The Impact of Organizational Slack and Lag

advertisement

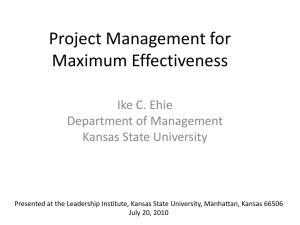

The Impact of Organizational Slack and Lag Time on Economic Productivity: The Case of ERP Systems John J. Morris* Kent State University Kevin E. Dow Kent State University Please do not quote without permission *Corresponding Author John J. Morris* Kent State University Kent, OH 44242 jjmorris@kent.edu (330) 677-9806 1 The Impact of Organizational Slack and Lag Time on Economic Productivity: The Case of ERP Systems Abstract: Much like research on the productivity paradox of the 1980s, empirical research in the 1990s has not provided a clear association between investments in ERP systems and improved productivity, even though these systems were designed, developed, and marketed as productivity improvement tools. This paper explores the relationship between organizational slack, lag time, and productivity improvements resulting from investments in ERP systems. Using data from a sample of firms that implemented these systems during the latter half of the 1990s, we provide support for the proposition that during the period of time surrounding implementation, firms build organizational slack; and following implementation organizational slack is absorbed and productivity and profitability increases. Thus suggesting that firms do realize improvements, however the improvements lag behind due to behavior of the firm during the implementation process. 1. Introduction Enterprise resource planning (ERP) systems erupted in the 1990s as one of the significant IT investments of the decade. While these systems were marketed as tools to improve productivity by integrating business processes across functional areas, early research on ERP systems generally found no association between spending on ERP systems and improved productivity. Research on ERP systems has been similar to the productivity paradox research of the 1980s. This paper explores this relationship further by further exploring the concept of organizational slack and introducing the concept of lag time to the extant literature. 2 Organizational slack (Cyert et al. 1963; 1992), provides an operational model to explore the lag effect offered by Brynjolfsson (1993) as a possible explanation for the productivity paradox. Many ERP projects require a major commitment of both capital and human resources over a time period that can span months or even years depending on the size of the organization and the number of modules implemented. During that time, the behavior of the firm can change significantly, as organizations often reengineer their business processes to meet the needs of the new system. This paper explores the proposition that these changes initially lead to an increase in organizational slack rather than an increase in productivity; and that once the implementation process is completed, this organizational slack will be absorbed, leading then to increases in productivity. To test this proposition, data was collected for a number of firms that announced their implementation of ERP systems during the last half of the 1990s. Both slack and economic productivity was measured before, during, and after implementation the ERP implementation. The results provide limited support for the proposition that during implementation, slack increases; and that in the time period following implementation slack decreases while economic productivity increases. These results suggest that Brynjolfsson’s (1993) time lag explanation for the productivity paradox of the 1980s may also apply to the ERP paradox of the 1990s. In other words, firms do realize improved productivity and profitability as a result of investments in ERP systems. However, the improvement lags behind due to the behavior of the firm during the implementation process, which in turn creates organizational slack. 3 The remainder of this paper is organized as follows: Section 2 develops the theory and hypothesis, Section 3 presents the research design and methodology, Section 4 presents the results, and Section 5 provides a discussion of the results and final conclusions. 2. Theory and Hypothesis Development 2.1 The Productivity Paradox The productivity paradox has motivated many empirical studies in the fields of economics, management science, and information systems. Dedrick et al. (2003) provides a critical review of several of these studies, beginning with the early studies in the 1980s that found no connection between IT investment and productivity at the firm, industry or overall economic level (Loveman 1994; Roach 1987; 1989; 1991; Strassmann 1990). Later studies using more rigorous and refined research methods, concluded that the productivity paradox does not hold, and that greater investment in IT is associated with greater productivity growth at both the firm and country level (Bosworth et al. 2000; Bresnahan 1999; Brynjolfsson 1993; 1996; Brynjolfsson et al. 1995; 1996; 1998; Jorgenson 2001; Jorgenson et al. 2000). Dedrick further concluded that although several firm level studies show an association between IT investment and productivity, most have failed to show a clear link to profitability. This was especially true for service firms where output measurement is difficult, and where relationships between productivity and profitability are less discernable than for manufacturing firms. It has been generally assumed that more productive firms will enjoy higher profitability than their competitors. Dedrick et al. (2003) further suggest that failure to document a clear link to profitability stems from the inability of researchers to quantify and incorporate the various unobservable factors that determine a firm’s competitive position and outcomes. 