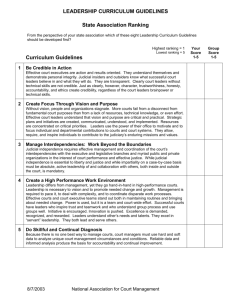

ARTICLE - Elon University

advertisement