Programme - (PDF - 1.1MB) - Faculty of Business and Economics

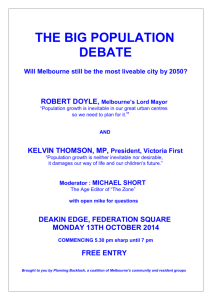

advertisement