Unit Two - Faculty

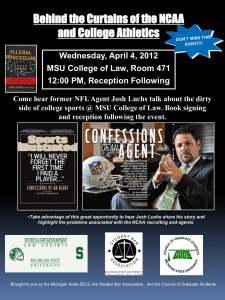

advertisement