4 Brynjolfsson (1993) offered four possible explanations for the productivity paradox: (1) mismeasurement of outputs and inputs, (2) lags due to learning and adjustment, (3) redistribution and dissipation of profits, and (4) mismanagement of information and technology. Subsequent studies have focused on one or more of these explanations. For instance, Brynjolfsson and Hitt (1996) focused on the mismeasurement explanation by using a neoclassical production theory approach to determine the contribution of IT investments. They found that gross marginal product for computer capital was at least as large as other types of capital investment, indicating that computers do contribute significantly to firm-level output. In a study focused on the redistribution explanation, Hitt and Brynjolfsson (1996) suggest that in a competitive marketplace, firms will pass financial gains on to consumers through decreased prices, thus resulting in higher productivity and consumer value, but lower profits. Stratopoulos and Dehning (2000) conclude that increasing investment in IT and a high failure rate for IT projects, which they consider to be a proxy for mismanagement, off-set the productivity improvements realized by successful IT projects in many empirical studies. Relatively few studies have addressed the lag issue, which Brynjolfsson (1993) suggests can take several years to show results on the “bottom line.” He points out that because of the complexity of IT systems, firms and individuals may require some experience before becoming proficient, resulting in a learning curve that would logically be longer for more complex IT investments. More recently, Brynjolfsson and Hitt (2000) have found that payoffs to IT investment occurred not just in labor productivity increases but also in multifactor productivity (MFP) growth, and that the impact of MFP growth is maximized after a lag of 4 to 7 years. 5 2.2 Enterprise Resource Planning (ERP) Systems Over the past decade companies have spent significant portions of their IT budgets on ERP systems. Annual license and maintenance revenue seems to have peaked in 2000 at an estimated cost of $21.5 billion worldwide (Hossain et al. 2002), which does not include significant related spending for computer hardware, infrastructure and consulting services. These systems were designed, developed and marketed as productivity improvement investments. As such, expectations that this type of IT spending would be associated with productivity and profitability were commonplace. However, empirical research targeted at ERP investments has found only limited support for any such association (Hayes et al. 2001; Hunton et al. 2003; Hunton et al. 2002; Poston et al. 2001). A number of explanations have been offered for these mixed results, most of which follow one of Brynjolfsson’s (1993) four explanations for the productivity paradox. For instance, Poston and Grabsky (2001) suggested that companies might be passing cost savings on to customers in the form of lower prices, therefore profitability did not improve. Hunton et al. (2003) found that comparing ERP implementers to non-implementers provided evidence that non-implementer results declined vs. implementers even though implementer results did not improve, suggesting that relative improvement may be a better measurement than absolute change. Another factor that may have confounded these early empirical studies was the impact of the millennium change. This so-called “Y2K event” influenced a significant amount of IT spending during the last half of the 1990s as firms replaced their legacy systems with Y2K compliant systems, especially ERP. Unfortunately, many firms experienced problems with their ERP implementation projects, including cost over-runs, time delays, and other related major implementation failures (Davenport 1998). As the much anticipated December 31, 1999 date 6 approached, focus shifted from productivity improvement to meeting the Y2K deadline suggesting that Brynjolfsson’s (1993) time lag explanation for the productivity paradox may be a more appropriate explanation for the lack of productivity improvements from ERP systems. Furthermore, during an ERP implementation project, firms tend to add employees, consultants and temporary workers to complete tasks that may not have been anticipated, resulting in a build up of organizational slack. 