time_line_of_blue_shield_of_ca_problems.doc

advertisement

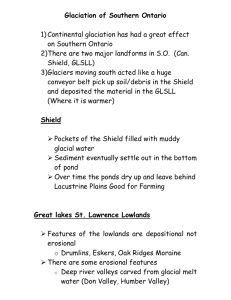

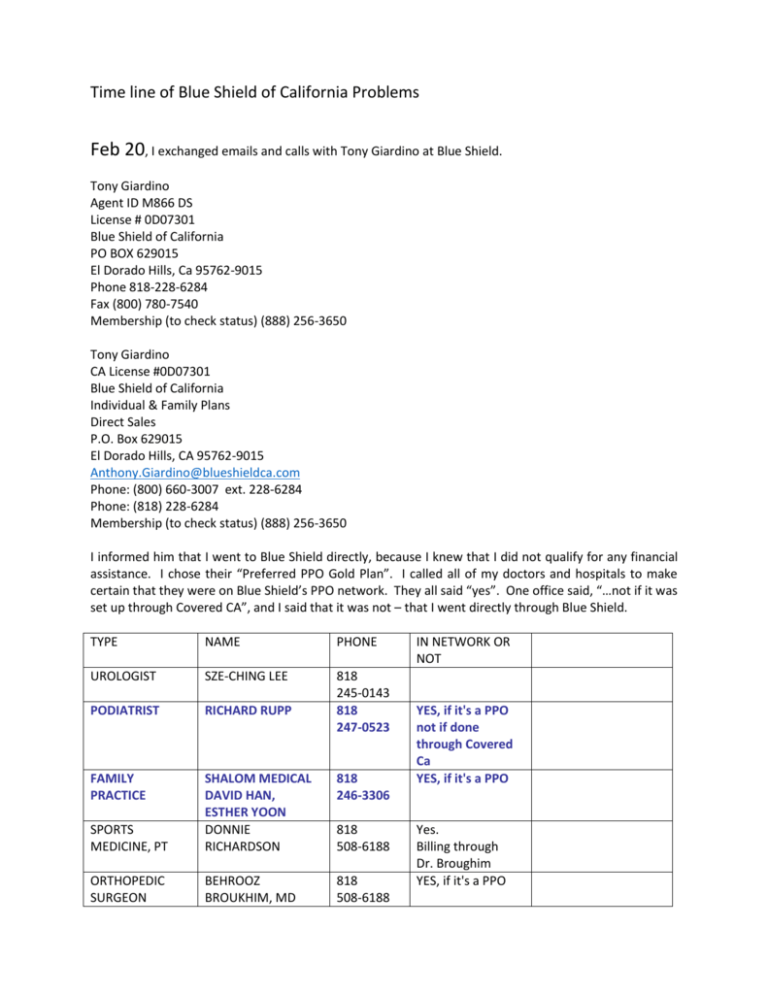

Time line of Blue Shield of California Problems Feb 20, I exchanged emails and calls with Tony Giardino at Blue Shield. Tony Giardino Agent ID M866 DS License # 0D07301 Blue Shield of California PO BOX 629015 El Dorado Hills, Ca 95762-9015 Phone 818-228-6284 Fax (800) 780-7540 Membership (to check status) (888) 256-3650 Tony Giardino CA License #0D07301 Blue Shield of California Individual & Family Plans Direct Sales P.O. Box 629015 El Dorado Hills, CA 95762-9015 Anthony.Giardino@blueshieldca.com Phone: (800) 660-3007 ext. 228-6284 Phone: (818) 228-6284 Membership (to check status) (888) 256-3650 I informed him that I went to Blue Shield directly, because I knew that I did not qualify for any financial assistance. I chose their “Preferred PPO Gold Plan”. I called all of my doctors and hospitals to make certain that they were on Blue Shield’s PPO network. They all said “yes”. One office said, “…not if it was set up through Covered CA”, and I said that it was not – that I went directly through Blue Shield. TYPE NAME PHONE UROLOGIST SZE-CHING LEE PODIATRIST RICHARD RUPP 818 245-0143 818 247-0523 FAMILY PRACTICE 818 246-3306 SPORTS MEDICINE, PT SHALOM MEDICAL DAVID HAN, ESTHER YOON DONNIE RICHARDSON ORTHOPEDIC SURGEON BEHROOZ BROUKHIM, MD 818 508-6188 818 508-6188 IN NETWORK OR NOT YES, if it's a PPO not if done through Covered Ca YES, if it's a PPO Yes. Billing through Dr. Broughim YES, if it's a PPO CARDIOLOGIST AUGUSTO SILVA HOSPITAL PROV. ST JOSEPH MED CTR tax id # 95-1675600 PROV. ST JOSEPH HEALTH CTR HEALTH CTR 818 846-2546 818 843-5111 YES, if it's a PPO YES, if it's a PPO 501 S. Buena Vista St. Burbank, CA 91505 818 953-4451 Same as Med Ctr ? 3413 W. Pacific Ave Burbank, CA 91505 201 S. Buena Vista Street, Suite 125 Burbank, CA 91505 18411 Clark St, Suite 107 Tarzana, CA 91356 1150 Indian Hills Rd, Suite 230 Mission Hills, CA 91345 DIAGNOSTC CTR PRO. ST. JOSEPH DIAGNOSTC CTR 818 848-4988 Same as Med Ctr ? HOSPITAL PROV. TARZANA MED CTR 818 776-9526 YES, if it's a PPO HOSPITAL PROV. HOLY CROSS MED CTR 818 838-9558 YES, if it's a PPO 818 981-7111 818 409-8000 310 825-9111 818 907-7546 818 238-2350 Did not call HOSPITAL SHERMAN OAKS HOSPITAL HOSPITAL GLENDALE ADVENTIST HOSPITAL UCLA, RONALD REAGAN DERMATOLOGIST MID-VALLEY DERMATOLOGY DERMATOLOGIST RACHEL D. BAK Dermatologist YES, if it's a PPO YES, if it's a PPO YES, if it's a PPO YES, if it's a PPO I signed up for the “Preferred PPO Gold Plan” at a monthly premium of $789.44, effective April 1, 2014. May 12 I arrived for an appointment with my Podiatrist to follow up on a surgery he had done on me two years prior, and I was informed that he was not accepting Covered CA patients. I strongly stated that I was NOT in a Covered CA plan – that mine was a Blue Shield Preferred PPO Gold Plan. They said that the prefix on my Blue Shield member number (XEK) and group number X0001000 defined me as Covered CA. SO MUCH FOR CONTINUITY OF CARE ! I called Blue Shield Customer Service, and someone there sent me a letter stating that I was a Blue Shield PPO Plan and NOT Covered CA. I had just lost one provider. What would be next ? May 12 I emailed Blue Shield sales rep : Tony, I just found out today that I was placed in the wrong plan. I went to the Blue Shield website directly -not Covered California -- with the express purpose of signing up for the PPO Gold Plan as shown on the Blue Shield website. Before I signed up I called all of my doctors and hospitals to make sure that they were contracted under the Blue Shield PPO plan. They all said "Yes", but more than a couple of my doctors said that they were contracted on the PPO plan but not if that PPO was set up through Covered California. At no time did you mention the phrase "Covered California", which would have sent up a big red flag, Today I was told by a Blue Shield Customer Service rep that the three letters at the head of my member number (XEK900940389) indicate a Blue Shield plan that is NOT Covered California. She further said that the prefix XED is used for all Covered CA plans. But today THREE offices told me that she is wrong -that I have a Covered CA plan, and two of them are not contracted for it. It's still called a PPO, but it's apparently an EPO in disguise. I now have no idea what doctors or hospitals are contracted under my plan. I am getting opposite stories, and I need to know ASAP what is going on in order to obtain covered medical care under a REAL PPO plan. If you need to escalate this matter, please do so immediately. Thanks, Richard Morrone (818) 522-1143 M-F 8:00-5:00 May 13 from Tony Hello, The plan you applied for is a direct plan with Blue Shield PPO, keep in mind it uses the same network as if you purchased a plan through Covered California. The network is the same if you buy direct or go through Covered California. It is true that there are 2 different codes that are used referring to XEK or XED, but both have the same network of Dr’s, the difference is that if you go through Covered California you most likely are getting premium assistance and that is the reason people are applying through Covered California. The Doctors and hospitals you called may have said they contracted with Blue Shield , but what they did not specifically say that is was not for individual plans but group plans with Blue Shield of California, so that is what you are probably running into. If you want to check to see if your physician or hospital is contacted for the individual plans you can