Bonds and Discount Notes - Federal Farm Credit Banks Funding

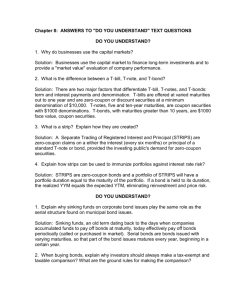

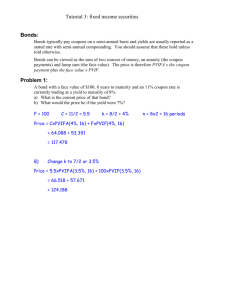

advertisement