2.3 Organizational Slack Organizational slack (Cyert et al. 1963; 1992) is the difference between resources available to the organization and the payments required to maintain the organization. They argue that slack absorbs variability in a firm’s environment, playing both a stabilizing and adaptive role in that it operates to stabilize the system by absorbing excess resources in good times and providing a pool of emergency resources in bad times. Although they provide a few examples of slack such as wages in excess of those required to maintain labor, the concept of organizational slack is presented as a hypothetical construct to help explain over-all organizational phenomena. Bourgeois (1981), proposed a method to operationalize the slack concept with a model that measured changes in slack as a function of changes in key financial indicators. Bourgeois & Singh (1983), grouped these indicators into three categories: available slack, recoverable slack, and potential slack. Each of these distinct categories represent a segment of a continuum along which the ability to redeploy slack resources becomes progressively more difficult. For instance available slack that consists of cash and near cash items could be redeployed quickly. Recoverable slack (when measured by other working capital components and discretionary administrative spending) may take more effort and time to redeploy. Finally, potential slack 7 (characterized by long-term capital raising ability measured by ratios such as debt/equity and price/earnings) may not ever be redeployed in the organization. A number of researchers have used this operational model or parts of it in empirical studies to explain organizational phenomenon (Miller et al. 1996; Sharfman et al. 1988). More recently, Dehning et al. (2004) introduced the concept to the information technology literature as a partial explanation for the productivity paradox. They concluded that during the productivity paradox period, firms experienced an increase in organizational slack rather than increased productivity. ERP systems are extremely complex and difficult to implement, with many projects taking several months or even years to complete. It is therefore reasonable to conclude that during this implementation time period organizational slack, would be affected, especially available and recoverable slack. The potential category of slack would probably not be affected during an ERP implementation process, unless the firm experienced a major problem that resulted in a significant financial loss that would impact their ability to raise additional capital. On the other hand, firms implementing ERP systems may tend adjust dividend policy and defer other capital spending projects to build up cash reserves as an insurance policy in case unanticipated problems arise, thus having a direct impact on available slack. Recoverable slack, measured by changes in working capital and administrative expense, could be affected in a couple of ways. First, management of working capital components, such as accounts receivable and inventory, could be expected to suffer during the transition period as employees learn how to use the new applications and modify business processes to match the new system. Secondly, during the implementation process, firms usually hire temporary employees and consultants to accommodate the additional work load, which would have a direct effect on administrative 8 expenses. These anticipated changes in measures of slack during the implementation process lead to the first hypothesis: Hypothesis 1: During the time period surrounding implementation of ERP systems, firms will experience an increase in organizational slack. Once an ERP implementation project has been completed, firms could be expected to resume dividend payments, make capital purchases that had been deferred, and otherwise take steps to invest surplus cash that had been held in reserve. Furthermore, as employees are trained and learn how to use the new ERP system, working capital ratios should improve, as more attention is paid to using the new tools for that purpose. Also, as the project winds down, consultants, temporary employees, and other project related expenses will be discontinued, leading to a reduction in G&A expenses. This leads to the second hypothesis: Hypothesis 2: In the time period following implementation of ERP systems, firms will experience a decrease in organizational slack. 