MS Word format - College of Administration & Business

advertisement

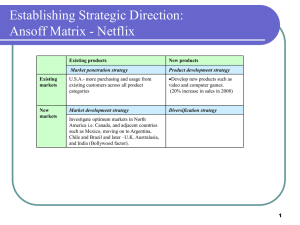

TENTATIVE SYLLABUS for A&B 495, Section 002 BUSINESS ADMINISTRATION CAPSTONE TR, 2-3:50pm; CAB214, Winter 2007 Instructor: Dr. Bruce Walters, CAB 129B, Ph: 257-3499, E-mail: bwalters@cab.latech.edu Office Hours: M-F, 9-10am, 1-2pm, & by appointment Required Texts: Thompson, Strickland, & Gamble, Crafting and executing strategy, 15th ed., McGraw-Hill/Irwin; supplemental handouts Students pursuing a degree in the CAB must earn a “C” or better in all courses in their major area, and they are responsible for taking courses in the proper order and with the appropriate prerequisites. Course Description: The focus of this course is on strategic management and business policy formulation and implementation. This course is designed as a "capstone course" to aid the student in synthesizing and applying knowledge gained in earlier courses and to introduce and apply theoretical concepts unique to strategic management. Students are provided with the opportunity to integrate the functional concepts, skills and techniques acquired in other courses and apply these skills to actual business cases. The course attempts to encourage an integrated, multifunctional "general management" perspective of the organization and its environment to develop analytical and decision-making skills needed to cope with organizational uncertainties and business realities. Objectives of this course include but are not limited to: integrating the disciplines you have already studied and applying theories and concepts relevant to strategic management in planning and solving business problems; analyzing internal organizational strengths and weaknesses and external environmental opportunities and threats; performing functional, business, corporate, and international strategic planning; integrating, implementing, and controlling the strategic planning process; and making effective oral and written presentations. The objectives of the course will be achieved through lecture/discussions, the case method, exercises, and team presentations in order to illustrate and further develop the relevant principles and concepts. Case Method: The case method allows you to acquire low-cost experience. It provides the benefit of applying concepts and theories--learning by doing--but in an environment where costs of mistakes are slight. It also provides you with practice in wrestling with important management issues. Sometimes we will come to a consensus regarding what the firm in question should do--but it is the reasoning process by which we arrive at the answer that’s key. In other instances, a single “right answer” may not emerge, or several feasible alternatives may surface. This should not bother you unduly. The case method is intended to lead us to the right questions, to build discussion and debate, and to force us to reconcile differences in analysis with those of our peers. In preparing a case, begin by reading it through at least two times: (1) Very briefly to get a “feel” of the situation (e.g., the company, its products and markets, its problems, and the people involved). This will allow you to see what’s important in analyzing the case and what is relatively less important. (2) Carry out your analysis in response to assignment questions provided for the case. Financial analysis and careful attention to the exhibits and tables are necessary for the development of recommendations that are sound. Document your analysis to help you organize and integrate your thoughts. Be sure to write down supporting arguments for your recommendations. These case preparation notes will provide you with a valuable aid for your in-class participation, and are to be turned in on the day of discussion. GRADING: In accordance with the academic honor code, students pledge the following: “Being a student of higher standards, I pledge to embody the principles of academic integrity.” Cheating of any sort will be dealt with to the fullest extent. Following are the grading components: Assignment Chapter quizzes (average) Exam 1 Exam 2 Team case analysis/presentation/discussion Participation* Total Points Available Points 200 200 200 200 200 1000 * Participation includes meaningful contributions to class discussion, participation in experiential exercises and other activities, individual case summaries, and obviously attendance. Final grades will be assigned as follows: A=900-1000 points; B=800-899 points; C=700-799 points; D=600-699 points; F=less than 600 points. Note: The College of Administration and Business is dedicated to enabling each student to reach his/her potential. Any student in this course who has a disability that may prevent him/her from fully demonstrating his/her abilities should contact me personally as soon as possible so we can discuss accommodations necessary to ensure full participation and facilitate your educational opportunities. Chapter Quizzes and Discussion: The chapters are straightforward, and