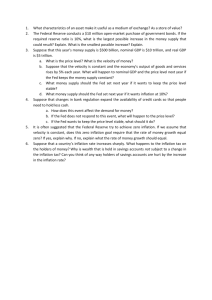

exercises for microeconomics

advertisement