DownloadDownload - Descartes Systems Group

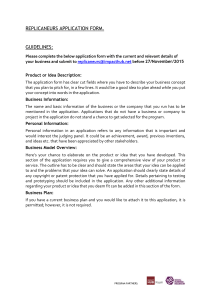

advertisement