Course Outline - University of Puget Sound

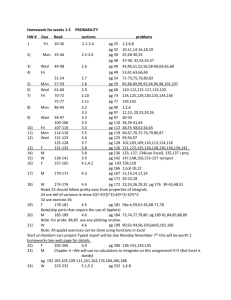

advertisement

University of Puget Sound School of Business and Leadership BUS 490C Senior Seminar Professor Alva Wright Butcher McIntyre 107 MWF 1:00-1:50 Fall Semester 2003 Office: McIntyre 111 I Phone: 253-879-3349 FAX: 253-879-3156 Office Hours: Mon-Wed-Fri 2:00-3:30 Tuesday 10:00-12:00 Note that I am always willing to schedule additional office hours by appointment. I check email frequently, so that is also a good way to communicate. Do not hesitate to call me at home. If you cannot reach me, please leave a number so that I can get back to you. Email: butcher@ups.edu Home: 206-285-3990 or 360-779-4706 Required: Text: Strategy, A View from the Top, Cornelis A. De Kluyver and John A. Pearce II, Prentice Hall, 2003 Packet of Harvard Business School Cases: Available in bookstore Cola Wars Continue: Coke vs. Pepsi in the 1990’s Sunrise Medical Inc.’s Wheelchair Products Open Market Inc.: Managing in a Turbulent Environment Staples.com Charles Schwab Corporation (A) Chadwick, Inc: The Balanced Scorecard Walnut Venture Associates Leadership Online: Barnes and Noble vs. Amazon.com Note on Financial Forecasting Assessing a Firm’s Future Financial Health G.E.’s Two Decade Transformation: Jack Welch’s Leadership Webvan: Groceries on the Internet Harvard Business Review Articles: Available on the library’s database http://library.ups.edu/gateway/business/business.shtml Access the Business Source Premier database. You can search on the article’s title. Robert S. Kaplan and David P. Norton, “Using the Balanced Scorecard as a Strategic Management System,” Harvard Business Review, January-February 1996. Michael E. Porter, “Strategy and the Internet,” Harvard Business Review, March 2001. William A. Sahlman, “How to Write a Great Business Plan,” Harvard Business Review, July-August 1997. BUS 490 Fall 2003 Professor Alva Butcher 1 Recommended: I recommend, but do not require, a subscription to the Wall Street Journal. We will be using the Wall Street Journal, Barrons, Financial Times etc. as sources of current topics that relate to the course material. As a student of business, you should be reading these publications on a regular basis. Course Objectives: The integrative senior seminar is designed to pull together the various theories and approaches that you have studied in your management, marketing, finance and accounting classes in order to analyze strategic issues facing a firm. The economic changes of the past several years suggest that an integrative approach to strategic problems and issues facing firms cannot ignore the growing impact of the Internet and new information technology on all aspects of strategic management. The ongoing revolution in communications and computing technology has major strategic implications for a wide range of industries. Thus we will examine strategic issues facing large firms such as Coca Cola and Pepsi, issues facing pure Internet firms, and issues facing “multichannel” firms - those with catalog or store as well as online operations. Current, decision oriented cases will be used to supplement the material. The course will emphasize the analysis of these real-life problems, and the effective communication of that analysis via written and oral reports. After completing this course you should have an understanding of the strategic management process. You will have experience in identifying opportunities and threats within an industry. You will have examined a variety of real situations facing firms and will have analyzed them in terms of internal strengths, internal weaknesses, value creation opportunities, and competitive advantage. You will be familiar with the key features of a business plan. You will have a clearer understanding of how financial, marketing and management issues are normally intertwined when making strategic decisions. Course Projects: Several projects and cases are assigned during the term. These are designed to enable you to: 1)practice effective communication techniques, both written and oral; 2) engage in an active learning situation: 3)perform data interpretation and analysis; 4)gain experience in the dynamic process of decision making under uncertainty. Several projects will require a written report. Reports must be typed, with exhibits inserted in the narrative where appropriate, or at the end of the report. Grades for both written reports and discussions will be based on content, exposition, and clarity. Over the course of the semester you will study a publicly traded company. You have been hired as an outside consultant to analyze the firm. Think in terms of the issues as we discuss topics over the semester. Your goal is to prepare a cohesive and careful analysis of the firm. It is important that you carefully cite all sources of information. The following questions are only suggested approaches. What is the history of the firm? How has its