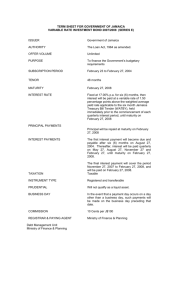

Farmer Mac

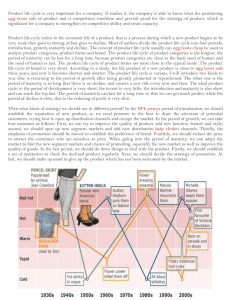

advertisement