go to www.blueshieldca.com and click explore and click health plans and click find a provider and click select a plan and set it to the 2014 Individual and family plans for PPO. Then select the sub plan like the Preferred gold plan, then you can look under Doctors and hit advanced search and type in the Dr’s name or look under hospital and do a zip code search if you want to see the hospitals that contract in your area. Hope that helps you understand! May 13 I emailed the sales rep. Tony, You and I established at the start that I didn't qualify for government assistance, so Covered CA was not a consideration. What Blue Shield PPO Gold plan is there that is NOT using the same network as Covered CA and that my doctors ARE servicing? They are certainly contracting with Blue Shield as some sort of in-network PPO provider. As to your search engine, I have already been there, and it returns doctors that are well out of my specified zip code and gives me all sorts of different types of doctors. I put GP's and get Chiropractors. May 13 Letter from Blue Shield Customer Service in response to inquiry number 141330001696 stated that, “Our records indicate that you are currently enrolled in IFP OFF EXCHANGE PREFERRED PPO alpha prefix XEK which is not a Covered California”. May 17 – a weekend. I experienced shortness of breath and some chest discomfort. May 19 I went to my cardiologist, Dr. Augusto Silva, for what had been scheduled as a routine visit, and he told me that I was sitting on a time bomb for a stroke! My heart was in atrial fibrillation on top of my mitral valve prolapse problem. He ordered blood tests across the street at Providence St. Joseph Medical Center and put me on a blood thinner and a drug to slow down my heart and lower my blood pressure. He scheduled me for a transesophageal echocardiogram and a cardioversion for Friday May 23 once he was sure of the clotting levels with a Thursday protime blood test. I went to Admitting (818) 847-3404) at Providence Saint Joseph Med. Ctr. I warned them about the problems that I was discovering with my insurance network and said that I wanted to be sure that the hospital was truly in my Blue Shield network. Adrienne (or Adriane) assured me that Financial would confirm network coverage and let me know before the Friday May 23 procedures if there was a problem. That call never came, so I figured I was in the clear. After all, St. Joseph had told me in mid February that they were in-network, and I had also saved the following May 13 search results from Blue Shield confirming that St. Joseph was in-network : HOSPITALS (Information updated on 05/13/2014) Los Angeles Providence St Joseph Med Ctr 501 S Buena Vista St Burbank, CA 91505 (818) 843-5111 Distance: 3.87 miles Inpatient: $$$ Outpatient: $$$ Mission Community Hospital 14850 Roscoe Blvd Panorama City, CA 91402 (818) 787-2222 Distance: 5.72 miles Valley Presbyterian Hospital 15107 Vanowen St Van Nuys, CA 91405 (818) 782-6600 Distance: 4.57 miles Inpatient: $ Outpatient: $ I had blood work done, including protime for checking my clotting factor. I had another protime on the 22nd, the day before the procedures. May 22 Two calls came to the home from (818) 843-5111, at 11:45 AM and 5:37 PM. Someone named Pauline called for medical prescreening. She called my home during the workday and not my cell phone, which I had provided to Admitting. A number was left – (818) 847-3510, option 2 to speak to Pauline. I got home after 6:00, and could not reach her. A Sonya in Financial has notes stating that she called the home at 5:41, but she left no actual message, no word of financial problems – just her name and number. Her 5:41 call might be the second call (which came to my home at 5:37), because no other St. Joseph number was recorded on my incoming call record on the evening of May 22. May 23 The two procedures were done. Something that was said that day caused me to make further inquiries on May 27 about in-network status. May 27 I called Blue Shield customer service and was told that St. Joseph was not contracting with Covered CA plans, and that meant ME. I also reported the emergency procedures performed on May 23 (there was a 3-day weekend that had intervened). I got customer service to initiate an appeal (ref. number 141470011703) to get me into a better network than the Covered CA so that I would not lose my doctors and hospitals. Blue Shield promised a 30-day response period; I received a letter to that effect, signed by Wilver O. I emailed the Blue Shield sales rep : Anthony, What do you and I have to do to get me onto the network that I thought I thought I was signing up for when I first came to you. A higher premium... what ? The fact that Blue Shield moved me into a Covered CA network without telling me that this would happen constitutes a "bait-and-switch", and I just got clobbered with the news that a procedure I had done last Friday at my local hospital, which is not handling this Covered CA network, is going to cost me a huge amount. I want a solution ASAP, before anything else happens in my life and health. This is, I assume, above your pay grade to address, but please call me about how Blue Shield and I can solve this mess. Thanks, Richard Morrone (818) 522-1143 M-F 8:00-5:00 day Home after 6:30 PM (818) 761-8156 [Tony called me back and said that all individuals and families are automatically placed in the Covered CA network. Only group plans avoid this at this time. I responded that if that had been stated when I was applying that he and I would not be talking,, because I never would have signed up with Blue Shield under