Syneron Medical Ltd. Investor Presentation

advertisement

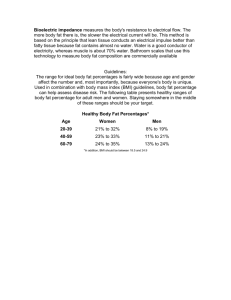

Syneron Medical Ltd. Investor Presentation August 2015 Safe Harbor For Forward Looking Statements Any statements contained in this presentation regarding future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Further, any statements that are not statements of historical fact (including statements containing "believes," "anticipates," "plans," "expects," "may," "will," "would," "intends," "estimates" and similar expressions) should also be considered to be forward-looking statements. There are a number of important risks and factors that could cause actual results or events to differ materially from those indicated by forward-looking statements in this presentation, including the risks set forth in Syneron Medical Ltd.'s most recent Annual Report on Form 20-F, and the other factors described in the filings that Syneron Medical Ltd. makes with the SEC from time to time. If one or more of these risks or factors materialize, or if any underlying assumptions prove incorrect, Syneron Medical Ltd.'s actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this presentation. Non-GAAP Financial Measures The following presentation includes certain "non-GAAP financial measures" as defined in Regulation G under the Securities Exchange Act of 1934. A schedule is included in the company’s Q2 2015 press release, which reconciles our results as reported under General Accepted Accounting Principles and the non-GAAP financial measures included in the following presentation. 2 Syneron at a Glance • A global leader in medical aesthetic devices • Growing aesthetic market and consumer demand for energy based non-invasive procedures • Largest worldwide presence in sales, distribution, service network and installed based 3 Drivers of Profitable Growth 1. Superior technology for non invasive Fat Destruction (UltraShape) and Body Shaping (VelaShape – 7,000 units sold WW) 27% Worldwide Market Share¹ 2. Focus on high margin recurring revenues 3. Significant expansion and optimization of NA sales force, focused on selling high margin products 4. PicoWay breakthrough technology for tattoo removal and treatment of pigmented lesions 5. Profound RF micro-needle technology addresses growing demand for high-end facial treatments ~$271M Revenue² (30% Recurring³) ~$92M in Cash4; No Debt ~30,000 Customers 1 Based on US publicly traded companies listed here (CYNO, CUTR, ZLTQ, LMNS); Professional Aesthetic Device Sector 2 Trailing twelve month revenue 3 Based on FY2014 results 4 June 30, 2015 Balance Sheet 4 Why is Non-Invasive Aesthetic Medicine Growing? The doctor can take a patient from This To this Photos: Macrene Alexiades, MD WITH NO SURGERY, MINIMAL DOWN-TIME AND A HIGH DEGREE OF PREDICTABILITY Procedure performed with Syneron’s Profound™ device 5 Why is Non-Invasive Aesthetic Medicine Growing? The doctor can take a patient from This To this Photos: Wendy Tink, MD WITH NO SURGERY, MINIMAL DOWN-TIME AND A HIGH DEGREE OF PREDICTABILITY Procedure performed with Syneron’s UltraShape™ device 6 Strong Shift Toward Non-Invasive Procedures Invasive Procedures Non- Invasive Procedures (Procedures in millions) (Procedures in millions) 12.0 12.0 10.0 CAGR= 4.02% 10.0 8.0 8.0 6.0 6.0 4.0 4.0 2.0 1.76M CAGR= 15.75% 8.9M 2.0 .901M .741M 0.0 0.0 1997 1997 2014 2014 Non-invasive procedures account for 83% and majority of growth Source: The American Society for Aesthetic Plastic Surgery 2015 7 Superior Technology to Address Fat Destruction and Body Shaping Market Opportunity 8 Potential Market for Body Shaping Procedures 154.7M Americans over the age of 20 are overweight or obese(1) 