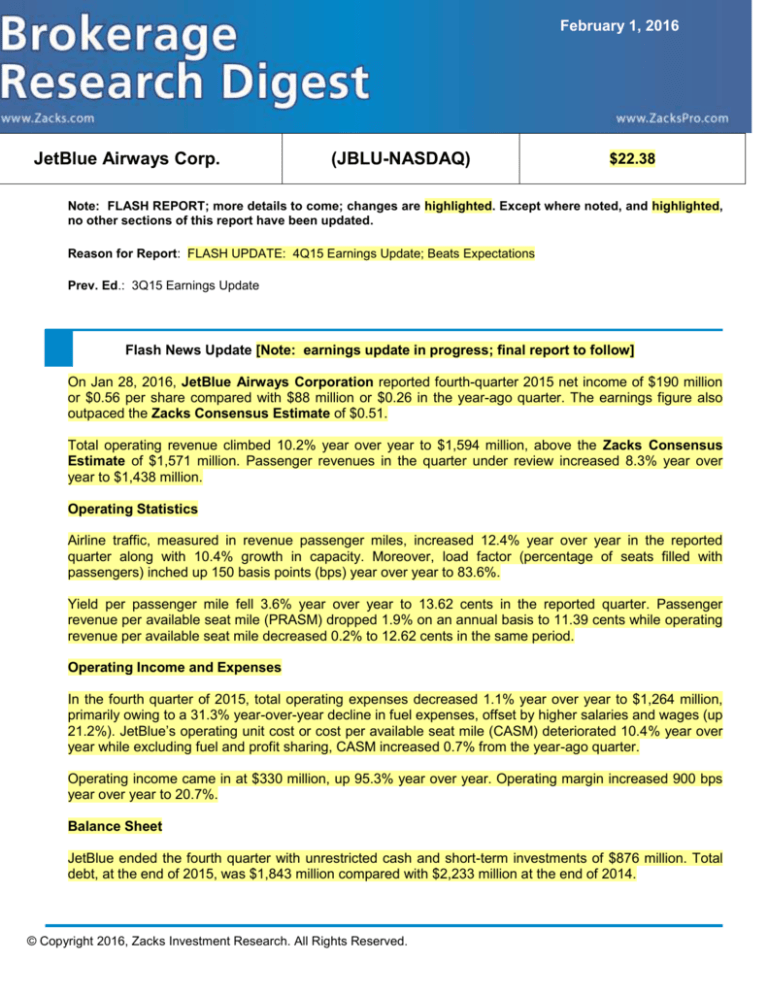

February 1, 2016

JetBlue Airways Corp.

(JBLU-NASDAQ)

$22.38

Note: FLASH REPORT; more details to come; changes are highlighted. Except where noted, and highlighted,

no other sections of this report have been updated.

Reason for Report: FLASH UPDATE: 4Q15 Earnings Update; Beats Expectations

Prev. Ed.: 3Q15 Earnings Update

Flash News Update [Note: earnings update in progress; final report to follow]

On Jan 28, 2016, JetBlue Airways Corporation reported fourth-quarter 2015 net income of $190 million

or $0.56 per share compared with $88 million or $0.26 in the year-ago quarter. The earnings figure also

outpaced the Zacks Consensus Estimate of $0.51.

Total operating revenue climbed 10.2% year over year to $1,594 million, above the Zacks Consensus

Estimate of $1,571 million. Passenger revenues in the quarter under review increased 8.3% year over

year to $1,438 million.

Operating Statistics

Airline traffic, measured in revenue passenger miles, increased 12.4% year over year in the reported

quarter along with 10.4% growth in capacity. Moreover, load factor (percentage of seats filled with

passengers) inched up 150 basis points (bps) year over year to 83.6%.

Yield per passenger mile fell 3.6% year over year to 13.62 cents in the reported quarter. Passenger

revenue per available seat mile (PRASM) dropped 1.9% on an annual basis to 11.39 cents while operating

revenue per available seat mile decreased 0.2% to 12.62 cents in the same period.

