Cash Handling Policies & Procedures

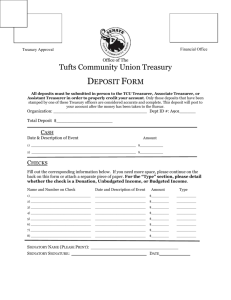

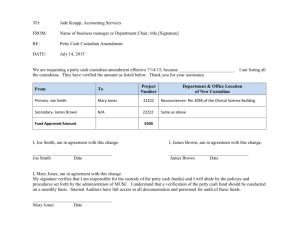

advertisement