33.5% Obese Target Population 32.6% Overweight 33.8% Normal or Underweight Total Potential US Patient Market Approximately 100M Patients KEY (Based on BMI(1)) | BMI of 30 or above is obese | BMI of 25-30 is overweight | BMI of 18.5-25 is normal weight | BMI of 18.5 or lower is underweight ¹ 2013 American Heart Association, Inc. 9 Potential Market for Fat Destruction Procedures In a survey of 1,045 women in NA 1 32.6% Overweight 56% 33.8% Normal or Underweight indicated interest in non-invasive fat destruction procedures Total Addressable Market in the US: 19.5M Patients 1 Syneron 22013 proprietary consumer research, 2012 Census estimates the US population 20 years and older to be 233M; and that 34.9% of the adult population has personal income of $35,000 or above. 10 2 Women Are Interested in Treating Multiple Body Areas* A proprietary Syneron research study of 1045 women, aged 25 and above in NA concluded that: 51% of women are not satisfied with their thighs 58% of women are not satisfied with their flanks 54% of women are not satisfied with their buttocks Source: Syneron proprietary consumer survey 2012. *In the US, UltraShape is currently indicated for treatment of the abdomen. 72% of women are not satisfied with their stomach 49% of woman are not satisfied with their back/bra fat 11 Rapid Growth of Non-Invasive Body Shaping Procedures¹ Liposuction (# of Procedures in Thousands, US) Non-Invasive Fat Reduction (# of Procedures in Thousands, US) Growth Rate -5.9% Growth Rate 42.6% 364 135 95 342 2013 2014 (1) American Society of Aesthetic Plastic Surgery 2014 2013 2014 Physician Qualitative Research Reveals Importance of Pain-Free Advantage • Research Takeaway • Pain Free represents advancement over existing technologies + opportunity to tap into growth of body shaping category. • Supporting Quotes • “Over 75% of patients come in to my office and immediately ask “How much is it going to hurt?" "100% of patients ask about downtime." • “Pain-free with no downtime, it’s effective and totally believable.” • “Pain-free permanent fat removal…BOTTOM LINE!” 13 Market Learnings • • • • More than half of the women (56%) are interested in non-invasive fat destruction A pain free procedure is the #1 consideration for patients Almost three quarters (72%) of the women are unhappy with their abdomen and want to remove fat from their stomach Almost half of the doctors (44%) are looking to buy non-invasive body shaping equipment What do women look for in a non-invasive fat destruction treatment? Syneron is ideally positioned to serve these patient and doctor market needs 14 Broad Body Shaping Portfolio Holistic Approach to Body Shaping Treatments: Fat Cell Destruction, Skin Tightening and Cellulite Targeting connective tissue Targeting and destroying fat 15 UltraShape Pulsed Focused Ultrasound (PFU) ® Focused ultrasound energy Mechanical acoustic effects breaks fat cell membranes Immediate and permanent fat cell destruction Comfortable – No Pain Selective: Skin, vessels, nerves and connective tissue remain unharmed 16 Superior Technology for Non Invasive Fat Destruction Immediate Fat Cell Destruction! Immediately post single tx Control X 40 X 40 UltraShape Technology, In-Vivo Porcine Model: Acute Micro Effects Brown SA, Greenbaum L, Shtukmaster S, Zadok Y, Ben-Ezra S, Kushkuley L. Characterization of nonthermal focused ultrasound for noninvasive selective fat cell disruption (lysis): technical and preclinical assessment. Plast Reconstr Surg. 2009 Jul;124(1):92-101 17 Superior Technology for Non Invasive, Immediate Fat Destruction Highly Selective! Intact Blood Vessel Fat Cell Destruction Intact Nerves X100 UltraShape Technology, In-Vivo Porcine