When efficient capital and operations go hand in hand

advertisement

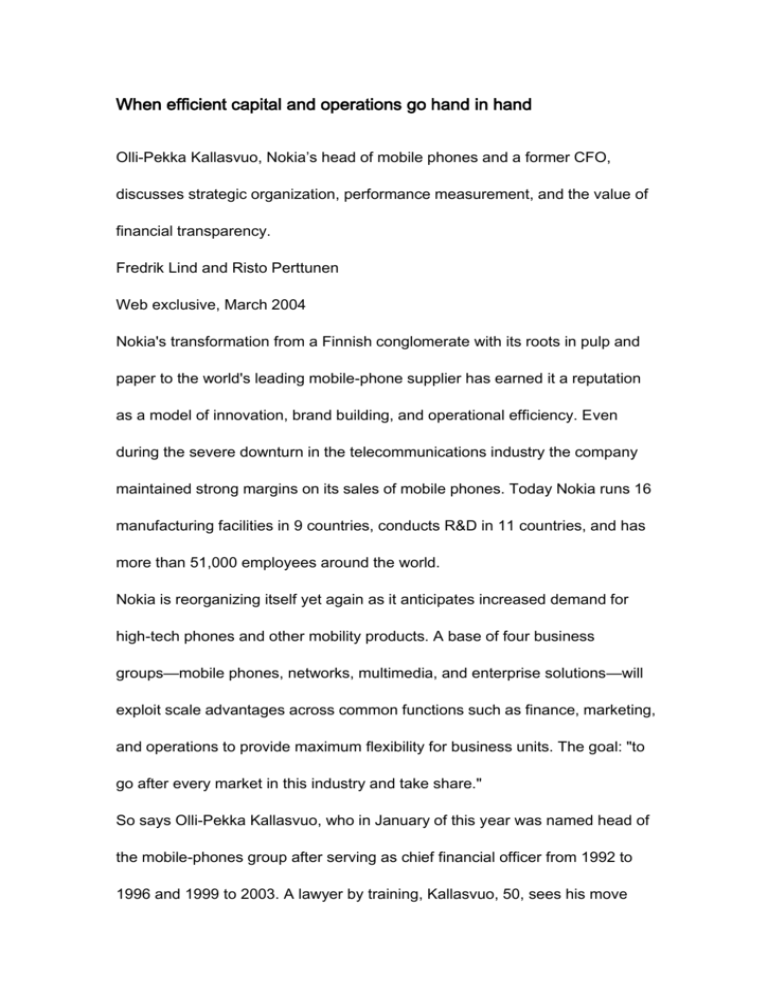

When efficient capital and operations go hand in hand Olli-Pekka Kallasvuo, Nokia’s head of mobile phones and a former CFO, discusses strategic organization, performance measurement, and the value of financial transparency. Fredrik Lind and Risto Perttunen Web exclusive, March 2004 Nokia's transformation from a Finnish conglomerate with its roots in pulp and paper to the world's leading mobile-phone supplier has earned it a reputation as a model of innovation, brand building, and operational efficiency. Even during the severe downturn in the telecommunications industry the company maintained strong margins on its sales of mobile phones. Today Nokia runs 16 manufacturing facilities in 9 countries, conducts R&D in 11 countries, and has more than 51,000 employees around the world. Nokia is reorganizing itself yet again as it anticipates increased demand for high-tech phones and other mobility products. A base of four business groups—mobile phones, networks, multimedia, and enterprise solutions—will exploit scale advantages across common functions such as finance, marketing, and operations to provide maximum flexibility for business units. The goal: "to go after every market in this industry and take share." So says Olli-Pekka Kallasvuo, who in January of this year was named head of the mobile-phones group after serving as chief financial officer from 1992 to 1996 and 1999 to 2003. A lawyer by training, Kallasvuo, 50, sees his move from finance to the leadership of the business group responsible for most of Nokia's profits as perfectly natural. In an interview conducted at Nokia headquarters outside Helsinki, Kallasvuo spoke to Fredrik Lind and Risto Perttunen of McKinsey about Nokia's strategy, communicating with markets, and the CFO's mind-set when operational and capital efficiencies go hand in hand. McKinsey on Finance: What long-term trends in the handset business do you see, and how are they affecting Nokia's strategy? Kallasvuo: The biggest long-term trend is our customers' increasing mobility and, as a result, their demands for ever more sophisticated handsets. In one sense, it's a kind of convergence of businesses into a new business domain defined by mobility. The result is that we'll continue to see a very simplistic entry-level phone, with no bells and whistles, on one hand, and on the other hand we'll see a multipurpose device that has all sorts of capabilities, like mobile gaming or mobile imaging. This is what we need to tackle at Nokia, and hence the reorganization to align our structure to different segments of this market. MoF: How do you think about measuring performance? Kallasvuo: The thinking over the years has definitely changed. We've learned to understand that for us, traditional measures of performance like working capital, for example, are financial matters, yes, but more important they're indicators of how a company is performing operationally. When I look at working capital, I really see it first as a reflection of efficiency and then as a reflection of where our capital is invested, which is the reverse of the usual way of thinking. MoF: So how do you track the company's performance over time? Kallasvuo: A more capital-intensive business would probably look much more closely at its returns on investment, but ROI just is not as useful a measure for a company that makes its money by investing in people, in research and development, and in brand marketing. Measures of efficiency are much more helpful—operational efficiencies, production efficiencies, and yes, financial efficiencies—and they really all go hand in hand. Production efficiencies and capital efficiencies are very relevant for every finance person at Nokia. And if there were just one single thing to do to improve performance, it would have been done already. Improvement is usually not about making a quantum leap; it's about taking small steps, improving a little bit every day. Nor is this about pushing responsibility off to individual departments and saying, "You look at working capital," or, "You look at inventory." These are the responsibility of everyone at Nokia because efficiency is the core of the business—and then working capital becomes a reflection of how efficient we are, and that's why it's such an important indicator that remains very high on our agenda even if financially it's not critically relevant at the moment. MoF: Can the corporate team and the CFO team contribute to and lead the different divisions and businesses on the working capital dimension? Kallasvuo: No; this is exactly the point. Efficiency is so intricately entwined in the system that everyone has a stake in it, everyone is helping out. So if you were to start some big push for working capital at Nokia, with a big headline saying, "Now we are going to emphasize working capital," or announce that suddenly financial concerns will drive