Sound Money and Sound Financial Policy

advertisement

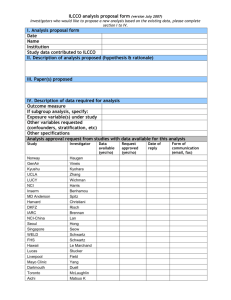

1 “Sound Money and Sound Financial Policy” * Michael D. Bordo Rutgers University and National Bureau of Economic Research Paper prepared for the conference “Anna Schwartz – The Policy Influence” American Enterprise Institute. Washington D.C. April 14, 2000 * This paper is based on joint research with David Wheelock and Michael Dueker at the Federal Reserve Bank of St. Louis. For helpful research assistance, we thank Heidi Beyer. 2 “Sound Money and Sound Financial Policy” 1. Introduction Anna Schwartz has long been an advocate of stable money. By stable money she means that the central bank should use its policy tools to keep money growth close to the long-run trend of the growth rate of real output and thereby maintain aggregate price stability1. Moreover, monetary policy should not be used to fine tune the economy, i.e.to offset short-run disturbances. This is because of the variable lags in the effects of changes in money growth on the real economy and because of our imperfect knowledge of the short-run behavior of the economy. To achieve the outcome of stable prices, Schwartz advocates the pursuit of predictable, transparent and simple monetary policy rules such as Milton Friedman’s k% rule and the avoidance of discretion. The pursuit of a stable monetary policy would also prevent severe contractions in the real economy, the most blatant historical episode of course being the Great Depression.2 A consequence of following stable money for Anna Schwartz is a stable financial system. Schwartz argues that aggregate price instability creates an environment conducive to financial instability, both in the sense of instability of the banking system and financial distress in general. It does so because in an environment of unstable prices, uncertainty over the price level makes it difficult for both borrowers and lenders to 1 See Bordo and Schwartz (1987). Friedman and Schwartz (1963) and Bordo, Choudhri and Schwartz (1995). This view does not argue that monetary forces are the only cause of business fluctuations but that monetary forces have caused serious recessions in U.S. history and have exacerbated recessions induced by non-monetary forces. See Romer and Romer (1989). 2 3 ascertain the real returns from investments, leading in turn to unprofitable borrowing and lending decisions, lending booms and lending busts.3 Maintaining price stability does not rule out financial instability as a consequence of real shocks or changes in relative prices. However, a robust financial system not hobbled by regulatory distortions and legal restrictions to optimal portfolio diversification will normally be robust to such forces unless they have systemic effects.4 In that case if the payments system is threatened, Schwartz advocates that a central bank should act as a lender of last resort and provide whatever liquidity is required to allay the public’s fear that means of payment will not be readily available. The monetary authority should act as a lender of last resort in the event of a banking panic when the public, fearful for the safety of their deposits, scrambles to convert deposits into currency, and when the commercial banks, in an attempt to meet the public’s demands, liquidate earning assets to build up their reserves. Another circumstance is a stock market crash that leads to fears that loans will be unobtainable at any price. These circumstances are referred to as “real” financial crises and they necessitate lender of last resort action. They are distinguished from shocks, which produce falling asset prices and wealth losses to particular sectors of the economy or industries without impinging on the payments mechanism, these events Schwartz (1986) refers to as “pseudo-crises.” They should not elicit a lender of last resort response. 3 Schwartz (1988, 1995a). 4 Schwartz (1995b). 4 Moreover, Schwartz (1992) argues that lender of last resort actions should only be done through open-market operations to provide liquidity to the market in general. She opposes discount window lending to particular financial institutions on the grounds that hostorically it has led the Federal Reserve to lend to insolvent banks and because it interferes with the normal allocative mechanism of financial markets. Morover, with the advent of deposit insurance and the “too big to fail” doctrine in recent decades, the notion of financial crises has changed from brief banking panics that could be resolved quickly, at relatively low cost, by the monetary authority acting as a lender of last resort, into prolonged banking crises that are resolved by costly fiscal means. The rest of the paper expands on Anna Schwartz’s views on the connection between price stability and financial stability (section 2). I then present some historical evidence for the U.S. on the relationship between aggregate price instability and instability in the banking system (section 3), as well as empirical evidence on the relationship between price level instability and an index of financial distress (Section 4). Section (5) discusses Schwartz’s views on sound financial policy in the face of a financial crisis, focusing on her distinction between real versus pseudo crises, discount window lending versus openmarket operations, and the evolution of financial crises into banking crises. Section (6) concludes. 2. Price Stability and Financial Stability : The Schwartz Hypothesis Anna Schwartz in several articles (1998, 1995a, 1997) has argued that a monetary policy directed at maintaining stability of the price level would lessen both the 5 incidence and severity of financial instability.5 Anna Schwartz (1988, p. 53) argues that a central bank “that was able to maintain price stability would also incidentally minimize the need for lender-of-last-resort intervention.” Financial instability, according to Schwartz, has often been caused or made worse by fluctuations in the aggregate price level. A monetary policy that maintains price stability would thus also promote financial stability. Schwartz contends that when monetary policy produces fluctuations in the inflation rate, information problems associated with evaluating alternative investments are made worse which, in turn, increases financial instability : Both [borrowers and lenders] evaluate the prospects of projects by extrapolating the prevailing price level or inflation rate. Borrowers default on loans not because they have misled uninformed lenders but because, subsequent to the initiation of the project, authorities have altered monetary policy in a contractionary direction. The original price level and inflation rate assumptions are no longer valid. The change in monetary policy makes rate-of-return calculations on the yield of projects, based on the initial price assumptions of both lenders and borrowers, unrealizable. (Schwartz 1995a, p. 24) Schwartz does not model formally how changes in the inflation rate can lead to financial instability, but her description fits well with the “monetary misperceptions” model of Lucas (1972, 1973). In that model, individuals are unable to distinguish with certainty shifts in relative prices from changes in the aggregate price level. This uncertainty can lead to resourse misallocation, which is corrected only once the true nature of a price change becomes known. This model is easily extended to incorporate financial decisions. Uncertainty about the nature of price changes can lead to bad forecasts of real returns to investment projects and, hence, to unprofitable borrowing and lending decisions. When 5 This discussion is adapted from Bordo and Wheelock (1998) and Bordo, Dueker and Wheelock (2000). 6 borrowers and lenders forecast returns based on incomplete information or uncertainty about the future level of prices, mistakes can be made that affect borrower defaults ex post. Inflation tends to encourage overly optimistic forecasts of real returns and, thus, can lead to “lending booms,” both because of misperceptions regarding the nature of individual price changes and because the default-risk premiums that lenders require may decline when inflation is expected to continue. By the same token, disinflation and, especially, deflation may lead to overly pessimistic forecasts or an increase in risk premiums and hence discourage the financing of projects that might otherwise be funded.6 Thus when not fully anticipated or hedged, a change in the inflation rate can cause the net realized real return to investment to deviate from what had been expected. Default rates in debt markets can thus be affected.7 The Schwartz hypothesis per se is not a theory of financial crisis, but rather an explanation of how price level instability can lead to or exacerbate financial distress, and possibly lead to a crisis. Moreover, the mechanism Schwartz describes is compatible with a variety of 6 In addition to causing mistakes that increase default rates, uncertainty about future inflation can add to the cost of finance because lenders may require an inflation risk premium on interest rates that would not exist in the absence of inflation uncertainty. 7 Although Schwartz emphasizes how inflation increases the difficulty of projecting real returns for both borrowers and lenders, variability in the price level, according to Schwartz (1988, p. 49), can also worsen problems associated with asymmetric information between borrowers and lenders because “fraud and mismanagement are more likely to gain ground in conditions of price variability, and institutions of unimpeachable standards of risk management may make judgements that later turn out to be mistaken, if not disastrous.” 