Tax-Policy-ROI-Goals-2013-2015-Strategy

advertisement

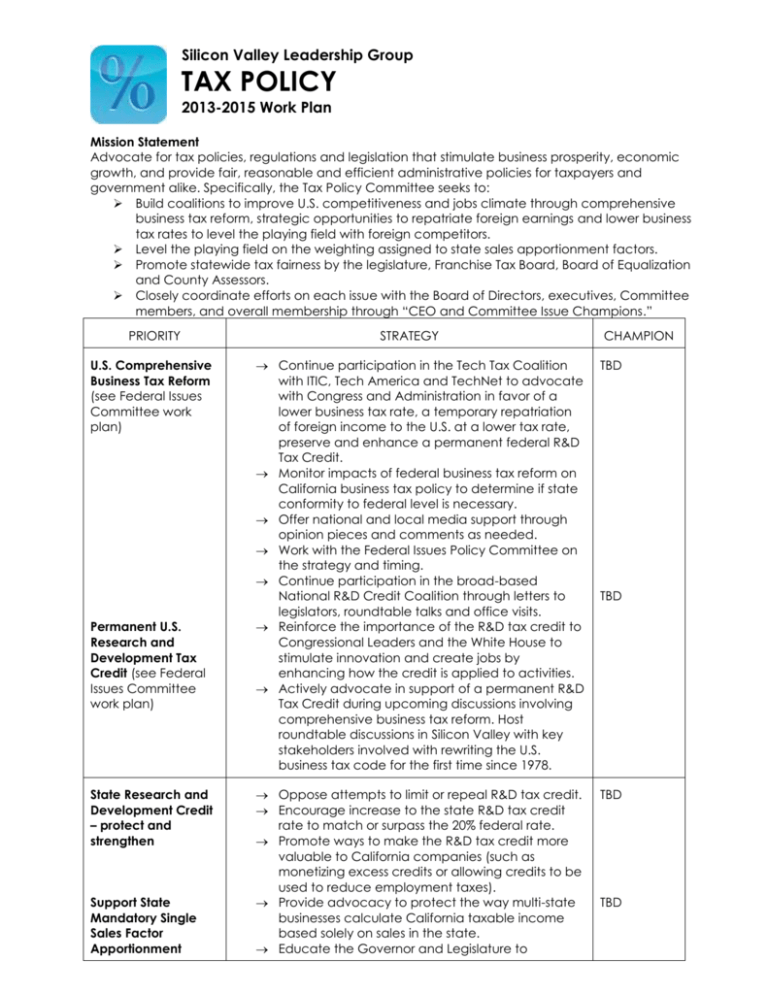

Silicon Valley Leadership Group TAX POLICY 2013-2015 Work Plan Mission Statement Advocate for tax policies, regulations and legislation that stimulate business prosperity, economic growth, and provide fair, reasonable and efficient administrative policies for taxpayers and government alike. Specifically, the Tax Policy Committee seeks to: Build coalitions to improve U.S. competitiveness and jobs climate through comprehensive business tax reform, strategic opportunities to repatriate foreign earnings and lower business tax rates to level the playing field with foreign competitors. Level the playing field on the weighting assigned to state sales apportionment factors. Promote statewide tax fairness by the legislature, Franchise Tax Board, Board of Equalization and County Assessors. Closely coordinate efforts on each issue with the Board of Directors, executives, Committee members, and overall membership through “CEO and Committee Issue Champions.” PRIORITY U.S. Comprehensive Business Tax Reform (see Federal Issues Committee work plan) Permanent U.S. Research and Development Tax Credit (see Federal Issues Committee work plan) State Research and Development Credit – protect and strengthen Support State Mandatory Single Sales Factor Apportionment STRATEGY CHAMPION Continue participation in the Tech Tax Coalition with ITIC, Tech America and TechNet to advocate with Congress and Administration in favor of a lower business tax rate, a temporary repatriation of foreign income to the U.S. at a lower tax rate, preserve and enhance a permanent federal R&D Tax Credit. Monitor impacts of federal business tax reform on California business tax policy to determine if state conformity to federal level is necessary. Offer national and local media support through opinion pieces and comments as needed. Work with the Federal Issues Policy Committee on the strategy and timing. Continue participation in the broad-based National R&D Credit Coalition through letters to legislators, roundtable talks and office visits. Reinforce the importance of the R&D tax credit to Congressional Leaders and the White House to stimulate innovation and create jobs by enhancing how the credit is applied to activities. Actively advocate in support of a permanent R&D Tax Credit during upcoming discussions involving comprehensive business tax reform. Host roundtable discussions in Silicon Valley with key stakeholders involved with rewriting the U.S. business tax code for the first time since 1978. TBD Oppose attempts to limit or repeal R&D tax credit. Encourage increase to the state R&D tax credit rate to match or surpass the 20% federal rate. Promote ways to make the R&D tax credit more valuable to California companies (such as monetizing excess credits or allowing credits to be used to reduce employment taxes). Provide advocacy to protect the way multi-state businesses calculate California taxable income based solely on sales in the state. Educate the Governor and Legislature to TBD TBD TBD Silicon Valley Leadership Group TAX POLICY 2013-2015 Work Plan Formula State Sales and Use Tax Exemption for R&D/Manufacturing Equipment Purchases Split Roll Property Taxation Onerous Reporting Trial de Novo Other Potential Legislation and Ballot Measures eliminate job growth tax penalties. Monitor CA status on the MTC and SSF impacts. If California’s SSF becomes mandatory support companies who have deferred tax assets by advocating for a transition period for companies who may not be able to utilize their deferred tax assets as a result of the change to SSF. Work with statewide coalition partners to support exempting sales and use taxes on the purchases of manufacturing and research productive assets. Educate legislators and Administration that California should join the majority of states who offer exemptions for capital investments. Partner with Assessors to advocate against separately taxing business real property from the tax imposed on residential property (including arbitrary reassessments of business property). Defend against proposals requiring businesses to disclose tax information on state websites. Monitor CA Revenue & Taxation Code Section 5170 and strongly support the independent judicial review of local property tax appeals. Closely monitor and advocate against legislation/ballot measures which disproportionately increase California business tax burden jeopardizing business competitiveness. TBD TBD TBD TBD TBD Productive Dialogue with Statewide County Assessors Partner with County Assessors Association and Silicon Valley Tax Directors Group to hold an annual dinner to educate on changes to valuation tables, consistent audit process efficiencies and open lines of communication with County Assessors. Work with Assessors as they evaluate how to assess new innovations and technology, closely monitor and communicate discrepancies/trends with property tax assessments. TBD State Board of Equalization Regulations and Rules Nortel refund claims – Technology Transfer Agreements, sec. 1507: Work with broader coalition to develop simple and fair application of tax to software as a technology transfer agreement in light of the Nortel decision. Leverage roundtables with Santa Clara County Assessor and those outside of Silicon Valley (e.g. San Diego, Stanislaus and Ventura) on embedded software assessment treatment by auditors. Work with Board of Equalization to develop reasonable valuations for business taxpayers. TBD Embedded Software TBD For more information on Tax Policy, please contact Kirk Everett, Vice President of Government Relations and Tax Policy at keverett@svlg.org or 408-501-7856 or Grace Kay, Federal and State Policy Associate at gkay@svlg.org or 408-501-7881. Silicon Valley Leadership Group TAX POLICY 2013-2015 Work Plan