Model: Acute Micro Effects Brown SA, Greenbaum L, Shtukmaster S, Zadok Y, Ben-Ezra S, Kushkuley L. Characterization of nonthermal focused ultrasound for noninvasive selective fat cell disruption (lysis): technical and preclinical assessment. Plast Reconstr Surg. 2009 Jul;124(1):92-101 18 Superior Technology for Non Invasive, Immediate Fat Destruction Exceptional Efficacy! UltraShape MRI Measurement of Fat Thickness Baseline Post 3 Tx Treated Area: Abdomen Fat Layer Thickness: 4.9 cm Treated Area: Abdomen Fat Layer Thickness: 3.8 cm Fat Thickness Reduction: 1.1 cm Circumference Reduction: 4.5 cm Leal H. et al, Procedures in Cosmetic Dermatology (book); Focused Ultrasound for Fat Reduction: Ultralipotripsy. pp 107-121 (2010) 19 Superior Technology for Non Invasive, Immediate Fat Destruction 13 published clinical studies with more than 900 subjects treated! Publication Year Patient Population Avg. Circumference Reduction Teitelbaum S. et al1 US, UK, Japan 2007 164 2.0 cm (1 Tx) 82% > 0.5 cm circumference reduction Leal H.2,3 Monterrey, Mexico 2009 24 3.0-3.4 cm (1 combo Tx) 96% > 1.5 cm circumference reduction 100% patient satisfaction Moreno-Moraga J1 Madrid, Spain 2007 30 3.95 cm (3 tx) Leal H.2,3 Monterrey, Mexico 2008 36 5.0 cm (3 tx) Ad El D.2,3 Beilinson Med, Israel 2008 26 3.96 cm (3 tx) Mulholland S.2 Toronto, Canada 2008 21 Inglefield C.2 London, UK 2007 148 3.48 cm (3 tx) 6.3 cm (3 tx) de Almeida G.2 Sao Paulo, Brazil 2007 20 Benchetrit A.2 Montreal, Canada 2010 109 Niwa A. 1 São Paulo, Brazil. 2010 120 4.95 cm (3 tx) Ascher B.1 Paris, France 2010 25 3.58 cm (3 tx) 90% reported no pain S.-L. Chang1,2 Taiwan 2013 32 3.91 cm (3 tx) 21.4% and 25% reduction in fat thickness measured by MRI Weiss, Coleman, Kenkel, Ad-El3 US, Israel 2013 32 3.34cm (3 tx) 100% reported very low pain levels Investigator 5.4 cm (3 tx) 4.5 cm (3 tx) Results 100% measurable and visual improvement 100% measureable reduction 94% patient satisfaction 90% > 2.0 cm circumference reduction 86% patient satisfaction 93% patient satisfaction 100% measurable reduction 86% patient satisfaction 96% measurable reduction 86% patient satisfaction 92% measurable reduction 94% reported comfortable treatment Average circumference reduction ranges from 3.3 to 6.3 cm (one to three pant size reduction) Average response rate ranged from 83% to 100% 1Published in peer-reviewed journal 2Presented in scientific conference 3Data on file 20 UltraShape Three Treatment Results ® Upper/ Lower Abdomen Pre-Treatment 4 Weeks Post Treatment Pre-Treatment Reduction -4.7 cm upper, -5.4 cm lower abdomen 4 Weeks Post Treatment Reduction -5 cm Weight change -2.2Kg Weight change -2.2Kg Courtesy of Dr. Arie Benchetrit, Montreal, Quebec 21 21 UltraShape Three Treatment Results ® Flanks Pre-Treatment 2 Months Post Treatment Pre-Treatment 2 weeks Post Treatment Reduction -14 cms Reduction -10 cms Weight change -3.2Kg Weight change -3.2Kg Courtesy of Dr. Wendy Tink, Vive Clinic – Calgary, Alberta 22 22 New FDA cleared: 25% power increase and VDF protocol Control Regular protocol Immediate Fat Destruction U.S. Launch in Q2 2015 In-vivo Porcine Model: Acute Macro Effects 23 VDF Multi-Focus More Fat Volume Destruction Per Pulse UltraShape Non-Invasive Fat Destruction UltraShape Treatments • • Tracking& GuidanceCamera • • Tracking& GuidanceMonitor • Effective - 1 to 3 pant size reductions Comfortable – No pain, Excellent Safety Record Results seen as early as 2 weeks post treatment Flexible - Any shape and size of fat pocket can be treated with the VDF and U-Sculpt applicators Quick - enables enhanced patient throughput – Less than 1 hour needed for full abdominal treatment UltraShape System • • • • • • 