I expect you to read the material before coming to class so that we can focus on applying the concepts in class. On days we discuss chapter material, after a time period for any Q&A regarding concepts that may be unclear, confusing, or especially challenging, you may be given a short quiz on the chapter, and we will subsequently apply the material in a variety of ways (e.g., lecture/discussion, experiential exercises, “mini-cases,” and break-outs). There will be no make-up quizzes, except in dire circumstances with an excused absence. Team Case Analysis/ Presentation/ Discussion: Each team is assigned to analyze a case and present it in class using visual aids (e.g., hand-outs, PowerPoint slides, overheads). All team members participate in the presentation. You have about 30-45 minutes for presentation, followed by Q&A and class discussion of the assignment questions. It is important that you are able to answer/argue questions raised by other classmates and the instructor. You also have the right to ask other classmates questions associated with the case. Feel free to be creative and make the class exciting during your presentation and discussion. It is up to you to organize your presentation, but you should thoroughly discuss the questions posed in connection with your case. With the aid of this discussion, the goal is to accomplish the following: o o o o o Diagnose the company’s situation, including external opportunities and threats, internal strength/capabilities/resources and weaknesses/liabilities, thorough financial analysis, etc. Identify problems that the company is facing Develop various action alternatives that can address the problems Analyze the pros and cons of the various action alternatives Make your conclusions and recommendations/implementation plans as specific as possible Use the tools and techniques in the chapters to “flesh out” your analysis and recommendations. You may find the available Case-Tutor exercises to be extremely helpful. Individual Case Summaries: This class strongly focuses on case analysis and discussion. You can’t follow the discussion in class without proper preparation. Answer the question connected to each class discussion case (they appear after the course schedule on this syllabus), covering the same issues as the presentation team. The presentation team can ask you questions regarding the case, and you should be able to provide a satisfactory answer. The individual case summary should be turned in to me at the end of the case discussion. Class Participation Students must participate and interact in class discussions to show their knowledge of the cases, chapter material, and applicable strategic management concepts. In evaluating the quality of participation in class discussions and assigned cases, I will consider your preparedness, logical reasoning, and the ability to apply general concepts to the specific situations under discussion. Write-ups for class discussion cases are due on the day of discussion. It is extremely important that you be prepared for all cases that are presented, as discussion from all class members will be expected. It goes without saying that you must be present to participate. TENTATIVE COURSE SCHEDULE November 30 December 5 Overview of the course Discussion of assignments Discuss “Guide to case analysis” Chapter 1 – What is strategy and why is it important? Form teams Chapter 2 – The managerial process of crafting and executing strategy 7 Chapter 3 – Evaluating a company’s external environment 12 Chapter 4 – Evaluating a company’s resources and competitive position 14 Chapter 5 – The five generic competitive strategies: Which one to employ? 4 Class Discussion Case 8: Netflix versus Blockbuster versus Video-on-Demand 9 Chapter 6 – Supplementing the chosen competitive strategy: Other important strategy choices Class Discussion Case 12: Krispy Kreme Doughnuts in 2006 11 Class Discussion Case 14: Adam Aircraft 16 Exam 1: Chapters 1-6 18 Chapter 7 – Competing in foreign markets 23 Class Discussion Case 25: Wal-Mart Stores in 2006 Chapter 8 - Tailoring strategy to fit specific industry and company situations 25 Class Discussion Case 17: eBay: Facing the Challenge of Global Growth 30 Chapter 9 – Diversification: Strategies for managing a group of businesses CAB SWOT Analysis/Discussion January February 1 6 Chapter 9 – Diversification: Strategies for managing a group of businesses (cont.) Class Discussion Case 21: Adidas—Will Restructuring its Business Lineup Allow it to Catch Nike? 8 Class Discussion Case 22: Proctor & Gamble’s Acquisition of Gillette 13 Class Discussion Case 29: Starbucks Global Quest in 2006 15 Chapter 10 – Strategy, ethics, and social responsibility Class Discussion Case 31: Merck and the Recall of Vioxx 20 Holiday 22 Exam 2 27 Wrap-up CASE ASSIGNMENT QUESTIONS Netflix 1. How strong are the competitive forces confronting Netflix in the DVD rental marketplace? Do a fiveforces analysis to support your answer. 