ALABAMA CPA MAGAZINE I MAY 2013

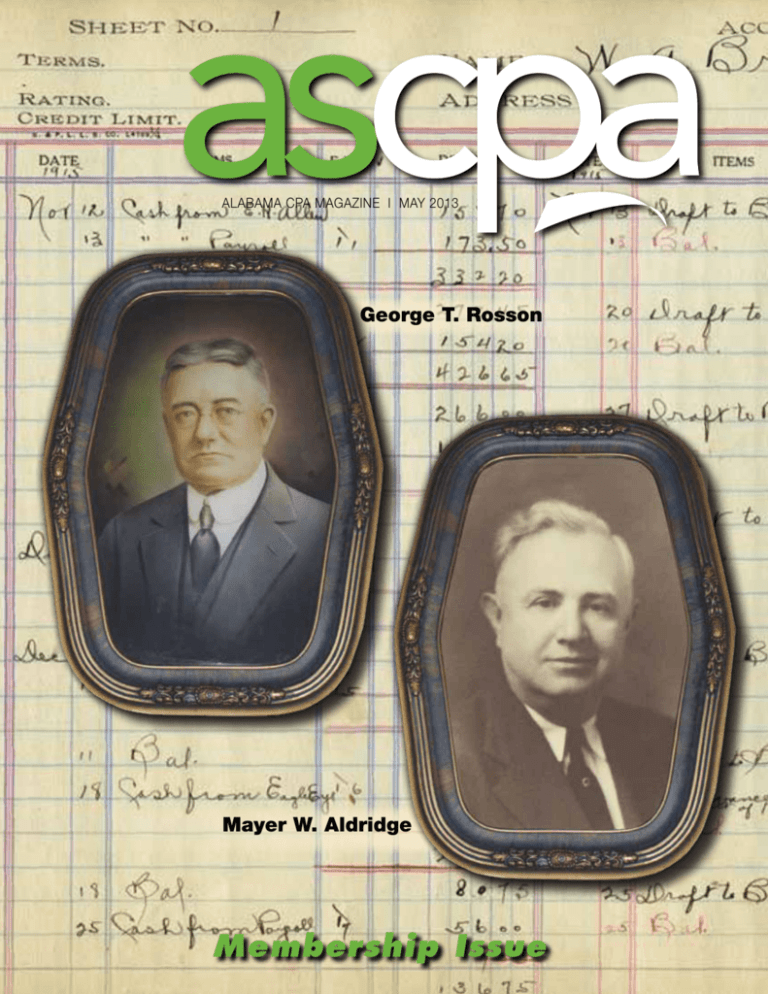

George T. Rosson

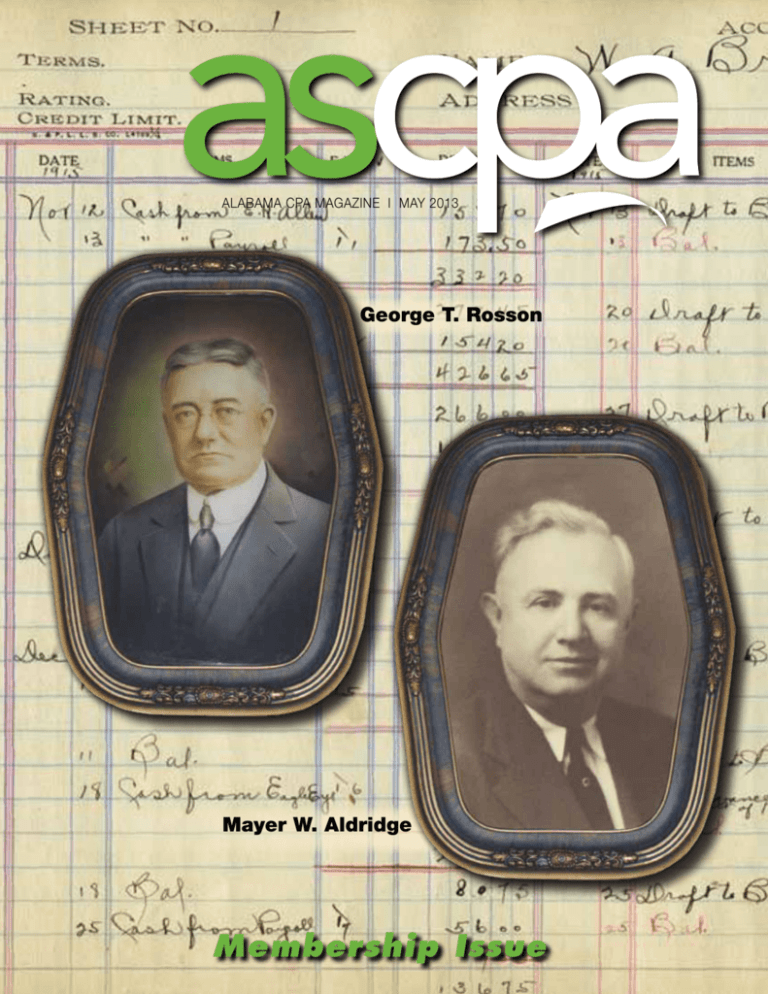

Mayer W. Aldridge

Membership Issue

Alabama Society of

Certified Public Accountants

P.O. Box 242987

Montgomery, Alabama 36124-2987

1-800-227-1711

334-834-7650

www.ascpa.org

Officers

Steven A. Shelton, Chair

Renee B. Hubbard, Chair-Elect

Don McCleod, Vice-Chair

Dr. Lowell S. Broom,

Secretary-Treasurer

John P. Shank, Past Chair

Board of Directors

Tuan P. Blank

Roger F. Bryant

James R. L. Carroll

James Adam Causey

Allison D. Edge

Allison H. Guice

Mark E. Hieronymus

R. Rush Letson III

Bradford A. Lynch

Amanda N. Paul

Gerald G. Pentecost, Jr.

Lewis T. Shreve

Ronald W. Stokes

Chasity L. Sweatmon

Douglas C. Moseley, Young CPA

Nicole Cunningham, Young CPA

AICPA Council Members

William H. Carr

E. Lamar Reeves

Steven A. Shelton

Jimmy L. Williamson

Message from the Chair...

It is really hard to believe that this is my last article as your chairman. What is

even harder to comprehend is that some of you actually read these articles over

the past year. I sincerely appreciate the comments you have shared with me as

I’ve traveled the state as your chair. This edition is focused on membership in the

ASCPA. Writing an article on membership to your members feels a lot like preaching to the choir about coming to church. Obviously you are already a member or

you would not be getting this newsletter.

However what we would like to emphasize are the benefits of membership. I am pretty confident

that the vast majority of you do not know everything your society does for you. I have served on the

board for several years, have chaired a committee or two, am your current chairman and I regularly

discover things the society does for us that I did not know about. Probably the most visible benefit is

excellent high quality education, but that is just the beginning. There is representation in Montgomery

and Washington D.C that is critical these days, affinity programs, opportunities for public service, leadership training, high school and college recruitment, business and career referrals, networking and professional feedback at chapter meetings, technical updates and much more. I want to encourage you

to get involved. Find the program, event, activity or service project that interest you and let someone

at the ASCPA office know you are ready to participate. You will find it rewarding to you and beneficial

to those you serve.

When I started last June, writing 10 articles seemed like a lot, and I have to admit I was dreading it a

little. The months have flown by and the words have appeared. I cannot tell you what a privilege it has

been to serve as your chairman this year. I have thoroughly enjoyed visiting the chapters and getting

to meet so many of you for the first time. Yes, Mobile, you are still on my list and I will see you in May.

I want to publicly thank Jeannine and the ASCPA staff for the excellent work they do. You need to

know that your Society is in good hands. It is a fact that they do more for us with less staff and fewer

dollars than most, if not every, Society in the country. You should be proud of them and the work they do.

I also want to say thanks to my wife, Sue. You encouraged me to serve and have been so supportive while I traveled the state this year and for that I am most thankful. I guess you will be expecting

me to catch up on some chores after June. No promises, but we shall see.

Well, farewell my friends. As always, if I or anyone at the ASCPA office can help you in any way, do

not hesitate to call on us.

Steve

GR WTH

Past Chair, AICPA

The Alabama CPA Magazine is published by

Alabama Society of Certified Public Accountants

as a membership service to Society members.

Views and opinions appearing in this publication

are not necessarily endorsed by the ASCPA. The

deadline for submitting materials for publication

is the first of the month preceding issue date.

A new designation representing accomplished professionals that

drive and deliver business success, worldwide.

Jeannine P. Birmingham, CPA, CAE, CGMA

Find out more at cgma.org

It’s what CGMA stands for.

President and CEO

Diane L. Christy, Editor

Photo of George Rosson

courtesy of Smith Dukes Buckalew;

Mr. Aldridge courtesy of Aldridge Borden.

2

The Alabama CPA MAGAZINE

Copyright © 2012 American Institute of CPAs. All rights reserved.

