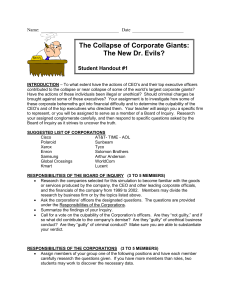

The Classical Corporation in American Legal Thought.doc

advertisement