7 explanations of why crises occur.8 Finally, a country’s institutional environment can affect the form and possibly the severity of financial instability associated with either a real or an aggregate price shock. Banking panics, for example, are much less likely to occur in the presence of an effective lender of last resort. Similarly, high bank failure rates are less likely in systems dominated by large, branching banks, than in unit banking systems. Nevertheless, regardless of the institutional environment, aggregate price instability can still increase borrower defaults, and thereby reduce banking system profits. Financial market structure and regulations can affect the nature of financial instability, and perhaps even lessen the effects of inflation shocks, but aggregate price instability will tend to exacerbate financial instability regardless of the institutional environment. 3. U.S. Historical Evidence on the Schwartz Hypothesis 8 Like the financial-fragility view (Minsky (1977), Kindleberger (1978)), Schwartz argues that financial instability occurs because of inefficient lending during economic booms associated with inflation. But, whereas proponents of the financial-fragility model attach an air of irrational behavior to such lending, Schwartz argues that unproductive lending occurs because inflation makes discerning the quality of borrowers and projects more difficult. Thus, price instability worsens the information problems lenders face. Like the aymmetric information model of crises (Jacklin and Bhattacharya (1988)), inflation may make it more difficult for lenders to uncover the true quality of borrowers; however, inflation also causes information problems about potential real returns that are common to both lenders and borrowers. Misinterpreting inflation as increases in relative prices could encourage lenders to make unproductive loans, while disinflation could discourage lending, again by making it difficult to distinguish relative price changes from movement of the aggregate price level. 8 We examine the history of financial instability in the United States to gauge the extent to which the American experience is consistent with the Schwartz paradigm.9 Specifically, we attempt to determine how closely episodes of banking instability align with instability in the rate of inflation, finding that most episodes of serious financial instability in the United States were associated with disinflations and that all large disinflations, except those immediately following wars, were accompanied by financial instability. This evidence does not prove that financial instability was made worse by price level instability; however, the proximity of episodes of banking distress to inflation and disinflation is circumstantial evidence in favor of the Schwartz Hypothesis. The average annual inflation rate for the United States from 1789 to 1996 is plotted in Figure 1. Banking panics occurred in years marked with black arrows on the figure; other years characterized by unusually high numbers of bank failures or losses to bank depositors, but not panics, are marked with gray arrows. Although the Schwartz Hypothesis is not strictly a theory of banking crises, but rather an explanation of how inflation variability can exacerbate financial distress, which may or may not be reflected in crises, we focus in this section on the association between movements of the price level and the timing of banking disruptions because in the U.S. experience, noted by unit banking and the absence of a lender of last resort until 1914, banking panics and distress often accompanied other forms of financial distress. Nineteenth century banking panics and other episodes of financial distress 9 are well documented in contemporary and historical sources, which are used to identify years of banking distress.10 3.1 Pre-Civil War Era Banking Instability In the pre-Civil War era, the United States had a small, open economy, in which the money supply and price level were substantially determined by inflows and outflows of gold and silver. The prices of American exports and imports were determined in world markets and, not surprisingly, the American price level rose and fell in concert with that of the United Kingdom. The American price level fluctuated widely in the pre-Civil War era, mirroring periods of rapid economic and financial growth followed by episodes of severe financial and economic distress.11 The era was characterized by numerous shocks, both nominal and real, which produced frequent, large inflows and outflows of gold, with consequent sharp fluctuations in the money stock and price level. Although the pace of financial development in this period was rapid (see, for example, Sylla 1998), the American financial system and world capital markets were frequently overwhelmed by shocks which reverberated to the gold market, and the American economy appears to have suffered considerable instability.12 9 This section is adaped from Bordo and Wheelock (1998) Schwartz (1988) lists years in which banking panics occurred, citing Thorp (1926). We use her dates, except that, following Thorp, panics are in 1792 rather than 1793, and 1809 rather than 1810. For years of high banking distress not marked by outright panic, we cite Sprague (1910) and Friedman and Schwartz (1963). To limit clutter, only one arrow is plotted for each of the 1920s and 1980s, even though bank failures were numerous in several years of each decade. For 1789-1947, the inflation rate is based on costof-living estimates in David and Solar (1977). For 1948-1996, the consumer price index of the Bureau of Labor Statistics is plotted. 11 Smith and Cole (1935) provide an excellent description of American economic growth and fluctuations during 1790-1860. 12 The possibility exists, of course, that the apparent high instability of the U.S. price level and national product merely reflects the poor quality of economic data from this period. Measurement problems do 10 10 The annual inflation rate from 1979-1859, as reflected by annual percentage changes in the David and Solar (1977) cost-of-living index, is plotted in Figure 2. Years in which banking panics occurred are also marked. The lack of continuous data on banking distress, except anecdotal information about the incidence of panics, forces us to restrict our analysis of financial instability in this era to banking panics. While the Schwartz Hypothesis is not a theory of panics, banking panics in this era appear to have coincided with episodes of banking distress in general and, consistent with the Schwartz Hypothesis, most panics, especially the most severe, coincided with disinflation. Some of the episodes marked in Figure 2 are briefly described below. The Schwartz Hypothesis seems broadly consistent with the historical description of the 1790s provided by Thorp’s (1926) anecdotal evidence and the David-Solar (1977) price index. Financial distress in 1796-97 occurred in a disinflationary environment that followed several years of inflation. As with the crisis of 1797, the Panic of 1815 occurred early in a disinflationary period that followed a substantial inflation. The next panic occurred in 1819. Deflation was the rule from 1815 to the mid-1830s, with an average annual rate of price change of – 4 percent between 1815 and 1833. The commodity price decline was especially sharp in 1818-19, the effects of which are described by Smith and Cole (1935, pp. 20-21) as follows : These price declines meant serious losses to merchants who had speculated in commodities; they portended decreased money incomes to the American farmer; and they precipitated the first major banking crisis of [the period 1790-1820]. make historical comparisons suspect, but there seems to be widespread agreement among economic historians that the U.S. economy was more stable after the Civil War than before. See Calomiris and Hanes (1994). 11 Banks with extended loans to speculators were now confronted with a demand for specie… Contraction of discounts (loans) at this time became a necessity, and the curtailment of bank loans made the position of the American merchant even more difficult… The collapse of European markets for American export products, and ‘internal predisposition,’ the over-extended condition of banks and mercantile credit, became indeed disastrous. As with the panics of 1797 and 1815, the financial crisis of 1819 was apparently triggered by the realization of prices and incomes that were below what borrowers and lenders had forecast. Whether or not the 1825 episode is consistent with the Schwartz Hypothesis is unclear. David and Solar’s (1977) consumer price index falls sharply in 1823-24, but is essentially unchanged in 1825-26. The panic of 1825 occurred in July, which appears to have been just before commodity prices collapsed. The panic, however, may have been a delayed result of the deflation of 1823-24. The panic of 1837 ushered in an exceptionally severe episode of deflation and economic depression. Inflation, caused by inflows of Mexican silver (Temin 1969), had prevailed since 1833, accompanied by “active speculation, especially in land” (Thorp 1926). Thorp writes that “great activity and excited speculation” prevailed in the first quarter of 1837, but by mid-year the banking system was in crisis. The Panic of 1837 was accompanied by some 600 bank failures, a “slackening and depression; many failures; unemployment; complete collapse of the cotton market … and commodity price decline” (Thorp 1926). A “slight revival” in 1838 and early 1839 brought a revival of land speculation, according to Thorp, but prices collapsed again, and another banking panic occurred in the fourth quarter of 1839. In all, the price level fell 23 percent between 1837 and 1843 (David and Solar, 1977). 