Operating Income and Expenses

In the fourth quarter of 2015, total operating expenses decreased 1.1% year over year to $1,264 million,

primarily owing to a 31.3% year-over-year decline in fuel expenses, offset by higher salaries and wages (up

21.2%). JetBlue’s operating unit cost or cost per available seat mile (CASM) deteriorated 10.4% year over

year while excluding fuel and profit sharing, CASM increased 0.7% from the year-ago quarter.

Operating income came in at $330 million, up 95.3% year over year. Operating margin increased 900 bps

year over year to 20.7%.

Balance Sheet

JetBlue ended the fourth quarter with unrestricted cash and short-term investments of $876 million. Total

debt, at the end of 2015, was $1,843 million compared with $2,233 million at the end of 2014.

© Copyright 2016, Zacks Investment Research. All Rights Reserved.

Guidance

For the first quarter of 2016, the carrier expects fuel price, net of hedges, to be $1.12 per gallon. Capacity

in the first quarter is projected to increase in the band of 14% to 16%. For full-year 2016, the metric is

expected to increase in the range of 8.5% to 10.5%. Consolidated operating cost per available seat mile,

excluding fuel and profit sharing, is expected to remain flat or decline 2% in first-quarter 2016. For full-year

2016, the metric is expected to remain flat or grow 2%.

MORE DETAILS WILL COME IN THE IMMINENT EDITIONS OF ZACKS RD REPORTS ON JBLU

Portfolio Manager Executive Summary

JetBlue Airways Corporation (JBLU) is a passenger airline that operates primarily on point-to-point

routes with its fleet of multiple Airbus A320 and 7 Airbus A321 aircraft along with 60 EMBRAER E-190

aircraft.

Of the 12 analysts covering the stock, 7 provided positive ratings while 5 assigned neutral ratings. None of

the analysts rated the stock negatively. The target prices range from $18.00 to $32.00, with the average

being $28.75.

The following is a summarized opinion of the diverse brokerage viewpoints:

Bullish outlook (7/12 analysts) – These analysts expect the company to benefit from the introduction of

Fly-Fi service, enhanced fare options, premium service offerings like Mint, ancillary services and the

acquisition of slots at Washington Regan National Airport (DCA). The firms are encouraged by the

company’s growing market presence in the Boston, Fort Lauderdale and Caribbean markets and its plans

to increase capacity in profitable routes, as these markets bode well for near-term operational efficiency

and margin growth. The firms believe that the company’s superior product offerings, coupled with its lowcost structure, would provide it with a competitive advantage leading to share gains in emerging markets.

Also, they expect oil prices to decline further which will likely boost the company’s bottom line.

Cautious outlook (5/12 analysts) – These analysts are optimistic about JetBlue’s unique business model,

strong brand name, enhanced in-flight services, fuel-hedging strategy, strong unit revenues and a nonunionized workforce. JetBlue’s growing presence in key markets, along with penetration into Latin America

and the Caribbean, will likely support its growth momentum. However, increase in non-fuel costs and

competitive pressure pose threats to the company’s earnings. According to the firms, the carrier’s effort to

improve ancillary revenues has already been discounted into the share price, thus limiting the upside

potential.

The analysts believe the following additional factors should also be taken into consideration for investing in

the stock:

JetBlue Airways is one of the few low-cost carriers in the U.S. that offer consumers excellent

service at low fares.

JetBlue Airways’ strength lies in its strong brand value, superior in-flight services, which include

LiveTV, and a non-unionized workforce with high-quality work culture.

JetBlue faces significant competition from growing low-cost carrier Spirit Airlines, which operates

in one of the former’s key markets – the Caribbean.

Zacks Investment Research

Page 2

www.zackspro.com

JetBlue's existing interline agreements are with AerLingus, South African Airways, Lufthansa

German Airlines, ElAl Israel Airlines, American Airlines, Cape Air and Emirates, Qatar Airways

and TAM Airlines, Virgin Atlantic, Icelandair, Japan Airlines, Jet Airways, Hawaiian Airlines,

Korean Air and Singapore Airlines, Silver Airways.

