Insurance: Mathematics and Economics 41 (2007) 362–381

www.elsevier.com/locate/ime

Integrating long-term care insurance purchase decisions with saving

and investment for retirement

Aparna Gupta ∗ , Lepeng Li

Decision Sciences and Engineering Systems, Rensselaer Polytechnic Institute, 110 Eighth Street, Troy, NY 12180, United States

Received April 2005; received in revised form October 2006; accepted 21 November 2006

Abstract

Risk related to long-term care (LTC) is high for the elderly. Planning for LTC is now regarded as the ‘third leg’ of retirement

planning. In this paper, planning for LTC is integrated with saving and investment decisions for an integrated approach to retirement

planning. Optimal LTC insurance purchase decisions are obtained by developing a trade-off between post-retirement LTC costs and

LTC insurance premiums paid and coverage received. Integrating insurance purchase with wealth evolution, consisting of saving

and investment decisions, allows addressing affordability issues.

Two-way branching models are used for the stochastic health events and asset returns. The problem, formulated as a nonlinearly

constrained mixed-integer optimization problem, is solved using a heuristic. Sensitivity analyses are performed for initial health

and wealth status. Some important aspects of an individual’s behavioral preferences are also addressed in this framework to provide

more robust decision support.

c 2006 Elsevier B.V. All rights reserved.

Insurance Branch Category: IB20

JEL classification: C61; D91; E21; G11; D01

Subject Category: IE10; IE12; IE13; IE50; IE53

Keywords: Strategy/planning; Mathematical programming/optimization; Investment–consumption; Long-term care insurance; Mixed-integer

program; Heuristic

1. Introduction and background

Long-term care (LTC) generally refers to a range of medical, social, personal care, and supportive services required

by people who have lost the capability of self-care due to long-term disability or chronic illness (Chen, 2001). The need

for and cost of LTC poses a significant risk for the elderly. A recent study by the US Department of Health indicates

that people who reach the age of 65 face at least a 40% risk of entering a nursing home in their lifetime (Collett et al.,

1999). About 20% of users of nursing home facilities will spend 5 or more years in these facilities (Kemper et al.,

1991; Spillman and Kemper, 1995).

∗ Corresponding author. Tel.: +1 518 276 2757; fax: +1 518 276 8227.

E-mail addresses: Guptaa@rpi.edu (A. Gupta), lepeng@alum.rpi.edu (L. Li).

c 2006 Elsevier B.V. All rights reserved.

0167-6687/$ - see front matter doi:10.1016/j.insmatheco.2006.11.008

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

363

The cost of LTC is high. For instance, in 1998, skilled nursing facilities charged over $188 per day on average, or

$69,000 per year, for an individual in New York state. According to the projections by the Congressional Budget Office

(CBO, 1999), the national expenditures for long-term care services for the elderly (people ages 65 and older) will

grow steadily each year through 2040. The total expenditures for nursing home care are projected by the Healthcare

Financing Administration (HCFA, 1999) to grow by 70% from 1998 to 2007 ($87 billion to $148 billion). Home

health care expenditures by the elderly will grow by more, 100% between 1998 and 2007 ($33 billion to $66 billion).

The main funding sources for LTC in the United States are Medicaid (a public program), privately purchased LTC

insurance or self-payment (Spillman and Kemper, 1995). The eligibility requirements are quite strict for Medicaid;

a beneficiary has to spend down his/her assets in order to qualify (Schwab, 2001; MEP, 2002). Medicare (another

public program) and its supplemental programs do not cover the expenses for LTC (Mitialo, 2002; Moody, 2000b).

Furthermore, as the ‘baby boom’ generation reaches the age of 65, the pressures on these public programs will

increase, resulting in less certainty in the future of these programs (Moody, 2000a).

In view of the need, cost, and funding considerations, increasingly more people will need to turn to private

LTC insurance. The LTC insurance’s contribution to LTC expenditures is projected to increase by 600% during the

2000–2020 period (CBO, 1999). This justifies making financial decisions to meet LTC needs after retirement be a

key part of retirement planning. LTC financing planning has been regarded by financial planners as the ‘third leg’ of

retirement planning, the other two being accumulating adequate wealth and maintaining healthy, independent living

(Cohen, 2003). Services exist that provide advice for this planning, but they are often not based on analysis using a

rigorous decision-making framework (AHCA, 2003; HIICAP, 2003).

In this paper, we develop a framework to help people make better LTC insurance purchase decisions as an

integral component of retirement planning. Following our past work (Gupta and Li, 2003, 2004), appropriate models

are developed to capture the characteristics of and interactions among an individual planner’s health and wealth

evolution, LTC premium and coverage, and LTC cost. We differentiate medical expenditures by the type of illness,

and use simulation to estimate the LTC costs incurred during an individual’s retired life. The LTC insurance purchase

decisions are integrated with one’s investment–consumption decisions. An optimization problem is formulated to

determine the optimal investment, consumption, and LTC insurance purchase decisions for an individual planner.

The optimization problem is a large-scale mixed integer nonlinear problem (MINLP), which is decomposed into two

subproblems, an investment–consumption problem and an LTC insurance purchase problem. The former is posed as a

nonlinear program (NLP) and solved by SNOPT, a sparse sequential quadratic programming (SQP) solver. The latter

is formulated as a dynamic program (DP) and solved using the backward recursion of DP. A heuristic is constructed

to link these two subproblems and find the optimal solution for the master problem. Following our previous work in

behavioral modeling (Gupta and Li, 2003), an individual’s behavioral preferences and their effect on the decisions are

also addressed.

The paper is organized as follows. Section 2 briefly reviews previous research in financial planning for retirement

and modeling in health-care research. Section 3 formulates the optimization problem for LTC insurance purchase

decisions with savings and investment. Behavioral modeling is discussed to capture an individual decision maker’s

behavioral preferences. Section 4 illustrates the solution approach applied to solve the optimization problem. We

demonstrate results in Section 5 and make some concluding remarks in the last section.

2. Literature review

The concept of risk management is well-known in the health care sector. Arrow (1963) claimed that the uncertainty

surrounding medical care is greater than the uncertainty surrounding most other commodities, such as, nutrition and

clothing. Grossman’s work in the early 1970s first investigated health as a capital and medical care as an investment

towards enhancing the capital (Grossman, 1972a,b). His well-known human capital model for the demand for health

has since been the basis for much research in health economics (Culyer et al., 1981). Cropper (1977) constructed a

life-cycle model for the investment towards increasing health capital, assuming two random factors that affect the

health capital — illness and death. Picone et al. (1998) modified Grossman’s model by introducing the uncertainty

of incidence of illness as described by Arrow (1963), and developed a simplified version of a dynamic Grossman

household production model to characterize patterns of individual’s precautionary behaviors.

Modeling of the need for long-term care and pricing of LTC insurance contracts have also been topics of much

research (Beekman, 1989; Haberman et al., 1997; Norberg, 1995; Levikson and Mizrahi, 1994). Gupta and Li (2004)

364

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

adapted Picone’s model by distinguishing restorable illness from non-restorable illness, and only the investment on

the former contributes to improve an individual’s health. They analyzed an individual’s LTC insurance purchasing

decisions under an affordability assumption by posing it as a large-scale dynamic programming problem. Modeling

the need for LTC and pricing of LTC insurance contracts have also been topics of much research. Haberman and

Pitacco (1999) discussed various LTC and Permanent Health Insurance (PHI) programs in which models based on

semi-Markov processes are used for pricing LTC contracts. Levikson et al. (2001) extended Haberman and Pitacco’s

approach by solving directly for premium in an individual’s active–inactive cycles. A recursive integral scheme is

used to find the expected present value of premium payments and benefits.

Problems related to investment, consumption, and saving for long-term financial planning have been the focus of

research for the past several decades. The classical investment–consumption problem was first solved in a discretetime setting by Samuelson (1969). Merton (1969) extended Samuelson’s results by posing the problem as an optimal

stochastic control problem in a continuous-time setting. Since then several researchers have addressed the problem

with more relaxed assumptions and greater complexity in the models (Birge, 1997; Campbell and Viceira, 1996;

Viceira, 1998; Barberis, 2000; Berkelaar and Kouwenberg, 2003). See Gupta and Murray (2003) and Gupta and

Li (2003) for a detailed literature review on the investment–consumption optimization problem. Labor income, an

important source of uncertainty in the financial planning problem, has also been a topic of many investigations (Hall

and Mishkin, 1982; Zeldes, 1989; Campbell and Viceira, 2002; Gourinchas and Parker, 2002).

An essential ingredient of modeling for decision-making is the assumption about decision makers’ preferences.