12 The Panic of 1837 was triggered by credit contraction and a precipitious drop in the price of cotton. The 1839 crisis followed a second collapse in commodity prices. One might question how much disinflation, as opposed to a shift in relative prices, contributed to the panics. Hard evidence of a disinflationary role is illusory, however the fact that the panics occurred after several years of a rapid increase in the money supply and rising inflation, followed by a collapse in the prices of output in the economy’s dominant sector – agriculture – suggests that unanticipated price decline played an important role in the crisis. The Panic of 1857 was triggered by a collapse of western real estate and railroad stock prices (Calomiris and Schweikart 1991). Much like the Panic of 1837, the 1857 crisis was associated with the collapse of a speculative bubble that followed several years of inflation. And, like 1837, some financial instability might well have occurred in 1857 in the absence of variability in the price level. The Schwartz Hypothesis suggests that inflation could have exacerbated the financial instability, however, by fostering an environment in which speculative lending was more likely to occur. The fact that commercial bank reserves declined as a fraction of bank deposit liabilities over the decade before 1857 suggests that banks were taking greater risks (Smith and Cole, pp. 120-21). The occurrence of a major panic in 1857 is thus consistent with the Schwartz Hypothesis. In sum, the most serious episodes of banking instability of the pre-Civil War period appear to conform well to the Schwartz Hypothesis, occurring early in disinflationary periods that followed substantial inflation. These are the panics of 1797, 1815, 1837, 1839, and 1857. Other, less severe, panics occurred in 1809, 1819, 13 1825, and 1833 and were less obviously associated with significant fluctuations in the price level. That the major financial disruptions of the era occurred immediately after episodes of substantial inflation had ended, however, is clear circumstantial evidence in support of the Schwartz view. 3.2 From the Civil War to 1914 From the end of the Civil War to World War I, the U.S. economy grew rapidly and became more diversified. The American financial system also became more developed, with considerably increased integration between regions within the United States and between the United States and the rest of the world. International capital markets absorbed substantially more of the shocks that formerly reverberated through the gold market. Hence gold flows tended to be less sudden and dramatic, leaving the money supply and price level more stable than they had been before the Civil War. The gold standard was, in effect, suspended during the Civil War, and the government issued inconvertible “greenbacks” to help finance the war. Although the gold standard was not formally resumed until 1879, price level expectations formed during the war (especially as the war’s outcome became more certain) could well have assumed that suspension would be temporary and that wartime inflation would be followed by a period of deflation. And, indeed, the United States experienced a prolonged deflation from 1866 to 1879, with an average annual rate of decline in the cost-of-living of 3.5 percent (David and Solar, 1977). Once resumption was accomplished, however, the price level was relatively stable until World War I. 14 Despite a sharp decline in the price level immediately following the Civil War, no serious financial instability occurred until 1873. The wartime experience illustrates that the impact of inflation on financial stability depends crucially on the monetary regime. The public tolerated wartime inflation, and even accepted nominal yields on government debt that were below current inflation rates, because they believed that the value of money would be restored to its prewar level soon after war’s end (see Bordo and Kydland 1995, and Calomiris 1993). Moreover, because it was expected, postwar disinflation brought relatively little immediate financial disruption, despite the extreme inflation that occurred during the war. Figures 3, 4, and 5 supplement the information about the timing of financial distress reflected in banking panics presented in Figure 1 and plot the inflation rate alongside bank failures, depositor losses in failed banks, and the annual standard deviation of the commercial paper interest rate between 1866 and 1913. Serious banking panics occurred in 1873, 1893 and 1907, but significant financial distress occurred also in 1878, 1884, and 1890. Like the Panic of 1857, the proximate cause of the Panic of 1873 was a collapse of real estate values and railroad security prices, with the panic’s capstone being the failure of the banking house, Jay Cooke and Company.13 The Panic of 1873 occurred during the long, post-Civil War deflation. The deflation had been briefly interrupted during 1871-72; however, when increasing prosperity and stable prices were accompanied by an increase in the money stock. The Panic of 1873, according to Friedman and Schwartz (1963, pp. 30-31), came after the money stock and business 15 cycle had peaked. If the resumption of deflation in 1873 was to some extent unexpected, the Schwartz Hypothesis suggests that it may have contributed to the severity of loan defaults and bank failures in this period.14 Despite a mild degree of price level instability, the period 1879-1914 was not free of financial disturbances. Financial instability occurred in 1884 and 1890, and major banking panics occurred in 1893 and 1907. Each of these episodes was to some extent caused by monetary instability, coupled with institutional arrangements that made the banking system susceptible to panics.15 A serious banking panic occurred in 1893, apparently precipitated by a stock market crash and large gold outflow. Throughout the post-war period, the U.S. commitment to remaining on the gold standard was questioned, which may explain the general tendency for the United States to lose gold (Friedman and Schwartz 1963, pp. 89-134). The proximate cause of the crisis was a stock market collapse and increase in commercial failures, which awakened fears about the solvency of commercial banks. Bankruptcies that were “due to oversanguine estimates of the future and reckless financing of the wildest sort” were contributors to the banking panic. 13 Sprague (1910) is the classic history of the banking panics of this era. Prior to the Civil War, the United States had been on a bimetallic (gold and silver) standard (though silver dollars had not circulated since 1836 because legislation in 1834 had under-valued silver relative to gold). During the war, unbacked currency (“Greenbacks”) was issued, but the question of how and when a metallic standard would be reinstated was left open. The Coinage Act of 1873 officially demonetized silver. Hence the drive to restore the dollar to its pre-war parity with gold may have involved more deflation than would have been expected from a resumption of bimetallism which, presumably, would have meant more rapid money supply growth (see Friedman 1990). The extent of deflation beginning in 1873 thus, to some extent, may have exceeded what had previously been anticipated. 15 Indeed, the absence of banking panics in the United Kingdom in this period (Bordo and Wheelock 1998) reflected neither greater price level stability nor the absence of real economic shocks, but rather the Bank of England’s effectiveness as a lender of last resort and the relatively high concentration of the U.K. banking industry, which prevented financial disturbances from becoming full-fledged banking panics. 14 16 Deflation, which resumed late in 1892, may have contributed to the severity of the panic, as Friedman and Schwartz (1963, p. 108) suggest : A large number of mercantile failures during the first half of 1893 had excited alarm concerning the quality of bank loans. As in many such cases, however, a deeper cause was doubtless the preceding price deflation. Loans that would have been good and banks that would have been solvent if prices had been stable or rising became bad loans and insolvent banks under the pressure of price deflation. Once again it appears that a sudden decline in the price level worsened an episode of financial instability. Like the panics of 1873 and 1893, the Panic of 1907 was not caused by instability in the aggregate price level. And, while each panic was preceded by a period of moderate price increase, at least of commodities, none of these panics offers strong support for the Schwartz Hypothesis – the pattern of inflation followed by disinflation simply was not large enough to have had a marked influence on the extent of financial instability. This seems especially true of 1907 when, despite a slight contraction of the money supply, prices continued to rise until the panic had occurred. The banking panics of the post-Civil War era stemmed more from a particular vulnerability of American banks to crisis caused by unit banking and the absence of a lender of last resort. Given this institutional structure, serious banking panics could be triggered by relatively