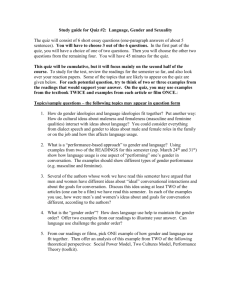

F680-01F99.doc - California State University, San Bernardino

advertisement

CALIFORNIA STATE UNIVERSITY, SAN BERNARDINO Department of Accounting And Finance Finance 680 Financial Strategy Spring 1999 Office Phone : 880 5713 Khan Office: JBH 239 Office Hrs: T Th. 2:30-4:30 SYLLABUS SCOPE: The objective of the course is to explore issues that arise in formulating and implementing corporate financial strategy and policy. Focus will be on current topics in the field with particular emphasis on problems, practices, and innovations that impact on formulation of financial strategy. Issues considered may include information analysis, forecasting, mergers and restructuring, acquisitions, debt capacity, implementation of financial strategy, and social ethical issues. CONTENT AND ORGANIZATION: The course will begin with basic issues and then will move on to confront the more complex and strategic issues. Cases and readings will be used when appropriate. Topics to be covered include strategic analysis of cashflows, consequences of debt and equity financing, design of acquisition programs, assessment of acquisition value, leveraged buyouts, ethical issues of investment policy and strategy. REQUIRED MATERIAL: Case Studies In Finance; Bruner. Irwin, Third Edition The New Corporate Finance: Where Theory Meets Practice: Chew,Jr. Donald, McGraw-Hill, 1998 SUPPLEMENTAL: Lowenstien, Louis. "No more cozy Management Buyouts." Harvard Business Review (Jan/Feb 1986): 147 - 56. Rock, Milton R. The Merger and Acquisition Handbook. New York: McGraw-Hill, 1987. Especially "Discounted Cash Flow Valuation" by Rappaport. Stewart, Bennett G. "Market myths" A Quest for Value: A guide for Senior Management; Harper & Row, 1990 Mergers, Restructuring And Corporate Control; Weston, Chung & Hoag, Prentioce Hall, 1990 Damodaran on Valuation; Damodaran, Wiley, 1996 ASSESSMENTS: Cases Term Paper Quizzes Midterm & Final Examination Class Participation 40% 15% 15% 20% 10% Cases: Cases will be researched and presented by the assigned group in class. While researching the company make sure that you take into consideration economic environment at the time the case was written. After evaluating the case within that context, offer your conclusions. Then comment on what actually happened and what actions were taken by the company. If your conclusion is different than the company’s, comment on why you think they made such a decision. Presentation will be made in professional manner utilizing overheads or power point. No reading of the paper will be allowed. Term Paper: Students will choose a current merger /acquisition /divestiture for analysis. You must consult with the instructor before launching on your research. Quizzes: There will be a quiz each week on the readings assigned for that week. Students will be tested on the substance of the readings rather than regurgitation of the printed matter. General questions pertaining to the case to be presented during the class period will also be included. Final Examination: Case will be used to test the ability of students to evaluate certain concepts learned during the quarter. Class Participation: It is imperative that students read the case and participate in the discussion of the case. STUDENTS NOT TAKING PART IN THE DISCUSSION WILL AUTOMATICALLY LOOSE 10 PERCENT OF THE GRADE. There will be no exception to this rule. In your discussion please refrain from old stories or wasteful comments. You will be asked to shut up if you do so. Finance 680 COURSE OUTLINE September 30 Introduction and Case Assignments October 6 Quiz #1 on Week 1 Readings Massey-Ferguson Ltd. (#1) October 11 Hospital Corporation of America (Case #2) Anheuser-Busch (Case #3) October 13 Quiz #2 on Week 2 Reading Systems Engineering Laboratories, Inc. (Case #4) October 18 Tiffany & Co. - 1993. (Case #5) MCI Communication Inc. (Case #6) October 20 Quiz #3 on Week 111 Reading MSCI - Alchala de Henares, Spain (Case #7) Read Note on Fundamental Parity Conditions Pp.471 October 25 American Chemical Corporation (Case #8) Cooper Industries (Case #8) October 27 Quiz #4 on Week IV Readings Netscape’s IPO (Case #9) November 1 Philip Morris and Kraft (Case #10) RJR Nabisco (11) November 3 Quiz #5 on Week V Readings Time Incorporated (Case #11) November 8 John M. Case (Case #12) RJR Nabisco (Case #13) November 8 Quiz on Week VI Readings Friendly Cards, Inc.(Case #14) November 10 Handout Case - 1 (Case 15) Handout Case - 2 (Case 16) November 15 Quiz on Week VII Readings Handout Case - 3 (Case 17) November 17 Examination Khan November 22 November 24 November 29 December 1 December 6 Quiz on Week VIII Readings Presentation of Individual term project Presentation of Individual term project Presentation of Individual term project Presentation of Individual term project Wrap-up Finance 680 READINGS Khan Text: The New Corporate Finance Week 1 Part IV - Raising Capital #22 - An Overview of Corporate Securities Innovation #26 - The Growing Role of Junk Bonds in Corporate Finance #31 - Seciritization : A Low Cost Sweetener to Lemons Week 11 Raising Capital (contd.) #24 - Are Banks Loans Different #32 - Using Project Finance To Fund Infrastructure Investments Week 111 Part 11 - Capital Budgeting Decisions #9 - Finance Theory & Financial Strategy #11-The EVA Financial Management System Week IV Part VI - Corporate Restructuring #46 - The Corporate Restructuring Of The 1980s - Its Import for The 1990s. #52 - Some New Evidence That Spinoffs Create Value #54 - LBOs - The Evolution of Financial Structures & Strategies Week V Part VI Contd. #47 - The Methods & Motives for Corporate Restructuring Part 1 #48 - " " " “ Part 11 Week VI Part VI Contd. #49 - Reversing Corporate Diversification #51 - Leveraged Recaps And The Curbing Of Corporate Overinvestment Week VII Part V - Risk Management #37 - Identifying, Measuring, And Hedging Currency Risk At Merck #38 - Rethinking Risk Management Week VIII Part 1 - Man & Markets #4 - The Theory of Stock Market Efficiency #5 - Market Myths #6 - An Analysis of Trading Profits: How Trading Rooms Make Money