strategy evolved over time? What are the characteristics of the industry or industries in which it operates? What is its market share? Is it an industry leader? Do you see high growth potential? Who are the major competitors? What are the strengths and weaknesses of your firm? What is its global strategy? How has your firm performed over the past several years? What would you forecast in terms of performance for the next three to five years? You will need to collect full financial information on the firm. Would you invest in this firm for the long term, the short term? Why or why not? You might want to pick a local firm that is publicly traded, since this would allow additional insight if the management of the company will agree to talk to you about the strategy and structure of the firm. Each student will prepare an individual project; you BUS 490 Fall 2003 Professor Alva Butcher 2 will also serve as an editor of another student’s project. This project will be a capstone for the course and will involve a written report as well as a presentation. Additional details will be presented in class. Late written reports will not be accepted. Reports are due at the beginning of the class period. Please make an extra copy for your use during the class discussion. Class Preparation and Discussion: Since we will cover a great deal of material and will move quickly, preparation for class is extremely important. Prior to class, you are expected to have read the assigned reading material. You are also expected to be prepared to participate in the class discussion. If for some reason you are not prepared to participate in the discussion please let me know prior to class. Your presence and contribution to class discussion are extremely important. There are several categories: thoughtful contributor, present, absent with leave, and AWOL. Study Groups: This is a rigorous course. Discussing the cases and reading materials with classmates will help you in learning the concepts and in analyzing the cases. I strongly encourage you to form study groups that meet regularly. Exams: There will be one closed book midterm exam. The midterm exam will consist of essay questions and decision oriented problems. As a general policy, makeup exams will not be given. Grades: Grades will be based on the following weights: One Midterm Exam Capstone Project Course Projects, Reports, Case Briefings and Class Discussion Total 100 points 150 points 250 points Written Case Analysis: Financial Forecasting Case (30 points) Sunrise Medical Inc.’s Wheelchair Products (35 points) Leadership Online: Barnes & Noble vs. Amazon.com. (35 points) GE’s Two Decade Transformation: Jack Welch’s Leadership Case Briefings (20 points each) Cola Wars Continue: Coke vs. Pepsi in the 1990’s Walnut Venture Associates Chadwick Inc: The Balanced Scorecard Staples.com Charles Schwab Corporation (A) Case Discussion and General Class Discussion (50 points) 500 points BUS 490 Fall 2003 Professor Alva Butcher 3 Date Wed 9/3 Course Outline Topic An overview of the Strategic Process Required reading Chapter 1: What is Strategy? Fri 9/5 What is Strategy? continued Examine the strategy of Dell Computer. Read about the firm’s history. One source is the firm’s website, http://www.dell.com. How has Dell’s strategy evolved from the 1980’s to the present? To what extent do you think that this evolution was the result of detailed long term strategic planning? What was the firm’s response to unforeseen contingencies? Do the strategic actions taken by Dell reflect responses to circumstances that were unpredictable? Mission Statements and Vision Statements We have discussed the mission statement of Johnson& Johnson. Go to the web site of Merck, another large pharmaceutical company, http://www.merck.com. Examine the firm’s mission statement. Does it contain a code of corporate conduct that provides clear guidance to management? Explore the links to Corporate Responsibility. How does Merck balance its goals to “improve human life” and at the same time to provide “investors with a superior rate of return?” Find an example of the mission statement of another firm. Does it provide strategic guidance and motivational focus? Is it clear? Is it implementable? Do some research on this firm. Can you point to some actions that are consistent with its mission statement? Do you find examples of actions that are not consistent with the mission statement? Mon 9/8 Change in the External Environment Required Reading Chapter 2: Change and Uncertainty in the External Strategic Environment What are some of the key trends in the external environment? Be prepared to discuss the impact of one or more of these trends on a specific firm or industry. Economic Globalization We will be discussing some of the global economic issues raised in the television series, Commanding Heights. I would encourage you to explore more of this material on your own. It can be accessed at http://www.pbs.org/wgbh/commandingheights/lo/index.html. BUS 490 Fall 2003 Professor Alva Butcher 4 Wed 9/10 Change in the Industry Environment Required Reading Chapter 2: continued Michael E. Porter, “Strategy and the Internet,” Harvard Business Review, March 2001, pp. 63-78 1. 