2.4 Productivity Improvements Economists typically divide productivity into two categories: (1) labor productivity, defined as real output per hour of work, and (2) total factor productivity, defined as real output per unit of all inputs (Steindel et al. 2001). However, many empirical studies on ERP systems have simply used proxies for productivity such as financial ratios, (Hunton et al. 2003; Poston et al. 2001) or stock market and analysts’ reaction to announcements (Hayes et al. 2001; Hunton et al. 9 2002). On the other hand, the National Academy of Sciences (NAS) (1979) suggest that productivity can be measured at the individual firm level by a number of asset, cost, and employment ratios. Table 1 outlines the primary productivity measures outlined by the NAS. These ratios change to reflect changes in economic productivity. For instance, as productivity increases sales per dollar of operating assets or per employee would be expected to increase, and costs per dollar of sales would be expected to decrease, resulting in an increase in operating profit per dollar of sales. Many of the underlying factors used to measure productivity and profitability behave in opposite directions from the slack factors discussed earlier. Thus as slack is absorbed by the firm these underlying measures of productivity and profitability will change, which leads to the final hypothesis: Hypothesis 3: In the time period following implementation of ERP systems, firms will experience an increase in productivity and profitability. 3. Research Design and Method 3.1 Model Specification Because the financial ratios that are used to measure both slack and productivity tend to vary from one industry to another, it is necessary to measure the relative change in ratios. Also, to model the impact of slack and productivity on a firm during and after an ERP implementation project, one must begin with a baseline from which changes can be measured. A diagram of the expected relationships between slack and productivity; before, during and after an ERP implementation project is provided in figure 1. [Insert Figure 1 Here] 10 As indicated in Figure 1, baseline measures of organizational slack are expected to increase during the implementation time period, and decrease afterwards. By contrast, the baseline productivity measures are only expected to increase after the ERP implementation is complete, as both available and recoverable slack decrease. 3.2 Measures of Slack Table 1, panels A and B, provides details of the following six ratios developed by Bourgeois & Singh (1983), which were used to measure available and recoverable slack: (1) changes in retained earnings to sales, (2) dividend payout, (3) cash & equivalents to sales, (4) accounts receivable to sales, (5) inventory to sales, and (6) general and administrative expense to sales. A confirmatory factor analysis provided strong support that these six factors measure the latent variable; organizational slack. 3.3 Measures of Productivity Table 1, panel C provides details of the following four ratios that were used to measure productivity: (1) operating profit to sales, (2) operating profit per employee, (3) sales per employee, and (4) sales to operating assets. These ratios were selected from the ratios suggested by NAS, (1979) because they are all widely accepted measures of productivity and profitability used in academic research and because the data is readily available. Furthermore, these ratios address four key aspects of the relationship between productivity and profitability. The operating profit to sales ratio is an indication of relative profitability. The sales-per-employee ratio represents the more traditional labor based measure of productivity. The operating profit 11 per employee ratio combines the concept of profitability and labor productivity. Finally, the ratio of sales to operating assets measures overall productivity, not just labor productivity. [Insert Table 1 Here] 3.4 Sample Selection The sample selection process began with the list of ERP announcements used by Hayes et al. (2001), which consisted of 91 announcements between 1992 and 1998. From this list, twelve firms were eliminated that had either merged with other firms or were no longer listed on the stock exchange during the study period. 17 firms were eliminated because their announcement date was prior to 1997, which was the first year for this study. This process yielded 62 firms. A search using LexisNexis found an additional 63 firm announcements, mostly in 1999 and 2000, which yielded a total of 125 firms that made ERP implementation announcements. Data for each of the measures of slack and productivity were extracted from the Standard & Poor’s Research Insight Compustat database. Another 15 firms had to be eliminated due to missing Compustat data, leaving a final sample size of 110 firms and is summarized in Table 2. [Insert Table 2 Here] 4. Results 4.1 Total Sample Set Table 3 presents descriptive statistics for the mean averages of each of the factors used in the analysis grouped by three, three year time periods: (1) prior to implementation, (2) during the implementation period, and (3) after implementation. The implementation time period includes the year before the announcement, the year of the announcement, and the year after the announcement. This approach was used due to the limitations associated with the determination of the exact timing of the ERP implementation. The three years prior to this implementation 12 time period was used to establish a baseline, and up to three years