The Alabama CPA

MAGAZINE

Annual Meeting

It’s time to sharpen your pencils and your skills!

N

etworking, the latest professional updates, 8 hours of education

credits, more networking, exhibitor and sponsor booths and door

prizes, too. Meet the accomplished speakers who will be there.

Robert Durak, CPA is the director of Private Company Financial

Reporting at the American Institute of CPAs and an 18 year veteran of

the AICPA. He has a background in auditing and was with Deloitte and

Touche for 8 years. James D. Martin, CPA is a partner at Atlanta firm

Martin & Orr, LLC. He currently manages a client base of 250 corporate,

individual, partnership and fiduciary clients providing services in tax, audit,

mergers and acquisitions and fraud. He prepares and presents to major

corporate clients and CPAs on a variety of accounting, auditing and taxation topics and is a regular contributor to the ASCPA education schedule.

Tommy Stephens, CPA, CITP is a partner in K2 Enterprises and has

lectured nationally in 1350 sessions to more than 40,000 participants.

He has worked in public accounting (including his own firm since 1994),

as well as in the corporate sector. He continues to provide consulting

services to small businesses and CPA firms. Rich Caturano, CPA is the

managing partner of McGladrey’s New England market circle (Boston) and

was elected chair of the AICPA in October 2012. Throughout his career,

Caturano has specialized in serving middle market companies, and he

cites the thousands of jobs created by clients as a point of professional

pride. He was a founding member of Vitale, Caturano and Company, which

built deep expertise in the high-tech, biotech, manufacturing and professional services sectors. By the time it merged with McGladrey in 2010,

it had grown into New England’s largest full-service, regional accounting

firm and was widely recognized for enlightened employment practices.

Bruce Ely is the chair of Bradley Arant, Boult & Cummings’ state and local tax practice group. He has been a frequent contributor to the ASCPA

education programs for the past 31 years and co-authors the legislative

e-zine which appears weekly during the legislative session. Ralph Summerford, CPA, ABV, CFE, CIRA CFF is the president of Forensic Strategic Solutions, Inc. Mr. Summerford testifies as an expert witness in federal

and state courts on matters involving complicated financial transactions.

He serves on the faculty of the Association of Certified Fraud Examiners

where he teaches courses around the world. He served a three-year term

for the Association of Certified Fraud Examiners’ Board of Regents as

Vice Chairman. He is a guest lecturer at seminars, colleges and universities where he strives to enhance the understanding of fraud and forensic

accounting. He has published articles that have appeared in Accounting

Today as well as a number of other publications. Mike Frost, CPA is an

associate and shareholder of MDA Professional Group, P.C. and has been

with the Albertville office since 1989. He has served as technical advisor

for tax articles for the Sand Mountain Reporter newspaper, and has been

a regular on the public speaking circuit. Frost is a member of the faculty

of the AICPA.

The Alabama CPA MAGAZINE

94th Annual Meeting Agenda

7:00 – 8:00 Chair’s Breakfast

Concurrent Sessions – A&A

Session A

8:00-9:00

Financial Reporting Framework for

Small to Medium-sized Businesses

Robert Durak, CPA, CGMA – Private Company Financial

Reporting, AICPA

9:20-12:00

Accounting and Auditing Update – Accounting Life

in the Real World

James D. Martin, CPA – Martin & Orr, LLC

Session B

8:00-12:00

Office 2013 and Windows 8: Ready or not, they are here!

Tommy Stephens, CPA, CITP – K2 Enterprises

12:00-1:30

Luncheon

Professional Issues Update

Chair of the AICPA, Rich Caturano, CPA – McGladrey LLP, Boston

Awards and Election of Officers

Concurrent Sessions

1:45-4:30

Recent Developments and Planning Ideas in Tax

Bruce Ely and staff from Bradley Arant Boult & Cummings, LLP

1:45-4:30

The Underbelly of Accounting Malpractice (A&A)

Ralph Q. Summerford, CPA, CFE, CIRA, ABV, CFF

Forensic Strategic Solutions, Inc.

1:45-4:30

Young CPA Session

The Young CPA and Marketing: From Fear to Confidence

Mike Frost, CPA – MDA Professional Group

3:15

Afternoon break and door prize awards

June 6, 2013

Cahaba Grand Conference

Center - Birmingham

3

MEMBERSHIP MATTERS

W

Looking Back to Look Forward

hen Alabama passed its first certified public accountancy (CPA) law

in 1919, Mobile accountant George

T. Rosson was awarded certificate number

one and Walter K. Smith was awarded number three. Out of their firm,

Rosson & Smith, came the

partnership Smith, Dukes &

Buckalew. Over the years,

Smith Dukes has been significant in the development

George Rosson of public accountancy in the

city of Mobile and the state of Alabama. Eight

of its members have served as president of the

Alabama Society of CPAs and have seen the

field of accounting progress from the “green

eye-shade” years to the high-tech systems of

today’s business world. Today, the firm celebrates over 75 years of continuous operation

and excellence in the field of accounting.

In Montgomery, Mayer W. Aldridge began

offering his services as an

accountant and tax advisor to the general public in

1918, and quickly became

known throughout central

and south Alabama as a

Mayer W. Aldridge leading authority on the Internal Revenue code. In 1919, he and several

other practitioners formed the Alabama Society

of the American Institute of Certified Public Accountants. This group of founders administered

the first Uniform CPA Examination in Alabama

to each other, and received certificates from the

American Institute. Mr. Aldridge was the first

chairman of the Alabama State Board of Public

Accountancy, and signed his own certificate as

chairman! Mr. Aldridge was issued the second

certificate by the Alabama Society, dated July

19, 1919. After World War II, Mr. Aldridge admitted John R. Borden and Charles Jones as

partners, eventually naming it Aldridge Borden

& Company. The firm has been located in in the

center of the city’s financial district in downtown

Montgomery throughout its existence.

As the centennial of the Alabama Society

approaches, an effort is being made to recognize 100 years of Alabama CPAs. To mark

two milestones in Alabama accounting history, the education spaces in the ASCPA office were recently named the Rosson Room

and the Chambers Room in honor of the first

CPA and the first woman CPA, Clara Chambers Lefievre.

What is your Society

doing for you today?

Networking

Whether it’s at the 94th Annual Meeting of

the ASCPA, at one of the hundreds of seminars,

workshops or conferences, at a local chapter

meeting members meet members and build

relationships. A sense of community is one of

the most valuable gifts that ASCPA membership offers.

Top quality continuing education

You speak, via the Professional Education

Committee and member surveys, and the Education Department heard. New this year are

several workshops and the Small Practitioner

Conference.

The Alabama

Society’s CPA PAC

Seeks Your

Support

A L A B A M A

CPA

PAC

4

The ASCPA’s partnership with the California

Society of CPAs (CalCPA) continues to flourish and will result in more than 175 interactive

webinars, ranging from 2-8 hours, and which

qualify as “live” CPE.

Communication

The ASCPA uses multiple channels to keep

you informed: The Alabama CPA magazine,

weekly e-newsletter (Tuesday Bulletin), targeted emails, and announcements at local chapter

meetings. This information may involve technical news, education, legislation, member milestones, and professional issues.

Governmental Affairs

The Society’s role at the Alabama statehouse and in Washington, D.C ensures that

members are heard. You can read more about

the Alabama CPA PAC in the box below.

Affinity Programs and

Business Partners

The ASCPA builds relationships with vendors who offer valuable services or products for

members. Want to get great liability insurance?

It’s covered. Disability insurance? Also covered.

What about shipping services at a discount,

UPS offers an excellent program for you. There

are discounts for associate members who are

sitting for the exam. Business partners are even

more fully integrated into the life of the ASCPA

by participating in multiple programs. They advertise in the magazine, provide content for education sessions, are exhibitors and sponsors

at conferences, and take the ASCPA member

message to their clients on the Society’s behalf.

Y

ou might have noticed that something was missing from

your dues notice. It was the check-off box for your annual

political action committee (PAC) donation.

In order to do a better job of keeping you informed about

your Alabama CPA PAC, you will receive a flyer in the mail in

early May. The flyer will describe the purpose of your CPA PAC

and ask that you help with this important work.

The CPA PAC doesn’t just contribute to political campaigns

for every Tom, Dick, and Harriet. The PAC board of trustees

carefully weighs which candidates are most likely to understand

the role that CPAs play in the business world and choose to

support the candidates who are “business-friendly”.

Questions? Contact Marty Abroms, CPA PAC trustee

chair, abromsm@abroms.com or CEO Jeannine Birmingham,

jbirmingham@ascpa.org.

The Alabama CPA MAGAZINE

Membership Categories

Leadership and Service

If you want to develop as a leader, both

personally and professionally, the ASCPA has

multiple avenues you can pursue. You can

become a member of an ASCPA task force,

a standing committee, work your way up in

leadership through local chapters and the

Board of Directors. In addition, Class III of

the Society’s Leadership Academy will launch

in May and is a perfect place for young and

emerging CPAs to learn critical skills. Each

chapter initiates charity and community

projects, providing amazing opportunities

to bond with fellow CPAs while wielding a

hammer on a Habitat for Humanity house,

or unloading bags of dog food at a humane

shelter.

