Case 1

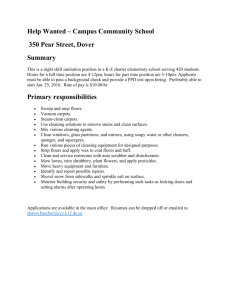

advertisement