation or profit including coaching or officiating. Riding in or driving any motor-driven vehicle in a race, stunt show or speed test. Participation in hang gliding, bungee jumping, sailgliding, parasailing, parakiting, ballooning, parachuting, and/or skydiving. Injuries to a dependent child received during the birth. An accident that occurred before the covered person is covered by this plan. Sickness, disease, mental infirmity or medical or surgical treatment. If Accident insurance premium is paid for on a pre tax basis, the benefit may be taxable. Please contact your tax or legal advisor regarding the tax treatment of your policy benefits. 27 COLUMBIA COLLEGE ALL OTHER ELIGIBLE EMPLOYEES Benefit Summary The Guardian Life Insurance Company of America, 7 Hanover Square, New York, NY 10004 28 Accident Coverage Advantage Benefit Children play to win. Our coverage plays it smart. Unique benefit with Guardian Accident Insurance Its important to encourage children to be active. And millions of children find an answer in organized sports whether its Little League, soccer or football. But accidents happen. Luckily, Guardian Accident Insurance has it covered: Benefits are increased by 20% if a covered dependent child (aged 18 years old or younger) is injured while participating in an organized sport.* For instance, imagine your child has a collision in the outfield while playing baseball. Hes taken to the hospital in an ambulance and given an MRI to check for injuries. He ends up staying overnight for observation because the MRI confirmed a concussion. Heres the breakdown of what Guardian covers, along with the additional Child Organized Sport benefit. PROCEDURE GUARDIAN ACCIDENT INSURANCE BENEFIT Ambulance ride Emergency Room visit Hospital admission (his stay was over 20 hours) MRI Concussion 2 follow-up doctor visits TOTAL BENEFIT GRAND TOTAL ADDITIONAL CHILD ORGANIZED SPORT ADVANTAGE BENEFIT $150 $175 $30 $35 $1000 $200 $150 $75 $50 X 2 = $100 $1,650 $30 $15 $20 $330 $1,980.00 Enroll in Accident coverage today. * Proof of registration required at time of claim Guardian's Accident Insurance is underwritten and issued by The Guardian Life Insurance Company of America, New York, NY. Products are not available in all states. Policy limitations and exclusions apply. Optional riders and/or features may incur additional costs. Plan documents are the final arbiter of coverage. 29 THIS PAGE INTENTIONALLY LEFT BLANK