minor events.16 However, short-run instability in the price 16 Calomiris and Gorton (1991) argue that events, such as a stock market crash, the failure of a major financial or commercial firm, or a decline in commodity prices could trigger a banking panic by raising questions about the value of bank assets and, hence, bank solvency. Lacking information to discriminate among the portfolios held by different banks, depositors run on all banks. In the absence of a lender of last resort, commercial banks resorted to suspension of payments and cooperative arrangements to provide liquidity, such as the issuance of clearinghouse loan certificates (Timberlake 1984, Gorton 1985). Unit 17 level may well have contributed to the incidence and severity of financial instability between 1866 and 1913. The Schwartz Hypothesis implies that financial instability would have been even greater in this period had there been episodes of high inflation and disinflation. The experiences of the pre-Civil War and Federal Reserva-era (post1913) regimes suggest that this might well be true. 3.3 The Federal Reserve Era Unlike the post-Civil War deflation, which lasted some 30 years, the post-World War I deflation in the United States was short-lived, though steep. The money stock began to grow again in 1922, and the economy quickly revived. Moreover, despite the large price level decline, there was no banking panic in 1921 or later in the decade, perhaps because the post-war deflation had been anticipated. Many banks failed in 1921 and throughout the 1920s; however, the failures were confined almost exclusively to small banks located in the rural Midwest and South. The high number of rural bank failured during the 1920s reflected dramatic shifts in relative prices – rising real prices for commodities during the war and falling real prices after the war – and unit banking. As had occurred so often before, a sharp increase in commodity prices during the war years matched by an equally sharp decline in the post-war – a decline that exceeded the decline in the aggregate price level. Once again, expectations of continued high output prices, which had justified the rising price of farmland and the banking, however, made such coordination difficult except at a local level, which also made the banking system more susceptible to crises stemming from localized shocks, such as a decline in commodity prices. 18 borrowing to finance expansion, had been dashed. Falling incomes left borrowers unable to repay their loans, causing banks to fail. Bank failures were most numerous in the regions where farmland prices and the expansion of agricultural acreage had increased the most during the war (Alston, Grove and Wheelock 1994). The banking distress of the 1920s was caused primarily by sudden changes in relative prices that first favored and then hurt commodity producers and their lenders. Aggregate price inflation and deflation could well have contributed to the distress, but the absence of financial disruption outside of commodity-producing regions suggests that relative price shifts had more to do with the rise of bank failures during the 1920s than did movements in the aggregate price level. 3.4 The Great Depression The Great Depression was the most calamitous macroeconomic episode of the 20th century. Between 1929 and 1933, national output declined by 25 percent, the price level fell some 30 percent, unemployment reached 25 percent of the labor force, and some 9000 banks suspended operations. Financial crises included the stock market crash of 1929 and, beginning in 1930, banking panics of increasing severity. Friedman and Schwartz (1963) emphasize the deflationary impact of banking panics during the Great Depression. The money multiplier dropped precipitously as bank customers sought to convert their deposits into cash and banks sought to convert illiquid assets into liquid reserves. Because the Fed failed to supply sufficient currency and bank reserves to offset the decline in the multiplier, the money stock fell some 30 percent. 19 Were the banking panics of the Great Depression themselves caused or worsened by deflation? The Schwartz Hypothesis argues that unanticipated disinflation, or the absence of full hedging against disinflation, will exacerbate financial distress. Falling prices in 1930-32 dramatically increased the real burden of debt on borrowers and many defaulted – contracts were not fully hedged. The extent to which the deflation of 1930-32 was anticipated is less clear. There is substantial evidence that tight monetary policy, which the Fed imposed in 1928 to check the flow of bank credit to the stock market, contributed to the initial economic downturn (Schwartz 1981; Hamilton 1987). And, certainly, in failing to prevent or offset banking panics, the Fed’s inaction permitted the money supply to fall precipitiously during 1930-32. Unclear, however, is whether the Fed’s inaction was predictable from its previous policies. Friedman and Schwartz (1963) contend, in essence, that a change in policy regime occurred with the death in 1928 of Benjamin Strong, Governor of the Federal Reserve Bank in New York and the Federal Reserve System’s leading figure. Strong pursued stabilizing policies during the 1920s, according to Friedman and Schwartz, and his death explains the apparent contrast in policy performance between the 1920s and early 1930s. This suggests that deflation would not have been expected from recent Fed performance. Other researchers have considered the consistency of monetary policy between the 1920s and early 1930s, however, and, for the most part, conclude that the Fed’s response to the Great Depression could have been anticipated from its past actions (see Wicker 1966; Brunner and Meltzer 1968; Wheelock 1991). 20 Direct evidence on price level expectations during the Depression is, unfortunately, similarly cloudy. Among recent studies, Hamilton (1992) argues that futures market trading indicates that much of the decline in commodity prices (and by extension the aggregate price level) was not expected. But, based on analysis of univariate time-series models of inflation and estimates of the real interest rate, Cecchetti (1992) concludes that deflation, at least at short (three to six month) horizons, was substantially expected. Evans and Wachtel (1993), however, contend that such models are biased. Their own analysis suggests that the deflation of the Great Depression was largely unexpected. In sum, the evidence for whether either monetary policy actions or movements in the price level during the Depression could have been anticipated is mixed. It seems unlikely, however, that either the timing of the initial downturn and subsequent shocks, or the length and severity of the deflation, could have been fully expected. We conclude, therefore, that unanticipated deflation probably played an important exacerbating role in the financial distress of 1930-33. 3.5 Recent Experience From the mid 1930s until the 1970s, the U.S. experienced no banking panics, and very few bank failures. This reflected both the institution of Federal Deposit Insurance (FDIC) in 1934, the recognition by the Federal Reserve of its role as lender of last resort, and sympathetic to the Schwartz Hypothesis, relatively stable price levels during the Bretton Woods era. Indeed, according to Schwartz (1987) it is the 21 latter factor that predominates, since other advanced countries did not have deposit insurance until the late 1960s, yet they, like the U.S., had relatively stable prices. Financial instability and bank failures increased dramatically in the 1980s following a runup of inflation from the late 1960s through the 1970s followed by dramatic disinflation in the early 1980s. The financial distress of the 1980s is perhaps most vividly reflected in the high number of bank and thrift failures (Figure 6). As with many earlier episodes of banking distress, the proximate cause of the high number of depository institution failures in the 1980s was a shift in relative prices. Rising real prices for agricultural products and energy had increased the real price of farmland and contributed to boom conditions throughout the Southwestern United States. Loans were made on the expectation that incomes would continue to rise, thereby justifying the prices paid for real estate and other assets. Commodity prices collapsed, however, proving wrong expectations that prices would continue to rise, and leading to loan defaults and bank failures. The boom and bust of commodity-producing regions occurred in an environment of aggregate price inflation and disinflation. From the early 1950s through the mid1960s, inflation remained low and stable. Inflation then accelerated, however, and rose to double digits by 1980 as the Fed pumped in money at an increasing rate in an effort to spur economic activity and employment. Nominal interest rates increased, but expectations of continued high inflation meant that, in real terms, interest rates fell. Borrowing was thus encouraged. 