JetBlue Airways continues to maintain one of the best liquidity positions in the U.S. airline

industry. The company’s balance sheet is healthy with manageable debt maturities and capital

commitments. This solid liquidity position will allow the company to generate accretive return on

invested capital.

JetBlue has also signed a deal with Airbus for the purchase of 110 ship-sets of Sharklets to be

retrofitted at the in-service A320 aircraft, leading to lower fuel consumption.

The company has hedged approximately 17% of its projected fuel requirements for full-year 2015

using a combination of collars, crude call options and jet fuel swaps. For 2015, the company

forecasts aircraft capital expenditures of approximately $820–870 million and non-aircraft capital

expenditures of around $150–200 million.

JetBlue does not pay any dividend on its stock.

General Outlook

The firms believe that JetBlue will continue to benefit from its low-cost structure and improving travel

demand that bode well in the present economy. They remain encouraged by JetBlue’s expansion into new

and untapped markets in Boston and the Caribbean. Further, growing partnerships, cost control measures,

enhancing ancillary revenue opportunities and robust liquidity profile are expected to serve as long-term

beneficiaries to the company’s growth.

Nov 19, 2015

Overview

Based in Forest Hills, NY, JetBlue Airways Corp. is a low-fare passenger airline providing high-quality

customer service. It provides high-quality customer service featuring all-leather seats and live satellite

television (offering up to 36 channels of DIRECTV programming) in every seatback. Through its wholly

owned subsidiary, LiveTV, LLC, the company provides in-flight entertainment systems for commercial

aircraft, including live in-seat satellite television, digital satellite radio, wireless aircraft data link service, and

cabin surveillance systems. JetBlue Airways operates a mixed fleet of Airbus and Embraer aircraft. Most of

the company’s flights have an origin or destination point in one of its focus cities: Boston, Fort Lauderdale,

Los Angeles/Long Beach, New York/John F. Kennedy International Airport (JFK), or Orlando.

Zacks Investment Research

Page 3

www.zackspro.com

Brokerage firms identified the following factors for evaluating the investment merits of JBLU:

Key Positive Arguments

Strong Fundamentals:

Efficient aircraft

utilization with A320 and E190 aircraft providing

capacity flexibility, revamping fare structure and

renewed focus on operational improvements

create a healthy platform for the company’s

growth.

Growth Opportunities: Emphasis on increasing

medium and short-haul flights with large

passenger base and high fares from the Boston–

New York market, availability of new gates at JFK,

capacity reduction by Delta and the return to

profitability initiative, present growth opportunities.

Competitive Position: Being a leading low-cost

carrier with a growing network presence, JBLU

has several competitive advantages.

Non-Union Status A Huge Advantage: As one

of the only non-union airlines in the industry,

productivity opportunities exist at JBLU that

cannot be contemplated at its unionized peers. A

cooperative workforce gives management the

flexibility to manage its cost structure.

Falling Fuel Prices: Fuel costs account for a

major chunk of an airline company's operating

expenses. Expectations of persistent decline in oil

prices should drive the company’s bottom line.

Key Negative Arguments

Competitive Threats: JBLU faces significant

competition with respect to routes, services, and

fares as well as at its hub airports. The company

competes with various domestic as well as

international carriers for passengers traveling within

U.S. as well as between foreign points.

Macro Factors: Weather issues, terrorist attacks,

economic slowdown and industry regulations tend

to pose hurdles in the company’s growth trajectory.

Technology Changes: JetBlue Airways is

dependent on automated systems and latest

technology to run its business, enhance customer

service and achieve low operating costs. These

require upgrades or replacements periodically,

which involve implementation and other operational

risks.

Further information on the company is available at its website: http://www.jetblue.com.

Note: JetBlue Airways’s fiscal year references coincide with the calendar year.

Nov 19, 2015

Long-Term Growth

JetBlue remains committed to deliver excellent customer service coupled with industry leading products, for

long-term sustainable growth. The company will benefit from rising demand, schedule optimization, cost

control, optimization of unit revenues, managed capital expenditures and disciplined growth. JetBlue is the

only non-unionized airline in the industry with the flexibility to manage its cost structure.