Be involved in something

larger than yourself

Maintaining membership in the ASCPA enables you to be part of the good work which

the Society performs in the name of the profession. Your dues, your generous support of the

Educational Foundation, and your contributions

to the Alabama CPA PAC also smooth the path

for those entering the profession.

WHO IS THE ASCPA?

Every once in a while, when ASCPA staff

is on the road at a college or university, it becomes clear that not everyone knows what the

Alabama Society of CPAs is. Shocking! And

of course the answer always involves explaining that it is a membership organization, composed of 6780 of the state’s certified public

accountants. (The explanation lengthens as the

age of the students declines.) But maybe even

YOU don’t completely know the make-up of

ASCPA membership.

Membership Categories

Public 39%

Industry 29%

Gov/Edu 6%

Out of State 8%

Associate 3%

Retired/Unemployed

6%

Life Members 1%

Students 9%

members – it is free, after all – are next in line,

with 590 members. To round out the numbers,

5.9% are in government/education, 8.3% are

out of state, 2.6% are associate members (eligible to sit for the CPA exam), 6.1% are retired

and unemployed and .7% are life members;

non-dues-paying members who have been

recognized for extraordinary service to the Alabama Society.

Keeping track of who members are and

what they want/need from their Alabama

Society is a primary concern of ASCPA leaders

The Power of Technology comes

to the Alabama CPA Magazine!

• Read it in hard copy, “old school”

style;

• Download a pdf from the ASCPA

website;

• Or use the e-reader to leaf through

the amazing content.

Go to www.ascpa.org/resources. Click

on ASCPA magazine and choose the

digital version option to flip through the

pages on your laptop, tablet or mobile

device.

n By Gender

55.9%

44.1%

Male

2013

ALABAMA CPA MAGAZINE I APRIL

Female

Parity between men and women is drawing closer, with numbers changing from 57%

men, 43% women in 2011, 58% men and 42%

women in 2012 to 55.9% men and 44.1%

women today.

Folks are always surprised to learn that not

all of ASCPA members are in public accounting. And you can see from the chart that only

38.9% are working in firms. Business and industry is catching up with 28.9%. Student

The Alabama CPA MAGAZINE

and staff. The board of directors and invited

guests convened on May 2 and 3 for the

annual Leadership Retreat to chart the course

of the Society for the next year. There will be

a full report in the June issue of the magazine.

Your feedback is always welcome, on any

topic, at any time. Contact your local chapter

leadership, officers or members of the board of

directors (listed on the website under the About

Us tab), current ASCPA Chair Steve Shelton

(sas@wrscpa.com) or Jeannine Birmingham,

jbirmingham@ascpa.org.

Busin ess and Indus try Issue

3/25/13 3:36 PM

61695-1 ASCPA.indd 1

5

We Welcome NEW Members

T o t h e A S C PA !

Jacob G. Williams, CPA

Lori Newcomer, CPA

Kevin E. Foshee, CPA

Laura M. Williams, CPA

Lott H. Brigham, CPA

Sarah S. Centeno, CPA

Steven D. Duck, CPA

Kristen W. Lawrence, CPA

Pauline P. Howland, CPA

Justin P. Detwiler, CPA

Eun Jeong Kim, CPA

Laura A. Williams, CPA

Mallory A. Jordan, CPA

Jessica R. Hall, CPA

Courtney R. Tibbets, CPA

Lauren M. Billings, CPA

James M. Chafin, CPA

Cruse N. Bevill, CPA

Cameron G. Pappas, CPA

Amy N. Sharp, CPA

T R. Lightsey, CPA

James R. Dulaney, CPA

David C. Kent, CPA

Judson R. Spooner, CPA

Lana C. Darby, CPA

Timothy A. Marquardt, CPA

Hannah M. Holland, CPA

Stephen J. Bailey, CPA

Steven D. Payne, CPA

Matthew L. Lazenby, CPA

Abbay E. King, CPA

Denise L. Locklar, CPA

Levi A. Knapp III, CPA

Clyde E. Rivers III, CPA

Caryn C. Hughes, CPA

Tracy J. Suggs, CPA

Virginia Burton, CPA

George D. Trummell IV, CPA

Lindsey M. Mann, CPA

Jessica S. Tackett, CPA

Phillip M. Mann, CPA

Andrea C. Easterwood, CPA

Anna S. Whitfield, CPA

Adam S. Himel, CPA

Dr. J A. Connell, CPA

Meagan L. Wilson, CPA

D W. Black, CPA

Mandeep S. Bhutani, CPA

Michelle T. Herman, CPA

Brooke H. Dobbins, CPA

EDUCATION Express

Workshops

Employee Benefits Workshop – The Employee Benefits Workshop

will be held at the Wynfrey Hotel in Birmingham July 29-31. The

discussion will include advanced employee benefit plan topics, audit

and accounting essentials and audits of 401(k) plans. Earn up to 24

hours of CPE credit. The more you take, the more you save! Receive

an additional $50 off for the second and third days of this workshop.

Yellow Book Workshop – Leita Hart will be back to champion the

Yellow Book Workshop on August 13 and 14. With her outstanding

credentials and knowledge base, paired with her enthusiasm, you will

not want to miss out. She’ll be leading discussions on audit findings

and governmental financial statement analysis. This workshop will be

held at the Wynfrey Hotel in Birmingham. Earn up to 16 hours of A&A

Yellow Book CPE credit. Receive an additional $50 off if you register

for both days.

At 60% off the going rate for this workshop, ASCPA offers The Franklin

Covey 7 Habits of Highly Effective People Workshop. Receive

two days world-class training with the program curriculum. Participants

will learn first-hand how to apply the principles taught in Franklin Covey’s

leadership, productivity, and communication workshops, including the

world-renowned workshop, The 7 Habits of Highly Effective People®.

Franklin Covey’s workshops provide solutions to challenges facing the

accounting profession today. This workshop is offered on August 22 –

23 at the Alabama Society of CPAs office in Montgomery.

Staff Training for Auditors

Give your auditing staff some guidance with specialized staff training

to meet their job duties. ASCPA began working with AHI to lead our

staff training workshops in 2012. With kudos from the attendees, this

results-based training garnered many comments from managers and

partners who sent staff to these programs. These classes combine

theory, hands-on assignments, group work, and critical thinking skills

development to make your staff a stronger player for your firm. For

more information about these programs, please visit our website at

www.ascpa.org.

6

Basic Staff Training for Auditors

August 5 – 7 / Montgomery

$550 for members and $600 for non-members

Receive a $25 early bird discount when registered by July 26

Improve inexperienced staff members′ knowledge, skills and attitude to

enable them to be more productive and profitable on audits, reviews and

compilations.

Semi-Senior Staff Training for Auditors

Augusts 8 – 9 / Montgomery

$400 for members and $450 for non-members

Receive a $25 early bird discount when registered by July 29

Enable more experienced staff to complete smaller audits, reviews and

compilations with minimum supervision and maximum profitability.

Beginning In-Charge Staff Training for Auditors

Augusts 12 - 13 / Montgomery

$400 for members and $450 for non-members

Receive a $25 early bird discount when registered by August 2

Enable experienced staff to advance more quickly to higher levels of

responsibility and to become more profitable to their firms by helping them

better plan and efficiently complete audits, supervise staff, review working

papers and interact with partners and clients.

The Alabama CPA MAGAZINE

MEMBERS IN MOTION

Promotions and New Positions

Brooke Covington has been named executive vice president and COO at the Alabama State

Employees’ Credit Union. Covington is a Troy University graduate. She began at ASE Credit Union

in 2002 and served as the credit union’s chief financial officer prior to being promoted.

Misti Rasmussen has joined Pearce Bevill

Leesburg Moore. She worked at another Birmingham firm for 13 years, the last eight as a manager.

Her experience includes assurance, financial reporting, tax planning and compliance as well as

retirement administration for small clients in a wide

variety of industries.

Southern State Bank of Anniston announced that Lynn

Joyce is now executive vicepresident and CFO. She will

manage the bank’s accounting, compliance and information security departments.

Joyce is a graduate of the UniLynn Joyce

versity of Alabama in Huntsville as well as the America’s Community Bankers

National School of Banking.

Anglin Reichmann Snellgrove

& Armstrong recently added

Carol E. Smith and Leah

DellaCalce to their staff.

Smith is a senior accountant

in the firm’s audit and assurance group. She has over 20

years of public accounting exCarol Smith

perience and is a graduate of

Murray State University. DellaCalce has eight years of previous audit experience. She

is a graduate of Auburn University and has a MAcc from

the University of Alabama in

Huntsville.