22 The Fed changed course in late 1979. Monetary growth was brought down and eventually inflation fell. Interest rates remained high, however, as investors feared that inflation would reignite. Thus, in this disinflationary environment, the real cost of borrowing rose, thereby contributing to financial distress for all borrowers, not just those tied directly to commodity and real estate markets. Financial disruptions whose primary cause was a shift in relative prices were thus worsened by disinflation following a sustained inflation. In the absence of inflation and disinflation, real shocks to commodity markets in the 1970s and early 1980s might still have caused significant financial distress. The coincidence of financial distress with disinflation in this episode, however, strongly suggests that price level instability contributed to the financial disruption. The financial instability in the 1980s was also a product of the regulatory regime and its interaction with inflation and disinflation. Beginning in the late 1960s, banks and, especially, S&Ls experienced declining profits as rising inflation increased the cost of funds and caused disintermediation, i.e. large-scale deposit outflows into higher-yielding financial instruments because government regulations limited deposit interest rates. Declining net worth, deposit insurance, and deregulation (of deposit rates and, for S&Ls, of asset portfolios) encouraged depository institutions to take increased risks, which the disinflation of the 1980s exposed. The episode illustrates how the nature and extent of financial instability is the product of interaction between the extant regulatory and monetary policy (price level) regimes. 23 4 Unanticipated Aggregate Price Movements and Financial Distress In this section, as a complement to the historical comparison of banking instability and price instability in Section 3, we compare measures of unexpected price movements with an index of financial distress.17 Following Schwartz, we conjecture that unanticipated movements in the aggregate price level or inflation rate destabilize financial conditions. Negative aggregate price shocks will cause financial distress by increasing insolvency and default rates above “normal” levels. Positive aggregate price shocks, on the other hand, will temporarily reduce insolvency and default rates. The nature of aggregate price disturbances depends on whether the monetary regime is based on a commodity (such as gold) or a fiat regime. Under the gold standard, the price level had a persistent stochastic trend because real shocks to the demand or supply of gold caused changed in the monetary stock and, over the long-term, the price level (Bordo and Schwartz, 1999). Hence the price level is decomposed into anticipated and unanticipated components using a trend-cycle decomposition (details can be found in Bordo, Dueker and Wheelock (2000), Appendix A) Inflation has become increasingly persistent since the establishment of the Federal Reserve System in 1914 (Barsky, 1987). This period has witnessed the decline and eventual abandonment of the gold standard in favor of a government managed fiat standard. A substantial shift in regime occurred in 1933 with suspension of the gold standard (Calomiris and Wheelock, 1998). Since then, the price level has risen almost 24 continuously and aggregate price shocks are best measured in terms of unanticipated inflation. Hence, for this regime, the trend-cycle decomposition is applied to estimate inflation (as opposed to price level) shocks. Financial conditions from 1790 – 1997 are measured by a qualitative index of financial distress. The index from 1797-1925 is based on the narratives in Thorp (1926), supplemented by Smith and Cole (1935) and other sources. From 1926 – 1997, it is based on Annual Reports of the Board of Governors of the Federal Reserve System. (For a detailed description of the chronology, see Bordo, Dueker and Wheelock (2000).) Table 1 presents the index. In it, each year is placed into one of five categories, from “severe distress” to “financial euphoria.” The number of years in each category is noted in parentheses. Below, we highlight the type of narrative, based on Thorp, that led to the decision criterion used to place a year into one of the five categories. Thus, 1797 is the first year we assign to the “severe distress” category. Thorp describes the year as one of “depression; panic; … falling prices; many failures, foreign trade restricted. Money tight; little speculation; financial panic, autumn” (p. 114). For 1798, which we classify as a year of “moderate distress,” Thorp writes: “Continued depression in the North with failures; … prosperity in the South; collapse of land speculation … money very tight” (p. 114). For 1799, which we classify as “normal,” Thorp writes: “Revival. Marked improvement in Northern activity; continued prosperity, South … money eases somewhat” (p. 114). We classify 1824 as a year of “financial euphoria.” Thorp describes the year as one of “prosperity; widespread activity; excited speculation … bank mania; many new banks chartered … money easy” (p. 119). For 1850, a year we classify as one of “moderate” 17 This section is adapted from Bordo, Dueker, and Wheelock (2000) 25 financial expansion, Thorp writes: “money easy; revival of stock market … influx of gold from California” (p. 125). For the post 1925 period, relying on the Federal Reserve narratives, 1926 was a year we classify as “normal” in which the Fed reported increased loan demand to finance strong growth in business activity, but the loans on securities had slowed somewhat from the year before. We classify 1928 as a “euphoric year” based on record growth in bank security loans and the Fed’s description of activity in securities markets as being extraordinary. The stock market boom was nearing to peak. The next year, 1929, was difficult to classify because the boom continued into the first half of the year, but the crash came in the fourth quarter. Because of the unsettled nature of financial markets throughout the year, in addition to the crash itself, we classify 1929 as a “normal” year, again averaging financial expansion during the first half with financial distress of the second half. The Great Depression years are among the easiest to classify. We classify 1930 and 1933 as years of “moderate distress,” and 1931 and 1932 as years of “severe distress.” We classify the first few years of World War II, 1941-44, as “moderately expansionary” and 1945-47 as “euphoric.” The 1950s began with financial “euphoria” as the Fed noted that credit was “easily available” to fuel a “boom” in housing, materials and durable goods purchases. The Fed found the expansion of bank credit so “exceptional” as to justify reimposing controls on installment credit. We characterize most of the 1950s and early 1960s as “normal,” however, with little evidence of either exceptional exuberance or distress in financial markets. By the mid-to-late 1960s, however, financial conditions were more consistently 26 “expansionary,” with the Fed characterizing 1966 as having a “too exuberant upsurge in economic activity,” and finding “widespread evidence of domestic overheating” in 1968. The Fed also reported that “inflationary psychology was becoming embedded in decision making for key sectors of the economy.” With inflationary surges and retreats, financial distress emerged in the mid-1970s. For 1974, the Fed reported record mortgage interest rates and tight credit supply. Franklin National Bank failed, the stock market was down and numerous real estate investment trusts failed. We characterize the year as one of “moderate” distress. The 1980s proved difficult to categorize, particularly the middle part of the decade. The years 1980 - 82 included two recessions. We classify 1981 and 1982 as having had “moderate” distress. 1987 was also a year of “moderate” distress, with the stock market crash in October, sharply lower banking system profits, as well as numerous bank and S&L failures. The years 1988-89 were back to “normal,” followed by two years (1990 91) of “moderate” distress characterized by regional banking problems, tighting lending standards and some stress on finance companies and insurance firms. We classify the next four years, 1992 - 95, as “normal,” but 1996 - 97 as “expansionary” because of the booming stock market and increased borrowing by households and firms. Figures 7, 8, and 9 plot the index against price level (inflation) shocks. Figure 7 covers the period 1795 - 1869. During this period, price level shocks were large, and the index also varies considerably from year to year. Moderate or severe financial distress occurred in general in years that had deflationary shocks, while inflationary shocks often are associated with “moderately expansionary” and “euphoric” years. 27 For 1870 – 1933 as seen in Figure 8, the correlation between the index and price level shocks holds up, but it is apparent that price level shocks were considerably smaller on average in this period. Only the deflationary shock of 1921 rivals the worst shocks of 1795 – 1869. Prominent episodes that back up the Schwartz Hypothesis include the 1870’s, 1890’s, 1920 – 22 and 1929 – 33. Finally, for the post 1933 period presented in Figure 9, a period with positive inflation throughout, a correlation between inflation shocks and the index is apparent for the 1930’s and 1940’s and for the 1970’s and 1980’s. The correlation is less evident for the intervening years where the index classifies most years as normal and inflation shocks were relatively mild. Thus this evidence, based on the qualitative index, complements that of the previous section. Unanticipated price level and inflation movements are in general associated with variations in financial distress as hypothesized by Anna Schwartz. Further evidence for the hypothesis is provided in Bordo, Dueker and Wheelock (2000). There, a quantitative index is constructed, based on available data on business failures, bank failures, ex post real interest rates, and a quality spread covering the period 1870 – 1997. A dynamic ordered probit model is then used to estimate the effects of aggregate price shocks on the quantitative index (as well as the qualitative index presented here), controlling for the effects of real output and liquidity shocks. Our results for both indices support the hypothesis that during 1792-1933, and especially the period 1870-1933, shocks to the price level significantly affected financial conditions as posited by the Schwartz Hypothesis. For the post-1933 period, inflation shocks, while exhibiting the 28 correct sign, are only significant for the quantitative index in the 1980-1997 period. The fact that aggregate price shocks did not have as strong an impact on financial conditions after 1933 as did price level shocks in the years before, may reflect the construction of the financial sector safety net in the New Deal era and subsequent years. The environmental changes that occurred in the late 1990s and 1980s (deregulation and disinflation) may have made the banking system more vulnerable to macroeconomic shocks as seen in our regressions. 