On Jun 30, 2015, the company introduced the fare options platform to drive revenues through first-bag

fees. This service will allow customers to choose between three fare bundle options, namely, Blue, Blue

Plus and Blue Flex. Fare options, regardless of the ticket price, will levy reduced charges on customers for

making changes in flight bookings.

With a low cost structure, the company continues to successfully expand its network footprint in major

growth regions like New York, Boston, Fort Lauderdale and the Caribbean. The company has won bids to

purchase takeoff and landing slots at Reagan National Airport (DCA) in Washington as part of the mega

Zacks Investment Research

Page 4

www.zackspro.com

merger deal between American and U.S. Airways. The slot wins will allow the carrier to expand its

operations to and from Washington. For the coming years, the company expects several Latin American

and Caribbean markets to drive growth as those countries have remained underserved by other carriers.

JetBlue currently serves 25 different countries in the Caribbean and expects almost one-third of its total

network to come from the Caribbean and Latin American market.

Airline partnerships are integral to JetBlue’s growth prospects. The carrier remains focused on partnering

(codeshare, interline and baggage handling agreements) with both legacy and international carriers to

enhance its services and take advantage of travel benefits. The company has collaborations with several

international companies including Cathay Pacific, Air China, the LOT Polish Airlines, Turkish Airlines,

Japan Airlines, Emirates, Etihad, Hawaiian Airlines, Aer Lingus and Korean Air.

JetBlue has also struck a one-way codeshare agreement with Qatar Airways and Etihad Airways. Further,

JetBlue and Emirates extended their ongoing three-year partnership by including bilateral code sharing.

JetBlue also entered into a bilateral code sharing pact with South African Airways. Per the agreement, both

the airlines will interlink their networks through New York's John F. Kennedy International Airport and

Washington's Dulles International Airport. In addition, the company’s recent agreement with British Airways

will incorporate 18 daily transcontinental flights, covering more than 50 routes within the U.S. and over 100

destinations beyond London. Thus, the firms are of the view that such alliances would attract travelers with

the promise of efficient service, wider networks, shorter routes and convenient travel timings.

JetBlue has also taken several steps to maximize the cost efficiency of its fleet that will eventually lower

maintenance expenses to a certain extent. The company is either disposing off old aircraft or replacing

old spare engines with new ones. During Oct 2013, the carrier converted its existing 18 A320 orders to

A321’s and ordered 15 new A321 planes to be delivered during 2015–17. In addition, 20 A321 neo aircraft

are scheduled for delivery during 2018–20. The company is expected to purchase 3 Airbus A320, 48

Airbus A321, 30 Airbus A320 neo, 30 Airbus A321 neo, 24 EMBRAER E190 and 10 spare engines through

2022.

Notably, JetBlue announced late in 2014 that it intends to increase the capacity of its Airbus A320 planes

by 15 seats to 165. The modifications, which will commence in the third quarter of 2016, will take

approximately two years to be completed. As a result of the decision to introduce extra seats, JetBlue

projects its operating income to increase by $100 million annually. Annual operating income of the carrier

should rise by $150 million as a result of its other initiatives. JetBlue stated further that 18 Airbus jets will

now be delivered between 2022 and 2023. The jets were earlier scheduled to be delivered between 2016

and 2018. Consequently, capital spending at JetBlue will be reduced by more than $900 million through

2017.

Nov 19, 2015

Zacks Investment Research

Page 5

www.zackspro.com

Target Price/Valuation

Provided below is a summary of valuation/target price:

Rating Distribution

Positive

58.3%↓

Neutral

41.7%↑

Negative

0.0%

Avg. Target Price

$28.75↑

Max. Target Price

$32.00↑

Min. Target Price

$18.00

No. of Analysts with Target Price/Total

10/12

Recent Events

On Nov 11, 2015, JetBlue reported strong improvement in October traffic. Traffic – measured in revenue

passenger miles (RPMs) – came in at 3.35 billion, up 11.8%. On a year-over-year basis, consolidated

capacity (or available seat miles/ASMs) increased 11.1% to 4 billion.