following implementation was used as the post implementation time period. Since Compustat data is available only through 2003, only two years of post implementation data for announcements made in 2000 was collected. For the complete dataset (panel A), four of the six measures of slack reflect the expected change in mean values, two each from the available and recoverable categories. Retained earnings increased and dividend payout decreased, reflecting an increase in available slack during the implementation period, reversing after implementation reflecting a decrease in available slack. With respect to recoverable slack, the ratio of accounts receivable and inventories to sales increased during implementation, and decreased after implementation reflecting the expected pattern. Two of the slack factors did not change as expected. The ratio of cash and equivalent and general and administrative expenses to sales both increased during and decreased after implementation. Three of the four measures of productivity/profitability also followed the expected pattern, with operating profit to sales, sales per employee, and sales to operating assets all increasing from the baseline to the post implementation period. Operating profit per employee however decreased, reflecting a trend similar to prior research where the relationship between productivity and profitability has not always been consistent. 4.2 Manufacturing Firm Sub-sample The sample was divided into two sub-sets, one for firms in the manufacturing sector (SIC Codes 2000 – 3999), and one for all other firms. Table 3, panel B presents descriptive statistics for the mean averages of each of the factors for the manufacturing firms. These results were 13 similar to the overall sample results, with only the ratio of accounts receivable to sales not reflecting the expected increase during the implementation period, although only by a small amount, and it did decrease after implementation, reflecting the expected pattern. All three of the same productivity/profitability ratios follow a similar pattern to the overall sample. 4.1 Non-Manufacturing Firm Sub-sample The more interesting results came from the sub-sample of non-manufacturing firms. Table 3, panel C presents descriptive statistics for the mean averages of each of the factors for these firms. The pattern of change in slack factors shifted somewhat, with the retained earnings factor not reflecting the expected change during the implementation period, and the ratio of inventory to sales factor not following the expected pattern during either time period. Both of these results may reflect more of the difference in firm structure than anything else, especially the inventory factor, because inventory does not play a significant role in a lot of non-manufacturing businesses. The most interesting result however, is in the two factors that did not follow the expected pattern in the manufacturing sub-sample and the overall sample. The ratio of cash and equivalents to sales and the ratio of general and administrative expense to sales both increased during the implementation period, and then decreased afterwards, which is more supportive of the first two hypothesis. The other interesting result is in the productivity/profitability ratios. The non-manufacturing firms reflect an increase in operating profit per employee, which was not present in the data for manufacturing firms. Two of the other factors; operating profit to sales and sales to operating assets both decreased, once again providing mixed results. 14 4. Conclusion and Discussion of Results This paper contributes to the research stream that follows the productivity paradox by addressing a specific aspect of IT investment that was designed developed and marketed as a productivity improvement tool, ERP systems. More specifically this paper focused on the relationship between organizational slack and productivity/profitability as a refinement of Brynjolfsson’s (1993) lag concept in explaining the productivity paradox as it applies to ERP systems. This is an important contribution to both theory and practice given the high level of spending that has taken place for ERP systems over the past decade and the mixed results that have been reported in both the popular and academic press. These results generally support the idea that during the period of time that firms are implementing ERP systems, they tend to build up levels of organizational slack, which are then absorbed following implementation, leading to improvements in productivity and profitability. Although the results are somewhat mixed a clear pattern does exist, which is stronger in the nonmanufacturing sector. One explanation may be due to the fact that ERP systems originated in the manufacturing sector, having evolved from manufacturing resource planning (MRP) systems. As such, these systems were initially a better fit from a business process perspective for manufacturing firms than for non-manufacturing firms. Therefore the lag time and the resulting