The Multi-State Plan Program. During the ACA's first open

advertisement

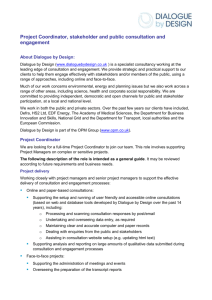

h e a lt h p o l ic y b r i e f 1 w w w. h e a lt h a f fa i r s .o r g Health Policy Brief u p dat e d : m ay 2 9 , 2 0 1 4 The Multi-State Plan Program. During the ACA’s first open enrollment period, exchanges in thirty states and D.C. offered multistate insurance plans. what’s the issue? One of the key mechanisms for expanding health insurance coverage under the Affordable Care Act (ACA) was the creation of insurance exchanges—Marketplaces where people can compare qualified private health plans on benefits, quality, and price; find out if they qualify for financial assistance; and use a premium subsidy to buy insurance. All plans sold on the exchange must offer ten essential health benefits, creating more standardization among plans and providing more comprehensive options than previously seen in the individual market. One goal of the ACA is to make shopping for health insurance easier, but a secondary goal is to create plan choice and stimulate competition through health insurance exchanges. In most states the insurance markets for individuals and small businesses are highly concentrated. For example, in thirty states a single insurance company accounts for more than half the enrollees in the individual market, and in most states one or two insurers dominate the small-group market. One insurance company may sell dozens of different plans in a given market, so even though a market offers plan choice, it still may not be competitive. ©2014 Project HOPE– The People-to-People Health Foundation Inc. 10.1377/hpb2014.11 Before the ACA was enacted, many policy makers and advocates argued that allowing insurers to offer plans across state lines—despite states’ different regulatory environments— would spur competition and keep premiums low. Under the law, this idea took the form of the Multi-State Plan Program (MSPP). However, in practice, the MSPP is likely only to offer additional plan choice to the exchanges, not necessarily additional competition. Any carrier that is in the position to apply to offer a multistate plan is likely already selling plans on the individual market in nearly every state. The Office of Personnel Management (OPM), which administers health insurance programs for federal employees and members of Congress, administers the MSPP and will contract with health insurance issuers to offer at least two plans in every exchange within four years. This policy brief updates an earlier brief on the MSPP based on the experience of the program during the first open enrollment period. This update examines how the concerns initially raised by state insurance regulators played out and whether the addition of the multistate plans increased competition in states with highly concentrated insurance markets. what’s the background? States had several options for organizing and operating their exchanges, also known as health insurance Marketplaces. A state could h e a lt h p o l ic y b r i e f 150+ plans The Office of Personnel Management entered into a contract with the Blue Cross Blue Shield Association to offer over 150 plans in thirty states and the District of Columbia. “The Multi-State Plan Program was included in the Affordable Care Act to increase the number of plan choices offered through the exchanges.” 2 t h e m u lt i - s tat e p l a n p r o g r a m establish and operate its own exchange, work with other states to establish regional exchanges, or run an exchange in partnership with the federal government. If a state did not establish its own exchange, the Department of Health and Human Services (HHS) operated a federally facilitated Marketplace for the state. In the end, only sixteen states and the District of Columbia elected to operate their own exchanges; seven states entered into a partnership with the HHS; and the remaining states let the federal government operate the exchange. oversight: Historically, insurance regulation has been a state responsibility, but for multistate plans the OPM will play a greater regulatory role. In addition to oversight at the federal level, the insurance companies must also be licensed by each state in which they offer a multistate plan. They will be subject to all pertinent state laws and regulations, so long as these rules do not conflict with the federal government’s multistate plan requirements. The OPM has a review and appeals process in place to deal with any unforeseen conflicts between federal and state requirements. Regardless of which entity runs an insurance exchange, there are two types in each state—one for individuals and their families and one for the employees of small businesses—with the option that states could combine their individual and small-group exchanges. As it does with the FEHB plans, the OPM has the authority under the ACA to negotiate premiums with participating multistate plan issuers. However, under the FEHB program the OPM has much more leverage for negotiations than under the MSPP. The FEHB program offers a large, stable pool of employees, employees are eligible for a large employer contribution covering the majority of the premium, and premiums are deducted automatically from employees’ paychecks making the FEHB program attractive to insurance carriers. progr am specifics: As mentioned, the MSPP was included in the ACA to increase the number of plan choices offered through the exchanges. Under the law, the program is administered by the OPM, drawing on that agency’s more than fifty years of experience in administering the Federal Employees Health Benefits (FEHB) Program. An estimated eight million federal workers and their dependents, federal retirees, and members of Congress and their staffs obtain health coverage through the FEHB program, making it the nation’s largest employer-sponsored health insurance program. The OPM has been recognized for its ability to negotiate relatively low rates with insurance carriers, keep administrative costs low, and offer government employees