On Oct 27, 2015, JetBlue announced 3Q15 EPS of $0.58 against $0.24 in 3Q14. The reported EPS also

surpassed the Zacks Consensus Estimate by a penny. Total operating revenue grew 10.4% year over year

to $1,687 million, also outpaced the consensus mark of $1,682 million.

Revenues

Total revenue grew 10.1% year over year to $1,687 million in 3Q15 backed by 9.7% growth in passenger

revenues.

Revenue passenger miles (RPM) in 3Q15 rose 9.2% year over year to 11.06 billion on the back

of a capacity increase of 10.4%. This translated into a load factor of 85.3% which reflects a

decrease of 90 basis points year over year.

Yield per passenger mile inched up 0.5% year over year in the reported quarter. Meanwhile,

passenger revenue per available seat mile (PRASM) dropped 0.6% while operating revenue

per available seat mile remained flat year over year.

Zacks Investment Research

Page 6

www.zackspro.com

Outlook

Management projects capacity increase of 8.5%–10.5% for the fourth quarter of 2015 and 8.5%–9.5% in

2015. The company is focused on achieving long-term sustainable growth by expanding its network,

improving operational performance by maintaining a competitive cost structure and offering a safe and

reliable service.

JetBlue is constantly striving to expand its operations. In keeping with its expansion motive, the carrier

announced in Feb 2015 that it will introduce nonstop flights (twice a day) from Baltimore to Fort

Lauderdale, FL. JetBlue intends to launch the new service from November this year. Moreover, the carrier

also announced nonstop flights (twice a week) between New York's John F. Kennedy (JFK) International

Airport and Grenada's Maurice Bishop International Airport from Jun 11, 2015. Through this move, JetBlue

aims to enhance customer satisfaction and attract more fliers, thus boosting its top line.

Also, in Fort Lauderdale-Hollywood, the company continues to execute its profitable growth strategy with

expanding service to both domestic and international destinations. JetBlue has also decided to charge bag

fees and squeeze seats in a bid to boost revenues. Further, it expects the fare options platform to

considerably boost the top line going forward.

JetBlue is thus successfully expanding its products and services on board and on the ground to aid growth

in ancillary revenues along with enhanced flexibility in ticket pricing. Also, JetBlue expects to generate solid

revenues owing to the strong demand for Mint − its premium service offering on the busy New York–Los

Angeles route. In Jun 2015, the carrier decided to expand its Mint-based flight service across the New

York's JFK Airport to Los Angeles International Airport (LAX) and San Francisco International Airport (SFO)

route. The firms believe that the increasing popularity of its Mint-based service will drive revenues for the

company, moving ahead. Also, these firms opine that Mint’s attractive fare pricing is expected to provide

JetBlue an edge over some legacy carriers. However, divestment of its in-flight entertainment subsidiary,

LiveTV, might reduce the carrier’s revenues from the Other segment.

JetBlue’s industry leading high-speed broadband Wi-Fi product, Fly-Fi, is now available in all A321 aircraft

and in 90% of the company’s A320s. Additionally, the company expects the entire A320 fleet to be

equipped with Fly-Fi by the end of 3Q15. Further, it will begin Fly-Fi installation on the E190 fleet this fall

and will cover its entire fleet with the service by 2016. Meanwhile, partnerships with the likes of Amazon

and Major League Baseball should bolster the product portfolio of the company.

Thus, along with Mint, the Fly-Fi service should also fuel demand for its luxury seats, particularly in the

long-haul markets. However, the firms remain skeptical about the product’s success if it becomes a paid

service and believe that the carrier could eventually tie up with digital companies to sponsor the product.