buildup of organizational slack may be greater for non-manufacturing firms as they change business processes and/or make adjustments and modifications to the ERP software to better fit their business processes. Overall, these results suggest that Brynjolfsson’s (1993) lag concept combined with the organizational slack theory of Cyert & March (1963; 1992) could explain why firms continued to invest in expensive ERP systems with little or no direct evidence of improved productivity or 15 profitability. This is especially true given the volume of mixed press that ERP systems received during the late 1990s, when in spite of the bad press, investments continued at record levels. One limitation of this study is the lack of specific information on the timing of the actual implementation process each firm undertook. Given the nature of the available data, it was necessary to estimate the implementation time period based on public announcement dates. It may be useful for future researchers to gather more precise data on timing and better delineate the period of time during which implementation takes place. Also, as more data becomes available, it would be useful to extend the timeline to explore even longer lag times. Since most of the ERP systems were implemented during the last four years of the 1990s, data is just now becoming available that would make longer lag time analysis possible. Another limitation of this study is the potential that other confounding factors may have impacted the results. Although the use of scaled data and relative change helps to mitigate this issue, the fact remains that other external events may be exerting undue influence on the data. One approach to addressing this limitation would be for future research to use a matched pair concept similar to the approach used by Hunton et al. (2003) to compare implementers with nonimplementers during the same time period. 16 Figure 1 – Changes in Slack and Productivity Measures Before Implementation Baseline Organizational Slack Measures During Implementation Organizational Slack Measures (+) Increase Baseline Productivity Measures After Implementation Organizational Slack Measures (-) Decrease Productivity Measures (+) Increase Table 1 – Details of Variable Calculations Panel A: Measures of Available Slack Variable Description SLK_RE Retained Earnings to Sales SLK_DP Dividends to Net Worth SLK_CE Cash & Equivalents to Sales Calculation (Compustat Variables) (NI – DV) / SALE DV / SEQ CHE / SALE Panel B: Measures of Recoverable Slack Variable Description SLK_AR Accounts Receivable to Sales SLK_IN Inventory to Sales SLK_GA Selling, General & Admin to Sales Calculation (Compustat Variables) RECT / SALE INVT / SALE XSGA / SALE Panel C: Measures of Productivity Variable Description PRO_OS Operating Profit to Sales PRO_OE Operating Profit per Employee PRO_SE Sales per Employee PRO_SA Sales to Operating Assets Calculation (Compustat Variables) (SALE – COGS – XSGA) / SALE (SALE – COGS – XSGA) / EMP SALE / EMP SALE / NOA Table 2 – Summary of Sample Selection Process Initial ERP announcements form Hayes et al. (2001) from 1992 to 1998 Less: Mergers, acquisitions, and de-listings Announcements remaining from Hayes et al. (2001) Additional ERP announcements collected for this study (mostly 1999 & 2000) Total valid ERP announcements collected Less: ERP announcements outside of study range (1997-2000) Initial ERP announcements available for study Less: Firms with no data available in Compustat during study period Net ERP announcements used in study 17 91 - 12 79 89 168 - 43 125 - 15 110 Table 3 – Mean Values of Slack and Productivity Measures 3 Years Prior to Implementation 3 Years During Implementation Change Expected N Mean N Mean Panel A: All Firms SLK_RE 288 -0.070 SLK_DP 293 0.038 SLK_CE 286 0.279 SLK_AR 266 0.226 SLK_IN 280 0.126 SLK_GA 241 0.357 PRO_OS 241 0.036 PRO_OE 222 40.770 PRO_SE 281 254.408 PRO_SA 286 2.636 Panel B: Manufacturing Firms SLK_RE 186 -0.128 SLK_DP 190 0.032 SLK_CE 184 0.332 SLK_AR 176 0.184 SLK_IN 180 0.152 SLK_GA 172 0.398 PRO_OS 172 -0.027 PRO_OE 160 39.495 PRO_SE 180 251.957 PRO_SA 191 2.151 Panel C: Non-Manufacturing Firms SLK_RE 102 0.035 SLK_DP 103 0.050 SLK_CE 102 0.184 SLK_AR 90 0.309 SLK_IN 100 0.078 SLK_GA 69 0.256 PRO_OS 69 0.192 PRO_OE 62 44.061 PRO_SE 101 258.775 PRO_SA 95 3.609 3 Years After Implementation Change Expected N Mean + + + + + 291 311 299 271 284 246 -0.006 0.007 0.141 0.232 0.127 0.282 + + + + + 220 241 228 207 225 185 185 176 232 236 -0.170 0.171 0.288 0.195 0.115 0.305 0.091 38.090 272.313 2.672 + + + + + 188 203 190 174 180 171 -0.117 0.025 0.099 0.180 0.167 0.257 + + + + + 135 148 138 127 135 126 126 123 146 149 -0.248 0.033 0.343 0.162 0.151 0.291 0.063 19.809 264.382 2.326 + + + + + 103 108 109 97 104 75 0.014 -0.027 0.213 0.324 0.057 0.341 + + + + + 85 93 90 80 90 59 59 53 86 87 -0.045 0.391 0.203 0.248 0.062 0.335 0.150 80.514 285.776 3.265 18 References Bosworth, B.P., and Triplett, J.E. "What's New About the New Economy? IT, Economic Growth