Rationality, coherence and consistency constitute the foundation of the traditional decision analysis paradigm. The

paradigm assumes that decision makers evaluate stochastic outcomes according to the expectation of the utility (EU).

Extensive experimental evidence in recent decades has shown that people systematically violate EU theory when

risky choices exist (Kahneman and Tversky, 1979; Kahneman et al., 1981; Bell, 1982; Tversky and Kahneman, 1986;

Bell et al., 1988; Tversky and Kahneman, 1991, 1992; Thaler et al., 1997). Alternative theories are developed to

explain these observed anomalies. They constitute what is called the descriptive theory of choice. Applications of these

theories to finance are often referred to as behavioral finance. A review of major research in the field of descriptive

theory of choice and behavioral finance can be found in Barberis and Thaler (2003) and Gupta and Li (2003). In order

to systematically organize an individual’s behavioral preference, Gupta and Li (2003) proposed a three-dimensional

modeling structure. The behavioral preferences were incorporated into a decision support framework for long-term

investment–consumption planning. The effect of these behavioral preferences on the decisions was discussed.

In the above section, we reviewed research conducted in the fields of health economics, retirement financial planning, and modeling of behavioral preferences. In the next section, we will utilize this research for developing an

optimization framework to integrate one’s LTC insurance purchase decision with his investment–consumption decisions for retirement. Some well-observed behavioral aspects of an individual’s preference will also be incorporated.

3. Problem formulation

In this section, we formulate an integrated optimization framework for combining LTC financing decisions with

saving and investment for retirement. The problem is formulated as a large-scale mixed integer nonlinear program. In

order to facilitate solving the problem, after formulating the master problem, we decompose it into two subproblems.

A heuristic algorithm developed to link the two subproblems provides a solution to the master problem. Following our

past work (Gupta and Li, 2003, 2004), appropriate methods are used to solve the investment–consumption and LTC

insurance purchase subproblems.

3.1. LTC financing in retirement planning — the master problem

To guarantee long-term well being after retirement, an individual planner needs to tradeoff between immediate

consumption and savings for long-term needs, including future LTC needs. Purchasing LTC insurance is becoming

an increasingly popular means for meeting LTC needs. Therefore, based on his wealth and health status, a planner

needs to decide whether, when and which type of LTCPinsurance policy to purchase. LTC insurance is purchased with

T

a motivation of minimizing life-long LTC expenses: t=0

MLTC,t , where MLTC,T needs to be interpreted depending

on the choice of the planning horizon, T . Simultaneously appropriate consumption-saving decisions are made so that

immediate needs as well as long-term financial needs are satisfactorily met. In general, the planner may have a certain

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

365

utility, U (.), for wealth and consumption. If T is the planning horizon, one formulation of the objective function for

this optimization problem can be:

"

#

T

−1

T

X

X

Obj : max

ηt [U (Ct )] + ηT E[U (WT )] − E

ηt U (MLTC,t (Yt ))

X t ,Ct ,Yt

t=0

t=0

+ ληT E[(U (WT ) − U (MLTCI,T ))YT ],

(1)

if WT ≤ MLTCI,T .

(2)

s.t. YT = 0

Here we assume that the utility for wealth, consumption and disutility for cost of LTC are governed by the same

function, however deviations from this assumption can be easily incorporated. X t stands for investment decision at

time t, Ct is the consumption in the time period t, and Yt denotes purchase of an LTC insurance policy at time t. LTC

insurance policies are well-defined contracts with several discretely defined features. One decides either to purchase

the policy, ‘Yt = 1’, or not purchase it, ‘Yt = 0’, hence Yt is modeled as a binary variable. We pick the planning

horizon, T , as the time of retirement.

It is assumed that the planner will make his LTC insurance purchase decision prior to retiring. WT stands for the

savings at planning horizon (retirement) and ηt is the time discount factor. The last term in the objective function above

(Eq. (1)) captures the gap between utility from final savings and average life-long LTC premium costs after retirement

when LTC insurance is purchased (MLTCI,T ). For a specific choice of Yt , this term attempts to achieve lifelong

affordability of LTC premium expenses when LTC insurance is purchased. Affordability of LTC expenses is more than

just being able to afford LTC insurance premiums; it is being able to afford lifelong LTC expenses, including future

LTC insurance premium and out-of-pocket expenses, with or without support from an LTC insurance. When LTC

insurance is found to lower lifelong LTC expenses, the planner attempts to make buying LTC insurance affordable,

i.e. attempts to make at least LTC premiums affordable. Parameter λ captures an individual’s desire for importance

given to LTC insurance as a means for meeting LTC related expenses. Constraint (2) restricts LTC insurance purchase

when wealth level at retirement makes LTC insurance premiums unaffordable.

The term MLTC,t in Eq. (1) is the LTC related cost incurred in time period t by the planner. Assuming an individual’s

pre-retirement LTC needs are covered by employer sponsored disability plans, MLTC,t for t < T represents the LTC

insurance premium payment if LTC insurance is purchased. While term MLTC,T , for planning horizon T , stands

for the total expected LTC related costs incurred by the planner after retirement until his demise. Depending on an

individual’s LTC insurance purchase decisions, MLTC,T may consist of different types of expenses. If an individual

chooses to purchase LTC insurance, MLTC,T includes the premium payment up to the time of first receiving insurance

benefits, and all future supplemental out-of-pocket payments when LTC is received (such as deductible and payment

for time in excess of the benefit period). If an individual chooses not to purchase LTC insurance, MLTC,T stands for

self-payment of LTC costs.

In the optimization problem, wealth and health of the planner are state variables, while investment, consumption,

insurance purchase, etc. are decision variables. For these state and decision variables, we also need to designate

appropriate constraints in the optimization problem. An individual’s wealth is a consequence of his income,

consumption, investment, and insurance purchase decisions. The first set of constraints is related to an individual’s

wealth status:

Wt+1 = [Wt + It − Ct − Mt − Yt ∗ MLTCI,t ][X t St + (1 − X t )R f ],

(3)

St = Su

= Sd

(4)

with prob. p,

with prob. 1 − p,

0 ≤ X t ≤ 1,

0 < cm ≤ C t ≤ I t ,

(5)

(6)

0 < wm ≤ WT ,

(7)

0 < Wt ,

0 ≤ t ≤ T − 1.

(8)

(9)

Eq. (3) is called the ‘wealth evolution model’ in Gupta and Li (2004). At the beginning of planning, t = 0, an

individual possesses an initial wealth capital of W0 . Each year he will spend Ct dollars for short-term needs, Mt dollars

366

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

for medical expenditure on restorable illness (see Gupta and Li (2004)), and MLTCI,t dollars of premium payment if

LTC insurance is purchased. If no LTC services are received prior to retirement, MLTCI,t = MLTC,t (Yt = 1) for t < T ,

and MLTCI,T ≤ MLTC,T (YT = 1).

The remaining wealth (Wt ) and income (It ) are invested into two asset classes, one risky and the other risk-free.

Return from risky investment, St , takes the value Su (1.25) and Sd (0.90) for an up or down in the market, respectively.

R f is a single period return from investment in a risk-free asset, taken as 1.05, and p(0.6) stands for the probability

of an up in the risky asset market. This process continues up to the planning horizon. A lower bound, wm , is imposed

on WT . This represents the minimum savings needed for post-retirement consumptions. Since retirement saving can

only be withdrawn after retirement, we assume that a planner can not consume more than his income throughout the

planning period. A lower bound, cm , is also imposed on consumptions, which represents the minimum amount needed

for current necessities.

In this paper, an individual’s lifetime income is captured by an adapted form of Zeldes’ (1989), Gourinchas and

Parker’s (2002) income model after removing the transitory part of income (Gupta and Li, 2003): It = It−1 eG t , where

G t is an age-specified drift taken as a linear function of time, G t = at + b. Income is a serially correlated process, and

the hump-shape in lifetime income curve is captured by picking an appropriate set of values for a and b (a = −0.0013

and b = 0.033).

A model for the LTC insurance premium, MLTCI,t , was developed in Gupta and Li (2004) as follows:

MLTCI,t = (−788 + 0.230Agec3 + 6.77Agec2 + 9.94MDB + 90.3B P − 6.78BWP

+ 0.538Agec ∗ MDB + 3.72Agec ∗ B P − 0.631Agec ∗ BWP) ∗ Rh .

(10)

This implies that the LTC insurance premium is determined by an individual’s age, health condition, and type of

LTC coverage selected. This regression model, developed using data from four major LTC insurance underwriters,

demonstrates an 86.5% predictive accuracy. Agec stands for centered age at which insurance is purchased (i.e., Agec

= Age−Sample mean of Age), MDB stands for maximum daily benefit, B P stands for benefit period, BWP stands

for benefit waiting period, and Rh stands for the adjustment ratio for insurance premium based on specific health

conditions (see Gupta and Li (2004) for details).

