BSc Accounting and Financial Management

advertisement

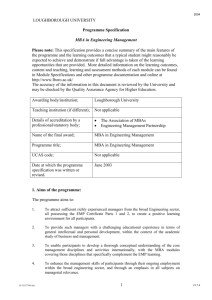

BSUB10 2010 LOUGHBOROUGH UNIVERSITY Programme Specification BSc (Hons) Accounting and Financial Management Please Note: This specification provides a concise summary of the main features of the programme and the learning outcomes that a typical student might reasonably expect to achieve and demonstrate if full advantage is taken of the learning opportunities that are provided. The accuracy of the information in this document is reviewed by the University and may be checked by the Quality Assurance Agency for Higher Education. Awarding body/institution Details of accreditation by professional bodies Name of the final awards Programme title UCAS code Date at which the programme specification was written or revised 1. Loughborough University The programme is accredited by some accounting bodies1 BSc (Hons) and DPS Accounting and Financial Management NN34 July 2009 Aims of the Programme 1. 2. 3. 4. 5. 6. 7. 8. The programme aims to: produce high quality graduates with the knowledge, skills and understanding for an effective and valued career in the accounting and financial management professions or more general management situations; develop knowledge, concepts and skills in the major academic disciplines of business and management, as well as accounting and financial management subjects, as a sound basis for practice, study and training in the graduate’s chosen profession; enable students to develop a deep understanding in areas of particular interest by pursuing them over an extended period and in considerable depth; provide a relevant, practical and constantly updated programme through close links with industry, professional firms and accounting bodies, through vocational experience in a professional placement and through accreditation by the major professional accounting bodies1; provide students with the opportunity to see ways in which theory can be applied in practice, both through taught content and through individual experience on professional placement; to develop teaching and learning in response to advances in scholarship and the needs of the business community; enhance the employability of our graduates; to attract well-qualified students from a variety of educational backgrounds; 1 Exemptions from some professional accounting examinations may be available from: The Association of Chartered Certified Accountants (ACCA); The Chartered Institute of Management Accountants (CIMA), The Chartered Institute of Public Finance and Accountancy (CIPFA), The Institute of Chartered Accountants in England and Wales (ICAEW) and the Institute of Chartered Accountants of Scotland (ICAS). D:\533570353.doc 1 09.06.10 BSUB10 2010 9. to encourage in our students hard work, enthusiasm and self-motivation, a positive attitude to change, a desire for excellence, a visionary and positive approach to future developments and an openness to new ideas. The Business School at Loughborough University is distinctive amongst 'traditional' university business schools in incorporating a third year spent on professional placement. This is an integral element of the programme and something which we believe is of particular benefit in achieving these aims and offers graduates of our Accounting and Financial Management additional and valuable opportunities to develop their knowledge, understanding and skills. 2. Relevant subject benchmark statements and other external and internal reference points used to inform programme outcomes: 3. Accounting Subject Benchmark Statement The Framework for Higher Education Qualifications Loughborough University Mission Statement Loughborough University Teaching and Learning Strategy Business School Mission Statement and Statement of General Aims for Undergraduate Programmes Requirements of the professional accounting bodies (See footnote 1). Programme Outcomes The programme provides opportunities for students to develop and demonstrate knowledge and understanding, qualities, skills and other attributes in the areas shown in the tables below. These intended learning outcomes are set in the context of the QAA subject benchmark statement for Accounting and those relating directly to this benchmark are marked (A) below. The programme is delivered through a combination of lectures, tutorials, seminars, workshops and practical IT sessions. Each student is assigned a personal tutor who provides advice and guidance on academic progress and study problems. Students are required to work both individually and in groups for both study and assessment. A programme booklet is provided every year to each student, which sets out general advice on study, key regulations on assessment, programme regulations and module specifications for all modules available for study. At the first session for each module, further information is provided in a module outline. This details the specific arrangements for teaching and assessment, the week by week lecture schedule and associated reading guidance. Students progress from descriptive understanding to critical evaluation and synthesis as the programme develops. They are expected to take increasing responsibility for their own learning as they progress through the course. This is reflected in the nature of the modules and the