such a condition.] May 28 I had to call my cardiologist and tell them to cancel the angiogram scheduled for May 30. I had to get a handle on this insurance situation. I was scared to run up a bunch of huge bills, and the cardioversion had me reasonably stabilized for the time being. My cardiologist was, nevertheless, very concerned about his ability to adequately care for me. I could go back into A-fib at any time. May 29 I found a 3:13 PM message (once again on my home phone) from Cecilia in Financial at Saint Joseph at (818) 847-3418. However, she did leave a message that St. Joseph was not contracted with Covered CA and that I would be responsible for a very large bill, because Blue Shield would pay only $500 of a roughly $5,500 bill for a heart angiogram. THAT WAS THE SORT OF CALL THAT I SHOULD HAVE RECEIVED ON MAY 22 BEFORE THE TWO PROCEDURES WERE DONE ON THE 23rd. The reason that Cecilia had called was that the system showed that the angiogram was still scheduled. May 30 I spoke to Cecilia and thanked her for the message about the insurance problem (even if it was left on my home phone during the work day). She strongly suggested that I call Blue Shield again and push for an immediate answer on the appeal. I called Blue Shield and asked Customer Service to find me a cardiologist on the network with privileges at either Valley Presbyterian or Glendale Adventist. Nicky also gave me the number of Wilver O. who was working on the appeal (818) 228-2697. Voicemail stated that his FAX is (916) 350-6683. Nicky promised to (but did not) get back to me with the name of a cardiologist in the network with privileges at Valley Presbyterian. Someone at Blue Shield called my home from (916) 910-0768 at 6:01 PM but did not leave a message. I got a protime blood test at Glendale Adventist Lab at 1560 Chevy Chase Dr. in Glendale. May 31 I was home to receive another call from (916) 910-0768. It turned out to be a Blue Shield customer satisfaction survey. I gave my opinion in no uncertain terms. Someone at Blue Shield sent an email at 7:40 AM which stated : The key to accessing health care is finding the right doctor for you. If you need to find a primary care doctor for your general medical needs, or even a specialist, we have a great online resource to help you locate doctors in your area and network. Just follow these four simple steps: 1. Register and log in as a member at blueshieldca.com. 2. Click the Find a Provider button on the top of the page. 3. Select the Advanced Search link under "Doctors." 4. Fill in the search fields and select Find Now. And if you have a medical concern and aren't sure what to do, you can call NurseHelp 24/7SM, at (877) 304-0504, for immediate health advice from a registered nurse at any time.” You might ask why I wasn’t already using the search engine. The fact was that I was, even before I signed up. The results were unreliable. A search for a cardiologist within a 5-mile radius returned a total of six. A different search with a radius of 5 miles returned results as far away as 15 miles. On another occasion I did a search for hospitals close by, and it showed Providence Saint Joseph in the results. I saved that PDF file. St. Joseph, of course, is telling me that they are not in the network. The Blue Shield Search says one thing while St. Joseph and Blue Shield Customer Service say another. Please note below the misleading search criteria. My logon produces a plan selection of “Preferred PPO”. Looks correct – right? Wrong. I had to call Customer Service several times to find someone who knew that the correct name for my plan is not what the Search engine shows me when I log on, despite its showing my name and address. It should default to plan my name. Instead I must repeatedly use the dropdown and change the plan selection to “2014 Individual and Family PPO Plans (including Covered California)” (the plan that they secretly put me into) to do a search for providers. How is a person supposed to navigate such treacherous waters ? June 2 I spoke to “Claims”, and we submitted a “Continuity of Care” petition (Ref. # 141530015819). She asked me many questions and took down the names of Providence St. Joseph Med Ctr and Dr. Silva – the goal being to get them placed in my Blue Shield network for the management of my condition. About three hours later at 7:04 PM Wilver O. called to tell me that he had received the “Continuity of Care” petition. After he listened to my whole, long story he said he would be processing the petition quickly. He told me about the confusion out there with doctors’ offices and hospitals not understanding that they also needed to contract for the PPO that I am currently in – that they should not just assume that handling the previous PPO’s meant that they would automatically be contracted for the new ones. We agreed that there were two things in the works. One was the “Continuity of Care” petition. He said that an answer could come within 5-7 business days. The other was the appeal initiated on May 27 to somehow get me into a better network (like I thought I was signing up for in February) – one where I did not lose all of my providers. He estimated a 30-day response time on that one. He said that there were other plans available that would have given me access to a wider/better network. I was shocked at hearing this and asked why that was the first time I was hearing about it. I noticed that he was a bit quiet when I said that I had received a letter from Customer Service stating that I was a Blue Shield IFP Off Exchange Preferred PPO and “NOT covered CA”. June 3 I spoke with my cardiologist