Another set of constraints is associated with the planner’s health state variable. An individual is assumed to possess

certain health capital, Ht , at any time, where ‘Ht = 10’ stands for perfect health and ‘Ht = 0’ implies demise. At the

beginning of the planning period, one is endowed with an initial stock of health, H0 , which depreciates at a certain

rate, δt , due to aging. An individual also suffers larger health capital losses due to sudden health events. However, the

health capital can be increased, albeit to an extent, by health investments (Grossman, 1972a). The following equations

summarize the bounds and constraints for an individual’s health status.

θ

Ht+1 = (1 − δt )Ht + t + (θ1 + θ2 t )Mt 3 ,

(11)

t+1 = 0, with prob. (e − 1)/(1 + e ),

= −1, with prob. 2/(1 + ez t ),

(12)

z t = 1 + θ4 Ht + θ5 t ,

(13)

0 ≤ Ht ≤ 10,

(14)

0 ≤ Mt ≤ Mu ,

(15)

0 ≤ t ≤ T − 1,

(16)

zt

zt

where Eq. (11) is the so called ‘health evolution model’ (Gupta and Li, 2004). Following Gupta and Li (2004), the

depreciation rate is taken to be a constant (0.015) before the retirement age of 65, and increases with a person’s age

after the age of 65, δt = 0.012e(0.021(32+t)) . Health shocks are denoted by, t , and health investment, Mt , helps regain

or increase the health capital. Mu is the upper bound for Mt , indicating that health investment can not indefinitely

improve health. θ1 , θ2 , θ3 are parameters specified to relate the effect of health investment on health capital. The

probability of a health event depends on previous health status and health event history, captured by parameters θ4 and

θ5 . A sample set of values for the parameters is (θ1 = 0.50, θ2 = 0.1, θ3 = 0.50, θ4 = 0.10, θ5 = 0.90), chosen using

simulation analysis of the model.

An individual’s LTC cost depends on the intensity of LTC service needed, which is determined by the number of

ADLs (activities of daily living, such as, eating and bathing) and IADLs (instrumental activity of daily living, such

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

367

as, doing housework and answering telephones) one needs help with. By relating one’s health capital to the number

of ADLs and IADLs one requires help with, an individual’s LTC expenditure is linked with his or her health capital.

The model presenting this linkage is referred to as the LTC cost structure model in Gupta and Li (2004).

3.2. Solution method

The optimization problem described in the previous section is a large-scale mixed integer nonlinear program

(MINLP). The number of outcomes of the health and wealth state variables, as well as the long duration of planning

period result in a large-scale problem. Investment and consumption decision variables are continuous, while insurance

purchase decisions are binary. Both objective function and constraints are nonlinear. Such problems are in general

difficult to solve. Therefore, we decompose the master problem into two subproblems: an investment–consumption

planning problem (Subproblem A) and an LTC insurance purchase decision problem (Subproblem B), which are

solved using appropriate optimization algorithms. A heuristic algorithm is developed to link the two subproblems and

find an optimal solution for the master program described in Section 3.1.

3.2.1. Investment and consumption problem — subproblem A

The investment–consumption planning subproblem focuses on obtaining investment and consumption decisions

that are consistent with specific LTC insurance purchase decisions. At the decision nodes in the tree, where purchase

of LTC insurance is considered desirable, this problem attempts to achieve affordability for lifelong LTC insurance

premiums, MLTC,T . Affordability of LTC insurance expenses prior to retirement is assured, depending on the chosen

Yt values, by the constraint of Eq. (8). Therefore, this subproblem is formulated as a nonlinear program as follows:

Obj : max

X t ,Ct

T

−1

X

ηt [U (Ct )] + ηT E[U (WT )] + ληT E[(U (WT ) − U (MLTCI,T ))YT ],

(17)

t=0

s.t. Wt+1 = [Wt + It − Ct − Mt − Yt ∗ MLTCI,t ][X t St + (1 − X t )R f ],

θ

Ht+1 = (1 − δt )Ht + t + (θ1 + θ2 t )Mt 3 ,

(18)

(19)

along with constraints formulated in Eqs. (5)–(7), (15), (14) and (16).

The objection function above (Eq. (17)) is modified from Eq. (1) of the master problem so that it acts as a link

between investment–consumption and LTC insurance decisions. For a specific choice of YT , the last term attempts to

achieve affordability of LTC premium expense when LTC insurance is purchased. Parameter λ, as before, captures

an individual’s desire for importance given to affordability of LTC related expenses. As described earlier, MLTCI,T

represents the expected, discounted future LTC premium expense. Simulation analysis is employed to estimate the

post-retirement LTC premium costs using the LTC premium model presented in the previous section (Gupta and Li,

2004).

3.2.2. LTC insurance purchase decisions — subproblem B

Subproblem B, the LTC insurance purchase problem, is formulated as a dynamic program. The goal of this

subproblem is, given a wealth and health status of the planner, if and when purchase of LTC insurance is optimal.

Based on the planner’s wealth status, an affordability constraint is exerted on his LTC insurance purchase decisions.

The mathematical formulation for Subproblem B is as follows:

f t (Ht , Wt ) = min{U (MLTC,t [Yt , (Ht , Wt )]) + ηt E[ f t+1 (Ht+1 , Wt+1 )|Yt , (Ht , Wt )]}

(20)

s.t. Yt = 0 or 1,

(21)

Yt

YT = 0

Yt−1 = 0

if WT ≤ MLTCI,T ,

if Yt = 0 (optimal stopping assumption),

0 ≤ t ≤ T − 1,

(22)

(23)

(24)

where (Ht , Wt ) is the pair of state variables at time period t, which defines the health and wealth status corresponding

to a specific node in the decision tree. f t is the value function for the dynamic program, representing the minimum

LTC expenditure incurred based on the purchase decision made in current period. The expectation of future LTC

368

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

expenditure is taken over stochastic outcome of health events and return of risky assets. Constraint (22) denotes that

an individual will not purchase LTC insurance at retirement if he can not afford future LTC premium costs. When

LTC insurance is desirable for recovering LTC costs, but LTC premiums are not affordable, the planner can attempt

to qualify for a federal program, like Medicaid. Consequently, the planner will either pay for LTC himself, when it is

affordable, or depend on Medicaid for his future LTC needs. Investigating Medicaid qualification, however, is beyond

the scope of this paper.

Constraint (23) denotes an ‘optimal stopping’ type of implementation, which implies once an individual planner

buys the insurance, he will keep it for the rest of his life (Gupta and Li, 2004). The sequential decisions reflect the fact

that an individual’s current decisions depend on the current medical cost as well as his expected future medical cost

incurred due to this decision. At each node of the decision tree, we compare the possible medical expenditure incurred

by decisions to buy the LTC insurance or not. The minimum cost is represented by the value function in the dynamic

programming (DP) recursion.

3.3. Connecting the subproblems — heuristic algorithm

In the above discussion, the integrated optimization problem was formulated as a mixed integer nonlinear program,

which was decomposed into two subproblems, an NLP and a DP. In the NLP, health evolution model is linked with

the wealth evolution model through health investments (Mt ) and premium payments for LTC insurance (MLTCI,t ). In

the DP, the individual’s wealth status determines affordability for LTC insurance. To create a link between above two

subproblems, a heuristic algorithm is developed as follows:

1. Find the optimal LTC insurance purchase decisions (Yt (0)) by solving Subproblem B, where affordability is

assumed, i.e., the planner can afford LTC related expenses with or without the insurance.

2. Using the current values of Yt as input variables, solve Subproblem A to obtain the supporting optimal investment

and consumption decisions (X t , Ct ).

3. Based on the wealth status (Wt ) obtained from solving Subproblem A in step 2, re-solve Subproblem B to refine

the LTCI purchase decisions (Yt0 ) in view of their affordability.

4. Convergence check. If decision set (Yt0 ) from step 3 matches that from step 2 (Yt ), then stop. The optimal solution

is found. Otherwise Yt0 → Yt and return to step 2.

The following is the motivation behind the above heuristic. We first find all the nodes of the tree where

LTC insurance purchase is desirable assuming affordability. Using these purchase decisions as the guideline,

the planner attempts to achieve affordability for LTC insurance where it is desirable by making corresponding

investment–consumption decisions. The degree of effort to achieve affordability is captured by the parameter λ. If

affordability for LTC insurance purchase is achieved, then the optimal decisions are obtained. Otherwise, the planner

readjusts his purchase decisions based on his wealth status, and re-determines his investment–consumption decisions

to support the new purchase decisions. The iteration stops when purchase decisions from the NLP and DP converge,

and the optimal decisions are obtained.

