App: Equations

advertisement

Back Matter

Appendix B: Key Equations

© The McGraw−Hill

Companies, 2010

B

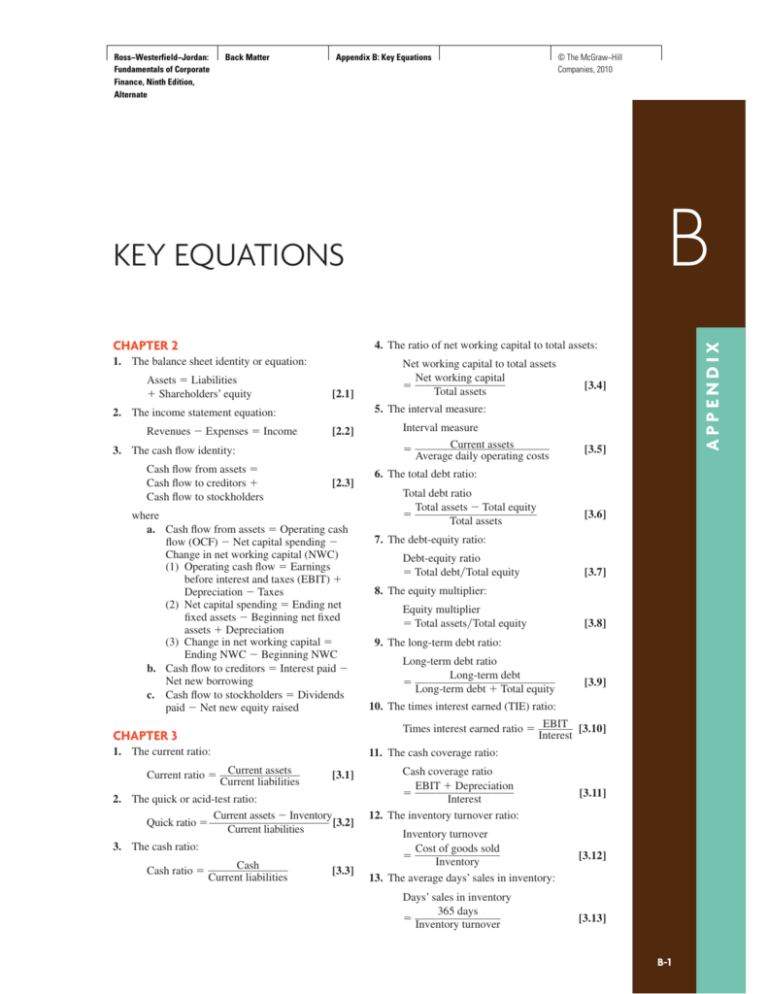

KEY EQUATIONS

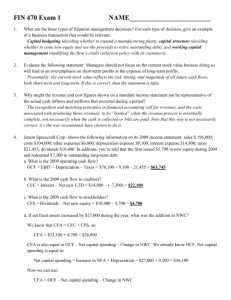

CHAPTER 2

4. The ratio of net working capital to total assets:

1. The balance sheet identity or equation:

Assets Liabilities

Shareholders’ equity

[2.1]

[2.2]

3. The cash flow identity:

Cash flow from assets Cash flow to creditors Cash flow to stockholders

[2.3]

where

a. Cash flow from assets Operating cash

flow (OCF) Net capital spending Change in net working capital (NWC)

(1) Operating cash flow Earnings

before interest and taxes (EBIT) Depreciation Taxes

(2) Net capital spending Ending net

fixed assets Beginning net fixed

assets Depreciation

(3) Change in net working capital Ending NWC Beginning NWC

b. Cash flow to creditors Interest paid Net new borrowing

c. Cash flow to stockholders Dividends

paid Net new equity raised

1. The current ratio:

[3.5]

6. The total debt ratio:

Total debt ratio

Total assets Total equity

______________________

Total assets

[3.6]

7. The debt-equity ratio:

Debt-equity ratio

Total debtTotal equity

[3.7]

8. The equity multiplier:

Equity multiplier

Total assetsTotal equity

[3.8]

9. The long-term debt ratio:

Long-term debt ratio

Long-term debt

_________________________

Long-term debt Total equity

[3.9]

10. The times interest earned (TIE) ratio:

11. The cash coverage ratio:

[3.1]