Aldridge Borden has promotLeah DellaCalce ed Scott Grier and Jason

Westbrook to principal; Wes Blake and

Corey Savoie to manager. Grier practices in

the firm’s attestation division. His specialty is in

the construction industry where he manages

engagements of closely held contractors. He

also assists them with licensing and pre-qualifications in multiple states. Grier has been with

the firm since 1998 and is a graduate of Auburn Montgomery. Westbrook’s primary focus

is in the firm’s consulting division, although he

provides attestation and tax services to clients in

various industries as well. He is also a graduate

of Auburn Montgomery, has been with the firm

since 1996 and is active with several Montgomery civic organizations. Both Blake and Savoie

are Auburn University graduates. Blake provides

both attestation and tax services across a wide

range of industries while Savoie practices in the

firm’s attestation division.

Smith, Dukes and Buckalew, LLP announced that

James W. Wishon, III has

been promoted to tax senior

in the Mobile office. Wishon

joined the firm’s tax department in September 2011. He

has served clients in a variety

of areas of taxation including

partnership, corporate, not-forJames Wishon, III profit, individual and trusts and

estates. Wishon received his bachelor’s degree

and a master of tax accounting from the University of Alabama. He currently serves as Mobile

Chapter representative on the Young CPA Board

of Directors.

Awards and New

Designations

Heather Scott

Heather Scott of Warren Averett and Jeremy Blackburn

of CDPA recently became Certified Valuation Analysts® (CVA)

through the National Association of Certified Valuation Ana-

lysts. To become accredited

by NACVA, the candidate is

required to successfully complete an intensive training and

testing process. Certified Valuation Analysts provide business valuation and litigation

Jeremy Blackburn consulting services.

Community News

Regional accounting firm Warren Averett announced that Steven M. Barranco has been

appointed to the Alabama

State Board of Public Accountancy by Governor Robert Bentley and confirmed by

the Alabama Senate. He will

serve a four-year term.

Barranco joined the firm

in 1989 in its Montgomery

Steven Barranco office. He has more than 23

years of public accounting experience and focuses his practice in the areas of hospitals, physician group practices and other health-related

companies. He served as president of the ASCPA (2006/07) and as a member of the American

Institute of CPAs’ governing council during that

same year.

In other Warren Averett news, Accounting Today recently recognized the firm as the largest accounting, tax and business consulting firm in the

four-state Gulf Coast region (Florida, Alabama,

Mississippi and Louisiana). In addition, they were

ranked 27 in the top 100 national firms.

LOOKING FOR A TEAM PLAYER ?

Every position has its own set of expertise, challenges and goals.

Whether it’s shortstop or baseman, you have to play to your strengths,

but this isn’t a one-man sport and we understand the essence of teamwork.

We believe that when you connect the right person to the right job

and the right individual to the right company, it’s like a hand in glove.

We’re here to help you find that ideal person to play on the team,

and to make sure they can help the team PERFORM FOR SUCCESS.

Shanna Jackson

is now Senior Manager of Membership

and Website Administration and your

contact for all member questions.

sjackson@ascpa.org,

334.386.5754.

www.itacsolutions.com

TECHNOLOGY | CORPORATE PROFESSIONAL/CLERICAL

GOVERNMENT/ENGINEERING | ACCOUNTING/FINANCE

Providing temporary/contract, contract-to-hire,

and direct hire staffing solutions.

SOLUTIONS

Birmingham | Mobile | Huntsville | Nashville

The Alabama CPA MAGAZINE

7

MEET THE CANDIDATES

CHAIR – Renee Hubbard is a tax consultant. She has provided tax

planning and compliance

services to both individuals

and closely-held small businesses at Jackson Thornton’s Montgomery office

since 1985.

Renee Hubbard

She now serves as chairperson of the Alabama Society of Certified

Public Accountants Federal Taxation Committee after chairing the State Taxation Committee for several years. Hubbard is a graduate

of Auburn University.

member of the National Association of Black

Accountants, as well as the National Black

MBA Association. Mr. McCleod serves as a

board member of the Southeast Regional

Planning and Development Commission,

as a member of the AICPA Minority Initiative

Committee and is an AICPA at-large Council

Member. Mr. McCleod is the immediate past

chair of the Dothan Community Development

Advisory Board. He was a member of the

Young CPA Board and served as its president.

McCleod was awarded the Public Service

Award of the ASCPA following his participation

in the Gulf Coast Service Project.

CHAIR-ELECT – Don McCleod is a native

VICE-CHAIR – Dr. Lowell Broom cur-

of Durham, North Carolina.

He received his undergraduate accounting degree from

North Carolina Central University and his MBA from

the University of Illinois at

Urbana-Champaign. Mr.

Don McCleod McCleod brings more than

a decade of experience in corporate, entrepreneurship, small business, non-profit, auditing,

accounting and consulting to his firm, Don

McCleod, CPA, in Dothan. Don is an active

rently serves as chair of the

Department of Accounting

and Management Information Systems at Samford

University. Prior to joining

Samford in 2008, Broom

was on the faculty at UAB

Dr. Lowell Broom and served terms as chair

of the accounting program and as associate dean of the school of business. Prior to

a career in higher education, he was with a

large international accounting firm. Broom

2013 Nominations Committee

Bryan R. Chandler joined

JamisonMoneyFarmer

in 1978, was admitted

as a shareholder in 1985,

and assumed the role of

managing shareholder in

2005. In this role he overBryan Chandler sees various administrative

and technical divisions of the firm as well as

leads and shapes the strategic direction and

growth of JMF. He has extensive experience

in business sales, acquisitions, succession

planning, strategic planning and valuation issues.

Matthew L. Griffith is

a senior tax manager at

Sellers Richardson Holman

& West in Birmingham.

He has been with the firm

since 2008.

Matthew Griffith S. Jon Heath has over 18

years of experience in serving large, multinational companies and smaller SEC registrants. Prior to joining Carr Riggs & Ingram,

he spent 11 years with PricewaterhouseCoo8

Jon Heath

pers where he specialized

in utilities and telecommunications. As the firm’s Director of Professional Services, Heath is responsible

for the firm’s quality control,

marketing and information

technology initiatives.

Mark E. Hieronymus has

been engaged in the practice of public accounting

for over 25 years. His areas of special concentration include tax planning

and advising corporations,

Mark Hieronymus partnerships, individuals,

estates and trusts. He is a founding partner of Wilkins Miller Hieronymus LLC. He has

previously served as president for the Alabama Federal Tax Clinic, the Mobile Chapter

of ASCPA, the University of South Alabama

Accounting Advisory Board and the Estate

Planning Council of Mobile.

Lisa C. Patterson is the founding and managing partner of Patterson Prince & Associ-

has held every office in the Birmingham

Chapter of the ASCPA, served on the ASCPA council 1995 - 2002, including terms

as an officer. He has received both the Society’s Outstanding Discussion Leader Award

(for CPE instruction) and also the Outstanding Accounting Educator of the Year Award.

Currently, he serves as a member of the

board of trustees for the ASCPA Educational Foundation.

SECRETARY-TREASURER – Jamey

Carroll is a partner at

MDA Professional Group

in Huntsville. Jamey has

been with the firm since

2001. His areas of specialization include construction, emergency serJamey Carroll vices, manufacturing, and

employee benefit plan auditing. He has a

long history of service with the Alabama Society. He was president of the Young CPA

Board of Directors and recognized as the

Outstanding Young CPA that year. Carroll has

been a member of the ASCPA Board of Directors for three years and has also served as

president of the Huntsville Chapter.

– Vote for Three

ates, a full service firm in

the Shoals. She is a past

chair of the Shoals Chamber of Commerce and was

named Small Business of

the Year. Patterson serves

on the University of North

Lisa Patterson Alabama College of Business advisory board, the board of the Fellowship of Christian Athletes, and is treasurer

of the Shoals Scholar Dollars.

Gerald G. Pentecost is a

Gadsden sole proprietor.

He is a past member of the

Alabama Society of CPAs

board of directors and a

past president of the ASCPA North Alabama ChapGerald Pentecost ter. Prior to forming his own

firm, he served as vice president of finance

for International Broadband Electric Communications, Inc. and was partner in charge

at the Ft. Payne, Alabama office of public accounting firm MDA Professional Group.

The Alabama CPA MAGAZINE

Leadership Academy Update

N

ineeen CPAs graduated from Leadership Academy Class II on

May 2. Their final class culminated in a brief ceremony attended

by the ASCPA Board of Directors and invited guests at the

annual Leadership Retreat. Staff from The Rainmaker Companies Scott Bradbary, Robin Brothers, and Joe Fehrman – identified several

class members for special recognition.

Kristi Daughtery

and Ryan Damrich

Firm Project Award

Crow Shields and Bailey

Amanda Freeman

Individual Project Award

ASCPA

Jennifer Taylor

Spirit Award

Erica Lane Enterprises

Rachel Taylor

Spirit Award

JamisonMoneyFarmer

Keina Houser

Foresight Award

Jackson

Thornton

New Look for the Young CPAs

There’s still time to

support the PANGEATWO

Charity Golf Tournament

brought to you by the

Alabama Young CPAs.

