Shipping instructions for AMPAC-ISP UK LAE

LOCKHEED MARTIN SPACE SYSTEMS COMPANY

SHIPPING INSTRUCTIONS

FOREIGN PURCHASES

INSTRUCTIONS TO SELLER:

Delivery is FCA (named place), in accordance with INCOTERMS 2000, unless specified otherwise in the Alterations and Special Provisions section or the Header Text in a purchase order. Seller to arrange and pay for the pre-carriage in the country of export. Carrier is Buyer’s choice.

Note: Seller must ship via the carrier specified by Lockheed Martin since title passes on delivery thereto, and

Lockheed Martin is responsible for freight charges, transit risk, United States Customs entry, duty, and charges thereafter. Unless otherwise directed, consign shipments to LOCKHEED MARTIN SPACE SYSTEMS

COMPANY.

SPECIAL NOTICE

AT TIME OF EACH SHIPMENT, SELLER SHALL IMMEDIATELY FACSIMILE TRANSMISSION OR EMAIL A COPY

OF THE AIR WAYBILL OR BILL OF LADING AND COMMERCIAL INVOICE FOR REVIEW TO THE LOCKHEED

MARTIN BUYER. THE DOCUMENTS SHOULD BE FAXED TO ______________________ OR EMAIL

________________________. NO SHIPMENTS SHALL TAKE PLACE WITHOUT THE PRIOR APPROVAL FROM

THE LOCKHEED MARTIN BUYER.

A. SHIPPING METHOD

1.

Please use the following Freight Forwarder:

(Buyer to identify Freight Forwarder information obtained from Traffic)

2.

The Foreign Seller shall complete the shipping paperwork and documentation as follows:

Consignee section of the Carrier Air Waybill/Bill of Lading and Commercial Invoice:

(Buyer to identify “Ship To” Address)

Forwarder/Agent/Notify Party section of the Carrier Air Waybill/Bill of Lading/Broker Select

Option (This section must be completed. It is the carrier’s instruction by the Seller to submit the Air

Waybill, Bill of Lading and all shipping documentation to the approved Lockheed Martin Customs Broker upon entry into the United States for proper U.S. Customs clearance):

(Buyer to identify LM Broker information obtained from Traffic)

SHP-001 (03/07)

Page 1 of 9

B. COMMERCIAL INVOICE REQUIREMENTS

1.

All shipments must be accompanied by a commercial invoice. Each commercial invoice for imported merchandise must be in English and contain the following information, as applicable to the shipment, for prompt U.S. Customs Clearance. a.

Buyer and Seller as defined on the purchase order. b.

Purchase Order number. c.

A detailed description of the merchandise, including i.

Full name by which each item is known. ii.

Part number as it appears on the purchase order. d.

Value of each item as identified in the purchase order. e.

All additional charges not included in the purchase price (e.g., assists, freight, insurance, export charges, etc.) f.

Quantities, weights, and measures. i.

Record the quantity of each part number in the shipment. ii.

If not separately noted on packing sheets, include on the invoice

1.

Total quantity of parts being shipped

2.

Net weight of each part number and gross weight of entire shipment.

3.

Unit of measure being used.

4.

Total number of boxes included on each packing sheet. g.

Country of Origin of each item. h.

The U.S. Port of Entry indicating the U.S. port where the merchandise is destined. i.

Harmonized Tariff Schedule (HTS) number of each item. j.

If applicable, reference the Lockheed Martin Program Name. k.

If applicable, reference the U.S. Government prime contract number for duty-free entry. l.

If applicable, reference the U.S. Department of State license or exemption information: i.

This shipment is being imported in accordance with and under the authority of 22 CFR

____________ ii.

Temporary Import License Number DSP-61 _____________ iii.

Originally exported under Temporary Export License Number DSP-73 __________

2.

Commercial Invoice Valuation Requirements a.

Ensure that the requirements are complete and accurate, including the unit cost of each part and the total value of the entire shipment. b.

Reflect on the invoice the actual currency of the purchase order. c.

List separately any Assists and/or additional costs in manufacturing each part. For example i.

Assists. Any components, materials, dies, molds, and tools that are supplied by the

Buyer free of charge or at a reduced cost to the Seller and used in the production of imported goods, including any Buyer-paid transportation costs associated with the assist.

These transportation costs will be provided by the Buyer responsible for this merchandise. ii.

