Deregulation of the South African Optometry Industry

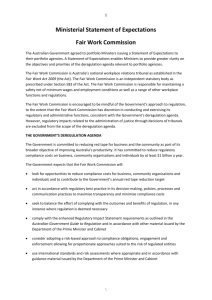

advertisement