Graduation at Wynlakes Country Club was followed by dinner so that

ce the Young

CPAs

had their

first meet

logo designed.

wasASCPA

based on

the Also

class

members

could

and spendSince

time itwith

leaders.

st due for them

to refresh

their brand.

Copperwing

Design

came to

the on May 3)

present

were participants

from

Class III (their

sessions

begin

who

had significant

time to

Montgomery.

Class III

includes

ered several

different

options. travel

The Young

CPA

Board of Directors

voted

on two

Tennessee,

Mississippi, one from Connecticut,

d revisions CPAs

and Tafrom

Da!…..here

it is inthree

all itsfrom

variations.

one from Northbrook, Illinois, and one from Toronto, Ontario. That’s right,

having Richard Mendelsohn from Toronto firm Stern Cohen gives Class

III an international flavor!

Contact Lacey Williams, lwilliams@ascpa.

org to register your team or become a

sponsor. Or go to the ASCPA website,

www.ascpa.org/AboutUs.

Benefitting The Exceptional Foundation

of Homewood and the

ASCPA Educational Foundation

New Look for

the Young CPAs

It’s been a couple of years

since the Young CPAs had

their first logo designed.

Since it was based on the old

ASCPA logo, it seemed past

due for them to refresh their

brand. Copperwing Design

came to the rescue one more

time and offered several

different options. The Young

CPA Board of Directors voted

on their favorite, Copperwing

did revisions and Ta Da!…..

The Alabama CPA MAGAZINE

PANGEATWO successfully matches clients with talented

professionals. Our seasoned understanding of human potential,

including individual strengths, lets us design far-reaching and

personalized workforce solutions for employers. Our experience

With offices in Birmingham, AL

and now in Mobile, AL

gives candidates an advantage and creates common ground

Birmingham, AL 205.444.0080

Mobile, AL 251.732.3000

www.pangeatwo.com

PANGEATWO is a leader in recruitment and staffing solutions

between companies and professionals.

in accounting and financial services. Call today, and we’ll help

you connect talent and potential.

9

State BOARD News

JANUARY-FEBRUARY 2013 CPA EXAMINATION

Grades from the January-February 2013 CPA Examination were mailed to candidates on March 8, 2013

and April 5, 2013. There were 164 total candidates

who sat for a total of 209 sections of the examination

and passed 91 sections for a section-passing rate of

43.54%. The 164 total candidates were comprised of

22 first-time and 142 re-examination candidates. A total

of 27 candidates passed. There were 16 candidates

who passed section(s) to receive credit status, 34 candidates who passed a section to improve their credit status, and 87 candidates who passed no sections to remain status quo. There were 122 candidates who sat for

one section of the examination, 39 candidates who sat

for two sections of the examination, three candidates

who sat for three sections of the examination, and no

candidates who sat for four sections of the examination.

ALABAMANATIONAL

SECTION PERCENT PASS PERCENT PASS

AUDIT39.29% 45.70%

BEC

55.56%

54.60%

FAR

34.55%

47.56%

REG

48.39%

47.88%

APRIL-MAY 2013 CPA EXAMINATION

Testing for the April-May 2013 CPA Examination

will close on May 31, 2013. During the month of June

2013, testing will be closed for systems and databank

maintenance. We anticipate receiving and distributing

the grades from the April-May 2013 CPA Examination

between June 12, 2013 and July 12, 2013.

JULY-AUGUST 2013 CPA EXAMINATION

Testing for the July-August 2013 CPA Examination will begin on July 1, 2013 and close on August 30,

2013. During the month of September 2013, testing will

be closed for systems and databank maintenance. We

anticipate receiving and distributing the grades from the

July-August 2013 CPA Examination between September 12, 2013 and October 11, 2013.

CPA Examination scores are available on-line

through the Board’s website at www.asbpa.alabama.

gov/exam.htm. Examination candidates will need their

“Section ID Number” and “Date of Birth” to access their

scores. The Board also mails official scores to candidates as soon as they are received and processed.

The Board accepts submission of CPA Examination

Applications during any month of the year. If you have

questions, please contact Anna Baker at the Board

office at 334-242-5700 or in-state 1-800-435-9743.

CPA Examination Application Forms, Application

Instructions, and CPA Examination Qualifications may

be downloaded from our website at www.asbpa.

alabama.gov/exam.htm. We encourage each CPA

Examination Candidate to review the “Test Tips For

CPA Candidates” and “CPA Candidate Bulletin and

Test Tutorial and Simulations” on the Exam Applications

page of the Board’s website.

STATE BOARD REVOKES CPA CERTIFICATES

The Alabama State Board of Public Accountancy

(“the Board”) held disciplinary hearings on January 28,

2013 for 37 CPAs and two firms who failed to apply for

an annual permit and/or register their certificate within

one year of their expiration date of September 30, 2011.

The Board ordered that the license, registration, certificate and/or permit to practice be revoked, a fine of

$2,000.00 be paid, and also required that the revoked

CPA Certificates and permits to practice be returned to

the Board office within 30 days by each of the following:

10 By J. Lamar Harris, CPA

LICENSEE

CERTIFICATE NO.

Certified Public Accountants:

Lawrence Scott Banks, CPA – 4995

Hampton Cove, AL

Dolores G. Prater Barnes, CPA – Trussville, AL

7506

Katherine Irene Blackmon, CPA Birmingham, AL

8168

Robert David Bonamy, Jr., CPA* Birmingham, AL

6949

Frank Vincent Brocato, III, CPA Birmingham, AL

9573

R. Dawn Burks, CPA – Mount Olive, AL

4667

John Edwin Burns, CPA – St. Charles, MO

8429-R

James Michael Ching, CPA – Robertsdale, AL

8726

William E. Cox, CPA – Birmingham, AL 3088

Edward Craig Crawford, CPA – Alexandria, LA

9326

Dane W. Cutler, CPA – Tampa, FL

2036

Marcus A. Davis, CPA – Moultrie, GA

3369-R

Kellon Knight Ellison, CPA – Trussville, AL

6217

William Perry Hall, CPA – Mobile, AL

4726

David A. Harris, CPA – Birmingham, AL

3742

Pamela Franklin Henderson, CPA – Hoover, AL 4953

Michael V. Hinson, CPA* – Birmingham, AL

2969

Cynthia M. King, CPA – Alexandria, VA

5068

Andrea Alman McKenzie, CPA*

Dawsonville, GA

8709

Jeff Merrill, CPA – Honolulu, HI

11266

Natalie Lynn Mickler, CPA – Jacksonville, FL

6010

Lori Ann Muse, CPA – Yorba Linda, CA

6144

Chukwuma A. Okeke-Ekpe, CPA

Columbus, GA

3130-R

Kristin Eileen Parsons, CPA – Cornelius, NC

8583

Thomas Stewart Parsons, CPA* – Searcy, AR

2195

Radhika Arvind Patel, CPA – Opelika, AL

11443

Kristy Del Signore Peralta, CPA – Newport, TN

Adam John Ryan, CPA – Memphis, TN

Dewey N. Sanders, CPA – Jacksonville, FL

8499

10168

3781

Stacey Michele Shinas, CPA – Greenville, SC 7103-R

Janette Dianne Smiley, CPA –

Jacksonville, FL

Nicholas Stinson, CPA – Montgomery, AL

Baruch Tal, CPA – Roslyn, NY

Pamela Davis Tilley, CPA – Tuscaloosa, AL

Jeremy Thomas Triefenbach, CPA

Anaheim, CA

10836-R

3102

10697

4342

9959-R

Kerry McKennley Williams, CPA – Huntsville, AL 7279

Wenyan Zhou, CPA – Pudong, Shanghai, China8822

Firms:

Kellon Knight Ellison, CPA – Trussville, AL

d/b/a Ellison & Co. CPA, P.C., Firm No. 972

Michael V. Hinson, CPA* – Birmingham, AL

d/b/a Michael V. Hinson, CPA, Firm No. 2120

6217

2969

The Board also held a disciplinary

hearing on January 28, 2013

for one CPA firm who failed to

complete the requirements of the

Board’s Peer Review Program.

The Board ordered that the license, registration,

certificate and/or permit to practice be revoked, a fine

of $10,000.00 be paid and required that the revoked

CPA Certificate and permit to practice be returned to

the Board office within 30 days by the licensee listed

below:

LICENSEE

CERTIFICATE NO.

Peer Review:

Harvey F. Cutter, CPA – Huntsville, AL

d/b/a Cutter Co., LLC, Firm No. 1394

1975

Additionally, the Board held disciplinary hearings

on January 28, 2013 for two CPA firms who failed

to complete the requirements of the Board’s Peer

Review Program. The Board ordered that the license,

registration, certificate and/or permit to practice be

revoked, a fine of $4,000.00 be paid, and that the

revoked CPA Certificate and permit to practice be

returned to the Board office within 30 days by the

licensees listed below:

LICENSEE

CERTIFICATE NO.