PT

The DP allows the present value of lifetime LTC cost, E[ t=0

ηt U (MLTC,t (Yt ))], to be minimized. The NLP

PT −1

trades off between the utility from consumption, t=0 ηt [U (Ct )], and the discounted utility from final savings,

ηT E[U (WT )]. The penalty term in the objective function of Subproblem A addresses the individual planner’s effort

to afford his future LTC cost. In accordance with the master problem, the desirability for affordability is captured by

parameter λ in the NLP. Linking the two subproblems allows us to find the optimal solution for the master problem.

A proof of this claim is provided in Appendix B.

There are two issues to consider for the numerical properties of the heuristic. First, in this heuristic, the convergence

condition is checked by examining the values of Yt0 s rather than X t , Ct . This is because decision variables X t , Ct can

take a range of numerical values, thus the convergence check will be affected by deviations due to numerical accuracy.

In contrast, Yt can only take binary values, 0 or 1, thus making the convergence condition more reliable.

Second, the heuristic requires iterating between two optimization problems, sometimes due to limited tolerance

level chosen for detecting optimality for a subproblem, a toggling behavior is observed. For instance, given a tolerance

limit of 10−6 , we observe that for λ = 0.01, LTC insurance purchase decisions at some nodes at retirement (YT ) toggle

between ‘buy’ (YT = 0) and ‘not buy’ (YT = 1) after each iteration. If we lower the tolerance to 10−8 , the toggling

vanishes. Uniformly setting a very low tolerance level would be computationally demanding for such a large scale

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

369

optimization problem. In order to find an optimal solution for the master problem under the toggling situation, either

the tolerance should be decreased or an analysis as follows can be conducted for the toggling nodes.

After identifying the toggling nodes, rank them according to their wealth and health capital values, (WT , HT ).

Since a larger wealth, WT , indicates a history of more up-markets, and a lower health capital, HT , indicates a lower

expected LTC cost, the nodes are ranked in an ascending order by WT along with a descending order by HT . Starting

with the node with the highest ranking, we sequentially attempt to assign a ‘buy’ decision to the toggling nodes.

The branch and bound method can be employed for searching for the optimal combination of purchase nodes. For

instance, given three toggling nodes ranked as {a, b, c}, we start with Y0 = {YT,a = 0, YT,b = 0, YT,c = 0} and obtain

the corresponding utility of U0 for the master problem. U0 is then set as a lower bound for the utility of the master

problem. Then we start branching by assigning the node a as a ‘buy’ node. The new master utility with decisions

Y1 = {YT,a = 1, YT,b = 0, YT,c = 0} is U1 . If U1 < U0 or affordability can not be achieved for decision set Y1 , the

search stops with optimal decision Y0 . Otherwise, if U1 > U0 and affordability is achieved, we accept decision set

Y1 and set U1 as the new lower bound for master utility; branching is then conducted on node b, and so on, until the

optimal combination of ‘buy’ nodes is found.

3.4. Behavioral aspects of preferences

As noted before, an individual’s financial behavior systematically violates the assumptions made by the normative

theory of choice. Some well observed behavioral preferences include loss-aversion, risk-seeking, framing effect,

asymmetric perception of uncertainty, hyperbolic time preference, and limited memory. A systematic modeling

approach for behavioral preferences was discussed in Gupta and Li (2003). In order to analyze the effect of behavioral

preferences on financial decisions, in this paper, behavioral aspects of loss-aversion, asymmetric perception of

uncertainty, and hyperbolic time preference will be incorporated in the decision framework. Since evidence in the

literature exists for financial decisions, the utility for consumption and wealth will be modified to incorporate these

behavioral features.

The Tversky and Kahneman (1991) loss-aversion utility function is used for capturing loss-aversion. In order

to incorporate an asymmetric perception of uncertainty, decision makers are taken to weight the utility of each

possible outcome with transformed weights, instead of the objective probabilities (Tversky and Kahneman, 1992).

The hyperbolic discount function (Loewenstein and Prelec, 1992; Laibson et al., 1998) is used for depicting the

hyperbolic phenomenon. The discount factor, ηt , is accordingly modified in Eq. (1).

3.5. Computational considerations

Following our past work (Gupta and Li, 2003), in Subproblem A, the wealth state-variable is treated as a variable.

Treating Wt as a variable simplifies the objective function and makes computation of objective gradients possible. Our

optimization problem becomes a nonlinearly constrained optimization problem with (4T − 1)/3 nonlinear constraints,

each involving four of the 5(4T −1 −1)/3+ T variables. Moreover, these constraints have a bilinear structure. Based on

the above problem structure, we use a sparse implementation of a sequential quadratic programming (SQP) algorithm

(SNOPT) to solve the nonlinearly constrained optimization problem. The computation is fast when the planning

horizon is less than seven periods (less than 1 min). However, when the planning horizon is larger than seven periods,

the increase in computation time is substantial. Subproblem B is formulated as a dynamic program, and solved by

backward recursion of dynamic programming implemented in MATLAB. The interaction between Subproblem A and

Subproblem B is facilitated using shell programming in Unix.

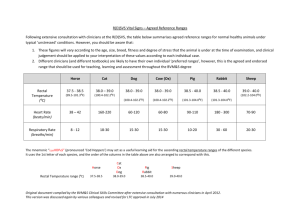

The tree structure of our optimization problem can lead to an extremely large problem, for instance, a 10 year

planning tree has 87,381 decision nodes. In order to reduce the problem size while retaining its structure, we

implemented ‘non-uniform time periods’ in the modeling (Gupta and Li, 2003, 2004). Two one-year-period branches

are compressed into a two-year-period branch by matching the first and second moments, as shown in Fig. 1. This

compression can be extended to create a four-year-period branch. However, to avoid greater losses in accuracy we will

not consider compressing to greater than four-year periods. By using a combination of multi-period branches, we can

substantially reduce the size of our optimization problem. Another advantage of using ‘non-uniform time periods’ is

that it enables more flexibility in modeling. The investment–consumption problem is in practice solved on a rolling

basis. In each time period, the current wealth is taken as the starting wealth for the optimization problem. The optimal

370

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

Fig. 1. Compressing the tree by matching its moments, p = 0.6, Su = 1.25, Sd = 0.90, u = 0, d = −1; Su∗ = 1.45, Sd∗ = 0.90, u0 = 0,

d0 = −1.13.

decision for t = 0 is implemented, which implies that the optimal decisions suggested for subsequent periods are

not directly relevant to the planner. Therefore, we can adopt a finer time resolution in the beginning of the planning

horizon (such as one-year-period branches), while longer time periods (such as two-year-period or four-year-period

branches) at the end to capture the inherent increased uncertainty farther out in time. This change retains the structure

of the optimization problem.

4. Discussion of results for the problem

We test our framework with a five-period decision tree, which consists of two one-year periods, two two-year

periods, and one four-year period, modeling a 10-year duration of pre-retirement phase. Assuming the individual

has a starting health capital (H0 ) of 10 at the age of 55, a four-way branching decision tree is constructed to model

his health and wealth evolution over time. We choose an LTC insurance coverage type with $200 maximum daily

benefit, a 30 days benefit waiting period, and a 7 years benefit period. This is a representative combination; any other

combination can be picked and analyzed in our framework. The individual planner is assumed to have $500,000 worth

of liquid assets, which is normalized to 50 units, at age 55.

4.1. Sensitivity to parameter λ

In our optimization framework, the parameter λ plays an important role. It captures an individual planner’s desire

to afford his future LTC expenditures. Therefore, we first conduct a set of sensitivity tests on the value of parameter

λ. In the following tests, the lower bound for the final saving (wm ) is set to be zero. Fig. 3 demonstrates the decisions

when λ = 1. The individual planner displays a very strong preference to try to afford the LTC costs. In order to

achieve affordability, he invests all his money in the risky asset (Fig. 3(a)) and restrains his consumption to the

minimum level (Fig. 3(b)). Consequently, at retirement (age 65), LTC expenditure is affordable at 97% of the decision

nodes by purchasing LTC insurance (Fig. 3(d)). We also observe that, when an individual has better health status

before retirement, he is more likely to purchase LTC insurance. Since a healthy person is expected to live longer after

retirement before he starts to receive LTC insurance benefits, he will pay the LTC insurance premiums for a longer

period of time. Therefore, in order to save on premium payments, he tends to buy LTC insurance at an early age when

the premium rate is relatively low.

