- LSA

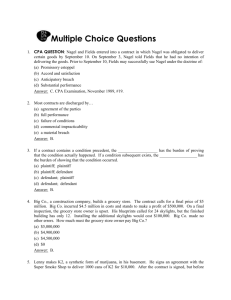

advertisement