and Productivity," in: Working Paper, Brookings Institute, Washington, D. C., 2000. Bourgeois, L.J.I. "On the Measurement of Organizational Slack," Academy of Management Review (6:1) 1981, pp 29-39. Bourgeois, L.J.I., and Singh, J.V. "Organizational Slack and Political Behavior Amoung Top Management Teams," Academy of Management Proceedings (1983) 1983, pp 43-47. Bresnahan, T.F. "Computerization and Wage Dispersion: An Analytical Reinterpretation," Journal of Royal Economics Society (109:456) 1999, pp F390-F415. Brynjolfsson, E. "The Productivity Paradox of Information Technology," Communications of the ACM (36:12), Dec 1993, pp 67-77. Brynjolfsson, E. "The Contribution of Information Technology to Consumer Welfare," Information Systems Research (7:3) 1996, pp 281-300. Brynjolfsson, E., and Hitt, L.M. "Information Technology as a Factor of Production: The Role of Differences Among Firms," Economics of Innovation and New Technology (3:3) 1995, pp 183-199. Brynjolfsson, E., and Hitt, L.M. "Paradox Lost? Firm-level Evidence on the Return so Information Systems Spending," Management Science (42:4) 1996, pp 541-558. Brynjolfsson, E., and Hitt, L.M. "Beyond the Productivity Paradox: Computers are the Catalyst for Bigger Changes," Communications of the ACM (41:8) 1998, pp 49-55. Brynjolfsson, E., and Hitt, L.M. "Beyond Computation: Information Technology, Organizational Transformation and Business Performance," Journal of Economic Perspectives (14:4) 2000, pp 23-48. Cyert, R.M., and March, J.G. A Behavioral Theory of the Firm Prentice-Hall, Englewood Cliffs, NJ, 1963, p. 332. Cyert, R.M., and March, J.G. A Behavioral Theory of the Firm, (2nd ed.) Blackwell Business, Cambridge, Mass, USA, 1992, p. 252. Davenport, T.H. "Putting the Enterprise into the Enterprise System," Harvard Business Review), July-August 1998. Dedrick, J., Gurbaxani, V., and Kraemer, K. "Information Technology and Economic Performance: A Critical Review of the Empirical Evidence," ACM Computing Surveys (35:1), March 2003, pp 1-28. Dehning, B., Dow, K.E., and Stratopoulos, T. "Information technology and organizational slack," International Journal of Accounting Information Systems (5:1), May 2004, pp 5163. Hayes, D.C., Hunton, J.E., and Reck, J.L. "Market Reaction to ERP Implementation Announcements," Journal of Information Systems (15:1), Spring 2001, pp 3-18. Hitt, L.M., and Brynjolfsson, E. "Productivity, Business Profitability, and Consumer Surplus: three Different Measures of Information Technology Value," MIS Quarterly), June 1996, pp 121-142. Hossain, L., Patrick, J.D., and Rashid, M.A. Enterprise Resource Planning: Global Opportunities and Challenges Idea Group Publishing, Hershey, PA, 2002. 19 Hunton, J.E., Lippincott, B., and Reck, J.L. "Enterprise Resource Planning: Comparing Firm Performance of Adopters and Nonadopters," International Journal of Accounting Information Systems (4:3), Sep 2003, pp 165-184. Hunton, J.E., McEwen, R.A., and Wier, B. "The Reaction of Financial Analysts to Enterprise Resource Planning (ERP) Implementation Plans," Journal of Information Systems (16:1), Spring 2002, pp 31-40. Jorgenson, D.W. "Information Technology and the U.S. Economy (Presidential Address to the American Economic Association)," American Economic Review (91:1) 2001, pp 1-32. Jorgenson, D.W., and Stiroh, K.J. "Raising the Speed Limit: U.S. Economic Growth in the Information Age," Brookings Papers on Economic Activity (1:1) 2000, pp 125-211. Loveman, G.W. An Assessment of the Productivity Impact of Information Technologies Oxford University Press, Cambridge, U.K., 1994, pp. 84-110. Miller, K.D., and Leiblein, M.J. "Corporate Risk-Return Relations: Returns Variability Versus Downside Risk," Academy of Management Journal (39:1) 1996, pp 91-122. National Academy of Sciences Measurement and Interpretation of Productivity The National Academies, Washington D.C., 1979. Poston, R., and Grabski, S. "Financial Impacts of Enterprise Resource Planning Implementations," International Journal of Accounting Information Systems (2:4), December 2001, pp 271-294. Roach, S.S. "America's Technology Dilemma: A Profile of the Information Economy," Morgan Stanley Special Economic Study (April) 1987. Roach, S.S. "Pitfalls of the New Assembly Line: Can Service Learn from Manufacturing?," Morgan Stanley Special Economic Study (June 22) 1989. Roach, S.S. "Services Under Siege: The Restructuring Imperative," Harvard Business Review (39:2), Sept-Oct 1991, pp 82-92. Sharfman, M.P., Wolf, G., Chase, R.B., and Tansik, D.A. "Antecedents of Organizational Slack," Academy of Management Review (13:4) 1988, pp 601-614. Steindel, C., and Stiroh, K.J. "Productivity: What is it, and why do we care about it?," Business Economics), October 2001, pp 13-31. Strassmann, P.A. "The Business Value of Computers: An Executive's Guide," Information Economics Press) 1990. Stratopoulos, T., and Dehning, B. "Does Successful Investment in Information Technology Solve the Productivity Paradox?," Information & Management (38:2) 2000, pp 102-117. 20