Peer Reviews:

Donnie Holder, CPA – Montgomery, AL

d/b/a Holder & Company, Firm No. 1139

1486

Christopher L. Miller, CPA – Birmingham, AL

3279

d/b/a Christopher L. Miller, CPA, Firm No. 1744

2012-2013 REGISTRATIONS

On-line registration is available for 2012-2013

for CPAs, PAs, and Firms. The link to the on-line

registration form can be found on the Board’s website at www.asbpa.alabama.gov/registration.htm.

Individual and firm registration packets for 20122013 were mailed to all licensees on September

24, 2012. The completed on-line registrations or

registration forms for 2012-2013, along with the

appropriate fee(s), were due in the Board office on

October 1, 2012. Licensees who have not already

filed are delinquent and encouraged to file as soon

as possible. A late renewal penalty of $500.00

is due for registrations postmarked April 1, 2013

through September 30, 2013. After September 30,

2013 disciplinary actions ensue for unpaid fees, late

renewal penalties, and CPE deficits. You may also

visit our website and download individual and firm

registration forms. If you have questions concerning

your 2012-2013 registration(s), please contact the

Board office.

ADDRESS CHANGES

Board rules require that all licensees keep us

advised of any change of address and/or change in

business affiliation. Such changes must be in writing

and may be submitted electronically by visiting

the Board’s website and completing the On-Line

Change of Information Form found on the “Change

of Information” page. You may also submit such

changes by mailing or faxing (334-242-2711) to the

Board office.

*CPA Certificate was reinstated by the Board on March

22, 2013.

The Alabama CPA MAGAZINE

FINANCIAL LITERACY

Alabama State Department of Education Mandates Financial Literacy

A

t the end of February, the Alabama State Department of Education (ALSDE) created

a new course for high school students, Career Preparedness. It focuses on three integrated areas of instruction—academic planning and career development, financial

literacy, and technology. From the ALSDE:

“Course content ranges from college and career preparation to computer literacy skills

to ways to manage personal finances and reduce personal risk. Designed to be interwoven

throughout course instruction, is the area of technology. Mastery of the content standards

provides a strong foundation for student acquisition of the skills, attitudes, and knowledge

that enables them to achieve success in school, at work, and across the life span.”

Career Preparedness is a one-credit course required for graduation that can be

taught in Grades 9-12; however, it is recommended that students take the course in Grade

9. ASCPA staff attended a resources fair on April 9, to share with the curriculum task force

the resources available through the Society. Having a mandatory financial literacy requirement for graduation has been a goal of the ASCPA and other state societies.

Drake Middle School Holds Second Financial Literacy Fair

Dr. Sarah Stanwick’s Auburn University graduate accounting students were on hand in

force on March 7 at Drake Middle School. Their job was to create and man stations for the

600 6th graders to rotate through, learning different lessons about money management.

Controlled chaos – maybe. But the students were surprisingly engaged and involved in

each of the activities. There was a piggy bank design contest, too, and some of those

creations showed real talent. Local accounting firms supplied prizes; the ASCPA helped to

promote it to members. Aubie showed up to cheer the kids on as did Benjamin Bankes,

from the AICPA’s Feed the Pig campaign.

The Alabama CPA MAGAZINE

11

e s q u i r e C a r O f t h e Ye a r

2 013 N O RT H A M E R I CA N CAR O F T H E Y EAR

C e le b r at e wi t h t h i s l i m i t e d -t i m e O f f e r f r O m C a d i l l a C .

T H E A l l- N E w AT s 2 . 0 l T U R B O

st a N d a rd C O l le C t i O N

299

$

36

Per mONth1

ultra-low mileage lease

for well- qualified lessees

mONths

$2,199 due at sigNiNg

a l l- N e w 2 013 at s 2 . 0 l tu r b O

after all Offers

NO SECURITY DEPOSIT REQUIRED.Tax,TITlE, lICENSE, DEalER fEES

ExTRa. MIlEagE ChaRgE Of $.25/MIlE OvER 30,000 MIlES.

aT PaRTICIPaTINg DEalERS ONlY.

vi s i t a C e N t r a l a l a b a m a C a d i l l a C d e a le r

cadillac.com

2

ExAMplE BAsEd ON NATIONAl AvERAgE vEHIClE sEllINg pRICE. EACH dEAlER sETs ITs OwN pRICE. YOUR pAYMENTs MAY vARY. PaYmeNts

are fOr a 2013 CadillaC ats 2.0l with aN msrP Of $35,795; 36 mONthlY PaYmeNts tOtal $10,764. OPtiON tO PurChase at lease eNd fOr aN

amOuNt tO be determiNed at lease sigNiNg, Plus $350. lessOr must aPPrOve lease. take deliverY bY 4/30/13. mileage Charge Of $.25/

mile Over 30,000 miles. lessee PaYs fOr exCess wear aNd tear Charges. PaYmeNts maY be higher iN sOme states. NOt available with

sOme Other Offers. resideNCY restriCtiONs aPPlY. ©2013 geNeral mOtOrs. all rights reserved. CadillaC®, ats®

12 GMLE0273000_ATS_ASPCA.indd

1

4:02 PM

The Alabama CPA 3/5/13

MAGAZINE

Doing it Better

What Every CPA Should Know about

Calculation Engagements vs. Valuation Engagements

By: Kevin Andrews, CPA/ABV, CFE, CFF

PAs who perform business valuation services are subject to Statements on Standards for Valuation Services No. 1, or

SSVS for short. SSVS is applicable whenever a

CPA exercises professional judgment in determining a value. Mechanical calculations, such as multiplying the number of shares of a publicly traded

stock held times a stated market price, are not

subject to SSVS. However, multiplying revenues

or some form of earnings to arrive at a value likely

requires professional judgment in the selection of

the multiple and is therefore subject to SSVS.

As all CPAs are subject to SSVS it is important to know what SSVS entails even if you do

not personally prepare business valuations. Your

clients may need to have a business valuation performed and therefore you need to know what the

client is receiving when a valuation is performed.

SSVS gives the CPA an option when performing

valuation services. The first is a “valuation engagement.” This type of engagement allows the

valuation analyst to estimate the value of a subject interest with no restrictions as to the valuation

approaches and methods used. The result of a

“valuation engagement” is a “conclusion of value”

which may be a single amount or a range.

The other option SSVS allows for is a

“calculation engagement.” In this type of

engagement the valuation analyst is limited to the

valuation approaches and methods to which the

client has agreed. These procedures are more

limited than those used in a valuation engagement

and therefore do not result in a “conclusion of

value.” Instead, a calculation engagement results

in a “calculated value” that does not purport to

include all of the procedures required to express

a “conclusion of value.”

Simply put, the difference between the two

types of engagements is that “valuation engagement” allows the appraiser to use all methods and

approaches deemed relevant while a “calculation

engagement” does not. As a result “valuation

engagements” will meet all of the professional

standards required by SSVS. A “calculation engagement” will not. In fact, SSVS requires that all

calculation engagements acknowledge that the

results may have been different if a “valuation engagement” was performed.

Which procedures can be left out of a

“calculation engagement?” That answer depends

on the agreement between the subject business

owner and the valuation analyst. The valuation

analyst may be limited to using only one of the

three primary approaches, or to use a specific

rate of return, or to use a specific discount. The

agreement may be based on eliminating valuation

approaches that the analyst does not think will be

appropriate. Alternatively, the agreement may be

C

The Alabama CPA MAGAZINE

designed to save costs. Here are some examples

of the ways costs can be saved:

• Agree in advance to a multiple or rate of return

that will be used.

• Agree in advance to a discount for lack of marketability or lack of control.

• Agree to forego industry research.

• Agree to forego all, or a portion of, analysis of national, state, and local economies.

• gree to forego application of the market approach

or certain segments of this approach, such as the

guideline public company method.

• Agree to forego peer analysis and financial benchmarking.

• Agree to forego a detailed analysis of the risks

of the subject company, such as concentrations

related to customers, suppliers, or salesmen.

It is important to note that you are not likely to

see a “calculation engagement” agreement that

specifically states these items will not be performed.

Instead these procedures will simply not be listed

among the procedures that will be performed. As

such these items are not performed and costs are

saved. While this may be appropriate in some circumstances it may not be in all circumstances.

So when might a “calculation engagement” be

appropriate? A business owner that plans to market his business, or simply wants to know what it

is worth, could benefit from a calculation engagement. This could give him an idea of what his actual return is and allow him to determine an asking price. Another situation could be one in which

owners have amicably agreed to a change in ownership and can agree on the criteria used to value

the business. This could even work if the owners

are a couple going through an amicable divorce.

Calculation engagements can be meaningful if the

procedures performed are not overly restricted.

