Aggregate Supply and Aggregate Demand

advertisement

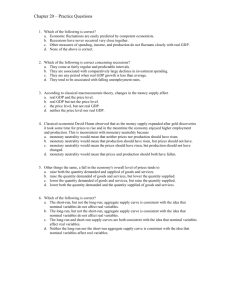

1.11 Aggregate Supply and Aggregate Demand ** This note is summarized by Hui Wang. Important reference Study Guides of Stalla Review for CFA Exams Learning Outcomes: The candidate should be able to: a. explain the factors that influence real GDP and long-run and short-run aggregate supply, explain movement along the long-run and short-run aggregate supply curves (LAS and SAS), and discuss the reasons for changes in potential GDP and aggregate supply; b. explain the components of and the factors that affect real GDP demand, describe the aggregate demand curve and why it slopes downward, and explain the factors that can change aggregate demand; c. differentiate between short-run and long-run macroeconomic equilibrium, and explain how economic growth, inflation, and changes in aggregate demand and supply influence the macroeconomic equilibrium; d. compare and contrast the classical, Keynesian, and monetarist schools of macroeconomics. Reference reading CFA Curriculum Volume 2 Reading 23 Macroeconomic long run In the macroeconomic long run, real wage rate is flexible enough for the labor market to achieve full employment: real GDP equals potential GDP, unemployment is at the natural rate, the price level is proportional to the quantity of money, and the inflation rate equals the money growth rate minus the real GDP growth rate. Macroeconomic short run In the macroeconomic short run, some money prices are sticky so that real GDP may be lower, equal to or higher than the potential GDP and the unemployment rate may be higher, equal to or lower than the natural unemployment rate. Aggregate supply Aggregate supply (AS) measures the quantity of goods and services produced within the economy at a given overall price level. It reflects the productive capacity of the economy and the costs of production in each sector. In the short run, producers respond to higher demand (thus prices) by bringing more inputs into the production process and increasing the utilization of their existing inputs. Therefore, the short-run aggregate supply curve is upward sloping, which represents the positive relationship between AS and the general price level. In the long run, the aggregate supply is determined by the productive resources available to meet demand and 1 / 11 by the productivity of factor inputs (labor, land and capital) and is independent of the price level (money is neutral) - thus the long run aggregate supply curve is vertical. Shifts in the AS curve can be caused by the following factors: (1) Changes in the quantity of the labor force. An increase in the quantity of labor force that is available for production will shift aggregate supply curve to the right. (2) Changes in the quantity of capital stock. An increase in the quantity of capital available for investment will shift aggregate curve to the right. (3) Technological progress and the impact of innovation. Advances in technology will shift aggregate supply curve to the right. (4) Changes in factor productivity of both labor and capital. The increase in productivity of either labor or capital will shift the aggregate supply curve to the right. (5) Changes in producer taxes and subsidies. The sectors being imposed heavy taxes will decrease supply while the sectors receiving subsidies will increase supply. Aggregate demand Aggregate demand is the total amount of final goods and services demanded in the economy at a given overall price level and in a given time period. It is represented by the aggregate-demand curve, which describes the relationship between price levels and the quantity of output that firms are willing to provide. Normally there is a negative relationship between aggregate demand and the price level. Aggregate demand is the demand for the gross domestic product (GDP) of a country, and can be calculated as: Y= C+ I+ G+ X-M Where Y is real GDP, C is consumption expenditure, I is investment, G is government expenditure, X is exports, M is imports. The main factors that affect aggregate demand include: (1) The price level. (2) Expectations (3) Fiscal policy and monetary policy (4) The world economy. Reasons for the negative slope of aggregate demand curve Wealth effect: a higher price level reduces the purchasing power of financial wealth. Assets such as stocks, bonds, cash, and checking account balances are worth less, which shrinks the amounts one person can buy. Thus, higher average prices reduce the amount of domestic production sold along an aggregate demand curve. The foreign-sector substitution effect: higher domestic prices cause domestic consumers to buy more imports and fewer domestic goods. Foreign consumers respond similarly, shrinking the country’s exports. 2 / 11 The interest rate effect: the amount of borrowing required to finance a major purchase rises if the price level rises. Thus, a higher price level increases the demand for loanable funds and, consequently, increases the interest rate, which is the cost of credit. This increase in interest rates reduces investment and such consumer purchases as new houses, cars, or appliances. Fiscal policy The term fiscal policy refers to the expenditure a government undertakes to provide goods and services and to the way in which the government finances these expenditures. There are two methods of financing: taxation and borrowing. Taxation takes many forms including taxation of personal and corporate income. The debt burden assumed by the government is itself an important policy variable and one that has implications for the conduct of monetary policy. Fiscal policy can be either expansionary or contractionary. A tax cut, an increase in transfer payments, or an increase in government spending is expansionary fiscal policy. A tax increase, a cut in transfer payments, or a decrease in government spending is a contractionary fiscal policy. Monetary policy The term monetary policy refers to the process by which the central bank (or other monetary authority) of a country controls 1) the money supply, 2) interest rate in order to attain a set of objectives oriented towards the growth and stability of the economy. Monetary policy can be either expansionary or contractionary. An expansionary monetary policy increase the total supply of money in the economy while a contractionary policy decreases the total supply of money in the economy. Disposable income Disposable income is the total amount of money