Dr. Silva about all of the delays in my care. He was surprised to learn that he was not in my PPO network after his staff had assured me that he was. He was worried about getting me an angiogram in a timely manner, and especially before his leaving town for three weeks starting June 10. With Dr. Silva out of town on vacation, and with an associate who is not in the network, he had no way of monitoring my protime lab results to stay on top of my blood clotting factor and Coumadin dosage. I gave Dr. Silva Wilver’s name and number so that he could make a stronger case for a quick resolution to this matter. Dr. Silva could only leave a message on Wilver’s voicemail. That’s as far as that went. Wilver did not return the call. After lunch I got a call from Chris at Dr. Heather Shenkman’s office [(818) 848-0023]. She and Dr. Silva had spoken, and it was agreed that she would cover for Dr. Silva and do my angiogram on June 12 at Valley Presbyterian Hospital. The plan was that whatever amount Blue Shield would pay, I was to simply hand the check over to Lakeside Community Healthcare, and that Lakeside would accept that as payment in full and not send it out for collection of the balance. June 4 I tried to search the Blue Shield website for doctors and hospitals and gave up. I spoke to Customer Service who ran searches for me and emailed the results as PDF’s. On the list was Keck Hospital of USC. I tried to get through to Cardiothoracic Department, but I was disconnected twice. June 5 I called Keck’s Cardiothoracic Department again at 8:15 AM and spoke to Ashley. She took my info, and I emailed her a photo of my insurance card. She called back within the hour and said that Keck was contracted to cover me for clinical (with a $50 copay) as well as surgical at 80% with maximum annual out-of-pocket of $6,350. [ Note, maximum out-of-network annual out-of pocket limit = $9,350 ] June 6 I got a protime blood test at Quest Labs on Riverside Dr. in North Hollywood in the hope that my cardiologist could read it before leaving on vacation on Tuesday June 10. He did. June 8 Filled out CA Dept. of Managed Healthcare complaint form regarding Blue Shield’s business practices. (800) 400-0815 M-F 8:00 AM – 6:00 PM Help Line: (888) 466-2219 www.dmhc.ca.gov. June 9 I called Blue Shield and got a recording that announced that my plan’s total combined maximum annual out-of-pocket limit for allowed services is $9,350. This means that the annual out-ofpocket limits “cross apply” for in-network and out-of-network services. This means that in-network expenses count toward the out-of-network limits, and vice versa.” So my total combined annual outof-pocket limit for allowed services is $9,350. June 11 I mailed the Fraud Complaint to the Department of Managed Health Care in Sacramento from the Studio City Post Office (certified/signed receipt). I called Blue Shield Customer Service and was told that Providence St. Joseph Med. Ctr. was IN my network. I explained that I had pieced together that my Preferred PPO (Gold) plan is an IFP (Individual and Family Plan), off-exchange plan and not in a Covered CA plan but that it is in a “mirrored” Covered CA network of providers. I was switched to Claims Department. The Claims Department said that Providence St. Joseph Med. Ctr. was NOT in my network. They said that they would mail me a letter that thoroughly explains what is going on with my plan and network. That letter never came. Claims told me that the procedures on May 23 were billed as mere outpatient procedures and not “emergency”. I explained that if I had walked into the ER when this A-fib started and they had shocked my heart, I could easily have had a stroke. My emergency treatment had to come in two stages. First I had to go on a blood thinner for 3 days and then get the emergency cardioversion shock procedure. That did not make it any less of an emergency procedure. Claims told me to have the providers resubmit the claims with emergency coding. I called St. Joseph Med. Ctr. They said that the doctors’ dictations are interpreted by transcribers as emergency or not, and that claims are submitted accordingly. With Dr. Silva on vacation from June 10 to June 23 that delayed the process of correcting the dictation. June 12 I had my cardiac angiogram done by Dr. Heather Shenkman at Valley Presbyterian Hospital. A protime test was done just prior. All went well, and Dr. Shenkman said she would send my records, the transesophageal echocardiogram and cardiac angiogram to Keck Hospital for my consultation. June 13 I called Wilver O. and left a message asking for an answer to the Continuity of Care request. He had estimated a quick answer by June 2nd (5-7 business days). Wilver did not return the call. June 16 I called Dr. Shenkman’s office to make sure that my records were sent to Keck. They had not when I called near the end of the day. June 17 I mailed the complaint form for Covered CA from the Studio City Post Office To : STATE OF CALIFORNIA DEPARTMENT OF INSURANCE CONSUMER SERVICES AND MARKET CONDUCT BRANCH CONSUMER SERVICES DIVISION 300 SOUTH SPRING STREET, SOUTH TOWER LOS ANGELES, CA 90013 I also went online and found the USPS record of the delivery of the complaint I had sent to the CA Department of Managed Health Care on June 11. It was delivered on June 13. Chris at Dr. Shenkman’s office was dragging his feet about sending my records to Keck. By Tuesday afternoon June 17 Chris still had not done anything about my material. I emailed Keck, and Ashley replied with instructions. I called Chris and said that I would forward the email to him, which I did. June 