2. How is the online movie rental business changing? What are the underlying forces that are driving industry change and are their impacts favorable or unfavorable in term of their impact on competitive intensity and future industry profitability? 3. What does your strategic group map of this industry look like? Is Netflix well-positioned? Why or why not? 4. What key factors will determine a company’s success in the online movie rental industry in the next 3-5 years? 5. What is Netflix’s strategy? Which of the five generic competitive strategies discussed in Chapter 5 most closely fit the competitive approach that Netflix is taking? What type of competitive advantage is Netflix trying to achieve? 6. What does a SWOT analysis of Netflix reveal about the overall attractiveness of its situation? 7. What is your appraisal of Netflix’s financial performance based on the data in case Exhibits 2 and 3? How well is the company doing financially? Is there evidence in case Exhibits 1, 2, and 3 (and elsewhere in the case) that Netflix’s strategy is working—what is the story of the numbers in case Exhibits 1, 2, and 3? Use the financial ratios in Table 4.1 of Chapter 4 as a guide in doing the calculations needed to arrive at an analysis-based answer to your assessment of Netflix’s recent financial performance. 8. Does Netflix have adequate competitive strength to go head-to-head against Blockbuster and other key rivals? Do a weighted competitive strength assessment using the methodology presented in Table 4.5 of Chapter 4 to support your answer. What do you see as Netflix’s competitive strengths and weaknesses? Do you believe that Netflix has built a sustainable competitive advantage in the online movie rental business? Why or why not? 9. What issues does Netflix management need to address? 10. What does Netflix need to do to strengthen its competitive position and business prospects vis-à-vis Blockbuster and other rivals? What specific actions should founder and CEO Reed Hastings take? 11. How is Blockbuster likely to react to the strategic moves that you believe Netflix should make? 12. Would you buy stock in Netflix at this time? Why or why not? Krispy Kreme 1. What were the chief elements of Krispy Kreme’s strategy as of early 2004? Which one of the five generic competitive strategies best characterize Krispy Kreme’s strategy? Does Krispy Kreme’s strategy have a vertical integration component? 2. Do you see any strategy-related reason to believe that the company was headed for big trouble in mid2004—or was what happened to the company in 2004 a “legitimate” surprise? 3. What is your assessment of Krispy Kreme’s financial performance prior to 2004? What was the most profitable part of Krispy Kreme’s business as of the end of fiscal 2004? Please use the financial ratio summary in Table 4.1 of Chapter 4 as a guide in doing the calculations to support your financial assessment. 4. What is your diagnosis of what went wrong at Krispy Kreme in 2004 to produce the sudden downturn in the company’s financial performance? What factors caused the company to crash so quickly when its future and growth prospects seemed so bright? 5. Do you think top management was employing “aggressive” accounting tactics to try to cover up disappointing earnings problems and keep the stock price pumped up? Do you see anything unethical going on here? Why or why not? What evidence supports your views? 6. What does a SWOT analysis reveal about Krispy Kreme’s overall situation heading into 2006? 7. What is your assessment of Krispy Kreme’s competitive strengths and weaknesses in comparison with key rivals as of 2004? Does the company possess the competitive strength to mount a comeback? Please use the methodology in Table 4.5 of Chapter 4 in arriving at your answer. 8. On the basis of your competitive strength assessment above, what do you think of Krispy Kreme’s turnaround prospects? Just how good are they? Is a comeback feasible? What evidence supports your answer? 9. What major issues besides how to make a comeback do you think that Krispy Kreme management needs to address? 10. What recommendations would you make to Krispy Kreme management to return Krispy Kreme to profitability by the end of 2006 (or in 2007 at the latest)? Adam Aircraft 1. What is competition in the twin-engine segment of the general aviation industry like? Which competitive forces seem to have the greatest effect on industry attractiveness? 2. What are the key success factors for competing in the twin-engine segment of the general aviation industry? 3. As a business start-up, what key resource strengths and competitive capabilities has Adam Aircraft developed? What are its resource weaknesses and competitive liabilities? What market opportunities exist? Do external threats to its success exist? 4. What are the pros and cons of the twin-engine segment of the general aviation industry? Are Adam Aircraft’s core competencies well matched to opportunities in the twin-engine segment? Do its core competencies line up with factors that define success in the segment? 