5. Sound Financial Policy Were the monetary authorities to follow stable monetary policy and produce price stability, then financial instability would be greatly reduced, but still the possibility arises that crises could be triggered by real shocks or stock market crashes which threaten the liquidity of the banking system or by the failure of important financial institutions that could possibly trigger contagion effects to the rest of the financial system. Under these circumstances, the role for the central bank is to act as a lender of last resort and to provide, in a timely fashion, whatever liquidity is needed to satisfy the demand. Three themes predominate in Schwartz’s work on appropriate lender of last resort policy : a) the circumstances in which it should be followed, i.e. the distinction between “real” and “pseudo” financial crises; b) how the policy should be conducted, i.e. openmarket operations versus discount window lending; c) how the nature of crises and the policy response to them has changed with the advent of a safety net. 5.1 Real Versus Pseudo Financial Crises 29 Schwartz (1986) makes clear the distinction between what she calls “real financial crises” and “pseudo financial crises”. According to her, “A Financial crisis is fueled by fears that means of payment will be unobtainable at any price and, in a fractional reserve banking system, leads to a scramble for high powered money” (1986, p. 11). It occurs in two scenarios, each of which creates a scramble for means of payment: (1) a contagious banking panic when the public attempts to convert deposits into currency; (2) a stock market crash that leads to fears that loans will be unobtainable at any price. Furthermore, “a real financial crisis occurs only when institutions do not exist, when authorities are unschooled in the practices that preclude such a development, and when the private sector has reason to doubt the dependability of preventive arrangements” (1986, p. 12). In other words, without timely intervention by the monetary authorities – through open-market operations or liberal discount window lending – the real economy will be impacted by a decline in the money supply, by impairment of the payments systems and by the interruption of bank lending. According to Schwartz, other events which produce falling asset prices and wealth losses to particular sectors of the economy without impinging on the payments mechanism should be viewed as ‘pseudo financial crises.’ These include deflations and disinflation, the financial distress of large non-financial firms, of financial industries, abrupt declines in the prices of particular commodities or assets and speculative attacks on fixed exchanged rate regimes. All these events represent losses of wealth to particular sectors of the economy, but none involve a scramble for high powered money – the hallmark of a ‘real’ financial crisis. 30 Moreover, according to Schwartz (1986), all the real financial crises in the United Kingdom and the United States occurred when the monetary authorities failed to demonstrate readiness at the beginning of a disturbance to meet all demands of sound debtors for loans and of depositors for cash. Thus in the United Kingdom in 1866, the Overend Gurney failure led to a crisis because the Bank of England’s actions were hesitant, and the public was not convinced that there was no reason to panic. This is compared to the Barings failure in 1890, which was not a crisis because of fast action by the Bank. The United States in 1873 experienced a real financial crisis because no institutions were available to deal with the sudden increased demand for high-powered money. In 1907, although institutions did not exist to act as a lender of last resort, there was a real crisis because the right actions were taken too late, whereas in 1884 bank failures in New York City did not lead to panic because of a timely announcement that assistance was at hand. The distinction between “real” and “pseudo” financial crises can also be applied to the concept of systemic risk defined as a situation where shocks to one part of the financial system lead to shocks elsewhere, in turn impinging on the stability of the real economy, unless offset by intervention by the monetary authorities.18 Recent sources of threat to the payments system that have been recognized include : the growth of international banking; financial innovation and securitization; integration of world capital markets; the development of international payments clearing mechanisms outside the control of the domestic monetary authorities; the widespread use of over-the-counter (OTC) derivatives; and the proliferation of emerging country funds. 18 See Bordo, Mizrach and Schwartz (1998) 31 The distinction between real and pseudo systemic risk holds for the new perceived sources of risk as well as it does for the old. The new and the old represent pseudosystemic risk, which is another way of saying that many ventures will prove uneconomic and result in losses. Wealth losses are not synonymous with real systemic risk. They can be dealt with by bankruptcy proceedings and reorganization in both the financial and real sectors. 5.2 The Conduct of Sound Financial Policy Schwartz (1992) makes a case against the use of discount window lending to individual banks in the face of a financial crisis and for the case of using open-market operations to provide liquidity to the financial system as a whole. The traditional view on the lender of last resort according to Bagehot’s rule (1873) posits that the central bank should lend freely to illiquid but solvent financial institutions on the basis of sound collateral but at a penalty rate.19 An earlier tradition tracing back to Henry Thornton favored purchasing marketable securities directly from the market.20 The Federal Reserve was established in 1914 in part to act as a lender of last resort and to use the discount window to provide liquidity to illiquid but solvent member banks on the basis of eligible collateral.21 According to Schwartz (1992), the Federal Reserve over its history repeatedly made loans to insolvent banks. In the 1920s, she argues, this may be excusable on the grounds 19 See Meltzer (1997), Chapter 2. See Humphrey (1975). 21 For the U.K. case, see Capie (1999) who argues that in the English institutional context where the Bank of England discounted the paper of the Discount Houses, who in turn lent to the commercial banks, impersonality was the norm. 20 32 that it was difficult to always distinguish between insolvency and illiquidity. In succeeding decades, the Fed became a reluctant partner to the U.S. Treasury and the FDIC in providing long-term capital assistance to both insolvent non-financial firms and banks. In the 1970s and 1980s, massive discount loans were made to the insolvent Franklin National Bank in 1974 and Continental Illinois Bank in 1984 on the grounds that they were “too big to fail”, and their failures would lead to contagion to otherwise sound financial institutions. Finally in the 1980s after the institution of the Camel rating system which carefully rated the solvency of financial institutions, hundreds of banks deemed likely to fail were assisted before they did so. Such assistance, by prolonging the life of the doomed banks and encouraging uninsured depositors to withdraw their funds, significantly increased the fiscal cost of resolution to be paid by taxpayers. According to Schwartz (1992), this long history of violation of Bagehot’s strictures makes the case for closing the discount window and relying on open-market operations.22 She prefers open-market operations because it is anonymous and allows the market to allocate reserves to the banks in need. Moreover, it avoids the use of discretionary subsidies to favored banks associated with discount window lending. Open-market 22 Goodfriend and King (1988) argue strongly for the exercise of the LLR function solely by the use of open market operations to augment the stock of high-powered money; they define this as monetary policy. Sterilized discount window lending to particular banks, which they refer to as banking policy, does not involve a change in high-powered money. They regard banking policy as redundant because they see sterilized discount window lending as similar to private provision of line-of-credit services; both require monitoring and supervision, and neither affects the stock of high-powered money. Moreover, they argue that it is not clear that the Fed can provide such services at a lower cost than can the private sector. Like Goodfriend and King, Friedman(1960) earlier argued for use of open market operations exclusively and against the use of the discount window as an unnecessary form of discretion which “involves special governmental assistance to a particular group of financial institutions” (p. 38). 