2. The quick or acid-test ratio:

Current assets Inventory

Quick ratio ______________________ [3.2]

Current liabilities

3. The cash ratio:

Cash

Cash ratio _______________

Current liabilities

Interval measure

Current assets

________________________

Average daily operating costs

EBIT [3.10]

Times interest earned ratio _______

Interest

CHAPTER 3

Current assets

Current ratio _______________

Current liabilities

[3.4]

5. The interval measure:

2. The income statement equation:

Revenues Expenses Income

Net working capital to total assets

Net working capital

_________________

Total assets

APPENDIX

Ross−Westerfield−Jordan:

Fundamentals of Corporate

Finance, Ninth Edition,

Alternate

[3.3]

Cash coverage ratio

EBIT Depreciation

__________________

Interest

12. The inventory turnover ratio:

[3.11]

Inventory turnover

Cost of goods sold

________________

Inventory

13. The average days’ sales in inventory:

[3.12]

Days’ sales in inventory

365 days

________________

Inventory turnover

[3.13]

B-1

Ross−Westerfield−Jordan:

Fundamentals of Corporate

Finance, Ninth Edition,

Alternate

B-2

Back Matter

APPENDIX B

© The McGraw−Hill

Companies, 2010

Appendix B: Key Equations

Key Equations

14. The receivables turnover ratio:

Receivables turnover

Sales

_________________

Accounts receivable

15. The days’ sales in receivables:

2. The internal growth rate:

[3.14]

ROA b

Internal growth rate ____________

1 ROA b

[4.2]

3. The sustainable growth rate:

ROE b

Sustainable growth rate ____________

1 ROE b

Days’ sales in receivables

365 days

__________________

Receivables turnover

[3.15]

[3.16]

17. The fixed asset turnover ratio:

Sales

Fixed asset turnover _____________

Net fixed assets

Total assets

Sales

[3.18]

[3.19]

[3.20]

21. Return on equity (ROE):

Net income

Return on equity __________

Total equity

22. The price-earnings (PE) ratio:

Price per share

PE ratio ________________

Earnings per share

PV (1 r)t FVt

PV FVt (1 r)t FVt [1(1 r)t]

Annuity present value

[3.22]

1 Present value factor

C ____________________

r

(

{

[3.23]

[3.24]

Return on assets

t

)

}

[6.1]

2. The future value factor for an annuity:

Annuity FV factor

(Future value factor 1)r

[(1 r)t 1]r

3. Annuity due value Ordinary annuity value

(1 r)

[6.2]

[6.3]

4. Present value for a perpetuity:

ROE Profit margin

Total asset turnover

Equity multiplier

PV for a perpetuity Cr C (1r)

1. The dividend payout ratio:

[4.1]

[6.4]

5. Growing annuity present value

1g t

1 _____

1r

C ___________

rg

[6.5]

6. Growing perpetuity present value

C

_____

rg

[6.6]

CHAPTER 4

Dividend payout ratio

Cash dividendsNet income

[5.3]

1. The present value of an annuity of C dollars per period

for t periods when the rate of return or interest rate is r:

1 [1(1 r) ]

C ______________

r

24. The Du Pont identity:

Sales ______

Net income ______

Assets

ROE __________

Assets

Sales

Equity

[5.2]

3. The relationship between future value and present

value (the basic present value equation):

CHAPTER 6

[3.21]

23. The market-to-book ratio:

Market-to-book ratio

Market value per share

___________________

Book value per share

[5.1]

2. The present value of $1 to be received t periods in

the future at a discount rate of r:

PV $1 [1(1 r)t] $1(1 r)t

20. Return on assets (ROA):

Net income

Return on assets __________

Total assets

1. The future value of $1 invested for t periods at rate

of r per period:

Future value $1 (1 r)t

19. Profit margin:

Net income

Profit margin __________

1

________________

Total asset turnover

CHAPTER 5

[3.17]

18. The total asset turnover ratio:

Sales

Total asset turnover __________

4. The capital intensity ratio:

Total assets

Capital intensity ratio __________

Sales

16. The net working capital (NWC) turnover ratio:

Sales

NWC turnover _____

NWC

[4.3]

(

)

Ross−Westerfield−Jordan:

Fundamentals of Corporate

Finance, Ninth Edition,

Alternate

Back Matter

© The McGraw−Hill

Companies, 2010

Appendix B: Key Equations

APPENDIX B

PV of cash flows

Profitability index ________________

Cost of investment

EAR [1 (Quoted ratem)]m 1

8. Effective annual rate (EAR), where q stands for the

continuously compounded quoted rate:

CHAPTER 10

1. Bottom-up approach to operating cash flow (OCF):

EAR e q 1

OCF Net income Depreciation

CHAPTER 7

[7.1]

[7.2]

[7.3]

[7.4]

[10.3]

[11.1]

2. Relationship between operating cash flow (OCF)

and sales volume:

Q (FC OCF)(P v)

[11.3]

Q FC(P v)

4. Financial break-even level:

[8.3]

Q (FC OCF*)(P v)

where

[8.7]

NPV Present value of future cash flows

Investment cost

2. Payback period:

Payback period Number of years that pass before

the sum of an investment’s cash flows equals the cost

of the investment

3. Discounted payback period:

Discounted payback period Number of years that

pass before the sum of an investment’s discounted

cash flows equals the cost of the investment

IRR Discount rate of required return such that

the net present value of an investment is zero

OCF (Sales Costs) (1 T)

Depreciation T

3. Cash break-even level:

1. Net present value (NPV):

5. Internal rate of return (IRR):

3. Tax shield approach to operating cash flow (OCF):

Q (FC D)(P v)

CHAPTER 9

4. The average accounting return (AAR):

Average net income

AAR _________________

Average book value

[10.2]

1. Accounting break-even level:

2. Required return:

R D1P0 g

OCF Sales Costs Taxes

CHAPTER 11

CHAPTER 8

1. The dividend growth model:

D0 (1 g) ______

D1

P0 ___________

Rg

Rg

[10.1]

2. Top-down approach to operating cash flow (OCF):

1. Bond value if bond has (1) a face value of F paid at

maturity, (2) a coupon of C paid per period, (3) t periods

to maturity, and (4) a yield of r per period:

1 R (1 r) (1 h)

Rrhrh

Rrh

B-3

6. Profitability index:

7. Effective annual rate (EAR), where m is the number

of times the interest is compounded during the year:

Bond value

C [1 1(1 r)t]r F(1 r)t

Bond value

Present value

Present value

of the coupons

of the face amount

2. The Fisher effect:

Key Equations

OCF* Zero NPV cash flow

5. Degree of operating leverage (DOL):

DOL 1 FCOCF

[11.4]

CHAPTER 12

1. Variance of returns, Var(R) or 2:

1 [(R __

R )2 · · ·

Var(R) _____

T 1 __1

(RT R )2]

[12.3]

2. Standard deviation of returns, SD(R) or :

Var(R)

SD(R) CHAPTER 13

1. Risk premium:

Risk premium Expected return

– Risk-free rate

[13.1]

2. Expected return on a portfolio:

E(RP) x1 E(R1) x 2 E(R2) · · ·

xn E(R n)

[13.2]

Ross−Westerfield−Jordan:

Fundamentals of Corporate

Finance, Ninth Edition,

Alternate

B-4

Back Matter

APPENDIX B

Appendix B: Key Equations

© The McGraw−Hill

Companies, 2010

Key Equations

3. The reward-to-risk ratio:

b. Proposition I:

E[Ri] Rf

Reward-to-risk ratio _________

i

VL VU TC D

4. The capital asset pricing model (CAPM):

E(Ri ) Rf [E(RM) Rf ] i

[13.7]

1. Required return on equity, RE (dividend growth model):

[14.1]

2. Required return on equity, RE (CAPM):

RE R f E (RM R f )

[14.2]

3. Required return on preferred stock, RP:

RP DP0

5. Weighted average flotation cost, fA:

fA _E_ fE _D_ fD

V

V

[14.8]

2. The cash cycle:

Cash cycle Operating cycle

Accounts payable period

[18.5]

a. Average daily float:

Total float

Average daily float _________

Total days

b. Average daily float:

Average daily float

Average daily receipts

Weighted average delay

a. Number of new shares:

[19.1]

[19.2]

2. The Baumol-Allais-Tobin (BAT) model:

a. Opportunity costs:

[15.1]

Opportunity costs (C2) R

[19A.1]

b. Trading costs:

Number of rights needed to buy a share of stock

Old shares

[15.2]

__________

New shares

c. Value of a right:

Value of a right Rights-on price Ex-rights

price

Trading costs (TC) F

[19A.2]

c. Total cost:

Total cost Opportunity costs

Trading costs

[19A.3]

d. The optimal initial cash balance:

(2T F)R

C* CHAPTER 16

[19A.4]

3. The Miller-Orr model:

1. Modigliani-Miller propositions (no taxes):

a. The optimal cash balance:

a. Proposition I:

C* L (34 F 2R)13

VL VU

[19A.5]

b. The upper limit:

b. Proposition II:

[16.1]

2. Modigliani-Miller propositions (with taxes):

U* 3 C* 2 L

[19A.6]

CHAPTER 20

a. Value of the interest tax shield:

Present value of the interest tax shield

(TC D RD)RD

TC D

[18.4]

1. Float measurement:

[14.6]

1. Rights offerings:

RE RA (RA RD) (DE )

Operating cycle Inventory period

Accounts receivable period

CHAPTER 19

CHAPTER 15

Number of new shares

Funds to be raised

_______________

Subscription price

b. Number of rights needed:

1. The operating cycle:

[14.3]

4. The weighted average cost of capital (WACC):

WACC (EV) RE (DV) RD

(1 TC)

[16.4]

CHAPTER 18

CHAPTER 14

RE D1P0 g

c. Proposition II:

RE RU (RU RD) (DE )

(1 TC)

[16.3]

1. The size of receivables:

[16.2]

Accounts receivable

Average daily sales ACP

[20.1]

Ross−Westerfield−Jordan:

Fundamentals of Corporate

Finance, Ninth Edition,

Alternate

Back Matter

© The McGraw−Hill

Companies, 2010

Appendix B: Key Equations

APPENDIX B

3. Uncovered interest parity (UIP):

2. NPV of switching credit terms:

E(St) S0 [1 (RFC RUS)]t

a. Present value of switching:

PV [(P v)(Q Q)]R

[20.4]

[20.5]

c. NPV of switching:

NPV of switching [PQ v(Q Q)]

[(P v)

(Q Q)]R

[20.6]

[20.9]

[20.10]

[24.5]

[24.6]

1. Put-call parity condition:

C S N(d1) E eRt N(d2)

[20.12]

[25.2]

[20.15]

[21.4]

b. Approximate, multiperiod:

[21.7]

[25.7]

CHAPTER 26

4. The NPV of a merger:

NPV V *B Cost to Firm A of

the acquisition

a. Exact, single period:

[25.6]

3. Value of a risk-free bond:

Value of risky bond Put option

[21.3]

[25.5]

where

d1 [ln(SE) (R 22) t]( t )

d2 d1 t

2. Interest rate parity (IRP):

Ft S0 [1 (RFC RUS)]t

[24.4]

2. The Black-Scholes call option formula:

1. Purchasing power parity (PPP):

F1S0 (1 RFC)(1 RUS)

Stock value

Present value of the exercise price

C0 S0 E(1 Rf )t

S P PV(E) C

CHAPTER 21

E(St) S0 [1 (hFC hUS)]t

b. Lower bound:

C0 0 if S0 E 0

C0 S0 E if S0 E 0

[24.3]

CHAPTER 25

[20.11]

d. The optimal order size Q*:

2T F

C0 S0

C0 S0 E(1 R f )

c. Total costs:

CC

_______

[24.2]

4. Value of a call that is certain to finish in-the-money:

Call option value

b. Total restocking costs:

Q* b. C1 S1 E if (S1 E) 0

3. S0 C0 E(1 R f )

a. Total carrying costs:

Total costs Carrying costs

Restocking costs

(Q2) CC

F (TQ)

[24.1]

[20.8]

4. The economic order quantity (EOQ) model:

Total restocking costs

Fixed cost per order

Number of orders F (TQ)

a. C1 0 if (S1 E) 0

a. Upper bound:

b. With repeat business:

Total carrying costs

Average inventory

Carrying costs per unit

(Q2) CC

CHAPTER 24

2. Bounds on the value of a call option:

a. With no repeat business:

NPV v (1 )(P v)R

[21.10]

1. Value of a call option at maturity:

3. NPV of granting credit:

NPV v (1 )P(1 R)

[21.9]

4. International Fisher effect (IFE):

RUS hUS RFC hFC

b. Cost of switching:

Cost of switching PQ v(Q Q)

B-5

Key Equations

[26.1]