a wide range of health plans and coverage options. The OPM was required to contract with health insurance issuers (at least one of which must be nonprofit) to offer a minimum of two plans in at least thirty states. At least one plan in each state must not offer coverage for abortion services beyond cases of rape, incest, or life endangerment. The multistate issuers were required to operate in at least 60 percent of states on January 1, 2014, expanding to every state and the District of Columbia within four years. The insurance carriers were allowed to offer plans in only parts of a state and expand to the rest of the state in later years. Insurance carriers were allowed to offer plans only in the individual markets and expand into the Small Business Health Options Program (SHOP) exchange markets over time. blue cross blue shield chosen: In September 2013 the OPM announced that it had entered into a contract with the Blue Cross Blue Shield Association (BCBSA) to offer over 150 plans in thirty states and the District of Columbia for individuals and their families. While the contract is between the OPM and the BCBSA, multiple independent insurance carriers operate under the BCBSA umbrella and offer multistate plans in local markets. The OPM also certified multistate plan options for SHOP in three states and the District of Columbia offered by the BCBSA. For 2015 at least five more states will have a multistate plan option based on the phase-in schedule outlined by the OPM. what are the concerns? A core issue was whether the MSPP would genuinely increase competition among health plans in highly concentrated markets. In addition, there was some uneasiness among state regulators on how the implementation of the MSPP would affect their exchange strategies and whether the OPM’s regulatory authority would preempt their traditional role as the primary regulator of health insurance coverage. competition: As noted above, the main goal of the MSPP was to increase plan choice and h e a lt h p o l ic y b r i e f 3 t h e m u lt i - s tat e p l a n p r o g r a m competition. However, few insurance companies were in position to participate in the MSPP. Issuers must be licensed in each state, have sufficient provider networks and financial reserves, and have an adequate information technology structure in place to meet enrollees’ needs nationwide. As a result, the BCBSA, representing thirty-seven independent BCBSA companies, was selected to offer plans through the MSPP. Many policy experts expected that the OPM would contract with at least two insurance carriers based on the language in the ACA that says the OPM “shall enter into contracts with health insurance issuers to offer at least two multi-state qualified health plans through each exchange.” However, the term “multi-state plan” is defined as the health plan offered under the contract between the OPM and the MSPP issuer. Because the BCBSA is offering at least two plans in each of the states, the requirements of the law are met even though the OPM has a contract with only one issuer. The OPM did not publicly state how many applicants applied to the MSPP. The selection of the BCBSA, although not surprising, may not do much to increase plan choice or competition in heavily concentrated markets. In all but a handful of states, the BCBSA-affiliated plans are already the most dominant plans in the individual market. In 2012 the BCBSA-affiliated plans held 50 percent or more of the market share in the individual market in twenty-three states. In forty-two states the BCBSA-affiliated plans were one of the three largest plans in terms of enrollment in the individual market. In a statement the OPM claims that “multi-state plans are already helping to drive competition and expand the number of plan options in many states.” The OPM goes on to say that without the MSPP, consumers in Alaska, New Hampshire, and West Virginia would have only one other type of insurance plan to choose from. However, at least in New Hampshire and West Virginia, exhibit 1 Multi-State Plan Program Options For 2014, By State Multi-State Plan Program option No Multi-State Plan Program option source Office of Personnel Management, http://www.opm.gov/healthcare-insurance/multi-state-plan-program/. note Multistate plan options are also available through the Small Business Health Options Program (SHOP) exchanges in Alaska, Maryland, Virginia, and the District of Columbia. h e a lt h p o l ic y b r i e f 42 states The BCBSA-affiliated plans were one of the three largest plans in terms of enrollment in the individual markets in forty-two states. “Lawmakers drafting the ACA included language requiring multistate plan issuers to operate on a ‘level playing field’ with other plans in the exchanges.” 4 t h e m u lt i - s tat e p l a n p r o g r a m the other insurance plan is also offered by the BCBSA. In fact, in most states with a multistate plan, the local BCBSA carrier is offering similar non-multistate plans. Offering a large number of plans in an exchange does not necessarily mean the market is competitive if the majority of enrollment is concentrated in one issuer’s plans. Detailed enrollment data by insurance carriers are not available, but the BCBSA recently testified before the House Energy and Commerce Committee that as of April 1, 2014, more than 280,000 individuals had enrolled in a multistate plan. This is a relatively small number compared with the overall enrollment figure of eight million. conflicting aims: As details emerged on the MSPP, one concern was the potential for conflict between federal regulators and state exchanges that wanted to be active purchasers. Under the law, an issuer that enters into a contract with the OPM in the MSPP is deemed certified by state exchanges. A handful of states took an active purchasing strategy in their exchanges. In other words, instead of allowing all plans that met certification requirements to participate in the exchange, some states issued requests for proposals and selected only those plans that submitted the