that a household has available for spending and saving after income taxes (net of transfer payment) have been accounted for: DPI= Aggregate income-Personal Income taxes + Transfer payment Macroeconomic equilibrium Short-run macroeconomic equilibrium occurs when the quantity of real GDP demanded equals the quantity of real GDP supplied. Long-run macroeconomic equilibrium occurs when real GDP equals potential GDPequivalently, when the economy is on its long-run aggregate supply curve. Economic growth Economic growth is the increase in a country’s productive capacity, as measured by comparing gross domestic product (GDP) in the current year with the GDP in the 3 / 11 previous year. Increase in the quantity of labor, the accumulation of capital and advances in technology are considered to be the principal causes of economic growth. Nominal growth is defined as economic growth including inflation, while real growth is nominal growth minus inflation. If the increase in aggregate demand is greater than the increase in long-run aggregate supply constantly, the economy will experience inflation. If aggregate demand increases at the same pace as long-run aggregate supply, the economy will experience real GDP growth with no inflation. In the long run, the main influence on aggregate demand is the growth rate of money supply. If the money supply increase rapidly, aggregate demand increase quickly and the inflation rate is high. Business cycle The business cycle is the periodic but irregular up-and-down movements in economic activity, measured by fluctuations in real GDP and other macroeconomic variables. Output gap Output gap is an economic measure of the difference between the actual output of an economy and the output it could achieve when it is most efficient, or at full capacity. The measure compares the actual GDP of an economy and the potential GDP. Recessionary gap is a shortfall in the amount of aggregate demand in an economy needed to create full employment- that is, real GDP falls short of potential GDP and the economy is at below full-employment equilibrium. Inflationary gap is a gap that exists when an economy’s resources are utilized and aggregate demand is more than the full-employment level of output. Prices will rise to remove the excess demand and the economy is at above full-employment equilibrium. When real GDP equals potential GDP, there is no output gap and the economy is at fullemployment equilibrium. Stagflation Stagflation is an economic trend in which inflation and unemployment rise while general growth of the economy is slow. It can be difficult to correct stagflation, because focusing on one aspect of the problem can exacerbate other aspect. The classical view Classical economics believes that the economy is self-regulating and the government should not intervene to try to correct this as it would only make things worse and so the only way to encourage growth was to allow free trade and free markets. The main roles of government are therefore to ensure the free workings of markets using ‘supply-side policies’ and to ensure a balanced budget. The main theories used to justify this view are: (1) Free market theory. The classical economists assumed that if the economy was left to itself, then it would tend to fully employment equilibrium. 4 / 11 (2) Say’s law. According to this law, any increase in output of goods and services (supply) will lead to an increase in expenditure to buy those goods and services (demand), i.e. “Supply creates its own demand.” (3) Quantity theory of money. The classical economists’ view of inflation revolved around the Quantity Theory of Money, and this theory was in turn derived form the Fisher Equation of Exchange: MV = PY Where: M is the amount of money in circulation V is the velocity of circulation of that money P is the average price level Y is the real GDP. According to classical economists, the money wage rate that lies behind the short-run aggregate supply curve is instantly and completely flexible and will always adjust quickly to keep labor market in equilibrium and keep real GDP equals to potential GDP. The Keynesian view Keynesian economics is a theory of total spending in the economy and its effects on output and price level. Keynesian economists believe that aggregate demand is influenced by a host of economic decisions-both public and private- and erratically. According to Keynesian economists, changes in aggregate demand, whether anticipated or unanticipated, have their greatest short-run effect on real output and employment, not on prices. Keynesians believe that, because prices are somewhat rigid, fluctuations in any component of spending- consumption, investment, or government expenditures- cause output to fluctuate. Furthermore, Keynesians believe the rigidity of prices; especially wages causes periodic shortages and surpluses, especially of labor. Many Keynesians advocate stabilization policy to reduce the amplitude of the business cycle, which they rank among the most important of all economic problems. The monetarist view Monetarism is an economic theory which focuses on the macroeconomic effects of the supply of money and central banking. Formulated by Milton Friedman, it argues that excessive expansion of the money supply is inherently inflationary, and that monetary authorities should focus solely on maintaining price stability. Monetarists advocate a central bank policy aimed at keeping the supply and demand for money at equilibrium, as measured by growth in productivity and demand. Underlying the monetarist theory is the equation of exchange, which is expressed as MV=PQ. Here M is the supply of money, and V is the velocity of turnover of money (i.e., the number of times per year that the average dollar in the money supply is pent for goods and services), while P is the average price level at which each of the goods and services is sold, and Q represents the quantity of goods and services produced. The monetarists believe that, as the money supply increases with a constant and predictable V, one can expect an increase in either P or Q. an increase in Q means that P will remain relatively constant, while an increase in P will occur if there is no corresponding increase in the quantity of goods and services produced. 5 / 11 Exercise Problems: (provided by Stalla PassMaster for CFA Exams.) Q1. Q2. Q3. Q4. Q5. 6 / 11 Q6. Q7. Q8. Q9. 7 / 11 Q10. 8 / 11 EXPLANATION Q1. Q2. Q3. Q4. 9 / 11 Q5. Q6. Q7. Q8. Q9. 10 / 11 Q10. 11 / 11