33 operations can prevent contagion by producing sufficient money supply to assure depositors. 5.3 Evolution from Banking Panics to Banking Crises The nature of banking crises and the type of response elicited by the monetary authority has changed dramatically in recent decades23. In the case of a banking panic, as occurred earlier in this century, the attempt by depositors to withdraw their funds in cash from banks in general and the attempt by the banks to augment their reserves could shut down the payments system, freezing the ability of the banks to extend loans and the ability of holders of claims on depositors to collect what was owed. It was the experience of these circumstances that taught central banks that an injection of liquidity was essential to relieve panic conditions. The aftermath of the interwar years, when the experience of banking panics led many countries to establish deposit insurance programs (the U.S. in 1934) and hedge their financial systems with restrictive regulations, was an extended period free of banking crisis. This period ended when episodes of inflation in the 1970s undermined the stability of bank operations (Schwartz 1987). The introduction of deposit insurance in most countries during the second half of the 20th century changed the relationship of central banks with the banking community. An agency other than the central bank was involved when troubled banks needed assistance in augmenting an inadequate capital base. Fiscal authorities became the source of capital funds for banks, which central banks were not supposed to provide. In the US, the legislation that provided for the reopening of banks after the Banking Holiday of 1933 34 authorized the Reconstruction Finance Corporation (RFC) to invest in the preferred stock or capital notes of commercial banks. The RFC was the forerunner of later use of fiscal agencies to build a weakened banking system. Whereas in earlier times the central bank was enjoined to lend only to temporarily illiquid but solvent banks, it has since been argued that the lender of last resort during a crisis cannot distinguish between an illiquid and an insolvent bank and, in fact, that it may be desirable to rescue an insolvent bank because of contagion effects on sound banks. Hence the practice of central banks has changed so that banks deemed “too big to fail” are resuscitated, and only small insolvent banks are closed (Goodhart 1987). Another modification of the rule to lend at penalty rates on good collateral is central bank assistance at market or below market rates with no collateral. One other modification is that central banks now prefer to be ambiguous about their commitment to provide financial markets with assistance in crisis conditions. “Constructive ambiguity” supposedly constrains excessive risk taking by financial institutions (Giannini 1999). These are the conditions under which domestic bailouts fluorish. The doctrine of “too big to fail” teaches that a central bank should rescue banks only above a threshold size. However, to avoid making known to commercial banks what the threshold size is, because such knowledge would influence their preferences for risk, it became a central bank belief that it should use constructive ambiguity about which banks it was likely to rescue (Goodhart and Delargy 1999). This was a pronounced departure from the classic prescription that size did not matter. What mattered was that only illiquid but solvent banks should be saved. And the market needed assurance that the central bank was committed to provide liquidity, not uncertainty about the commitment. 23 See Bordo and Schwartz (2000). 35 The rationale for saving big institutions, even if insolvent, was the fear of contagion. Continental Illinois was bailed out in 1984 on this ground.24 Moral hazard was unavoidable, given that the market knew the central bank would rescue banks in distress. One consequence of “too big to fail,” was that the sheer size of a bailout required use of taxpayer funds.25 The central bank was no longer the mover and shaker. Special agencies had to be created to take over nonperforming loans of troubled banks, to recapitalize undercapitalized banks, to offer subsidies to bidders for a troubled bank, to pay off depositors. The large sums that were involved invited corruption. Regulatory and supervisory personnel were implicated in devising accounting gimmicks and exercising forbearance (Kane 1998). Brief banking panics that a central bank could end by injecting liquidity through open market operations or by charging a penalty rate for a loan backed by good collateral have become prolonged banking disasters that fiscal authorities try to deal with at a huge cost to the national budget. 6. Conclusion 24 Recent evidence, however, suggests that contagion was limited in US banking panics in the past (Kaufman 1994;Calomiris and Mason 1997). Depositors were generally able to distinguish sound from unsound banks. 25 Problems affecting financial institutions other than banks and also conglomerates comprising financial and non-financial subsidiaries also have emerged in both advanced and emerging market countries. Widespread insolvency of bank and non-bank financial institutions as well as of conglomerates has generated a perceived need for rescue justified by the unchanged objective of protecting the functioning of the payments system. The rescue of Long Term Capital Management, a non-bank insolvent institution, is a recent example. 36 Central banks of advanced countries in recent years have heeded Schwartz’s wisdom on the importance of stable money, and the world has, in a sense, returned to an environment of low and steady inflation very much like the “convertibility regime” that prevailed before 1914.26 But they apparently have not completely listened to her with respect to the proper role for a lender of last resort. Instead they have gone the route of discount window lending to large insolvent institutions on the grounds that they are “too big to fail” and not to do so would lead to contagion to sound ones.This has spawned the doctrine of “creative ambiguity” and an expansion of discretionary policy which, in turn, has fostered the seeds of moral hazard. They also have intervened in pseudo crises. As a consequence, the banking panics of the past have evolved in many countries into costly banking crises resolved by fiscal rather than monetary means. These costs might have been avoided if Schwartz’s advice on sound money and sound financial policy had been heeded. 26 See Bordo and Schwartz (1999). 37 References Alston, Lee J. Grove, Wayne A., and Wheelock, David C. (1994). “Why Do Banks Fail? Evidence from the 1920s,” Explorations in Economic History (1994), pp. 409-31. Bagehot, Walter (1893). Lombard Street. London. Barsky, Robert B., (1987). “The Fisher Hypothesis and the Forecastability and Persistence of Inflation,” Journal of Monetary Economics (January), pp. 3-24. Bordo, Michael D., Ehsan U. Choudhri and Schwartz, Anna J., (1995). “Could Stable Money Have Averted the Great Contraction?” Economic Inquiry 33 (July), pp. 488-505. Bordo, Michael D., and Kydland, Finn E., (1995). “The Gold Standard as a Rule: An Essay in Exploration,” Explorations in Economic History 32 (October), pp. 423-64. Bordo, Michael D. and Schwartz, Anna J., (1987). “The Importance of Stable Money: Theory and Evidence:” in James A. Dorn and Anna J. Schwartz (eds.) The Search for Stable Money: Essays on Monetary Reform. Chicago: University of Chicago Press, pp. 53-72. Bordo, Michael D. and Wheelock, David (1998). “Price Stability and Financial Stability: The Historical Record.” Federal Reserve Bank of St. Louis Review (September / October), pp. 41-62. Bordo, M.D., Mizrach, B., and Schwartz, A.J., (1998). Real Versus Pseudo-International Systemic Risk: Lessons from History. Review of Pacific Basin Financial Markets and Policies 1: 31-58. Bordo, Michael D. and Schwartz, Anna J., (1999). “Monetary Policy Regimes and Economic Performance: The Historical Record,” Handbook of Macroeconomics. New York, North Holland. Bordo, Michael D., Dueker, Michael, and Wheelock, David (2000). “Aggregate Price Shocks and Financial Instability: An Historical Analysis.” NBER Working Paper No. ____. 38 Bordo, Michael D. and Schwartz, Anna J. (2000). “Measuring Real Economic Effects of Bailouts: Historical Perspectives on How Countries in Financial Distress Have Fared With or Without Bailouts.” Rutgers University (mimeo). Brunner, Karl, and Meltzer, Allan H., (1968). “What Did We Learn from the Monetary Experience of the United States in the Great Depression?” Canadian Journal of Economics 1 (May), pp. 334-48. Calomiris, Charles W., and Gorton, Gary, (1991). “The Origins of Banking Panics: Models, Facts, and Bank Regulation,” in R. Glenn Hubbard, ed. Financial Markets and Financial Crises. Chicago: University of Chicago Press, pp. 109-73. Calomiris, Charles W. and Schweikart, Larry, (1991). “The Panic of 1857: Origins, Transmission and Containment,” Journal of Economic History (December), pp. 807-34. Calomiris, Charles W., (1993). “Greenback Resumption and Silver Risk: The Economics and Politics of Monetary Regime Collapse in the United States, 1862-1900,” in Michael D. Bordo and Forrest Capie, eds., Monetary Regimes in Transition. Cambridge: Cambridge University Press, pp. 86-134. Calomiris, Charles W., and Hanes, Christopher, (1994). “Consistent Output Services for the Antebellum and Postbellum Periods: Issues and Preliminary Results,” Journal of Economic History 54 (June), pp. 409-22. Calomiris, C.W., and Mason, J.R. (1997). The Origin of Banking Panics: Models, Facts, and Bank Regulation. (Ed) R.G. Hubbard. Financial Markets and Financial Crises, University of Chicago Press, Chicago. Calomiris, Charles W. and Wheelock, David C., (1998). “Was the Great Depression a Watershed for American Monetary Policy?,” in M. Bordo, C. Goldin, and E. White, eds. The Defining Moment: The Great Depression and the American Economy in the Twientieth Century. Chicago: University of Chicago Press, pp. 23-66. 