But when might a “calculation engagement”

not be appropriate? The answer to this lies in the

purpose for the valuation. For example if a “calculation engagement” is prepared for a divorce then the

appraiser could not deny that the procedures used

were limited to those agreed to with the party who

requested the valuation and that a different result

may have occurred had a “valuation engagement”

been performed. This may not appear to be objective when the ultimate end user, the judge, decides

whether or not to rely upon this value.

Another example might be an appraisal required

to be filed with the Internal Revenue Service. In

Revenue Ruling 59-60, the IRS lists factors it expects to be considered when determining fair market value. Several requirements of SSVS are rooted

in this revenue ruling. Some of the factors listed in

Revenue Ruling 59-60 are the ones excluded from

many “calculation engagements”. As such the “cal-

culated value” attached to the gift tax or estate

return being filed may not be sufficient to meet the

basic criteria set forth by the IRS.

In addition to the basic criteria stated in Rev.

Rul. 59-60, a “calculation engagement” may be

absent procedures that cause problems in other

areas. For example, the IRS issued a job aid for

its field agents to use when considering discounts

for lack of marketability. An overriding theme in

this document, which the IRS released internally

in 2009 but did not become public knowledge

until 2011, is that discounts should be driven by

a detailed analysis of the subject interest and not

a simple average. If company benchmarking has

been omitted from valuation procedures, or the

discount used was agreed to in advance, it may

be hard to defend the applicability of the discount

applied.

When considering a report stating a “calculated value,” you should consider the procedures

performed, as well as the ones inherently omitted,

and the effect these may have on the appropriateness of the report in the eyes of its end user. “Calculation engagements” do not contain everything

required to reach a “conclusion of value.” If they

did they would not be “calculation engagements,”

which are limited due to the agreement between

the client and the valuation analyst. The procedures omitted may or may not be appropriate for

the end user. Omitted steps could be costly if the

end user determines a “calculated value” is of no

value at all.

____

Kevin A. Andrews, CPA/ABV, CFE, CFF is a

shareholder in Financial Forensics & Valuation

Group, PC located in Birmingham, Alabama

and specializing in assisting business owners

in litigation. Kevin also owns Alabama Business

Valuations, LLC which focuses exclusively on

valuations for regulatory purposes, such as for

ESOP filings and gift and estate returns. Additionally,

Kevin is an instructor for the Alabama Society of

Certified Public accounts for fraud and business

valuation topics and won the Thomas A. Ratcliffe

Outstanding Discussion Leader Award presented

to the highest rated instructor in 2011-2012. Kevin

can be contacted at ka@ffvgroup.com.

Attend ASCPA’s

Introduction to

Business Valuation

class on

September 24th

in Mobile

13

DOING IT BETTER

Potential Liability of the Outside CPA for a Client’s Payroll Taxes

C

By Bruce P. Ely, Justin B. Cureton*, Bradley, Arant, Boult & Cummings

PAs should be aware of the potential

The accounting firm warned GCAD of the

liability they can assume if they handle

unpaid taxes on multiple occasions. Members

a client’s “trust fund” taxes. These taxes

of the firm even met with the management of

include payroll taxes on the federal level, as well

GCAD to develop a plan for repayment. When

as income tax withholdings and sales and seller’s

a plan was created, the accounting firm would

use tax on the state/local level. If the client fails

send the proposed plan to the IRS for approval.

to pay these taxes, the IRS and the Alabama

GCAD, however, would direct the firm to pay

Department of Revenue each have the power

other creditors, and even members of GCAD

to assess the so-called 100% penalty against

management. The Service asserted that the

each of the “responsible persons”. The penalty

accounting firm followed its client’s orders, while

is known officially as the Trust Fund Recovery

knowing that the funds remaining would not be

Penalty (“TFRP”). I.R.C. § 6672; Ala. Code §§

enough to cover the unpaid taxes. But there was

40-29-72, -73.

no evidence that GCAD ever purposefully directed

A recent federal district court case shows

the accounting firm to evade withholding taxes.

the IRS’ continued efforts to hold third parties

The IRS assessed over $325,000 in TFRP

responsible when their client or customer fails to

against each of accounting firm’s owners—not

timely remit its trust fund taxes. Erwin v. United

just the firm itself. Despite concessions that the

States, 111 AFTR2d ¶2013-426 (D. N.C., Feb.

firm had simply followed the directives of its client,

2013). In that case, Buddy Light Accounting and

the IRS determined that the firm and its owners

Tax Services (the “accounting firm”) managed

met the requirements of I.R.C. § 6672 by being

most of the accounting functions for its client,

willfully acting, responsible persons, and deemed

GC Affordable Dining, Inc. (“GCAD”). Among

each of them personally liable for the client’s

other duties, the accounting firm was in charge

unpaid taxes.

of calculating employee withholding taxes and

The court agreed, concluding that although the

making tax deposits for the client. GCAD began

owners of the accounting firm were not members

experiencing

financial

difficulties.

The accounting

of 1GCAD management or even employees, they

E-9002-0313

AL_Layout

1 3/19/13

2:08 PM Page

firm was fully aware of those financial difficulties.

were clearly in control of the accounting and

payroll operations. Members of the firm were the

first persons to know the amount of the employee

withholdings and the amount of accrued but

unpaid taxes, and were assigned the duty of

paying those taxes. In determining “willfulness”

-- a necessary element-- the court focused on

the firm’s issuance of “thousands” of checks on

behalf of GCAD, while its members must have

known that the money for these checks could

instead have been used to pay the unpaid taxes.

CPAs in private practice shouldn’t think they

or their firms will never be held liable for a client’s

or former client’s unpaid payroll or sales/seller’s

use taxes. The TFRP is not reserved for business

owners and in-house finance or payroll officers.

Outside CPAs can become liable, jointly and

severally, due to their accounting responsibilities

for a client. Obviously, CPAs should avoid

becoming too close to a client in financial

difficulties. For example, CPAs who are involved

in the payroll/bookkeeping functions for a client

should not follow the directives of the client

regarding payment of non-tax creditors when

they know, or even suspect, that trust fund taxes

are going unpaid. They should quickly consult

their own tax counsel and probably resign from

the engagement—in writing.

When your firm is ready, there’s a

path to follow. The Premier Plan.

As your firm grows, so do your risks. So when it’s time to decide how

to protect your firm, it’s important to choose professional liability

insurance that can address the evolving needs of your business.

When you choose advanced coverage offered through the AICPA

Premier Plan, you have options. Available liability limits range from

$100,000 to $10 million, with 28 deductible options for qualified firms.

When you choose the AICPA Premier Plan, you’re on the right path to

your firm’s future.

Contact Vernon Dutton at Regions Insurance, Inc. today at

(501) 664-8791 or visit www.cpai.com/premierad

Endorsed by:

Underwritten by:

Nationally administered by:

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (AR 244489); in CA, MN & OK, AIS Affinity Insurance Agency, Inc. (CA 0795465);

in CA, Aon Affinity Insurance Services, Inc. (0G94493), Aon Direct Insurance Administrator and Berkely Insurance Agency; and in NY and NH, AIS Affinity Insurance Agency.

One or more of the CNA companies provide the products and/or services described. The information is intended to present a general overview for illustrative purposes only. It is not intended to constitute a binding

contract. Please remember that only the relevant insurance policy can provide the actual terms, coverages, amounts, conditions and exclusions for an insured. All products and services may not be available in all

states and may be subject to change without notice. The statements, analyses and opinions expressed in this publication are those of the respective authors and may not necessarily reflect those of any third parties

including the CNA companies. CNA is a registered trademark of CNA Financial Corporation. Copyright © 2013 CNA. All rights reserved.

E-9002-0313 AL

14 The Alabama CPA MAGAZINE

Annual Sandestin Conference...Arrrrrgh!

It’s a Beach Party Kind of Education Event

It’s the signature beach event for ASCPA members! Education and

fun merge together. Add in family time and networking, and you’ve got

the Sandestin Conference. Speakers include Jim Martin,

Jeff Patterson, Carlton Collins and Bruce Nunnally. New this year is an afternoon beach party, complete with

a blow up pirate ship water slide on the beach. Join us for the fun!

Sandestin

Conference

Registration

Sandestin

Conference

Registration Form

Mail form to :

ASCPA

P.O. Box 242987

Montgomery, AL 36124-2987

Form – JulyJuly

21-25

21 - 25

Fax form to :

Sherry Russ

334.834.7310

Scan/email to: sruss@ascpa.org

Last Name

Register online at:

www.ascpa.org

M.I.

First Name

ASCPA Member Number

Firm / Employer

Business Phone

Address

Email Address (for confirmation)

City

State

Sunday, July 21

st

Monday, July 22

nd

Tuesday, July 23

rd

Zip

3:00pm-5:00pm

Registration

6:00pm-8:00pm

Opening Reception

8:00am-noon

Practical Guidance for Impairment Accounting Standards

James D. Martin, CPA

1:00pm

Golf Tournament

8:00am-noon

Top State and Federal Tax Case Law Topics

Jeff Patterson, Esq.