5. What are your recommendations for Adam Aircraft upon certification of its A500 twin piston and A700 jet by the FAA? What strategies should Adam Aircraft pursue beyond startup to prosper in the general aviation industry? Are any preparations needed at this time to prepare for full production? Wal-Mart 1. What impresses you about this company? What aspects of Wal-Mart do you find unimpressive? What accounts for Wal-Mart’s success over the past 20 years? Is it a great strategy, superb strategy implementation and execution, or great leadership? 2. How would characterize Wal-Mart’s strategy? Which of the five generic strategies is the company employing? What are the chief components of its strategy? 3. What has Wal-Mart management done to implement and execute the strategy? What policies, practices, support systems, and management approaches underlie Wal-Mart’s strategy execution efforts? 4. What is your assessment of Wal-Mart’s culture? What are its chief elements and characteristics? Why does the culture seem to be so much stronger in Bentonville than out in the stores? 5. What does the financial information in case Exhibit 1 reveal about the company’s success and performance during the 2000-2005 period? You should consider using the financial ratios presented in Table 4.1 of Chapter 4 to guide your calculations and reach conclusions about the caliber of Wal-Mart’s financial performance. 6. Can the company continue to be successful? What issues does management need to address? 7. What recommendations would you make to Wal-Mart management? eBay 1. What is competition like in the online auction industry? What do we learn about the nature and strength of the competitive pressures eBay faces from doing a five-forces analysis of each segment? 2. What do you see as the key success factors for firms in the online auction industry? 3. What forces are operating in the online auction macro-environment that have the power to alter the nature and structure of competition in the online auction industry? 4. What does a strategic group map reveal about the positions of the major players in the online auction industry? Is eBay in a good position on the map? Why or why not? Who are eBay’s closest competitors? 5. What does a SWOT analysis reveal about eBay? How attractive is the company’s situation and position? 6. What is your assessment of eBay’s financial performance and financial condition? Is the company in good financial shape? Why or why not? Please use the summary of financial ratios in Table 4.1 in Chapter 4 to guide your calculations and support your assessment of the company’s financial performance. 7. Does your competitive strength analysis for eBay and its rivals reveal that eBay has a competitive advantage or disadvantage in the online auction industry? What are the sources of advantage or disadvantage? Does eBay have a sustainable competitive advantage in the online auction industry? 8. Is competition in the online auctions industry best described as global or multi-country? Why? Which type of international strategy is eBay using in its international operations? 9. What types of issues does eBay need to consider when entering the Chinese market? Do you believe the entry mode they chose was the best one? Why or why not? 10. Based on your analysis of the industry and eBay’s situation, what problems and issues does eBay’s top management need to address? Which ones are top priorities? Which are low priorities? 11. What actions would you recommend to Ms. Whitman and Mr. Omidyar to improve the company’s competitive position, especially its international operations, and its long-term financial performance? Adidas 1. What is Adidas’ corporate strategy? Was there a common strategic approach utilized in managing the company’s lineup of sporting goods businesses prior to its 2005-2006 restructuring? Has the corporate strategy changed with restructuring? 2. What is your evaluation of Adidas’ 1998 acquisition of Salomon SA? Did the acquisition achieve the Robert Louis-Dreyfus’ objective of putting together the best portfolio of sports brands in the world? What does a 9-cell industry attractiveness/business strength matrix displaying Adidas-Salomon’s business units look like? 3. Did Adidas’ business line-up prior to the divestiture of Salomon and Mavic exhibit good strategic fit? What value-chain match-ups existed? What opportunities for skills transfer, cost sharing, or brand sharing were evident? What strategic fits will be possible once Reebok International is acquired? 4. Did Adidas’ business line-up exhibit good resource fit between 1998 and 2004? What were the financial characteristics of each of three major segments? Which businesses might have been considered cash hogs and cash cows? How did Adidas-Salomon’s performance vary by geographic region? 