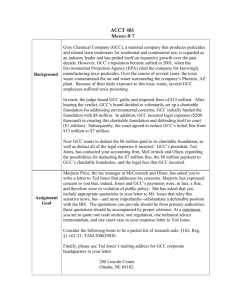

Microsoft Word - WP-FRONTPAGE

advertisement