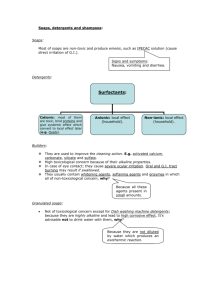

market analysis

advertisement