ECMC49F: Financial Economics

advertisement

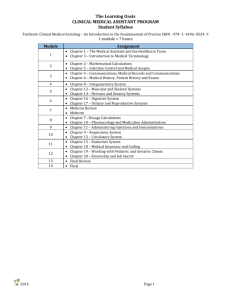

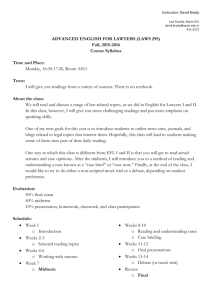

ECMC49Y Syllabus, Summer 2006 UTSC ECMC49S: Financial Economics Instructor: Email: Class Time: Location: Office hours: Office: Website: Travis NG ngkaho@chass.utoronto.ca Wed 9 to 11am MW160 Wed 11 to 12pm MW379 http://www.chass.utoronto.ca/~ngkaho/ECMC49Y Prerequisites: Microeconomics (ECMB02H or ECO200 or 206), Macroeconomics (ECMB06H or ECO202 or 208), Statistics (ECMB09Y or ECO220) Course Description: This course is comprised of 3 main parts: 1) Individual decisions under uncertainty 2) Asset pricing 3) Market Efficiency Goal: My goal is to deliver a broad but rigorous introduction to the theoretical foundations of modern financial economics. Your goal is 1)to have a good understanding of the theories covered in the course and 2)develop the linkage between financial theories and various economics models you have been studied in your previous economics classes. Upon completion of this course, students will be able to: 1) Calculate equilibrium asset prices 2) Determine equilibrium portfolio allocations given price and risk preferences 3) Be able to tell how risk allocations and asset prices will change as the characteristics of uncertain outcomes change. Important Dates: Term Test: Drop Deadline: Final Exam: Jun 21, 2006 Jul 23, 2006 Any date between Aug 12 - Aug 24 Grading: 50% midterm, 50% final if you do better in the midterm than in the final. 25% midterm, 75% final if you do better in the final than in the midterm. This is a mechanism to encourage you to work harder in your final in case your midterm mark is not satisfactory. -1- ECMC49Y Syllabus, Summer 2006 UTSC Main Textbook Reference: Thomas E. Copeland and J. Fred Weston, Financial Theory and Corporate Policy, Addison Wesley, 2005 Fourth Edition (available in Bladen library Short term loan, type “ECMC49” in library catalogue course reserves). The course’s material is mainly from this classic textbook. But you do not have to buy the textbook to do well in the course. Problem sets: There will be assigned questions for each topics covered. You do not need to hand them in for grading. But previous students performance has shown that those who had tried them out performed relatively better in the course. Ideally, you team up with one or two of your classmates to form a study group to try the assigned questions. Appeals: If you appeal to re-grade the midterm, please submit your complaint to me in written format. I will re-grade not only the parts that you have complained, but also the other parts that you have not. Note that this may lead to a lower overall grade. Missing the Midterm: If you miss the midterm due to an approved reason, you must submit official documentation either to me or to the department of management within one week of the missed test. For medical reason, you must provide a signed and detailed copy of the UofT student medical form from the following URL: http://www.utoronto.ca/health/forms/medcert.pdf For any other reason, such as time conflicts among tests, please come and see me before the midterm to get approval. Approved students will have 100% of their grading weight shifted to the final. Non-approved students will have 25% of their grading weight assigned as zero. Other places where I draw course materials from: For your references, here are some places that I read to draw the lecture materials from. You will not be tested on materials in these references that are not covered in the lectures. Bodie, Kane, Marcus, Perrakis, Ryan: Investments, 5th Canadian Edition, 2005, McGraw-Hill. John C. Hull: Fundamentals of Futures and Options Markets, 5th Canadian Edition, Prentice Hall. -2- ECMC49Y Syllabus, Summer 2006 UTSC Brealey and Myers: Principles of Corporate Finance, 6th Edition, 2000, McGraw-Hill. Chicago Board Options Exchange website Options Clearing Corporation website Options Industry Council website Course Structure: Session Date 1 May 10 2 May 17 3 May 24 4 May 31 5 Jun 7 6 Jun 14 7 Jun 21 8 Jun 28 * Jul 5 9 Jul 12 10 Jul 19 11 Jul 26 12 Aug 2 Lecture Description Basics of Financial Market Inter-temporal Consumption Choice Decisions under Uncertainty Portfolio Theory CAPM I: Theory CAPM II: Empirics Midterm Option Pricing I: Basics Reading Week Option Pricing II: Advanced Efficient Market Hypothesis I: Theory Efficient Market Hypothesis II: Empirics Portfolio’s Rate of Return Calculations Readings: The main readings are the lecture notes. In addition, as the course progresses, I will update you about the precise supplementary readings that you may want to do prior to the midterm and final. The first priority, however, is to master the lecture notes provided in the course website. -3-