5:45am

Fishing Tournament, Harborwalk Fishing Docks

1:00pm – 4:00pm

Wednesday, July 24

th

th

Thursday, July 25

Beach Party with water slide

8:00am-noon

The Tech Savvy CPA

Carlton Collins

8:00am-noon

Accounting & Auditing Update

Bruce Nunnally, CPA

*Electronic course materials are included in the registration fee and will be emailed at least two weeks before the course date.

CPE Registration

Registration Fees

CPE

EarlyBird

BirdRegistration

Registrationbyby

July

Early

July

1111

n

Member

Member

$475

Non-Member

$475

$525

n

Non-Member

$525

Standard Registration after July 11

Standard

Registration after July

11

Member

$525

n Member

$525

Non-Member

n Non-Member

$575

$575

BeachParty

Party

Beach

n

Number

NumberAttending

Attending

OpeningReception

Reception

Opening

n

Attending

Attending

Tickets

Ticketsfor

for all

all guests

guests

includedin

in fee

fee

included

__ Number of Adults

____

Number of Adults

GolfTournament

Tournament

Golf

n

Member

Golf

Member

Golf$125

$125

Additional

T-shirts

for for

salesale

for $10

each –

Additional

T-shirts

for $10

____Handicap

____Handicap

One

included

registrant

fee. Please

each

–One for

included

forinregistrant

in list

fee. Please

list number

andcost

sizes

number

and sizes

and include

in total

and Youth

include

cost in

Youth

fees.

Medium

to total

Adult fees.

XXL available.

__ Number of Children

____ Number of Children

Not Attending

n Not Attending

Medium to Adult XXL available.

________________________________

_____________________________

________________________________

_____________________________

_____________________________

________________________________

____________________________

Guest

Golf $125

$125

n

Guest

Golf

____Handicap

____Handicap

Guest Golf

$125

n Guest

Golf

$125

____Handicap

____Handicap

Fishing

Tournament

Fishing

Tournament

n

Member

Fish

$135

Member

Fish

$135

Guest

Fish$135

$135

n

Guest

Fish

Guest Fish $135

n

Guest

Fish $135

Guest Fish$135

$135

n Guest Fish

Total Fees:

Check:

enclosed

a check

payable

to to

ASCPA

in the

amount

of $________________

Check: I Ihave

have

enclosed

a check

payable

ASCPA

in the

amount

of $ ___________

authorize

the

ASCPA

to charge

$ __________

my credit

card. Card:

Credit

II authorize

the

ASCPA

to charge

$ __________

to mytocredit

card. Credit

n Card:

MC n MC

Visa

Card Number

Visa

Discover

AMEX

n Discover

n AMEX

Month

Year

________________________________________

Print Cardholder’s Name

________________________________________________

Cardholder’s Signature

Address of cardholder

City, State, Zip of cardholder

The Alabama CPA MAGAZINE

15

EDUCATION Express

No.

Date(s)

Field of

Study

Title

Location

001* 5/10/13

AA

002* 6/18/13

Other

Early Bird *Registration Non-Member

Member Fee

Fee

Add-On

AICPA Advanced Course: Overview of the Peer Review Program Standards Montgomery

$250 $275 $50

Trusted Business Advisor Workshop 2 Montgomery

$250 $275 $50 003

6/24/13

AA

Annual FASB Update and Review

Gulf Shores (AM)

$150 $175 $50 004

6/24/13

TX

Select Estate and Life Planning Issues for the Middle-Income Client Gulf Shores (AM)

$150 $175 $50 005

6/24/13

Other

Controller/CFO Update: Hot Topics Facing Today’s Financial Professional Gulf Shores (AM)

$150 $175 $50 006

6/24/13

AA

Accounting and Reporting for Not-for-Profits: Avoiding the Headaches and Heartaches

Gulf Shores (PM)

$150 $175 $50 007

6/24/13

TX

Individual Income Tax Return Mistakes and How to Fix Them

Gulf Shores (PM)

$150 $175 $50 008

6/24/13

Other

Gaining a Competitive Advantage: Critical Skills for CFOs and Controllers

Gulf Shores (PM)

$150 $175 $50 009

6/25/13

AAFinancial Reporting Fraud: The Top 25 Tips on How to Prevent and Detect Executives and Managers from

010

6/25/13

TX

011

6/25/13

Other

012

6/25/13

013

Manipulating Financial Statements

Gulf Shores (AM)

$150 $175 $50 Federal Tax Update

Gulf Shores (AM)

$150 $175 $50 Innovative Forecasting and Budgeting: Moving Beyond the Traditional Techniques Gulf Shores (AM)

$150 $175 $50 AA

Preparing OCBOA Financial Statements: Cash, Modified Cash and Tax Basis Financial Statements Gulf Shores (PM)

$150 $175 $50 6/25/13

TX

Mastering Basis Issues for S Corporations, Partnerships, and LLCs

Gulf Shores (PM)

$150 $175 $50 014

6/25/13

Other

Thriving in a Chaotic Economic Environment: Planning and Strategy Formulation for Your Organization

Gulf Shores (PM)

$150 $175 $50 015

6/26/13

AA

Fraud in Purchasing and Cash Disbursement Cycles Gulf Shores (AM)

$150 $175 $50 016

6/26/13

TX

Maximizing Your Social Security Benefits

Gulf Shores (AM)

$150 $175 $50 017

6/26/13

Tech

Technology Update

Gulf Shores (AM)

$150 $175 $50 018

6/26/13

AA

COSO Internal Control: One Size Does Fit All Gulf Shores (PM)

$150 $175 $50 019

6/26/13

TX

Estate Planning: What to Do in 2013

Gulf Shores (PM)

$150 $175 $50 020

6/26/13

Tech

Excel Macros - Part 1 Gulf Shores (PM)

$150 $175 $50 021

6/27/13

AA

Compilation Engagements Gulf Shores (AM)

$150 $175 $50 022

6/27/13

TX

Key Partnership and S Corporation Tax Planning Strategies

Gulf Shores (AM)

$150 $175 $50 023

6/27/13

Tech

iPad - An Effective Business Tool

Gulf Shores (AM)

$150 $175 $50 024

6/27/13

AA

Efficient Small Business Audits Gulf Shores (PM)

$150 $175 $50 025

6/27/13

TX

Critical Tax Issues in Buying and Selling a Business Gulf Shores (PM)

$150 $175 $50 026

6/27/13

Tech & AA

Excel Reporting - Best Practices, Tools and Techniques

Gulf Shores (PM)

$150 $175 $50 027* 7/8/13

AA

Governmental and Nonprofit Update

Montgomery

$250 $275 $50 028* 7/8/13

Other

AICPA’s Annual Update for Controllers

Montgomery

$250 $275 $50 029* 7/9/13

AA

Governmental Accounting and ReportingHuntsville

$250 $275 $50 030* 7/9/13

AA

Detecting Misstatements:Integrating SAS 99 and the Risk Assessment StandardsHuntsville

$250 $275 $50 031* 7/10/13

AA

Understanding the Clarified Auditing Standards: The Changes You Need to Know

Montgomery

$250 $275 $50 032* 7/10/13 6AA/1Tax/1Other Construction Accounting, Auditing, Tax

Montgomery

$250 $275 $50 033

7/16/13

Automobile Dealerships: An In-Depth Perspective

Montgomery

$250 $275 $50 034

7/16/13

Tech

Top 50 Security Measures for CPAs

Montgomery

$250 $275

$50 035* 7/17/13

AA

Now I Oversee: Advanced OMB A-133 Issues

Birmingham $250 $275

$50 036

7/17/13

Tech

QuickBooks 2013 for CPAs

Birmingham $250 $275

$50 037* 7/17/13

AA

New GASB Reporting Requirements: GASB Statements 67 & 68

Mobile

$250 $275

$50 038* 7/17/13

TaxHandling IRS Disputes

Mobile

$250 $275

$50 039

7/18/13

AA

Forensic Accounting: A Comprehensive Guide to Conducting Financial Fraud Investigations

Auburn

$250 $275

$50 040

7/18/13

Tech

Tech Savvy CPA

Auburn

$250 $275

$50 041* 7/18/13

AA

Studies on Audit Deficiencies

Mobile

$250 $275

$50 042* 7/18/13

Tax

Fundamentals of a Trust

Mobile

$250 $275

$50 044

7/26/13

Tax

Shortcuts to Tax Cuts: Individual Tax, Social Security, and Retirement Planning Tools and Strategies

Auburn

$250 $275 $50 045

7/29- 7/31/13 AA

Employee Benefits Workshop – Fee Determined by Sessions

Birmingham 046

8/5 - 8/7/13

AA

Basic Staff Training for Auditors

Montgomery

$525 $550 $50 047

8/5/13

AA

Forensic Accounting: Critical Phases of an Effective Fraud Investigation

Birmingham (AM)

$155 $180 $50 048

8/5/13

Tax

Tax Challenges for Older Americans