24 Computer Guided treatment Intuitive graphic guidance monitor Fast learning curve Treatment can be delegated to staff Fast, full abdomen in less than 1 hour Supports applicator and software upgrades High Margin Recurring Revenue Business Model UltraShape Consumer Business Model Revenues from Consumables Revenues from Capital Equipment • Consumables will be sold in the form of Focal Treatment Zones (FTZ) • Average abdominal treatment requires 10 FTZ’s • Practice purchases FTZ’s based on patient volumes • Cost of FTZs represents 25%-33% of treatment revenue charged by physician System List Price $109,000* FTZ List Price: $25 UltraShape GM Over 70% * List price as of August 2015 25 UltraShape Practice Value Proposition ® • New technology provides clinic differentiation – attracts new patients • Cross selling opportunities with other offerings – attracts new patients • Practice Development Partner (PDP) marketing and clinical support for practice • Computer guided treatment - Easy to learn & use - High staff acceptance • 10 new patients per month (20 treatments per month) = $220,000 - $250,000 in annual revenue 26 Ultrashape Launch – Marketing Campaign Raise consumer awareness and Interest in Ultrashape as a breakthrough body shaping solution Establish Ultrashape’s competitive edge to become the category leader Support Ultrashape’s practices with consumer demand building tools via Co-op program UltraShape Brand Ambassador Larisa Pippen Consumer Campaign Practice Campaign • Consumer website • Collateral materials • PR campaign • Digital campaign (banners, text) • Digital campaign • PDP program • Search Engine Marketing • Marketing Incentive program • Print campaign • Print campaign 27 UltraShape® 2015 Target Customers • Differentiate practice • Differentiate practice • Complementary to VelaShape • Painless; low side effect profile • New marketing program • New marketing program • Offer latest Immediate Fat Destruction technology • Alternative for “painsensitive” patients • Correcting unevenness from Lipo/other devices • Can treat any size and shape of fat pocket 28 UltraShape®: A Game Changer for Syneron Candela • 2015 year-to-date U.S. – 94 systems sold • Planned 2015 revenue: $20M • $65M-$100M in UltraShape revenues within 3 years • Above 70% gross margin on UltraShape business • 50% capital equipment and 50% recurrent revenues within 3 years • Achieving a long term win-win partnership with our customers • International re-launch in 2016, expanding recurring revenue business model 29 Broad Body Shaping Portfolio Holistic Approach to Body Shaping Treatments: Fat Cell Destruction, Skin Tightening and Cellulite Targeting connective tissue Targeting and destroying fat 30 VelaShape III Cellulite, Skin Laxity, Circumferential Reduction • FDA cleared for the treatment of cellulite and circumferential reduction (abdomen and thighs) • Increased RF Power by a factor of 2.5 to 150W • Single treatment with an average abdominal circumferential reduction of 2.5cm and 100% patient responders 31 Treatment of Skin Laxity with VelaShape Technology Before After Photos: Regine Bousquet, MD 32 VelaShape III - Single Treatment Protocol 42 patient trial Average Abdominal Circumference Reduction % of Patients with CR of at least 1cm, 1.5cm and 2cm 1 cm Mean abdomen circumference reduction 1.5 cm 2 cm 3.5 100% 3 2.6 80% 80% 67% 2 60% 1.8 1.5 40% 1 0.8 55% 36% 27% 20% 0.5 0 0 Baseline 71% [%] [cm] 2.5 100% 4 weeks 7 weeks 10 weeks 0% 0% Baseline 33 4 weeks 7 weeks 10 weeks Body Shaping as a Growth Driver - Leveraging Our Strengths • Installed base of close to 15,000 systems in NA out of which 2,000 are body shaping systems • Superior technology platforms • Ability to offer comprehensive body shaping solutions for all major indications (Non-Invasive Fat Destruction, Skin Laxity, Cellulite, Circumference) • Cross selling opportunities with other devices 34 Body Division Creating Bifurcated Body Shaping Business Group (team of 50-60 reps by end of 2015) Practice Development Partners (PDP’s) Territory Managers For Capital Sales • Focus on educating practices • Initial Focus on Installations • Provide marketing support • Expansion of installed base • Drive utilization of Focal • Ensure healthy pipeline Treatment Zones (FTZs) • Targeting 2,000 VelaShape NA installed base and users of competitive systems • Potential for bundling with VelaShape 35 PicoWay Breakthrough Technology for Tattoo Removal and Treatment of Pigmented Lesions Dual wavelength PicoWay - Shortest Picosecond Pulse, Highest Peak Power 36 PicoWay – Shortest Picosecond Pulse, Highest Peak Power Dual wavelength picosecond laser to treat tattoos of all types and colors, and pigmented lesions on any skin type • FDA Clearance in late Oct. 2014 for removal of tattoos of all colors; April 2015 for pigmented lesions • • Investing in sales & marketing to support launch US potential market for tattoo removal procedures: $11.4B - $22.7B1 • Received CE Mark in July 2014 for removal of tattoos of all colors and pigmented lesions • Received Korean regulatory clearance in July 2015 • $260K list price and 15-20% higher gross margin on top of current gross margin levels • Growth driver with $7.3M in revenue in 1H 2015 ¹ 2013 Census; 21% of adults in America have at least one tattoo; The Harris Poll, 2012 Harris Interactive; 14% of those with a tattoo regret their tattoo; The Harris Poll, 2012 Harris Interactive; Estimated average tattoo removal procedure fee is $400; 4-8 treatments required 37 Candela global installed base of ~1,400 dedicated tattoo removal & pigmented lesion lasers and >11,000 platforms that include pigmented lesion indications PicoWay – Shortest Picosecond Pulse, Highest Peak Power • Treat widest range of tattoos & pigmented lesions 2 wavelengths + ultra-short 450 picosecond pulses enable treatment of more patients than single wavelength picosecond units • Compared to other picosecond or Q-switched lasers PicoWay’s ultra-short pulses optimizes the photoacoustic pressure on the target better than any device, shattering the ink with the least amount of heat transferred into the skin • Pulse-on-demand Lower cost of ownership than other picosecond laser systems which run continuously throughout the day • Compact system Fast and easy to use • Upgradability Additional applications and upgrades 38 PicoWay Treatment Results Tattoo Removal and Pigmented Lesion 39 Facial Aesthetics Treatments Growing Demand for High-End Facial Treatments ** Syneron Candela proprietary online consumer survey 2015 Assuming household income of >$50,000, US Census Bureau June 2014 Assuming treatment price of $5,000 Comprehensive Solution for Most In-Demand Facial Concerns Facial concerns for women over the age of 35*: * Syneron Candela proprietary online consumer survey 2015 Profound ™ Facial Aesthetics Treatments • • • • Minimally invasive microneedle electrode array with unique real-time temperature controlled RF Creates dermal volume, naturally, to answer a big challenge physicians doing aesthetic treatments have: how to replace lost volume in aging skin One treatment. One hour. 100% response. 