fact that students have more choice of optional modules in their final year, providing an opportunity to pursue areas of particular interest in depth. Constructive criticism is provided to students on coursework assignments and feedback on exam performance is given on request to help students in their academic progress through the course. D:\533570353.doc 2 09.06.10 BSUB10 2010 The specific learning outcomes for the programme are detailed below: Knowledge and understanding 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. On successful completion of this programme, students should be able to demonstrate knowledge and understanding of: Foundational disciplines of management, including economics, business mathematics and statistics; Business organisations in their technological, economic, fiscal, legal and political contexts; The behaviour of people in organisations; The processes of management and decision making; Accounting and financial management in its major contexts, including the legal and social environments, the business entity and capital markets (A) and the integral nature of the accounting function in the successful management of organisations; Current technical language, developments, methods, practices and issues in accounting and financial management; Selected alternative techniques and practices in accounting and financial management (A); Methods of recording and summarising economic events and preparation of financial statements (A); Analytical tools for the effective financial management of business operations (A); Contemporary theories of accounting and financial management and their related research evidence (A); The development, management and exploitation of information systems and their impact on organisations; A range of contemporary issues in management. Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated: Aspects 1 to 4 are acquired in Parts A and B, through a combination of lectures, tutorials, examples classes, workshops, guided reading and private study. These fundamentals are integral to the components of Part C. Opportunities for advancement of in-depth knowledge and understanding of selected aspects also exist in the choice of optional modules available to students. The foundations for 5 to 11 are laid in Part A and continued in Part B through a combination of lectures, tutorials, practical sessions, guided reading and private study. They are taken to more advanced levels in Part C, using a combination of lectures, seminars, guided reading, group work and private study. Choices of optional subjects allow development of aspect 12 in Parts B and C. Testing of the knowledge base is accomplished using a mixture of objective tests, assessed tutorials, computer-based assignments, individual reports and essays, group reports and presentations and unseen examination papers. D:\533570353.doc 3 09.06.10 BSUB10 2010 Skills and other attributes a. Subject specific cognitive skills: On successful completion of this programme, students should be able to: i) Analyse, model and solve structured and unstructured problems (A); ii) Evaluate and assess alternatives in complex scenarios; iii) Gather relevant data and evidence from various sources, integrate them appropriately and reference sources adequately (A); iv) Critically evaluate arguments and evidence (A); Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated: Intellectual skills are developed throughout the teaching and learning programme as outlined above and the Programme Structure shown below. In Part A, this development would normally be expected to relate to the analysis and solution of straightforward situations with a limited number of possible alternatives but including a basic level of discernment as to appropriate data collection and interpretation. This is further developed through Part B, whilst in Part C, students are exposed to complex situations and ways of critically assessing evidence and argument. A combination of lectures, tutorials, seminars, workshops, discussion groups, guided reading and private study are used for these purposes. Assessment of these skills occurs throughout the programme, through a mixture of individual reports and essays, group work and unseen examinations. b. Subject-specific practical skills: On successful completion of this programme, students should be able to: i) Record and summarise transactions and other economic events (A); ii) Prepare financial statements (A); iii) Use appropriate analytical tools for accounting and financial management tasks (A); Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated: Practical skills are developed through the teaching and learning programme outlined above and the Programme Structure shown below. These practical skills are acquired principally during Parts A and B and applied also in Part C. A combination of lectures, tutorials, practical sessions and private study are used to accomplish these. Subject-specific practical skills are assessed using individual and group coursework and unseen examinations. c. Key/transferable skills: On successful completion of this programme, students should be able to: i) Organise themselves personally and independently to be a valued contributor through time management, self-direction, self-motivation, tenacity and proactiveness (B&M); ii) Learn (A) and work independently; iii) Work well in a team, using appropriate skills, including leadership, team-building and project management (B&M); iv) Interpret numerical information, reason numerically and apply appropriate mathematical and statistical techniques (B&M); D:\533570353.doc 4 09.06.10 BSUB10 2010 v) Use communication and information technology appropriately in acquiring, analysing and communicating information (A); vi) Communicate quantitative and qualitative information, analysis, argument and conclusions in appropriate ways (A); vii) Make oral and written presentations appropriate to the audience (A); Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated: Transferable skills are developed throughout the teaching and learning programme outlined above and the Programme Structure shown below. The foundations of skills i) to iii), vi) and vii) are laid specifically in plenary sessions and workshops in Part A. Skills iv) and v) are also introduced in Part A, through lectures, tutorials and practical work. All these skills are cultivated through Parts B and C of the programme. Skills i) and vi) are important aspects of assessment in almost all elements of the programme, whether by coursework or examination. Whilst skill ii) is not formally assessed, it is a necessity in all individually produced assessments. Skill iii) is assessed through group coursework assignments. Skill iv) is assessed throughout the programme by coursework and examination. Skill v) is assessed both specifically and indirectly, primarily using coursework assignments. Skill vii) is assessed primarily by group coursework (oral) and by coursework reports and written examinations. 4. Programme Structure and requirements, levels, modules, credits and awards The programme is a four-year, full-time course of study, with the third year spent on a professional placement. The programme is divided in to units of study called modules, which may be rated as 10 (single) or 20 credits (double). Each Part of the programme comprises 120 credits taken over one year of study, 60 credits in Semester 1 and 60 credits in Semester 2. Each semester lasts 15 weeks, with 11 weeks of teaching followed by revision time and examinations. In Part A (Year 1), students take 120 credits of core modules, of which 30 are specifically accounting-related. The remainder provide the foundational subjects of economics (20 credits) and business mathematics and statistics (30 credits), and related contextual subjects such as law (10 credits), organisational behaviour (10 credits) and information technology (10 credits). Part A also provides the specific opportunity for students to understand and develop key transferable skills (10 credits). Part B (Year 2) further develops students’ knowledge, understanding and skills in specialist and other core areas and provides the opportunity to choose optional 10 credit modules in other business-related areas. Students spend their third year on a professional placement. This is an integral part of the degree programme and on successful completion of the placement and the programme, students will be awarded the Diploma in Professional Studies in addition to their degree. D:\533570353.doc 5 09.06.10 BSUB10 2010 Part C (Year 4) comprises of core modules in advanced accounting subjects and optional subjects, which can be chosen from a wide range of accounting and financial management and other business areas. Full details can be found in the Programme Regulations at: http://www.lboro.ac.uk/admin/ar/lps/progreg/index.htm 5. Criteria for admission to the programme Typical admission requirements for this programme can be found at: http://www.lboro.ac.uk/prospectus/ug/courses/dept/bs/index.htm 6. Information about the programme assessment strategy: Full information about our assessment strategy can be found in section 6 of our comprehensive statement to supplement this programme specification which is available on our web site at: http://www.lboro.ac.uk/departments/bs/ug/progspec-6to9.html 7. What makes the Programme Distinctive The Business School was awarded an ‘Excellent’ grade in its school wide Teaching Quality Assessment. It has also been very highly rated for research in the recent RAE, indicating international excellence in research. The Business School values its undergraduate programmes very highly and excellence in teaching and related support activities amongst its staff is actively encouraged, highly rated and fully rewarded. All Business School Undergraduate Programmes have very high graduate employment levels. 8. Particular support for learning Information about the support offered by the Business School for this programme and the general support offered by the University for all programmes can be found in section 8 of our comprehensive statement to supplement this programme specification which is available on our web site at: http://www.lboro.ac.uk/departments/bs/ug/progspec-6to9.html 9. Methods for evaluating and improving the quality and standards of learning The official University statement about improving quality for all programmes can be found in section 9 of our comprehensive statement to supplement this programme specification which is available on our web site at: http://www.lboro.ac.uk/departments/bs/ug/progspec-6to9.html D:\533570353.doc 6 09.06.10