Fig. 2 shows the discounted lifetime premium costs for LTC insurance, given that an individual possesses different

levels of health capital at retirement, HT . For instance, if an individual possesses a health capital of 9 at age 65, he

is expected to pay LTC insurance premium for another 16 years before he receives the benefits. If LTC insurance

is purchased at age 55 with an annual premium of $1,281, the discounted lifetime premium expenditure would be

$25,555. If LTC insurance is purchased at age 65 with an annual premium of $2,664, the discounted lifetime premium

cost would be $29,250. Therefore, early purchase is preferred. In contrast, an individual with HT = 4.5, is expected

to pay premiums for another 3 years before receiving the benefits, thus the discounted lifetime premium costs for

purchasing at age 65 and age 55 are $8,025 and $15,349, respectively. Hence late purchase is favored.

The above results are different from those demonstrated in Gupta and Li (2004). This is partially due to the

enhancement we have made to our LTC premium regression model. It is also due to difference in coverage benefit

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

371

Fig. 2. Comparison of discounted lifetime LTC insurance premium costs.

Fig. 3. W0 = 50, wm = 0, λ = 1. (a) Investment weights for the planning period. (b) Consumption and income levels. (c) Histogram for wealth

at planning horizon. (d) The location and percentage of ‘buy’ and ‘not buy’ decisions (the percentage in (a) indicates the percentage of decision

nodes with X t = 1; the percentage in (d) indicates the proportion of ‘buy’ nodes).

period and LTC cost structure implemented. Under the setting in Gupta and Li (2004), purchasing LTC insurance did

not allow a healthy person to save much on his LTC costs, hence making LTC insurance purchase less desirable at

early ages. The difference in the results also indicates that the coverage type of LTC insurance one selects might have

an impact on the optimal timing of LTC insurance purchase.

Fig. 4 shows the decisions when λ is set at 0.01. The individual is less concerned about whether future LTC costs

are affordable, therefore he consumes more and accumulates less wealth at retirement (Fig. 4(c)). Consequently, he is

less likely to afford the LTC costs. As shown in Fig. 4(b), the individual can afford the LTC costs only at 88.3% of the

nodes at retirement.

Lastly, we test the scenario when λ is set extremely small, 10−10 . The individual is now barely concerned about

his future LTC costs. Therefore, he consumes as much as he can, and invests solely in the risky asset. As a result, the

individual can afford LTC costs only at 68.5% of the nodes at retirement (results not shown).

In summary, in our optimization framework, an individual’s investment–consumption and LTC insurance purchase

decisions are very sensitive to the value of λ. In other words, this indicates that the heuristic works and λ is effective

in performing its role of constructing a trade-off between consumption and LTC decisions. The larger λ is, the more

concerned an individual is about affordability of the future LTC expenses. Therefore, he will try to achieve greater

affordability by taking appropriate investment–consumption decisions. In contrast, when λ is small, the individual

pays less attention to meeting his LTC expenses, and therefore hopes to rely on other means, such as qualifying for

Medicaid. Based on the results shown above, in the continued analysis, we take λ to be 0.01 as a representative level.

372

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

Fig. 4. W0 = 50, wm = 0, λ = 0.01.

Fig. 5. W0 = 50, λ = 0.01 with non-uniform lower bound w

em .

4.2. Sensitivity to the lower bound for final saving, wm

In the previous section, no lower bound was exerted on the value of final savings at retirement. We now impose

a lower bound, wm , on the final wealth, WT . The value for wm is estimated according to an individual’s health level

at retirement. Since a healthy person is expected to live longer than an unhealthy person, more assets are required

to support his post-retirement needs. Thus a state-dependent lower bound for final wealth based on an individual’s

health status at retirement is imposed. The non-uniform lower bound is w

em = {Wm,1 , Wm,2 , . . . , Wm,N }, where N

corresponds to the number of nodes in the decision tree at retirement. Based on data from the Consumer Expenditure

Survey (Bureau of Labor Statistics, 2003), we take the average annual spending for an elderly person above 65 to

be $27,561. The Wm,i is estimated as the product of an individual’s life expectancy at node i and the average annual

expenditure. Fig. 5 shows the decisions with a non-uniform lower bound imposed on final wealth, where W0 = 50

and λ = 0.01. As a result of the non-uniform w

em , the lower bound for a decision node with low health capital (Ht )

is lower than that of a decision node with a higher health capital. The values for Wm,i range between 77 and 63 for

HT between 9.5 and 7. Fig. 5 demonstrates the decisions with a non-uniform lower bound for final wealth. As shown

in Fig. 5(a), the planner lowers his consumption and invests more in the risk-free asset in order to maintain a saving

level above wm . As a result, the percentage of nodes at which LTC costs are affordable is 87.4%.

4.3. Sensitivity to initial wealth and income

An individual’s initial wealth and the income stream received thereafter, to a large extent, determine how much he

may save at retirement, even though consumption pattern and investment decisions affect the savings. A low initial

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

373

Fig. 6. Percentage of ‘buy’ nodes at each time period given different initial health, H0 .

wealth level with low income will require an individual to save more during the planning period in order to afford

the future LTC costs. Moreover, a certain level of low initial wealth and income may imply that the individual is

a potential candidate for utilizing Medicaid. In this section, sensitivity tests are performed on an individual’s initial

wealth, W0 , and income flow, It .

We first test the scenario when W0 = 50, but income level is only half the income one received in Fig. 5. λ is taken

as 0.01, and a non-uniform lower bound w

em is imposed on the final savings. The individual is observed to invest more

in the risk-free asset to ensure that his final savings reach the lower bound, w

em . However, LTC costs are affordable

only at 55.8% of the nodes at age 65. Similar results are observed for an individual with a lower initial wealth level,

W0 = 40. The planner further reduces his consumption in an attempt to meet the lower bounds. At retirement, only at

53.5% of the nodes are LTC costs affordable, which indicates that he is a potential candidate for utilizing Medicaid.

4.4. Sensitivity to initial health H0

In the above discussions, an individual planner is assumed to have a perfect health at age 55, i.e., H0 = 10. We now

conduct some sensitivity tests on the initial health status, H0 . We test the scenarios when an individual has an H0 = 9

and 8, assuming W0 = 50, and a non-uniform lower bound, w

em , is imposed on his final saving, WT . We observe that

affordability is obtained at a higher percentage of nodes at age 65 for an individual with a poorer initial health status

(Fig. 6). This is because at the planning horizon, an individual with better health condition needs more assets to afford

his future LTC expenses. Thus affordability for LTC is easier to achieve for an individual planner with a poorer initial

health status. And he consumes more and invests more in the risky asset. We also observe that an individual with

poorer initial health makes less frequent insurance purchase decisions at earlier ages, since a delayed LTC insurance

purchase reduces his premium costs.

4.4.1. Robustness of the decisions

As discussed before, estimates of post-retirement LTC costs with or without LTC insurance are obtained by

simulation. Fig. 7 shows the 95% confidence interval for the expected LTC expenditure with or without LTC insurance

from our simulation results. Since health event, t , is the only source of uncertainty in the simulation, high or low LTC

expenditures for an individual with or without LTC insurance appear in pairs.

To give a view of the robustness of our decision framework, Fig. 8 compares the percentages of purchase decisions

at each time period when post-retirement LTC expenditures take their upper/lower 95% confidence limit and mean

value. Although the investment and consumption decisions are consistent in the above three cases, the LTC costs

are more likely to be affordable when they are at their lower 95% confidence limit (90.7% at age 65), while costs

are less likely to be affordable when the LTC expenditures are at their upper 95% confidence limit (81.3% at

age 65). For instance, in order to achieve affordability even when the expenditures are above the mean, different

investment–consumption decisions should be made. In order to obtain an 87.4% affordability when the future LTC

expenditures are at their upper 95% confidence limit, the planner lowers his consumption and invests more in the risky

asset (results are not shown).

374

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

Fig. 7. (a) Confidence interval for the expected medical expenditure with LTC insurance. (b) Confidence interval for the expected medical

expenditure without LTC insurance.

Fig. 8. Purchase decisions for LTC expenditures at lower 95% confidence limit, mean, and upper 95th percentile confidence limit.

4.5. Study of the effect of behavioral preferences

Next, we incorporate some of the behavioral aspects of an individual planner’s preference into our LTC financing

decision framework.

