Chapter 4: Marketing Research and Information Systems

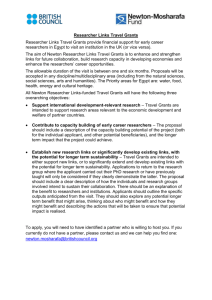

advertisement