2.6 years younger skin Long lasting and Predicatible results due to complete control over temperature endpoints and duration of treatment Recurring revenue model ($400 disposable tip) Dedicated U.S. sales force under the Aesthetics Division Clinically Proof: New Elastin, Collagen & Hyaluronic Acid Histological studies confirm that Profound yields neoelastogenesis and neocollagenesis Profound Results in a Single Treatment Iluminage Beauty - Unilever Syneron Joint Venture Structure Strategic Rationale • Build on investments in Syneron Beauty to create focused home beauty device business with enhanced growth and profitability profile • Unilever participation provides additional validation of Syneron Beauty and robust home-use beauty device market • Eliminate impact of Syneron Beauty on consolidated financials and cash flow while retaining upside potential • Allows Syneron Medical to focus on the significant opportunities in the professional business • Improves core business margins and profitability • Agreement closed December 8, 2013 • Global joint venture with Unilever to include: - Syneron Beauty - Iluminage (Unilever subsidiary) - $25 million Unilever investment • Ownership: Unilever 60% / Syneron 40% (Based on: Unilever preferred shares, Syneron ordinary shares) • Management / Board of Directors - Shimon Eckhouse – Chairman - Syneron 2 seats / Unilever 2 seats / 1 independent director/ Unilever entitled to add 2 directors • Valuation based on the Fair Value of the JV, $20.8M as of July 2015 July 2015 – Iluminage Beauty sold teeth whitening technology to Colgate-Palmolive • Received ~$10 million dollars and a mid-single digit percent earn-out on product sales • Entered into a Supply Agreement with Colgate-Palmolive for the teeth whitening product 45 Additional Potential Business Opportunities CoolTouch™ opportunity elure™ opportunity Strengthens recurring revenue strategy; Entry into new markets Addresses growing skin lightening market, especially in Asia • Integration on track • Signed a distribution agreement in Korea • FDA clearance received October 31, 2014 for our OEM 30-Watt Holmium Laser for breaking of kidney stones and soft tissue urological work • Signed a distribution agreement in China – In discussion with large chains, commercial as of Q1 2015 • Addressing the lucrative vein treatment market with high recurring revenue component • Japan – in discussions with strong local potential partners • 6 dedicated sales reps in U.S. are on board Revenue Highlights for Q2 2015 • Constant currency revenue growth of 19% – – Revenue negatively impacted by $3.1 million due to changes in foreign currency exchange rates Primarily devaluation of the Euro and Japanese Yen against the U.S. dollar • Total revenue was $73.5 million, up 13.8% y/y • Recurring revenue was $19.3 million, down (1.8%) y/y, sequentially up $1.5M Y/Y Revenues ($M) 76 74 72 70 14% (19% cc) Total Revenues North America International Total Revenue ($M) 27.6 45.9 73.5 Reported Growth 26% 8% 14% Constant Currency Growth 26% 15% 19% 19.6 18.0 15.4 1.2 45% 9% 16% (21%) 32% 14% 25% (21%) 54.2 21% 25% 68 66 64 62 60 Q2 14 Q2 15 NA Product EMEA Product APAC Product LATAM Product Total Product Revenues 47 Financial Highlights 5Q Trend (Non-GAAP) $ Thousands (except per margins) Q2 14 Revenues 64,618 Q3 14 Q4 14 Act 60,257 74,062 Q1 15 Q2 15 Y2013 63,399 73,507 Act 232,129 255,750 6.1% 8.3% 23.7% 11.6% 13.8% Cost Of Revenue Gross Profit 29,609 35,009 26,775 33,482 32,810 41,252 29,654 33,746 33,904 39,603 105,187 115,592 126,943 140,158 GM % Total OPEX 54.2% 31,851 55.6% 30,858 55.7% 36,050 53.2% 32,631 53.9% 36,663 54.7% 54.8% 115,170 127,283 % OPEX 49.3% 51.2% 48.7% 51.5% 49.9% 49.6% 49.8% EBIT 3,158 2,624 5,202 1,115 2,940 11,773 12,875 4.9% 4.4% 7.0% 1.8% 4.0% 5.1% 5.0% 228 3,386 900 (764) 1,860 920 (316) 4,886 1,696 (243) 872 262 409 3,349 900 221 11,994 -1,431 (688) 12,187 4,243 27% 49% 35% 30% 27% 2,486 940 3,190 610 2,449 