lowest bids or met other standards, such as quality benchmarks. Of the states that took active purchasing strategies, only two—California and New York—also had a multistate plan in their exchanges. However, there were no public reports of any conflicts between the multistate plans and regulators in those two states. regulatory conflicts: Lawmakers drafting the ACA included language requiring multistate plan issuers to operate on a “level playing field” with other plans in the exchanges. For example, the law specifies that if a multistate plan were exempted from federal or state laws in any of thirteen specific categories, such as with respect to solvency and financial requirements, then other health plans would not be subject to those requirements, either. This provision was intended to ensure that multistate plans are neither competitively advantaged nor disadvantaged compared with other private health plans in the exchange. But because the OPM is the primary regulator of multistate plans, some state insurance commissioners and consumer advocates expressed concerns that multistate plans might not be subject to important state oversight and consumer protection laws and regulations beyond the thirteen categories cited in the law. This, in turn, could give multistate plans an unfair competitive advantage over other insurance plans offered through the exchanges. The OPM stated its intention to provide a dispute resolution process if a state wanted to challenge the OPM’s ruling that a state law is not applicable to a multistate plan issuer. Information on the dispute resolution process was just made available in a March 2014 letter, so it is too early to tell if any states will take advantage of this process. service areas and phased-in coverage: As mentioned above, multistate plans must offer a plan in at least 60 percent of the states as of January 1, 2014, and then expand to all states incrementally over four years. The OPM determined that multistate plans will be able initially to offer coverage in only parts of a state and to expand coverage statewide over time. However, many stakeholders objected to allowing multistate plans to have only partial coverage within a state, arguing that the plans could gain an unfair economic advantage by avoiding high-cost areas. Acknowledging concerns for “cherry-picking,” the OPM says that it will review and approve expansion plans to ensure that they are not discriminatory—that is, they have not been designed to exclude high-cost or medically underserved populations. It does not appear that the BCBSA avoided states that were running their own exchanges when determining in which states to offer a multistate plan. Multistate plans in nine states and the District of Columbia are running their own exchanges. States without a multistate plan are more heavily concentrated in the West, upper Midwest, and Southeast (Exhibit 1), so many rural states did not benefit from additional plan options provided by the MSPP. There is no evidence that the BCBSA discriminated against certain states. In about half of the eleven states in which it did not have a multistate plan option this year, the BCBSA did not have a large market share based on 2012 enrollment data in the individual market. It appears the BCBSA offered the MSPP in markets where it had a strong existing presence. what’s next? Multistate plans’ 2014 experience will inform their future decisions about enrollment, premiums, and outreach. The OPM recently issued the 2015 Call Letter to interested applicants for the MSPP. This annual letter sets out the requirements for applicants and outlines the OPM’s priorities. The OPM states h e a lt h p o l ic y b r i e f t h e m u lt i - s tat e p l a n p r o g r a m that it is interested in “building a more robust [multistate plan] brand identity” across states. However, the OPM says it needs to balance consumers’ desire for consistent plans across states with issuers’ needs for flexibility to vary their plan offerings from state to state to meet their business needs. Most of the requirements of the Call Letter do not differ from the requirements for all qualified health plans stipulated by HHS. One exception is the requirement that multistate plan 5 issuers have a process in place to allow enrollees to receive out-of-network care in certain instances without added cost sharing or balance billing. Qualified health plans are “encouraged” to have such processes in place, but multistate plan issuers “must” do so. Finally, in addition to offering a multistate plan in at least five more states, the OPM hopes to add at least one more multistate plan issuer, which could increase the number of plans available in many states. n About Health Policy Briefs Written by Sarah Goodell Health Policy Consultant Editorial review by Sabrina Corlette Research Professor Health Policy Institute Georgetown University Jane Hyatt Thorpe Associate Research Professor School of Public Health and Health Services George Washington University Ted Agres Senior Editor Health Affairs Rob Lott Deputy Editor Health Affairs Health Policy Briefs are produced under a partnership of Health Affairs and the Robert Wood Johnson Foundation. Cite as: “Health Policy Brief: The Multi-State Plan Program,” Health Affairs, Updated May 29, 2014. Sign up for free policy briefs at: www.healthaffairs.org/ healthpolicybriefs resources Jost T, “Implementing Health Reform: The MultiState Plan Program Final Rule,” Health Affairs Blog, March 2, 2013. Kaiser Family Foundation, “Market Share and Enrollment of Largest Three Insurers—Individual Market,” 2012. Office of Personnel Management, “Multi-State Plan Program Issuer Letter,” February 4, 2014. Office of Personnel Management, “Patient Protection and Affordable Care Act: Establishment of Multistate Plan Program for Affordable Insurance Exchanges,” Federal Register 78, no. 47, March 11, 2013. Riley T, Hyatt Thorpe J, “Multi-State Plans Under the Affordable Care Act,” School of Public Health and Health Services, George Washington University, April 2012.