We first incorporate the loss-aversion feature of behavioral preferences. The individual has a loss-aversion utility

function as depicted in Gupta and Li (2003). The reference value for final wealth, RW,T , is taken as the expected return

when no risky investment is made (136.36), and the reference value for consumption is set at half of the individual’s

income. Fig. 9 demonstrates the results for a loss-averse planner with W0 = 50 and H0 = 10. A non-uniform lower

bound, w

em , is exerted, and λ is taken as 0.01. Compared with the power utility (shown in Fig. 5), loss-aversion utility

shows more investment in the risk-free asset (Fig. 9(a)). In order to reduce losses with respect to his reference value

for final savings, the individual reduces his consumption significantly (Fig. 9(c)). Consequently, he ends up with a

higher level of retirement saving (Fig. 9(c)), and LTC costs are affordable at all the decision nodes at age 65 (shown

in Fig. 9(d)). To demonstrate the sensitivity of decisions on the reference value for final savings, we reduce RW,T to

2/3 of its former value, 90.91 (results not shown). Compared with the results shown in Fig. 9, less investment is made

in the risk-free asset, and more consumption is observed. Consequently LTC costs are only affordable at 78.3% of the

decision nodes at age 65. Decisions are seen to be very sensitive to the reference value.

The next behavioral feature we incorporate is hyperbolic discounting of time value of wealth (see Gupta and Li

(2003)). The individual planner possesses a loss-aversion utility, along with hyperbolic discounting of wealth over

time. As shown in Fig. 10, the consumption curve shows a hyperbolic pattern. Meanwhile, we observe LTC insurance

purchase decisions appear at an earlier age—age 57. According to the characteristics of hyperbolic discounting, the

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

375

Fig. 9. W0 = 50, λ = 0.01, non-uniform lower bound w

em , with a loss-aversion utility, R W,T = 136.36.

Fig. 10. Loss-aversion utility with hyperbolic discounting, R W,T = 136.36.

discount rates for later time periods (after the turning point) are very small (around 0.98). A low discount rate in these

time periods makes earlier purchase of LTC insurance more favorable when compared with exponential discounting.

Next, the behavioral aspect of asymmetric perception of uncertainty is examined in our framework. The asymmetric

perception of uncertainty can have an effect on both types of probabilities, the probabilities of investment return and

the probabilities of health events. Since the probability of an up-market is 0.6, according to the characteristics of the

probability of weight function (see Gupta and Li (2003)), the individual planner underestimates the probability of an

up-market, while overestimating the probability of a down-market, thus being pessimistic about investment returns

from the risky asset. In contrast, the probability of a future health event depends on an individual’s current health

and history of health events (see Eq. (12)). According to our health model, an individual with a health capital of 7

and no health shock in the previous period has a 0.166 probability of suffering a shock in the next period, while the

probability becomes 0.336 when he suffered a shock in the previous period (i.e., P(t = −1|Ht−1 = 7, t−1 = 0)

= 0.166, P(t = −1|Ht−1 = 7, t−1 = −1) = 0.336). A healthier person has a lower probability of suffering a

health shock. According to our simulation, given an initial health capital of 10, an individual’s health capital ranges

between 7.4 and 9.7 after ten years. Therefore, the weight function exerted on the probability of health events makes

the individual planner underestimate the probability of no health event and overestimate the probability of suffering

a health event, hence being pessimistic about his future health. Fig. 11 shows the decisions for an individual with

a loss-aversion utility and asymmetric perception of uncertainty. As shown in Fig. 11(a), more risk-free investment

is made as compared to one without asymmetric perception of uncertainty (see Fig. 9(a)). By increasing the riskfree investment, the possibility of insufficient retirement savings due to sequential down-markets of the risky asset

376

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

Fig. 11. Loss-aversion utility with weight function on the probability of investment and health event.

Fig. 12. Loss-aversion utility with weight function on the probability of investment and inverted weight function on the probability of health event.

is reduced. To a loss-averse planner, it means that the probability of large losses with respect to his reference value

decreases. Hence a slight increase is observed in the consumption level (see Fig. 9(b)). Since the individual is also

pessimistic about his future health, he postpones his purchase decisions to later time periods. No purchase decisions

are observed before age 59 (Fig. 11).

We also test the scenario when a healthy individual is overconfident about his health status. Contrasting with the

perception of the probability of health event described above, he now tends to overestimate the probability of no health

event and underestimate the probability of suffering a health event in the next time period. Thus the individual has

a different nature of perception of probabilities related to investment return and future health events. As shown in

Fig. 12, the individual invests less in the risky asset because he is pessimistic about its future returns. However, more

LTC insurance purchase decisions are observed in the decision tree from age 57 to age 61. Being optimistic about

his future health, he tends to purchase LTC insurance at an earlier age. The perception of uncertainty related to one’s

health may also be affected by one’s experience with health shocks. For instance, an individual may overestimate the

probability of suffering a health shock in the next time period after experiencing a health shock in a period, while

underestimating this probability when no health events happened in pervious period. Thus the asymmetric perception

of uncertainty on health event is no longer static, but dynamically changing with one’s experience with health events.

5. Conclusion

In this paper, LTC insurance purchase decisions are integrated into a framework of retirement financial planning.

Linking an individual’s health evolution with his wealth evolution allows us to address affordability issues of LTC

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

377

financing. The optimization problem is formulated as a large-scale mixed nonlinear integer program and solved by

employing an appropriately constructed heuristic. Optimal investment, consumption, and LTC insurance purchase

decisions are obtained by making tradeoffs between immediate consumption and saving for long-term needs, LTC

insurance premium and coverage. Sensitivity tests are performed on one’s initial health, initial wealth, income level,

desirability to pay for his LTC insurance related costs. We observed that the coverage type of LTC insurance one

selects has a great impact on the optimal timing of LTC insurance purchase. Well-observed behavioral preferences,

such as loss-aversion, hyperbolic discounting, and asymmetric perception of uncertainty, are incorporated into the

decision support framework, and their effects on the decisions are discussed.

In our current health evolution model, a two-way branching tree model is used to capture the occurrence of health

events, while the severity of the health events is not considered. In the next step of research, a multi-branching tree

model will be constructed to model a more realistic scenario of health evolution. The health parameters in the health

evolution model require calibration for a specific individual, or category of individuals, based on their age, sex,

geographic location, and family health history. This can be achieved by relating an individual’s health evolution

to the health risk factors he is exposed to, such as, heart disease, cholesterol level, and family health history. Likewise,

behavioral parameters capturing an individual’s behavioral preferences also need to be calibrated.

In current work, we did not include the utility for health into the objective function of the optimization problem.

LTC insurance purchase decisions are made based on comparison between LTC expenses with or without the

insurance. In the next step, the utility of one’s health will be addressed.

In the extension of our current decision support framework, we see merit in aggregating individual’s health

evolution and cost models for considering LTC issues relevant for households or couples. Moreover, addressing the

problem from different stakeholders’ (such as legislature, taxpaying public, or insurance company) perspectives will

provide valuable insight into policy-making for federal programs.

Appendix A. Data sources

• Income modeling

US Department of Labor: Bureau of Labor Statistics — http://www.bls.gov/bls/wages.htm.

• LTC cost structure model

National Health Expenditure Data — http://www.cms.hhs.gov/NationalHealthExpendData/.

Medical Expenditure Panel Survey: Data and Statistics, 1996 Nursing Home Survey —

http://www.meps.ahrq.gov/newLayout/DataStatistics.htm.

Center for Disease Control and Prevention: National Center for Health Statistics — http://www.cdc.gov/nchs/.

• LTC premium model

Cross-validating data from the following companies: GE Financial LTC Insurance (now under Genworth), John

Hancock, CNA Insurance, Teachers Insurance and Annuity Association — College Retirement Equities Fund

(TIAA-CREF) LTC Insurance (now under Metlife).

Appendix B. Proof of convergence for the heuristic

B.1. The long-term care insurance (LTCI) purchase optimization problem [LTCI master problem]

The long-term care insurance purchase optimization problem, as described in Section 3.1, is formulated as follows:

#

"

T

−1

T

X

X

ηt [U (Ct )] + ηT E[U (WT )] − E

ηt U (MLTC,t (Yt ))

MasterObj : max

X t ,Ct ,Yt

t=0

+ ληT E[(U (WT ) − U (MLTCI,T ))YT ].

t=0

s.t. Wt+1 = [Wt + It − Ct − Mt − Yt ∗ MLTCI,t ][X t St + (1 − X t )R f ],

θ

(1 − δt )Ht + t + (θ1 + θ2 t )Mt 3 ,

(25)

(26)

Ht+1 =

0 ≤ X t ≤ 1,

(27)

(28)

0 < cm ≤ C t ≤ I t ,

(29)

378

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

0 < wm ≤ WT ,

(30)

0 < Wt ,

0 ≤ Ht ≤ 10,

(31)

(32)

0 ≤ Mt ≤ Mu ,

(33)

Yt = 0 or 1,

YT = 0 if WT ≤ MLTCI,T ,

(34)

(35)

Yt−1 = 0 if Yt = 0 (optimal stopping assumption),

(36)

0 ≤ t ≤ T − 1.