13,525 7,944 37,237 37,228 37,128 0.07 0.03 0.09 37,328 0.02 37,283 0.07 36,254 0.37 37,160 0.21 YOY change, % Operating Margin Financial Income (expenses), net Pre Tax Income Taxes on Income (tax benefit) Tax rate Net Income Avg Shares EPS ($) (3.8%) Y2014 (*) Y2014 year-over-year comparison to Y2013 is on a pro-forma basis, excluding Syneron Beauty from Y2013 results following its de-consolidation as of December 8, 2013 48 10.2% Q2 2015 Highlights 80.0 70.0 Y/Y Revenues ($M) 73.5 26% 27.6 21.9 40.0 26% const curr Revenue by Geography 38% 8% 30.0 20.0 19% const curr 64.6 60.0 50.0 14% 42.7 45.9 Q2 14 Q2 15 62% 15% const curr 10.0 International International North America Product Revenue ($M) 60.0 Revenue Mix 54.2 45.0 50.0 25% 40.0 North America 15.4 16% const curr 18.1 14% const curr 19.6 45% const curr 26% 13.4 30.0 9% 74% 16.6 20.0 45% 10.0 13.5 Q2 14 Total NA Total EMEA Q2 15 Total APAC Product Total LATAM 49 Recurring Select Financial (Non-GAAP) Items as of Q2 15* Gross Margin % 54.5% • 55.6% (cc) 54.2% 53.9% 54.0% 53.5% Gross margin of 53.9% vs. 54.2% in Q2 2014 • 53.2% • 1.7% negative impact from changes in foreign currency exchange rates Constant currency GM of 55.6% 53.0% 52.5% Q2-2014 Q1-2015 Q2-2015 • Operating Margin % 6.0% • 4.9% 4.0% 4.0% 1.8% 2.0% Operating margin of 4.0% vs. 4.9% in Q2 2014 5.7% (cc) • Includes net negative impact of ~$1.5 million related to changes in foreign currency exchange rates Constant currency OM of 5.7% 0.0% Q2-2014 Q1-2015 • Q2-2015 • EPS ($) 0.10 0.07 0.05 0.07 0.02 0.09 (cc) • EPS of $0.07 vs. $0.07 in Q2 2014 • Q2-2014 Q1-2015 Q2-2015 50 Expecting to add $3-4M S&M in 2H15 vs 1H15 Expecting OM 4.5% for the full year 2015, or 5.5%-6% in constant currency for 2015 Q2 2015 EPS would have been $0.09 excluding changes in foreign currency exchange rates Select Balance Sheet Items as of June 30, 2015 • $92.3 million in cash and cash equivalents at June 30, 2015 Cash Position ($M) 120.0 • Used $5.4 million in cash from operations in Q2 2015 • • 100.0 • 100.4 92.6 Q1 14 Q2 14 Q3 14 99.9 60.0 40.0 20.0 - Q2 2015 - repurchased 55,025 shares at avg. price of $10.94 for $0.6 million Since inception (Dec 2014), repurchased 431,677 shares at an avg. price of $11.1 for $5.0 million Q4 14 Q1 15 Q2 15 Cash Flow from Operations ($M) 13.3 15.0 • 92.3 80.0 Reflects investments in inventory to support anticipated growth in 2015 and increased working capital related to the Company’s increasing volumes $20M share repurchase program: • 110.4 96.4 DSO of 76 vs. 81 days in Q2 2014 10.0 • Expecting to drive further improvements in DSO, which combined with more normalized inventory levels and spending, will put Company back on track to generate positive cash flow from operations 3.7 5.0 4.9 (5.0) (10.0) 51 (4.0) (6.5) (4.9) (5.8) (5.5) Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 2014 Highlights* Y/Y Revenues ($M) 300.0 250.0 200.0 10.2% 232.1 15.3% 79.6 60.0% 255.8 50.0% 30.0% 7.4% 152.5 0.37 40.0% 91.8 150.0 100.0 0.19 163.9 10.0% 0.0 0.0% 2.1% International 0.21 0.28^ 20.0% 50.0 2013 54.8% 54.7% 53.0% 2013 2014 5.1% 2013 (ex-Syneron Beauty) 5.0% 2014 North America Gross Margin % Operating Margin % EPS ($) ^ 2013 EPS would have been $0.28 excluding one-time tax settlement Cash Position ($M) Cash Flow from Operations ($M) 115 30 110.4 110 17 20 108.5 10 0 105 -10 -10 -20 100 2013 2014 -30 -23 2013 *The full year 2014 year-over-year comparisons to the full year 2013 are on a pro-forma basis, excluding Syneron Beauty from the full year 2013 results following its de-consolidation as of December 8, 2013 52 2013 (ex-Syneron Beauty) 2014 $0.50 $0.45 $0.40 $0.35 $0.30 $0.25 $0.20 $0.15 $0.10 $0.05 $0.00 Thank you!