capital structure analysis of indian automobile industry

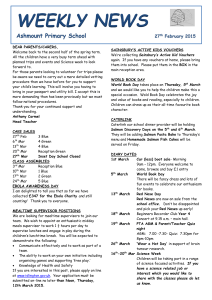

advertisement