(37)

Our heuristic finds an optimal solution for the above problem by iteratively solving the following two subproblems:

Subproblem A — Nonlinear program

SubAObj : max

X t ,Ct

T

−1

X

ηt [U (Ct )] + ηT E[U (WT )] + ληT E[(U (WT ) − U (MLTCI,T ))YT ],

(38)

t=0

along with constraints (26)–(33) and (37).

Subproblem B — LTC insurance purchase decisions

"

#

T

X

SubBObj : min E

ηt U (MLTC,t (Yt )) ,

(39)

t=0

along with constraints (34)–(37).

Our objective is to show that first, our heuristic converges, and second, that it converges to an optimal solution of

the master problem. Before we begin with the proof, we define the following two sets: St (n) = {Decision nodes in the

tree with Yt = 1, t ≤ T , at the nth iteration}. ST (n) = {Decision nodes in the tree with YT = 1 at the nth iteration}.

Let Yt (n), X t (n), Ct (n), Wt (n) be LTCI purchase, investment, consumption decisions and wealth level after iteration

n, respectively.

B.2. Proposition 1: ST (n + 1) ⊆ ST (n) and St (n + 1) ⊆ St (n), ∀n

The objective function of Subproblem A (Eq. (38)) can be rearranged as follows after adding and subtracting

ηT E[U (WT )YT ]:

SubAObj : max

X t ,Ct

T

−1

X

ηt [U (Ct )] + ηT E[U (WT )(1 − YT )]

t=0

+ (1 + λ)ηT E[(U (WT )YT ] − ηT E[U (MLTCI,T ))YT ].

(40)

For a given set of LTC insurance purchase decisions (Yt ), the value of ηT E[(U (MLTCI,T ))YT ], is fixed. Hence the

PT −1

optimal solution of Subproblem A is obtained by trading off among utility from consumption, ( t=0

ηt [U (Ct )]), final

saving at decision nodes where LTC insurance is not purchased, (ηT E[U (WT )(1 − YT )]), and final saving at nodes

where LTC insurance is purchased, (ηT E[(U (WT )YT )]). Depending on an individual’s preference for affordability of

LTC insurance, an extra weight of λ is given to final saving at insurance purchase nodes. Therefore, higher WT levels

are reached at LTC purchase nodes at the cost of lowered consumption and final savings at LTC non-purchase nodes.

In step 1 of our heuristic, ST (0) is obtained assuming LTC insurance hypothetical affordability at all nodes at

retirement, i.e., WT (i) ≥ MLTCI,T (i), ∀i. Therefore, ST (n) ⊆ ST (0), ∀n. During each subsequent iteration of the

heuristic, only nodes with YT = 1, i.e., subsets of ST (n), ∀n, are given extra weight in the objective function

for retaining affordability for LTC insurance, as discussed above. Therefore, only a subset of ST (n) will achieve

affordability in the following iteration, i.e., ST (n + 1) ⊆ ST (n).

For nodes prior

to the planning horizon, T , the objective function of Subproblem A focuses on maximizing the

PT −1

consumption, t=0

ηt [U (Ct )], therefore Wt (n + 1) ≤ Wt (n), for t < T and ∀n. Combining this fact with the

optimal stopping rule of Subproblem B, we have St (n + 1) ⊆ St (n), ∀t, n.

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

379

B.3. Lemma 1: The heuristic developed for solving the LTCI problem converges

Proof. The heuristic described in Section 3.3 first solves Subproblem B assuming affordability of LTC costs with or

without purchase of LTC insurance. There are two possible outcomes for the resulting LTCI purchase decisions.

– Scenario 1: ST (0) = ∅, therefore St (0) = ∅ by optimal stopping.

– Scenario 2: ST (0) 6= ∅, therefore St (0) 6= ∅, since ST (n) ⊆ St (n), ∀n.

In Scenario 1, the LTCI purchase decisions (Yt (0)) are fed into Subproblem A, the objective function of Subproblem

A becomes:

Obj : max

X t ,Ct

T

−1

X

ηt [U (Ct )] + ηT E[U (WT )].

(41)

t=0

The resulting investment (X t (0)) and consumption (Ct (0)) decisions are fed into Subproblem B. Since St (1) ⊆ St (0),

Yt (1) = Yt (0) = 0 and the heuristic converges.

In Scenario 2, since ST (1) ⊆ ST (0), if ST (1) = ∅, the heuristic converges for the same reason as in Scenario 1.

Otherwise, Yt (1)(6=0) are fed into Subproblem A. For each subsequent iteration, n, we have ST (n + 1) ⊆ ST (n) and

St (n + 1) ⊆ St (n) (Proposition 1). The heuristic continues and stops only when St (m) = St (m − 1), for certain m.

Since St (n) is a finite set and St (n + 1) ⊆ St (n), ∀n, convergence occurs in finite steps. B.4. Theorem 1: The solution our heuristic converges to is an optimal solution for the LTCI master problem

Proof. If Z t∗ = {X t∗ , Ct∗ , Yt∗ } is the solution obtained from the heuristic, it satisfies constraints given by Eqs. (26)–

(37), and we have:

PT

Condition 1: Given {X t∗ , Ct∗ }, Yt∗ solves Subproblem B, with objective function min E[ t=0

ηt U (MLTC,t (Yt ))].

PT −1

∗

∗

∗

Condition 2: Given Yt , {X t , Ct } solves Subproblem A, with objective function max X t ,Ct t=0

ηt [U (Ct )] +

ηT E[U (WT )] + ληT E[(U (WT ) − U (MLTCI,T ))YT ].

We develop a proof by contradiction as follows. Let Z t0 = {X t0 , Ct0 , Yt0 } be a feasible, optimal solution different

from Z t∗ , with MasterObj(Z t0 ) > MasterObj(Z t∗ ). We have the following two scenarios:

– Scenario 1: Y 0 = Y ∗ .

– Scenario 2: Y 0 6= Y ∗ .

PT −1

In Scenario 1, by Condition 2, {X t∗ , Ct∗ } maximizes the objective function t=0

ηt [U (Ct )] + ηT E[U (WT )] +

ληT E[(U (WT ) − U (MLTCI,T ))YT ]. Therefore, SubAObj(Z t∗ ) ≥ SubAObj(Z t0 ). Since Y 0 = Y ∗ , SubBObj(Z t∗ ) =

SubBObj(Z t0 ). This contradicts MasterObj(Z t0 ) > MasterObj(Z t∗ ).

Let St0 = {Decision nodes with Yt0 = 1, t ≤ T }, and ST0 = {Decision nodes with YT0 = 1}. St∗ and ST∗ are similarly

defined for Z t∗ . Note that St∗ ⊆ St (0) and St0 ⊆ St (0), since St (0) is the maximal set of nodes where LTCI is desirable,

and those that are also affordable have to be a subset of St (0).

In Scenario 2, there are three cases.

– Case 1: St∗ ⊆ St0 . In the heuristic, St (n +1) ⊆ St (n), ∀n, where in each iteration fewer nodes are retained affordable

for LTCI purchase in favor of increasing the utility from consumption and wealth. The heuristic converges to St∗

where a balance in trade-off between utility from consumption (and wealth) and LTCI costs is reached. St∗ satisfies

conditions 1 and 2 as stated above.

Since St∗ ⊆ St0 ⊆ St (0), for some m, St (m + 1) ⊆ St0 ⊆ St (m). At iteration m, LTCI affordability is given up

in some nodes in favor of optimally increasing utility from consumption and wealth, thus increasing the SubAObj.

Therefore, SubAObj(Z t (m + 1)) ≥ SubAObj(Z t0 ), and Z t (m + 1) is feasible. Moreover, SubAObj(Z t (m + 1)) ≤

SubAObj(Z t∗ ), otherwise, the heuristic stops at iteration m + 1. Also, SubBObj(Z t (m + 1)) ≤ SubBObj(Z t0 ), since

St (m +1) ⊆ St0 ⊆ St (m). Therefore, MasterObj(Z t (m +1)) ≥ MasterObj(Z t0 ). This is a contradiction to optimality

of Z t0 .

380

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

– Case 2: St0 ⊆ St∗ . A reverse argument from Case 1 applies here. Since a balance in trade-off between utility from

consumption and wealth and making LTCI affordable is achieved at Z t∗ , further reducing the nodes where LTCI

is retained to be affordable to increase the utility from consumption and wealth does not improve the SubAObj.

Therefore, SubAObj(Z t∗ ) ≥ SubAObj(Z t0 ), and E[U (MLTC,T (YT∗ ))] < E[U (MLTC,T (YT0 ))], since ST0 ⊆ ST∗ , which

means more of the LTCI desirable nodes are affordable by ST∗ . By the backward recursion of DP and the optimal

stopping rule, SubBObj(Z t∗ ) ≤ SubBObj(Z t0 ). This implies MasterObj(Z t∗ ) ≥ MasterObj(Z t0 ), which contradicts

MasterObj(Z t0 ) > MasterObj(Z t∗ ).