Apart from offering service in Orlando, Fort Lauderdale and Boston within the domestic market, JetBlue

has launched three new routes from Ronald Reagan National Airport (DCA) to Fort Myers (RSW),

Jacksonville (JAX) and West Palm Beach (PBI) in the Floridian market. In 2014, JetBlue significantly

enhanced its Washington, D.C. operations by adding a total of six routes and also increasing flights to

existing destinations. Hence, its increased flight frequencies coupled with low fares should not only

enhance travelling options for Washington travelers but should also boost passenger revenue for the

carrier, going forward

JetBlue is banking heavily on the new services offered from Fort Lauderdale to different locations in North

America, the Caribbean and Latin America. The company’s plan is supported by a significant investment

from the Broward County Aviation Department, including a new 8,000 foot runway which opened in Sep

2014. Further, the carrier introduced new twice-weekly flights to the Caribbean city, Curaçao. The analyst

Zacks Investment Research

Page 7

www.zackspro.com

believe adding such new routes will help enhance JetBlue’s growth and strengthen its network against

other group members

The analysts also specifically believe that there exists a lot of potential for expansion of operations in Latin

America and the Caribbean and the carrier remains committed to growing its presence and building its

momentum across the aforementioned markets. The carrier’s investment in Boston is also paying off well.

Going forward, the company expects to add new routes from Boston. JetBlue believes targeted growth is

critical for its plan to improve financial returns over the long term as demonstrated by the company’s

success in growing capacity while also improving margins in Boston, San Juan and Fort Lauderdale.

Margins

Operating income in 3Q15 came in at $351 million, up 114% year over year. Operating margin stood at

20.8% in 3Q15 compared with 10.7% in 3Q14.

Total operating expenses in 3Q15 decreased 2% year over year to $1,336 million, primarily due to higher

aircraft fuel and related taxes.

JetBlue’s operating unit cost or cost per available seat mile (CASM) decreased 11.2% year over year.

Excluding fuel and profit sharing, CASM increased 2.4% from 3Q14.

Outlook

For 4Q15, the company expects CASM, excluding fuel and profit sharing, to increase in the range of 0 to

2% from the year-ago quarter level. Excluding fuel and profit sharing, CASM, for full-year 2015 is estimated

to rise in the band of 0 to 1.5%.

Management remains committed to improve its margins in 2015 backed by cost control measures,

maximization of revenues, low fuel costs and a strong balance sheet. The firms expect strong demand for

Mint to significantly improve transcontinental margin performance. Also, they expect management’s

increased focus on product monetizing to boost margins.

Moreover, they expect the fare options platform to generate at least $65 million in incremental operating

income in 2015 and over $200 million annually by the end of 2017. However, JetBlue expects competitive

capacity pressure in various areas of its network which may hurt margin opportunities from time to time.

The carrier is in its early stage of operational reliability improvement that should help reduce costs. The

firms anticipate various cost-control measures undertaken by the company to boost its bottom line as well.

However, the carrier has approved a 20% pay hike for the next three years to maintain its competitiveness

with respect to pilot pay packages. The firms thus believe that increase in pilot compensation will likely

affect the company’s cost going forward. Additionally, higher depreciation costs due to increased IT

infrastructure spending and higher landing fees could drag margins down. Also, the analysts anticipate that

non fuel operating expenses like maintenance costs might drive costs higher in 2015.

Zacks Investment Research

Page 8

www.zackspro.com

Earnings per Share

In 3Q15, JetBlue reported EPS of $0.58 compared with $0.24 in 3Q14.

Outlook

Management continues to expect year-over-year Return on Invested Capital (ROIC) improvement and

have set a three-year goal of improving ROIC to more than 10%. Low fuel prices should continue to boost

the bottom-line going forward. Average fuel cost in 3Q15 declined 39% to $1.85 per gallon. The carrier

projects fuel costs at $1.77 per gallon (inclusive of fuel hedges and fuel taxes) in 4Q15.

The company’s cost control measures should also boost the bottom line going forward. In addition, most

firms believe that strong demand for its premium service offering, Mint, should meaningfully contribute to

JetBlue’s earnings.

On the other hand, the analysts remain skeptical about increased maintenance costs coupled with high

fixed expenses and stiff price competition may affect the bottom line.

Aug 26, 2015

Research Analyst

Anirban Halder

Copy Editor

Parijat Sen

Last updated by

Anjali Hirawat

Reason for Report

Earnings

Zacks Investment Research

Page 9

www.zackspro.com