18 I called Chris again to insist that he at least get the CD’s mailed out. He told me that I would have to obtain the two CD’s from the respective hospitals. He would FAX my chart records. I already had a CD copy of my angiogram from Valley Presbyterian, which they had made on the day of the procedure. I called Saint Joseph Medical Records and arranged to pick up a copy of the echocardiogram. June 19 I picked up the CD of the echocardiogram at St Joseph Med. Ctr. I sent it and the cardiac angiogram CD to Ashley Valentino at Keck/USC Cardio Thoracic Institute via USPS Priority Mail. I got a protime blood test at Quest Clinical Labs. Dr. Shenkman received the results. June 20 Julisa called for Dr. Shenkman to have me modify my daily 5mg dose of warfarin (blood thinner) to 7.5 mg and to get another protime test on June 26. The USPS tracking website showed that the two CD’s were delivered to Keck on Friday June 20. June 23 I called Keck to see if they had received the material. Ashley had the FAX’s of my records. She told me that a “Sherry” would be calling me sometime around 5:00-6:00 PM to discuss matters with me. Sherry never called. I searched Blue Shield for Urgent Care facilities, pulmonary specialists and imaging facilities. On May 12 my GP Dr. Yoon had ordered a CT with contrast to explore a 9-month-old persistent cough and lung pain when inhaling – possible next step, a pulmonary specialist. I had to find a different imaging facility, because the one she chose was not in-network. Blue Shield Customer Service confirmed the in-network status of San Fernando Valley Interventional Radiology and Imaging at 16311 Ventura Blvd. # 120, Encino CA 91436 (tax ID 562631760) for my CT scan. Dr. Yoon’s call to them ordering the CT is what Blue Shield calls prior authorization, but the person at Customer Service also gave me a number to call for prior authorizations (888) 642-2583. I got the CT that afternoon. I also asked Blue Shield Customer Service for the status of my two appeals : As to the May 27 appeal 141470011703, she found that it had been turned over to someone named Rosie V. at 818 228-6199. As to the June 2 appeal 141530015819, she called medical management to check the status. She reported that one provider was slow in getting back to them with additional material, but once the material was complete an answer would come in 5-7 business days. Why didn’t Wilver O. tell me that in my two requests for an update? Three providers had been contacted – Dr. Yoon, Dr. Silva and Saint Joseph Med Ctr. I did not know which was slow in returning the additional material. June 25 I called Rosie V. at Blue Shield Grievance for a response to my May 27 appeal. I had to leave a voicemail. When she returned the call at lunchtime my cell was getting poor reception, and I could not answer in time. I recognized the number and immediately called back. I got the voicemail again and left a message. I don’t know when she called back, but when I got home I noticed a message on my cell. She said that she had mailed the appeal response on June 21 (that was a Saturday). I called back and left another voicemail and said that I had been to my P.O. box June 25, and there was no response to the appeal. I further said that I hoped that she had used my mailing address (the P.O. box) and NOT my home address. I emailed Ashley at Keck asking for faster action on my case, since Sherry had not called me on Monday evening or Tuesday evening as I was told by Ashley that she would. I wrote that I was getting more short of breath and that I was getting weaker by the day. She emailed me back to apologize and wrote that she would cc my email to Sherry. Sherry called me at 4:15 PM and said it was useless to leave a message on her voicemail and that she would have to call me. She said that the surgeon Dr. Starnes was on vacation until July 16. I said I was willing to go with Dr. Baker instead. She said that we had only the next day (June 26) to gather any remaining records, because she was leaving on vacation on Friday June 27 and that she would call me at home that evening June 25 to work me up and let me know what additional she might need. For the third time, she did not call. For the third time I spent my evening glued to the phone and waiting. June 26 I emailed Ashley at Keck again and asked for her help once again. I wanted to talk to anyone who might be covering for Sherry during her absence. At 7:00 PM I got a call from Sherry. She had someone named Alexis Brazda on 3-way. Alexis was to call me back in a few minutes for the work-up. She called back at 8:00 PM. We planned the next day’s possible gathering of needed reports and tests. I got a protime blood test at Quest Diagnostics in West Hills. At 1:30 PM I received a callback from Rosie V. at Blue Shield. She said that she did use my P.O. box to mail the response to the May 27 appeal and confirmed that it was mailed on Saturday June 21. I said that it had not arrived as of Wednesday June 25. We talked at length and when I mentioned the Blue Shield provider search producing a PDF showing Providence Saint Joseph as in-network, she said that this had not been brought to her attention and that she would generate a new appeal to assign innetwork status to Saint Joseph for the tests and procedures done at Saint Joseph on May 19, 22, and 23. She gave me her email address, and I sent her the PDF at 3:16 PM and included some of my story as well. June 27 I called Alexis for the final pickup list and had to leave a message twice. I called again, and she said that Bob was not in that day, and she needed to ask someone