Insurance Law

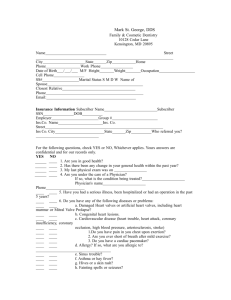

advertisement