Engineering and design work. Work that is performed outside the United States by non-

U.S. employees and is not included in the unit price of the merchandise being imported. iii.

Packing costs. Costs for packing that are incurred by the Buyer and have not been included in the unit cost. iv.

Nonrecurring charges. One time charges, incurred by the Buyer, for such items as expedite fees and transportation costs that have not been included in the unit cost. v.

Selling Commissions. Commissions incurred by Buyer that have not been included in the unit cost. vi.

Royalties. Fees the Buyer is required to pay as a condition of sale. d.

List all discounts that have been agreed to, or may be allowed, that apply to the purchase price or value but that have not been included in the unit price (terms of payment).

SHP-001 (03/07)

Page 2 of 9

C. SELLER ADDITIONAL REQUIREMENTS:

1.

When the Foreign Seller is furnishing merchandise at no charge, please note that a value for customs purposes must be shown on seller’s commercial invoices as U.S. Customs does not recognize merchandise imported with no assigned value. The value declared must be an accurate representation of the actual value/fair market value of the item (See also Repaired Merchandise).

2.

Country of Origin

Any merchandise eligible for duty-free entry under a U.S. Free Trade Agreement should include the appropriate document that certifies origin and free trade act eligibility. Shipments from Canada and Mexico may be eligible for duty-free entry.

(See URL: https://forms.customs.gov/customsrf/getformharness.asp?formName=cf-434-form.xft

for an example of “North American Free Trade Agreement Certificate of Origin form”).

3.

Country of Origin Markings

Seller shall identify each item or component with markings designating the Country of Origin (country of manufacture). Every article imported into the United States is required to be individually marked with its country of origin (manufacture). The marking must be legible, indelible, and permanent, as the nature of the article or container will permit. The marking must be conspicuous, i.e., easily readable and visible upon casual inspection.

When an article is exempt from direct marking, the outer carton, box or packaging MUST be marked with the correct country of origin (manufacture) of the contents.

4.

Temporary Exports from the U.S.

Any defense article temporarily exported on a DSP-73 temporary export license (e.g., tooling or items to be repaired) must be returned to the U.S. prior to the license expiration date. At the time of re-import to the

U.S., the applicable license number and the original value as indicated at the time of export from the U.S. must be clearly indicated on the supplier’s invoice in order to close out the license entry.

5.

Temporary Imports to the U.S.

Any defense article that will be temporarily imported and returned to the origin country (or to another country) will require an unexpired DSP-61 temporary import license or appropriate ITAR exemption. At the time of import, the applicable license or exemption number must be clearly indicated on the supplier’s invoice.

6.

Military Duty-Free Entry

Buyer will notify Seller in the event shipment is entitled to military duty-free entry. If Seller is advised military duty-free entry applies: a.

Seller shall consign the shipment to the following military department in care of contractor

Lockheed Martin, including Lockheed Martin’s delivery address:

DCMA

Defense Contract Management Agency c/o (Buyer to Insert LM “Ship to” Address) b.

All seller documents, including bills of lading and air waybills, shall bear the following: i.

Government prime contract number and delivery order number, if applicable ii.

Purchase Order or Subcontract Number iii.

Identification of carrier iv.

The notation: "United States Government, Department Of Defense, Duty-Free Entry to be claimed pursuant to Section XXII, Chapter 98, Subchapter VIII Item 9808.00.3000 of the

SHP-001 (03/07)

Page 3 of 9

Harmonized Tariff Schedule of the United States. Upon arrival of shipment at port of entry, District Director of Customs, release shipment under 19 CFR Part 142 and notify

Commander, Defense Contractor Management Agency (DCMA) New York, ATTN:

Customs Team, 207 New York Avenue, Staten Island, NY 10305-5013 for execution of

Customs Forms 7501 and 7501-A and any required duty-free entry certificates.” v.

Gross weight in pounds (if freight is based on space tonnage, state cubic feet in addition to gross shipping weight) vi.

Estimated value in U.S. dollars

Seller must follow the procedure outlined for annotation and supply of the documents. Failure to do so will establish liability for debit of any customs duty required on entry through U.S.

Customs.

7. Repaired Merchandise

When the Foreign Seller is returning merchandise after repair, the following information must be included on the invoice: a.

Original value as indicated at the time of export from the U.S. This value can be found on the export documentation (export document or Export Declaration). b.