everything, no one would understand what you're talking about. Everyone understands that working capital is everyone's job—by taking those little steps to get logistics working even better. This is one of our key competitive areas. MoF: Are there any particular structures or processes at Nokia to make this cooperation work? Kallasvuo: In the end, it really comes down to a company's business infrastructure and how it operates in general. As we have grown from a small, flexible player to such a large company, we've put considerable effort into combining flexibility and economies of scale, which has an impact on how we operate. The emphasis has been on doing everything we can to take advantage of economies of scale where we can and where it makes sense, but not to centralize anything that is business specific. We've drawn that line very carefully. If something is business specific, it gets maximum flexibility, empowerment, decentralization. If it's not business specific, then let's take the economies of scale. The result has been an increasing platformization, if you will, of the business infrastructure. And here the business infrastructure means other than IT, so it's a wider concept. MoF: What have been the special challenges of communicating the results of a very fast-growing company to financial markets? Kallasvuo: Communicating results is easy. Giving estimates is more of a challenge, because in this type of fast-moving business no one can really know what will happen over three months—no one. No system in this world can make that prediction in a way that is certain. The best you can do is communicate your best understanding to the market at the time, which is actually pretty simple. At Nokia, we have been simply communicating our best possible understanding to the market. We have not been playing games. I was personally criticized by some investors for not playing games—for not giving an estimate and then exceeding it by one penny, which so many companies were doing. Now, of course, everyone feels this way. Whatever numbers come out of the system, in accordance with your accounting principles, those are your results. MoF: What is your view of the emergence of companies over the past year or so that are minimizing their financial transparency to the markets? Kallasvuo: Of course, I can't speak on behalf of other companies, but I feel that our investor base wants quarterly guidance. It's very much a matter of providing the markets with the information they want, rather than telling them what we think they should want. This isn't brain surgery. If the markets want information, you give them information. The question has to be, how can we better understand what our investors want? The mind-set really needs to be that we must listen and communicate in terms of what is expected. This is very relevant coming from a small market and growing into one of the most traded shares in the world. We come from a context where we really didn't have the benefit of the doubt when it came to our existence and our ability to deliver over the long-term. It really was an imperative to listen to what investors expected—if we did not have that mind-set, we never would have become one of the most widely held shares in the United States. MoF: What is the optimal way to distribute value back to the shareholders—for example, through share buybacks or dividends? Kallasvuo: I don't think there is a big difference between dividends and buybacks. In the end it's a pragmatic choice, very much driven by tax questions and the shareholder base. Otherwise they're both pretty equal from the financial perspective. MoF: How important is it for a company to be listed in the United States? Kallasvuo: It's really not possible to become a major name among US investors if you're not represented in the US market in a major way. Being listed supports the business, and the business supports the listing—which Nokia's experience in the 1990s illustrates very well. Indeed, I would claim that without its listing in New York, Nokia would not have become the market leader in the United States. Furthermore, if it had not become a market leader in the United States, the share story would have been a lot less well-known. When we first issued our IPO in the United States, it wasn't really that we needed US capital but rather that the listing would support the business, which is how it worked out. The result was a positive spiral, if there is such a thing, each one supporting the other. MoF: And how has that transformation changed your relationship with shareholders—on both sides of the Atlantic? Kallasvuo: Sometime in 1995 or 1996, we became the first company in the world with a major market cap that had the majority of its market capitalization coming from outside its home country, as domestic Finnish share dipped below 50 percent. That happened very suddenly and continued at a rapid pace. Other companies have since found themselves in similar positions, but not to