5. Based on your analysis of Adidas-Salomon businesses, did the 2005 restructuring make sense? Does it appear the acquisition of Reebok International will produce positive results for shareholders? What strategic actions should Adidas CEO Herbert Hainer initiate to improve the company’s financial and market performance now that the restructuring is nearing completion? Proctor & Gamble’s Acquisition of Gillette 1. What is Procter & Gamble’s corporate strategy? Do the company’s businesses seem to be related or unrelated? Are Gillette’s businesses closely related to P&G’s businesses? How will a merger with Gillette provide a 1 + 1 = 3 effect for P&G? 2. What is your evaluation of Procter & Gamble’s business lineup? How attractive are the industries it competes in? What is the competitive strength of each of its business segments? Does Gillette seem to compete in attractive consumer segments? Are its business units strong in their respective markets? What does a 9-cell industry attractiveness/business strength matrix displaying P&G and Gillette’s business units look like? 3. Does Procter & Gamble’s business line-up exhibit good resource fit? How do Gillette’s profit margins compare to the profit margins for P&G’s businesses for the 2000 – June 2005 time period? Do both companies have similar growth rates and debt structures? How do the free cash flow and free cash flow productivity rates compare for the two companies? Does it seem that the addition of Gillette business units will boost P&G’s bottom line? 4. What is your assessment of the $57 billion acquisition price Procter & Gamble paid for Gillette? Does the 20% purchase price premium seem appropriate? Are the sales and EBITDA multiples based on the $57 billion purchase price in line with other mergers in consumer goods industries? Does the 0.975 exchange ratio seem fair to both P&G and Gillette shareholders? 5. What strategic actions should Procter & Gamble executives undertake to ensure the Gillette acquisition ultimately benefits shareholders? What must be done to achieve the expected 1 + 1 = 3 benefit? Should the company pursue additional acquisitions? Should certain business units be eliminated from the business lineup? Starbucks 1. What are the key elements of Starbucks’ strategy as of 2006? Which of the five generic competitive strategies best fits what Starbucks is doing to build a competitive advantage? 2. What grade would you give Howard Schultz for the job he has done as CEO and Chairman of Starbucks? Be prepared to support your answer based on how well (or not so well) he has performed the five tasks of strategic management discussed in Chapter 2. 3. What was Howard Schultz’s original strategic vision for Starbucks? Is his present strategic vision for Starbucks different from the one he had in the 1980s? How many times has his strategic vision changed? Is his present strategic vision likely to undergo further evolution? 4. Has Starbuck’s strategy evolved as the strategic vision has evolved? 5. What are the key policies, practices, business principles, and procedures that underlie how Howard Schultz and Starbucks’ management have implemented and executed the chosen strategy? 6. What “values” does this company have? How well do they connect to the strategy and to the manner in which the company conducts its business? 7. What is your evaluation of Starbucks social responsibility strategy? Is it sincere or just something the company does and talks about to create a good public image? What grade would you give Howard Schultz for the job he has done in trying to make Starbucks a great place to work? 8. What is your assessment of Starbucks’ financial performance during fiscal years 2000-2005? Does the company’s performance indicate that Starbuck’s strategy is working well? 9. What issues confront the company as of 2006? What should Starbuck’s management be worried about? 10. What recommendations would you make to Howard Schultz to sustain the company’s growth and support continued strong financial performance in the years ahead? Merck 1. Do you see anything unethical about how Merck handled the research of Vioxx’s safety? 2. What evidence supports the conclusion that the actions and behavior of Merck’s executives were ethical and aboveboard insofar in how the marketing of Vioxx was handled? 3. What evidence indicates that Merck’s executives knew that there were important safety issues regarding Vioxx that were not adequately disclosed to doctors and patients? 4. Do you see anything unethical about how Merck handled the marketing of Vioxx? Is it ethical for a pharmaceutical company to market its drugs directly to the public as opposed to marketing through doctors (by informing them of the benefits and potential adverse side effects of their drugs)? 5. Did the Federal Drug Administration do a good job in monitoring the safety of Vioxx? Should the FDA have been more aggressive in pushing Merck to do more research and clinical trials regarding the safety of Vioxx following the results of the Naproxen study? Should the FDA have insisted on stronger warning labels? Why or why not? 6. Did Merck act appropriately in recalling Vioxx and ceasing all efforts to market Vioxx in September 2004? Should it have recalled the drug sooner? Why or why not?