FNB Pricing Guide

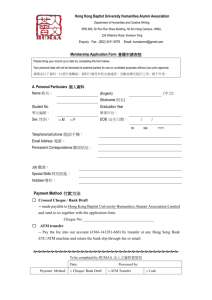

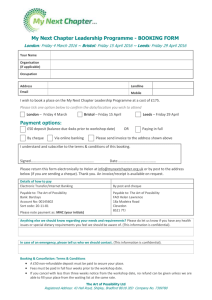

advertisement