the same extent. So we basically said to ourselves, "Now we have to see ourselves as a US company and we have to do things in the same way a US company would, because that's what a majority of our investors will expect." That became a real priority. For example, instead of having our US investor relations (IR) staff report to an IR executive in Helsinki, we located the IR head office for the entire company in the United States—and then of course allocated a lot of resources and everything to make it work. Even the Helsinki-based IR office reported for many years to the US office. When it came to communications, we said to ourselves, we need to communicate like a US company. Even today, if some capital-markets-related legislation or other comes out of the United States that isn't necessarily applicable to non-US companies, we comply anyway, even if the legislation does not, strictly speaking, apply. There is no other way for us. Other companies have chosen exactly the other way: to be domestic first and foremost, abiding primarily by their own government's practices and legislation and domestic shareholders. Which one is wrong or right I can't say. MoF: And how comfortable are you with Nokia's current level of transparency? Kallasvuo: I can say that every time we have had a discussion internally about whether we should go into this more transparent reporting, and every time we have made a decision to report instead of holding back, the decision to report has been the right decision, eventually. It's what I feel. Not once have I looked back and thought, "Why did we have to tell this?" But here again, I would suggest that theories aside, in our case it's been a necessity. You are foreign. You are an ADR.1 You don't have the option of not listening to what the market wants. MoF: Is there any risk, as Nokia begins reporting separately for multimedia handsets and enterprise solutions? What if one unit doesn't achieve very good results? Kallasvuo: No, definitely not. As I said, every time we've increased our transparency it was the right decision, so it must be the right decision here too. And you have to also remember that external pressure is good for you. It makes you run even harder. The people running those operations have even more reason to perform if external pressure is there also. That's been our experience. MoF: Has the CFO been a part of the strategic decision-making process in Nokia, and do you see that role being strengthened in the future? Kallasvuo: I don't really think there is one and only one role for a CFO. Of course, the role of a CFO has to be aligned with the way the company operates, and it also depends very much on the size of the company. But it really can't be the same in every company, in every business situation, and in every type of business a company is in. At Nokia, being CFO has meant being very much a part of the management team, looking at matters from a financial perspective but really not taking the role of a finance guy who primarily becomes the voice of that department. Instead of defining the role in one way and taking that into the management team, the CFO at Nokia has a responsibility for the same decisions as everyone else on the management team. Yes, of course, you might look at those decisions from a certain perspective, but that doesn't have to mean that you always take the same sort of role. You have to be more versatile than that, which makes the role a very strategic one. MoF: In many companies, the role of the CFO has been expanding on the traditional role in two directions: the first is a more strategic-architect or strategic-planning type of role, even to the point of having M&A or strategy divisions; the second is moving toward a more involved operations role, enhancing some business-controlling activities or leading corporate-pricing or working-capital programs. What are your thoughts on the evolution of the CFO role in general? Kallasvuo: If you assume a traditional sort of controller role as the starting point, then yes, those are the two natural directions for the role to evolve. But because it varies depending on how the company operates, it's also possible that both of those roles might even be combined. The latter role—the more involved operations role—is particularly apt for the CFO of a major business unit, which is very much an operational role in an operational unit. The former, more strategic role is more apt for a corporate, head-office CFO who operates, supervises, and oversees several business units. And both are quite relevant at Nokia, too, because of how we operate and how the roles of the business units or even business groups have been defined. And I would also claim that the role of the CFO must be aligned to the approach of the CEO. Without alignment, success is difficult. About the Authors Fredrik Lind is a principal in McKinsey's Stockholm office, and Risto Perttunen is a director in the Helsinki office. Notes 1 American depository receipt