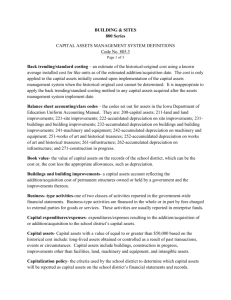

Chapter Five Accounting for General Capital Assets and Capital

advertisement