else. She needed a signed form for Authorization & Consent, Disclosure & Transfer of Medical Records. She said she would send a blank to me right away. I waited around the house until 2:30. She still had not sent the form. I called to get upset with her and Keck. After all, she had said that she would get answers for the pickup list and that I would be on the road gathering the items on the pickup list. With Bob’s absence she was going to ask someone else, and she still had not done so. I told her I had just sent her a signed form, having found it in the “New Patient” packet. She called back at 3:22 having arranged for FAX;s of remaining reports and for my picking up a CD of the CT at SFV Interventional Radiology and Imaging on Monday PM. She confirmed my 7:30 appointment with Dr. Craig Baker on Tuesday AM July 1st. Alexis confirmed that the entire service would be in-network, according to Blue Shield. I spoke to Cindy at Lakeside, and she gave me results of the protime. The INR was 2.8, and the new dosage for warfarin was 7.5mg on Mon-Wed-Fri and alternating 5mg on Tu-Th-Sat-Sun. She told me to get another protime in two weeks (July 11) June 28 I checked the P.O. box. Mailed June 23, the Department of Insurance informed me that they were turning my complaint over to the Department of Managed Health Care. As to the June 21st mailing from Rosie V. at Blue Shield, it read that my appeal for a better network had been turned down – that I would have to wait until open enrollment to make any changes. It was a boilerplate response and addressed nothing of the misrepresentation on the part of Blue Shield and its sales representative prior to my signing. Neither my Application nor the Uniform Health Plan Benefits and Coverage Matrix (sent to me after signing) mention anything about Covered CA networks being applied to my Preferred PPO plan. If Blue Shield thinks this is a miniscule point, then it is out of touch with its customers – potential or otherwise. Once again, if I had been informed that I would be in such a network, I would surely have signed up with Kaiser Permanente instead. June 29 I had a bad night – woke up many times with panic breathing from having stopped breathing in my sleep or in twilight stages (in a sitting position). I can’t keep this up. The last 6 weeks have been really tough, but it’s getting worse, and I am afraid of this “trying” to sleep. I will ask if I can stop the metoprolol. After all, this was the stuff that Dr. Silva was worried could cause me to just plain die in my sleep. This was based on the holter monitor readout from 4 years ago, showing how slow my heart rate went and how low my BP went in my sleep. I know what my sleep apnea feels like, and this is different. June 30 I called Lakeside to have Julisa to ask Dr. Silva (now back from vacation) to please redictate his notes for my May 19–23 procedures so that transcription would apply the needed emergency codes. She gave me an email address to send the request to him, myself. I sent it that day. I went to Saint Joseph to talk to Financial, but the person there recommended that I drive to the Regional Business Office in Torrance and hand the paperwork to a supervisor. I called the Business Office (800) 750-7703 and was transferred to someone’s voicemail. I could not make out the name. I called back and asked again. I was transferred to Vanessa Cota’s voicemail, on which I left my name account and phone numbers. July 1 Vanessa Cota called back form Saint Joseph Regional Business Office and gave me a FAX number to send her my material. She said that Saint Joseph was in the midst of meetings to determine how to handle the many errors and misinformation given by Saint Joseph and insurance carriers. I basically said that everyone would have to wait for things to settle out before I would be sending any money – that I was hoping for 3 or so possible approaches to a correction. I had my consultation with Dr. Craig Baker at Keck. He said he was comfortable with an arthroscopic approach as well as attempting a repair of my mitral valve. NOTE : It’s probably best at this point to build a separate timeline for Keck… July 2 In my P.O. box I found another bill – this one from an anesthesiologist for the cardioversion at Saint Joseph. I also found a letter from Rosie V. stating that the June 26 appeal was in the works and that I could expect another 30-day response time. July 3 I FAX’d the anesthesiologist statement to Vanessa Cota and separately emailed it to Rosie V. at Blue Shield. At 4:49 PM I received a call from (916) 403-6909. A “Janice” at the California Department of Managed Health Care identified herself as an R.N. whose job it was to check on the medical status of people filing complaints against insurance companies to determine if they needed urgent medical intervention. I told her that I was reasonably stabilized though still at risk of stroke while awaiting surgery. She asked for me to put in a nutshell what I want, and I stated that I wanted the following : 1. For Blue Shield to get me into a network commensurate with my nearly $800 monthly premium, 2. For Blue Shield to cover all medical expenses incurred in the month of May 2014, including the cardiac angiogram performed on June 12 at Valley Presbyterian. 3. For Blue Shield to be forced to stop their fraudulent practices and therefore inform prospective members of the type, quality and extent of the provider network so that prospective members can make informed decisions. Joyce told me that she would file the formal complaint against both Blue Shield and Covered CA right then, before she left work for the day. She gave me the case # 741110 and the Help Line number (888) 466-2219 with a hint to ask, “Who owns my case today?”