Value of repairs done. This must be an accurate value of material and labor provided, or in the case of non-warranty repair, the amount that will be billed to Lockheed Martin. If repairs were completed under warranty and there is no charge billed to Lockheed Martin for the repairs, then the

Seller shall include an estimate of the fair market value of the repairs. c.

An indication as to whether the repairs were conducted as Warranty or Non-warranty. d.

DSP-73 license number as indicated on the U.S. Export documentation. e.

A declaration from the Foreign Shipper performing declared repairs or alterations (See attached

“Foreign Shipper’s Declaration for Repaired Merchandise” form).

8. U.S. Goods Returned Without Any Improvements

When the Foreign Seller is returning unaltered U.S. merchandise, a declaration by the Foreign Shipper is required to import the items duty-free (See attached “Foreign Shipper’s Declaration for U.S. Goods

Returned” form).

9. U.S. Goods Returned for Repair; To Be Re-Exported

In the event the Foreign Seller finds it necessary to return U.S. made goods to the U.S. for repair, the following items are required prior to shipment: a.

Foreign Shipper’s Declaration (to be provided by Foreign Seller) b.

Commercial/Pro-Forma Invoice (to be provided by Foreign Seller)

NOTE: Foreign Seller shall be directed to put the following verbiage on all return shipping documentation but in particular on their Commercial/Pro-Forma invoice: i.

If Commerce: “This shipment is being imported in accordance with and under the authority of the Export Administration Regulations, RPL” - OR - ii.

If State: “This shipment is being imported in accordance with and under the authority of [

22 CFR 123.4(a)(1) or DSP-61 # _____] iii.

“HTS 9801.00.1012 – US good returned for repair, alteration, processing; to be reexported” c. Manufacturer’s Affidavit (to be completed by Lockheed Martin) d. Importer’s Declaration (to be completed by Lockheed Martin)

Buyer will not authorize the return shipment until such time that all documentation has been received and approved.

SHP-001 (03/07)

Page 4 of 9

FORMS:

The following documents are included in this package and must be completed by the Foreign Seller as identified in Section C.7 or C.8 above.

Document Purpose

Foreign Shipper's Declaration for Repaired Merchandise Use to identify to Customs and Border Protection (CBP) items that were exported from the US for repair and return

(imported into the US)

Foreign Shipper’s Declaration for U.S. Goods Returned Use to identify to CBP U.S. origin items returned from

Foreign Seller

SHP-001 (03/07)

Page 5 of 9

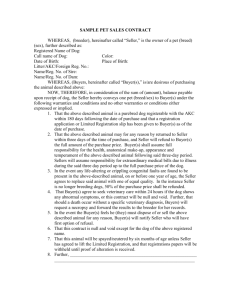

FOREIGN SHIPPER’S DECLARATION

FOR REPAIRED MERCHANDISE

19 CFR §10.8(a)(1)

I, ___________________________________, declare that the articles herein specified are the articles which, in the condition in which they were exported from the United States, were received by me (us) on _____________________, 200_, from Lockheed Martin Space Systems Company,

_________________________________, USA; that they were received by me (us) for the sole purpose of being repaired or altered; that only the repairs or alterations described below were performed by me (us); that such repairs or alterations were (were not) performed pursuant to a warranty; that the full cost or (when no charge is made) value of the such repairs or alterations are correctly stated below; and that no substitution whatever has been made to replace any of the articles originally received by me (us) from the owner or exporter mentioned above.

Marks and numbers Description of articles and of repairs or

alterations

Full cost or (when no charge is made) estimate of the fair market value of repairs

or alteration

Total value of articles after repairs or

alterations

____________________________________________________

Date

____________________________________________________

Address

____________________________________________________

Signature

____________________________________________________

Capacity

SHP-001 (03/07)

Page 6 of 9

FOREIGN SHIPPER’S DECLARATION

FOR U.S. GOODS RETURNED

19 CFR §10.1(a)(1)

I, ___________________________________, declare that to the best of my knowledge and belief the articles herein specified were exported from the United States, from the port of _____________ on or about __________________, 200_, and that they are being returned without having been advanced in value or improved in condition by any process of manufacture or other means.

Marks Number Quantity Description Value, in U.S.

