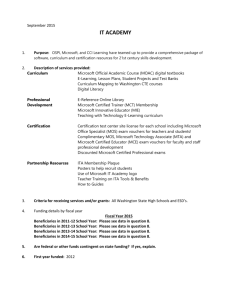

- Microsoft

advertisement