39 Capie, F., (1998). “Can There Be an International Lender of Last Resort?” International Finance 1: 311-325. Cecchetti, Stephen G., (1992). “Prices During the Great Depression: Was the Deflation of 193032 Really Unanticipated?” American Economic Review 92 (March), pp. 141-56. David, Paul A. and Solar, Peter, (1977). “A Bicentenary Contribution to the History of the Cost of Living in America,” Research in Economic History, pp. 1-80. Evans, Martin and Wachtel, Paul, (1993). “Were Price Changes During the Great Depression Anticipated? Evidence from Nominal Interest Rates,” Journal of Monetary Economics 32 (August), pp. 3-34. Friedman, Milton (1960). A Program for Monetary Stability. New York: Fordham University Press. Friedman, Milton and Schwartz, Anna J, (1963). A Monetary History of the United States, 18671960. Princeton: Princeton University Press. Friedman, Milton, (1990). “The Crime of ’73,” Journal of Political Economy (December), pp. 1159-94. Giannini, C., (1999). “Enemy of None but a Common Friend of All? An International Perspective on the Lender-of-Last-Resort Function,” Princeton Essays in International Finance No. 214, Princeton. Goodfriend, Marvin and King, Robert A. (1988). “Federal Deregulation, Monetary Policy and Central Banking” in W. S. Haraf and R.M. Kushmeider (eds). Restructuring Banking and Financial Services in America. Washington D.C. American Enterprise Institute. Goodhart, C., (1987). “Why Do Banks Need a Central Bank? “Oxford Economic Papers 39: 7589. Goodhart, C., and Delargy, P.J.R. (1998). “Financial Crises: Plus ca Change, Plus c’est La Meme Chose.” International Finance 1: 261-287. 40 Gorton, Gary, (1985). “Clearinghouses and the Origin of Central Banking in the U.S.,” Journal of Economic History 45, pp. 277-83. Hamilton, James D., (1992). “Monetary Factors in the Great Depression,” Journal of Monetary Economics 19 (March), pp. 145-70. Hamilton, James D., (1992). “Was the Deflation During the Great Depression Anticipated? Evidence from the Commodity Futures Market,” American Economic Review 82 (March), pp. 157-58. Humphrey, Tom, (1975). “The Classical Concept of the Lender of Last Resort.” Federal Reserve Bank of Richmond Economic Review (January / February), 61:2-9. Jacklin, Charles J. and Bhattacharya, Sudipto, (1988). “Distinguishing Panics and InformationBased Bank Runs,” Journal of Political Economy 96 (June), pp. 568-97. Kane, E.J., (1998). “Role of Offshore Financial Regulatory Competition in Asian Banking Crises.” Unpublished paper, Boston College. Kaufman, G.G., (1994). “Bank Contagion: A Review of the Theory and Evidence.” Journal of Financial Services Research 8: 123-150. Kindleberger, Charles P., (1978). Manias, Panics and Crashes: A History of Financial Crises. New York: Basic Books. Lucas Jr., Robert E., (1972). “Expectations and the Neutrality of Money,” Journal of Economic Theory (April), pp. 103-24. Lucas Jr., Robert E., (1973). “Some International Evidence on Output-Inflation Tradeoffs,” American Economic Review (June), pp. 326-34. Meltzer, Allan H. (1997). A History of the Federal Reserve. Chapter 2. Carnegie Mellon University (mimeo). Minsky, Hyman, (1977). “A Theory of Systemic Fragility,” in Edward J. Altman and Arthur W. Sametz, Eds., Financial Crises: Institutions and Markets in a Fragile Environment. New York: Wiley, pp. 138-52. 41 Romer, Christina D. and Romer, David (1989). “Does Monetary Policy Matter? A New Test in the Spirit of Friedman and Schwartz.” NBER Macroeconomics Annual 4: 121-170. Schwartz, Anna J., (1981). “Understanding 1929-1933” in Karl Brunner ed., The Great Depression Revisited. Boston: Martinus Nijhoff, pp. 5-48. Schwartz, Anna J., (1986). “Real and Pseudo-financial Crises,” in Forrest Capie and Geoffrey E. Wood, eds., Financial Crises and the World Banking System. New York: St. Martin’s Press, pp. 11-31. Schwartz, Anna J., (1987). “The Lender of Last Resort and the Federal Safety Net,” Journal of Financial Services Research 1: pp. 77-111. Schwartz, Anna J., (1988). “Financial Stability and the Federal Safety Net,” in William S. Haraf and Rose Marie Kushneider, eds., Restructuring Banking and Financial Services in America. Washington, D.C.: American Enterprise Institute, pp. 34-62. Schwartz, Anna J. (1992). “The Misuse of the Fed’s Discount Window” Federal Reserve Bank of St. Louis Review (September / October), pp. 58-69. Schwartz, Anna J., (1995a). “Why Financial Stability Depends on Price Stability,” Economic Affairs (Autumn), pp. 21-25. Schwartz, Anna J. (1995b). “Systemic Risk and the Macroeconomy,” Research in Financial Services Private and Public Policy, Vol. 7: pp. 14-30. Smith, Walter B. and Cole, Arthur Harrison, (1935). Fluctuations in American Business 17901860. Cambridge: Harvard University Press. Sprague, O.M.W., (1910). History of Crises Under the National Banking System. National Monetary Commission. Washington D.C.: Government Printing Office. Sylla, Richard, (1998). “U.S. Capital Markets and the Banking System, 1790-1840,” Federal Reserve Book of St. Louis Review (September / October). Temin, Peter., (1969). The Jacksonian Economy. New York: V.W. Norton. 42 Thorp, William Long, (1926).Business Annals. New York: National Bureau of Economic Research. Timberlake, Richard (1984). “The Central Banking Role of Clearing House Associations.” Journal of Money Credit and Banking. XXI, 1-15. Wheelock, David C. (1991). The Strategy and Consistency of Federal Reserve Monetary Policy 1924-1933. Cambridge University Press. Wicker, Elmus, (1966). Federal Reserve Monetary Policy 1917-1933. New York: Random House. 43 Table 1 Qualitative Index of Financial Conditions, 1790-1997 Severe Distress (12) 1797 1819 1837 1857 1873 1874 1876 1893 1894 1896 1931 1932 Moderate Distress (48) 1796 1798 1808-09 1812 1814-16 1818 1820 1822 1825-26 1829 1833 1838-42 1846 1848 1854 1858 1861 1869-70 1875 1877 1883-85 1895 1903 1907-08 1914 1921 1930 1933 1938 1974 1981-82 1984 1986-87 1990-91 Normal (103) 1790 1792-94 1799-1803 1807 1810-11 1817 1821 1827-28 1830-32 1834 1843-45 1849 1851 1853 1855-56 1859-60 1865-68 1871-72 1878 1882 1886-92 1897-98 1900-01 1904 1909-13 1915 1917-18 1920 1922-24 1926-27 1929 1934-37 1939 1948-49 1951-64 1967 1970-73 1975-76 1979-80 1983 1985 1988-89 1992-95 Moderate Expansion (35) 1791 1804 1806 1813 1823 1835-36 1847 1850 1852 1862-64 1879-81 1899 1902 1905-06 1916 1925 1940-44 1965-66 1968-69 1977-78 1996-97 Euphoria (9) 1795 1805 1824 1919 1928 1945-47 1950 44 Figure 1 U.S. Annual CPI Inflation Rate 1789-1996 (year-to-year change in log CPI) Percent 25 20 15 10 5 0 -5 - 10 - 15 - 20 17 89 1 81 9 1 84 9 18 79 19 09 1 93 9 19 69 19 99 NOTE: Black arrows represent years in which banking panics occurred. Gray arrows mark years characterized by unusually high numbers of bank failures or losses to bank depositors, but not with banking panics. 45 Figure 2 U.S. Annual CPI Inflation Rate 1789-1859 (year-to-year change in log CPI) Percent 20 15 10 5 0 -5 -1 0 -1 5 -2 0 17 89 1 79 9 1 80 9 18 19 NOTE: Arrows mark years in which banking panics occurred. 1 82 9 1 83 9 18 49 185 9 46 Figure 3 Annual Inflation and Bank Failures 1866-1913 Percent Number of Failures 6 600 4 500 Inflation 2 400 0 300 -2 200 -4 -8 1866 100 Bank Failures -6 0 1871 1876 1881 1886 1891 1896 1901 1906 1911 47 Figure 4 Annual U.S. Inflation and Deposit Losses in Failed U.S. Banks as a Percentage of Total Deposits in U.S. Banks 1866-1913 Deposit Loss Rate Inflation, Percent 0.8 0.7 8 6 Deposit losses Inflation 0.6 4 0.5 2 0.4 0 0.3 -2 0.2 -4 0.1 -6 0.0 1866 -8 1871 1876 1881 Source: Bordo, Rockoff, Redish (1996) 1886 1891 1896 1901 1906 1911 48 Figure 5 Annual Inflation and Standard Deviation of Commercial Paper Rate 1866-1913 Percent Standard Deviation 6 3.5 4 3.0 Inflation 2 2.5 0 2.0 -2 1.5 Commercial Paper -4 1.0 -6 0.5 -8 1866 0.0 1871 1876 1881 1886 1891 1896 1901 1906 1911 Figure 6 49 Annual Inflation and Bank Failures 1946-1996 Number of Failures 240 210 Bank Failures Inflation 180 Percent 16% 14% 12% 10% 150 8% 120 6% 90 4% 60 2% 0% 0 -2% 19 46 19 49 19 52 19 55 19 58 19 61 19 64 19 67 19 70 19 73 19 76 19 79 19 82 19 85 19 88 19 91 19 94 30 Figure 7 50 Qualitative Index and Price Level Shocks 1795-1869 0.2 5 0.15 0.1 4 0.05 0 3 -0.05 -0.1 2 -0.15 -0.2 1 -0.25 -0.3 0 1795 1800 1805 1810 1815 1820 1825 1830 1835 1840 1845 1850 1855 1860 1865 1795-1869 Figure 8 51 Qualitative Index and Price Level Shocks 1870-1933 5 0.2 0.15 4 0.1 0.05 3 0 -0.05 2 -0.1 -0.15 1 -0.2 -0.25 0 -0.3 1870 1875 1880 1885 1890 1895 1900 1905 1870-1933 1910 1915 1920 1925 1930 52 Figure 9 Qualitative Index and Inflation Shocks 1934-1997 5 8 6 4 4 2 3 0 -2 2 -4 -6 1 -8 -10 0 -12 1934 1939 1944 1949 1954 1959 1964 1969 1934-97 1974 1979 1984 1989 1994