Dollars

____________________________________________________

Date

____________________________________________________

Address

____________________________________________________

Signature

____________________________________________________

Capacity

SHP-001 (03/07)

Page 7 of 9

SHIPPING INSTRUCTIONS - FOREIGN PURCHASES --- Buyer Instructions for Use

Purpose: This document is used by Buyers to provide the Foreign Seller with appropriate shipping instructions for the foreign shipment of deliverable items to a Lockheed Martin facility. Buyers are to incorporate the completed document in purchase orders with foreign sellers involving deliverables to Lockheed Martin from a foreign source.

These instructions will ensure that the entry of the imported item(s) is properly authorized and compliant with U.S. export, import, and Customs regulations.

DELIVERY IS FCA (named place):

FCA means “Free Carrier” and is the INCOTERM identified in the CORP DOCS Terms & Conditions. FCA requires the

Seller to deliver the goods, cleared for export, to the carrier identified by the Buyer at the named place. FCA

INCOTERM requires the Buyer to identify the named place where the carrier operates in which the Foreign Seller is to arrange for pre-carriage of the shipment (e.g., FCA Seller’s Plant or FCA Ottawa, Ontario).

If Buyer negotiates a delivery term other than FCA, the shipping instructions will need to be modified accordingly to identify the Buyer and Seller responsibility regarding the delivery of the item(s). Buyer should contact Lockheed

Martin Traffic for guidance.

If the INCOTERM negotiated is EXW (Ex Works), FAS (Free Alongside Ship), FOB (Free Onboard Vessel), CFR

(Cost & Freight), CIF (Cost, Insurance & Freight), CPT (Carriage Paid To), CIP (Carriage & Insurance Paid To),

DAF (Delivered at Frontier), DES (Delivered Ex Ship), or DDU (Delivered Duty-Unpaid) in which LM will be the

Importer of Record for the merchandise, the Buyer must indicate to the Seller to use an LMC approved Freight

Forwarder and/or Broker designated by LM Traffic.

Special Notice:

Buyer should insert the appropriate Buyer fax number and email address for the Seller to send a copy of the air waybill or bill of lading and commercial invoice. The prior notification requirement allows the Buyer to complete the necessary

Import Notification Form and obtain prior approval from ILCO and Traffic prior to the Seller shipping the item(s).

SHIPPING METHOD:

Buyer should contact LM Traffic to obtain the applicable LMC-approved Freight Forwarder and Broker information.

Buyer to also identify the applicable “Ship To” Address for the Seller to ship the items.

COMMERCIAL INVOICE REQUIREMENTS:

The commercial invoice needs to include the items listed in a.-i. For item k, Buyer should contact ILCO for the applicable ITAR exemption reference, Temporary Import License Number or Temporary Export License Number.

COMMERCIAL INVOICE VALUATION REQUIREMENTS:

Having the proper declared value of the merchandise to Customs & Border Protection (CBP) is critical. The CBP value may be different from the per unit costs because value reflects per unit costs plus additions included in item 2.c.

SELLER ADDITIONAL REQUIREMENTS:

Country of Origin:

Note that the country of origin is not always the same as the Port of Exit. The manufacturer or purchaser must specify the Country of Origin.

Military Duty-Free Entry:

Applicable only if DFARS clause 252.225-7013, Duty Free, is in the prime contract and the requirements called out in the DFARS clause are met. Buyer to coordinate request for duty-free entry with LM Contracts so that proper notification is forwarded by the appropriate Administrative Contracting Office to DCMA New York. The duty-free entry notification must be on file at DCMA New York prior to the import shipment of the item(s). If duty-free entry applies,

Buyer to notify Seller that the shipment is entitled to military duty-free entry. Buyer to insert the LM Ship To Address.

The commercial invoice must show that the shipment is consigned to a U.S. Government agency (e.g., DCMA), in care of Lockheed Martin.

SHP-001 (03/07)

Page 8 of 9

U.S. Goods Returned for Repair; To Be Re-Exported:

Buyer should contact ILCO for the applicable language (listed under i., ii., or iii) for the Foreign Seller to include on all return shipping documentation and the commercial invoice.

FORMS:

Foreign Shipper’s Declaration for Repaired Merchandise and Foreign Shipper’s Declaration for U.S. Goods

Returned Forms: The forms must be completed by the Foreign Seller as identified in Section C.7 or C.8. Buyer should contact ILCO if they need guidance on the applicability of these forms to their purchase order transaction.

SHP-001 (03/07)

Page 9 of 9