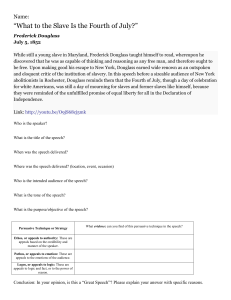

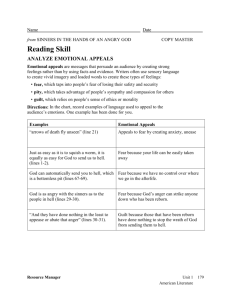

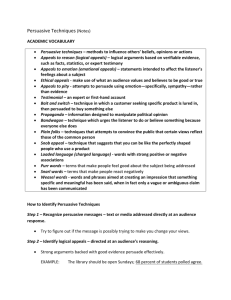

Section VIII “Appeals

advertisement