. July 5 I emailed Blue Shield asking for clarification on the bill/claim for the Valley Presbyterian cardiac angiogram, Acct # V01008567032. On the date of service the provider ran my Visa card for an estimate of $815.68. Blue Shield wrote a check # 11616998 to the provider for $738.00 on 6-27-2014. My question was did this mean that the provider should not submit the $815.68 charge to Visa. DID I GET A RESPONSE ? NO ! I left messages at two numbers at Valley Presbyterian about a second payment, and I asked for a credit on my Visa card for $815.68. They got back to me and said that it had not yet arrived. Summary : This complaint is presented regardless of any possible future remedy by Blue Shield. I am the victim of a bait-and-switch on the part of Blue Shield. Blue Shield knew full well what they were doing, and without any discussion they took my so-called Preferred PPO Gold Plan with its $789.44 monthly premium and placed me in a very scaled-down Covered California-type network for people paying much less. I had gone to them directly (not to Covered CA) to buy a better plan for myself and later discovered that I never had any chance of purchasing such a plan for myself at the time of sign-up. Later I found that it wouldn't have mattered if I had bought a bronze, silver, gold or platinum plan – the provider network would have been the same. The only difference would have been in the various combinations of premiums, co-pays and co-insurance features. Then, on June 2nd, I was told by Wilver O. (in the Blue Shield Grievance and Appeals Department) that wider/better networks were actually available. Why was I not presented with this information when I signed up? Blue Shield misled me from the start. I told them that I was not interested in Covered CA. The form for the application showed no description of a Covered CA plan. Blue Shield showed me a name and description of their Preferred PPO Gold Plan, and I went to my medical providers for confirmation that they were in-network. They ALL told me that they were, including Providence Saint Joseph Med Ctr. On May 12 I showed up for an appointment with my podiatrist to follow up on a surgery from two years ago and to discuss a possible reoccurrence of the problem. I was informed that he was not contracted with my Blue Shield network. I started making calls to Blue Shield Customer Service to have them confirm that I was not a Covered CA plan – that I was a straight Blue Shield PPO (Gold) plan. They sent a letter that stated that my plan was not Covered CA. In other calls I was told that all individuals and families were automatically placed in a “mirrored, off-exchange” Covered CA network. If I had been informed of that at the time, I would never have signed up with Blue Shield. On May 17, I went into atrial fibrillation after one of my “heartstrings” ruptured. The tendinous chords connect the papillary muscles to the tricuspid valve and the mitral valve in the heart. That was in addition to my existing mitral valve prolapse. I saw my cardiologist, Dr. Augusto Silva on Monday May 19. My acute episode had to be delicately stage-managed with 3 days on blood thinner BEFORE performing a cardioversion on May 23 to return me to normal sinus rhythm. A trans-esophageal echocardiogram was also performed. That’s how they found the ruptured heartstring. The fact that this treatment took place over a span of 4 days did not make it any less of an emergency. Before those hospital procedures, I warned Admitting at Providence Saint Joseph Med. Ctr. on May 19 that I was having problems with my insurance network, and they assured me that Financial would confirm my in-network coverage before the procedure and notify me if there were any problems. They did not, and it ran up a hefty bill. If I had been properly warned of a problem at that hospital I would have cancelled the procedures and made arrangements at another facility that was in network. I was compelled to cancel a May 30 angiogram because of these insurance problems. I finally got my angiogram on June 12 at a network hospital. That’s 13 days after the initial/cancelled appointment. That’s 3½ weeks after my visit with the cardiologist, when he told me that I was “sitting on a time bomb for a stroke”. It came as a surprise to my cardiologist when I informed him that he was not in the network either. Be it at Blue Shield or the doctor’s offices or hospitals – at each of these one person says one thing, and another person says something else. I have used the search engine on the Blue Shield website, but it failed to base its searches on the specific plan that they placed me in. So I must use a dropdown and choose a different plan name than the default name each time I log on. That is why I have a printout that shows Providence St. Joseph Medical Center in-network. Now Saint Joseph does not show up as innetwork. WHY on earth would the search engine identify me so fully and yet skip over this vital piece of information when I log on to do a search? I did my due diligence BEFORE signing with Blue Shield, and I have done so since. It’s Blue Shield that did not. It’s Saint Joseph Medical Center that did not (at least regarding their failure to alert me prior to the May 23 procedures). When I discovered the problem on May 12, I pushed for clarification from Blue Shield as well as from the providers. The assurances I received proved to be anything but reassuring – or consistent for that matter. Even on June 11, customer