– Case 3: St0 − St∗ 6= ∅ and St∗ − St0 6= ∅. We have that St0 ⊆ St (0), since St (0) is the maximal set of nodes where

LTCI is desirable, and St0 ⊆ St (1), since St (1) is the maximal set of nodes where purchase of LTCI can be made

affordable. Therefore, in the heuristic iterations, either for some m, St0 ⊆ St (m), but St (m + 1) is not a subset of St0

and St0 is not a subset of St (m + 1), or St0 ⊆ St∗ . If St0 ⊆ St∗ , it is the same as Case 2.

Since the heuristic moves the solution, Z t (n), keeping conditions 1 and 2 satisfied, from St (m) to St (m + 1)

such that LTCI is affordable in nodes that allow optimally increasing the utility from consumption and wealth,

SubAObj(Z t (m + 1)) ≥ SubAObj(Z t0 ), and E[U (MLTC,T (YT (m + 1)))] ≤ E[U (MLTC,T (YT0 ))]. This is because

St0 ⊆ St (m), and among all the subsets of St (m), St (m + 1) results in the best possible LTC-related cost reduction.

Also, Z t (m +1) is feasible. By the backward recursion of DP and the optimal stopping rule, SubBObj(Z t (m +1)) ≤

SubBObj(Z t0 ). This implies MasterObj(Z t (m + 1)) ≥ MasterObj(Z t0 ), which contradicts the optimality of Z t0 .

In conclusion, MasterObj(Z t∗ ) ≥ MasterObj(Z t0 ) for all Z t0 that is feasible by constraints (26)–(37).

References

AHCA, 2003. Consumer information — about long-term care. http://www.longtermcareliving.com/.

Arrow, K.H., 1963. Uncertainty and the welfareeconomics of medical care. American Economic Review 53, 941–973.

Barberis, N., Thaler, R., 2003. A survey of behavioral finance. In: Handbook of the Economics of Finance. Elsevier, North-Holland.

Barberis, N., 2000. Investing for the long run when returns are predictable. Journal of Finance 55, 225–264.

Beekman, J.A., 1989. An alternative premium calculation method for certain long-term care coverages. Actuarial Research Clearing House 2,

39–61.

Bell, D., Raiffa, H., Tversky, A. (Eds.), 1988. Decision Making: Descriptive, Normative, and Prescriptive Interactions. Cambridge University Press,

Cambridge, ISBN: 0-521-35149-9.

Bell, D., 1982. Regret in decision making under uncertainty. Operations Research 30, 961–981.

Berkelaar, A., Kouwenberg, R., 2003. Retirement saving with contribution payments and labor income as a benchmark for investments. Journal of

Economic Dynamics and Control 27, 1069–1097.

Birge, J.R., 1997. Stochastic programming computation and applications. INFORMS Journal on Computing 9 (2), 111–133.

Campbell, J.Y., Viceira, L.M., 1996. Consumption and portfolio decisions when expected return are time varying. National Bureau of Economics

Research, Working paper No. 5857.

Campbell, J.Y., Viceira, L.M., 2002. Strategic Asset Allocation. Oxford University Press, New York.

CBO, 1999. Projections of expenditure for long-term care services for the elderly, http://www.cbo.gov/showdoc.cfm?index=1123&sequence=0.

Chen, Y.P., 2001. Funding long-term care in the United States: The role of private insurance. Geneva Papers on Risk and Insurance 26, 656–666.

Cohen, M.A., 2003. Private long-term care insurance. Journal of Aging and Health 15 (1), 74–98.

Collett, D.A., Austin, C.L., White, J.W., 1999. Long-term care insurance: A rapidly growing, little understood product. Best Week-Life/Health

Supplement 7, October 25.

Cropper, M.L., 1977. Health, investment in health, and occupational choice. Journal of Political Ecomomy 85, 1273–1294.

Culyer, A.J., Gaag, J., Perlman, M.B. (Eds.), 1981. Health, Economics and Health Economics. North-Holland, Amsterdam.

Gourinchas, P., Parker, J.A., 2002. Consumption over the life cycle. Econometrica 70 (1), 47–89.

Grossman, M., 1972a. The Demand for Health: A Theoretical and Empirical Investigation. National Bureau of Economic Research, Columbia

University Press, New York.

Grossman, M., 1972b. On the concept of health capital and the demand for health. Journal of Political Economy 80 (2), 223–255.

Gupta, A., Li, L., 2003. Behavioral modeling in optimal investment-consumption decisions for long-term financial planning. In: The Proceedings

of the International Conference on Computational Intellegence in Economics and Finance, North Carolina.

Gupta, A., Li, L., 2004. A modeling framework for optimal long-term care insurance purchase decisions in retirement planning. Health Care

Management Science 7, 105–107.

Gupta, A., Murray, W., 2003. How to spend and invest retirement savings. Annals of Operational Research 124 (1), 205–224.

Haberman, S., Pitacco, E., 1999. Actuarial Models for Disability Insurance. Chapman/CRC.

Haberman, S., Olivieri, A., Pitacco, E., 1997. Multiple state modeling and long-term care insurance. Presented to the Staple Inn Actuarial Society.

Hall, R.E., Mishkin, F.S., 1982. The sensitivity of consumption to transitory income: Estimates from panel data of households. Econometrica

461–481.

HCFA, 1999. National health expenditure projections.

HIICAP, 2003. Long term care. http://hiicap.state.ny.us/ltc/.

A. Gupta, L. Li / Insurance: Mathematics and Economics 41 (2007) 362–381

381

Kahneman, D., Tversky, A., 1979. Prospect theory: An analysis of decision under risk. Econometrica 47 (2), 263–292.

Kahneman, D., Slovic, P., Tversky, A., 1981. Judgement Under Uncertainty — Heuristics and biases. Cambridge University Press, Cambridge.

Kemper, P., Spillman, B.C., Murtaugh, C.M., 1991. A lifetime perspective on proposals for financing nursing home care. Inquiry 28 (4), 333–344.

Laibson, D.I., Repetto, A., Tobacman, J., 1998. Self-control and saving for retirement. Brookings Papers on Economic Activity 1, 91–172.

Levikson, B., Mizrahi, G., 1994. Pricing long term care insurance contracts. Insurance: Mathematics and Economics 14, 1–18.

Levikson, B., Frostig, E., Bshouty, D., 2001. An algorithm evaluating general life insurance programs. Methodology and Computing in Applied

Probability 3, 329–340.

Loewenstein, G., Prelec, D., 1992. Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economics 107,

573–598.

Medicaid eligibility policy, 2002. http://www.cms.hhs.gov/medicaid/eligibility/.

Merton, R.C., 1969. Lifetime portfolio selection under uncertainty: The continuous-time case. Review of Economics and Statistics 51 (3), 247–257.

Mitialo, C., September 2002. What share of beneficiaries total health care costs does medicare pay? http://www.cms.hhs.gov/medicaid/eligibility/.

AARP.

Moody, E.F., 2000. Long term care, http://www.efmoody.com/longterm/longtermtext.html.

Moody, E.F., 2000. Long term care commentary, http://www.efmoody.com/longterm/commentary.html.

Norberg, R., 1995. Differential equations for higher order moments of present value in life insurance. Insurance: Mathematics & Economics 17,

171–180.

Picone, G., Uribe, M., Wilson, R.M., 1998. The effect of uncertainty on the demand for medical care, health capital and wealth. Journal of Health

Economics 17, 171–185.

Samuelson, P.A., 1969. Lifetime portfolio selection by dynamic stochastic programming. Review of Economics and Statistics 51, 239–246.

Schwab, C.A., July 2001. What share of beneficiaries total health care costs does medicare pay? http://www.cms.hhs.gov/medicaid/eligibility/.

Spillman, B.C., Kemper, P., 1995. Lifetime patterns of payment for nursing home care. Medical Care 33 (3), 280–296.

Thaler, R.H., Tversky, A., Schwartz, A., 1997. The effect of myopia and loss aversion on risk-taking: An experimental test. Quarterly Journal of

Economics 112, 647–661.

Tversky, A., Kahneman, D., 1986. Rational choice and the framing of decisions. Journal of Business 59 (4), 251–278.

Tversky, A., Kahneman, D., 1991. Loss aversion in riskless choice: A reference-dependent model. The Quaterly Journal of Economics 106 (4),

1039–1061.

Tversky, A., Kahneman, D., 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5 (4),

297–323.