service said that Providence Saint Joseph Med. Ctr. was IN-network. When I was transferred to Claims, Claims said just the opposite. If Providence Saint Joseph were to take the position that I, alone, am responsible for confirming network status, my response would be that I did so (to the extent possible as a Blue Shield customer). I put it that way, because it does not matter what I confirm – the real confirmation is done between the provider and Blue Shield. THAT is why I warned Saint Joseph about the inconsistent answers coming from Blue Shield. THAT is why Admitting assured me that Financial would confirm any network problems before performing the emergency procedures on May 23 and call me if there were any. Whereas I was able to climb 10 flights of stairs the previous week, I was no longer able to do so, even after the cardioversion. Even talking or walking through the house was leaving me short of breath. I was in need of surgery. I was also at risk of slipping back into A-fib at any time and possibly throwing a clot to my brain. I was on a blood thinner and a drug to lower my heart rate and blood pressure to my usual, historical levels of 115/75 at 65 bpm while I waited for answers from Blue Shield about my petition for “Continuity of Care”, which I applied for on June 2 so that I could deal with my condition promptly. I was told I could expect a decision by June 11 (5-7 business days). That did not happen. My appeal to get me into a better network (so as not to lose my providers) was filed on May 27, and there was no response to that either, as of a June 25 check of P.O. box. While I was under this Sword of Damacles I had to look for a new, unknown cardiologist, a cardiothoracic surgeon, imaging technicians and a hospital that were ALL in-network. Only then could I undergo surgery to repair my mitral valve and ruptured heartstring. I found such a combination at Keck Hospital of USC in downtown Los Angeles. I got an angiogram Thursday June 12. Tests and records were sent to Keck. I had to wait for an consultation in the Cardio Thoracic Department. I got that on July 1 with Dr. Craig Baker. I cannot possibly be the first (or only) patient to be going through this. This failure of Blue Shield to inform me of their intent to place me in a Covered CA network of providers was unconscionable. Blue Shield’s misrepresentation of their insurance product caused considerable confusion for me and my providers, as well as expense for me and undo risk to my health and life. On June 11 I asked for a new letter from Blue Shield Claims Department. They said they I would be able to show the letter (which they promised would arrive in 10 days) to providers, but I still don’t see that it would change anything, because they are still going to check with Blue Shield as to confirm their network status. Blue Shield Claims further said that providers are confused or unaware that they need to contract with Blue Shield to service these new networks. I countered that Blue Shield is confused and unaware that one Blue Shield department says that providers are in-network while other Blue Shield departments say that they are not. My Blue Shield application makes one statement about Covered CA : “To enroll or modify coverage obtained through Covered California, contact Covered California directly.” I have read my Blue Shield Preferred PPO Statement of Benefits & Coverage, and it does not mention Covered CA networks at all. Blue Shield withheld vital information in its product marketing and recruitment. It is responsible for inconsistencies in its marketing and recruitment and in the documentation and search results available to customers on their website as well as answers from Customer Service. Their failure to mention their use of a “mirrored Covered CA network” for their Preferred PPO plans cannot be anything less than fraudulent. Providence Saint Joseph’s part in this is the simple negligence of their Financial department for not notifying me that there was a problem with the insurance. My cardiologist messed up in not knowing that he was not contracted for my PPO network and in not stressing in his dictation the emergency nature of the events of the week of May 19 – May 23. ------------------------------------------------------------------------------------------------------------------------------- Blue Shield PPO Plan INDIVIDUALS Blue Shield of CA Preferred PPO (Gold) 0 / 20 Per Month 789.44 Per Year 9,473 Deductible 0 Yearly, 0 Drugs Out-of-Pocket Max/Yr. 6,350 Preventative Care Copay Periodic, Free Primary Dr. Office Visit 30 Specialty Dr. Office Visit 50 X-Rays (most) 50 Lab Tests (most) 30 MRI, CT, PET 20% Coinsurance Outpatient Surgery 20% Coinsurance Inpatient Hosp Surgery 20% Coinsurance Mental Health Visit Outpatient 30 Plan Pharmacy, up to 30-day supply Generic Drugs: $19 Copay Brand Name Drugs: $50 Copay Non-Formulary Drugs: $70 Copay Special Drugs: 20% Coinsurance Emergency Room $250 Copay. Ambulance = $250 Copay Urgent Care 60 Out-of-Network Cover Yes, see brochure Out-of-Country Cover NO Skilled Nursing Facility 20% Coinsurance, 100 Days per Benefit Period Home Healthcare 20% Coinsurance, 100 Visits per Year Chiropractic Coverage Not Covered Durable Medical Equip. 20% Coinsurance Hospice "No Charge" Out-of-Network Authorization Required YES Out-of-Network Annual Deductible $0 Out-of-Network Annual Coinsurance 50% Out-of-Network Out-of-Pocket Yr/Limit 9,350 Lifetime Maximum Unlimited Lifetime For a list of participating providers, see www.blueshieldca.com or call 855-836-9705. Blue Shield search result showing St. Joseph as IN-Network.