2. 3. 4. 5. What is the Internet? Who will capture the economic benefits that the Internet creates? Will the Internet influence your careers as business leaders of the future? What new business opportunities does the Internet offer? How does the Internet provide better opportunities for companies to establish distinctive strategic positions? 6. Who is doing business on the Internet? Visit some home pages and analyze what these companies are trying to achieve with their presence on the Web. Video: Internet Shopping: Interactive or Invasive? Fri 9/12 Change in the Industry Environment: continued Industry Structure and Porter’s Five Forces Model Dealing with Risk and Uncertainty: Sensitivity Analysis Do some research on the U.S. airline industry. Be prepared to discuss Porter’s five forces model with respect to this industry. How do these five forces shape competition in this industry? Mon 9/15 Case Discussion and Case Briefing Prepare a two to three page typed case briefing for question number 1. Be prepared to discuss question number 2. Cola Wars Continue: Coke vs. Pepsi in the 1990’s The Cola Wars case is set in 1994. Can Coke and Pepsi maintain their phenomenal growth at home and abroad? 1. Conduct a Five-Forces Analysis of the concentrate Manufacturing Industry. Barriers to Entry What are the barriers to entry? Are there advantages to those who move first into the market? Substitutes What other substitutes are available? What do they cost? Why don’t they have much effect on prices? Suppliers What power do suppliers have vis-à-vis the concentrate manufacturers? Buyers Who are the buyers for the concentrate manufacturer? How much power do they have? Rivals BUS 490 Fall 2003 Professor Alva Butcher 5 Who are the rivals? Who has won the cola wars? Why? What have been the “weapons of war”? 2. Conduct a Five-Forces Analysis of the Bottlers. Wed 9/17 Strategic Resources and Frameworks to Assess Strategic Position Required Reading 1. Chapter 3: Leveraging Internal Resources and Change Drivers for Competitive Advantage Note: We will be discussing various topics in this chapter over the next few weeks. Thus I recommend that you review this chapter several times in conjunction with the supplementary reading materials and cases. 2. Assessing a Firm’s Future Financial Health, Harvard Business School Case Read the discussion of the essence of long-term financial health Work through the programmed text on financial ratios. Answer each of the questions and be sure you understand the calculation and meaning of each of the ratios. Be prepared to discuss your results in class. This does not need to be handed in. Using any approach you find helpful, identify three of the five unidentified industries (pages 14, 15 and 17 of the case). The case is designed to help you recognize the range of distinctive patterns in financial statements for different industries. The operating and competitive characteristics of the industry in which a firm operates has a strong influence on the firm’s investment in the various types of assets and the form of financing used to support those assets. You are asked to play the financial detective here, and to use selected financial data to identify companies in 5 industries. Note that the balance sheets shown in Exhibit 3 are common size balance sheets. That is all items are calculated as a percentage of total assets. What were the key screening devices or key clues that you used to identify a particular industry? Be prepared to discuss your rationale in class. This does not need to be handed in. Fri 9/19 Strategic Resources and Frameworks to Assess Strategic Position continued Required Reading Note on Financial Forecasting, Harvard Business School Case You may skip the section on Cash Budgets, pp 6-8. The assumptions used to prepare the Pro Forma Operating Statement (Table A) and the Pro Forma Balance Sheet (Table B) are provided in the Note. Be prepared to discuss the details behind some of these pro-forma forecasts. In particular, can you explain the calculations behind the Pro Forma numbers for Inventories, Accounts payable, Accrued liabilities, Earned surplus, and Additional financing needs in Table B? BUS 490 Fall 2003 Professor Alva Butcher 6 Mon 9/22 Financial Forecasting Case You will use financial statements for the past year and will prepare pro forma statements (or forecasted statements) for the coming year based upon some stated assumptions. I will email you an excel file with the assumptions and the past year’s financial statements. Use this excel file to prepare your forecasts. Please bring a hard copy of your excel file for class discussion. Prior to class, please send your excel file to me as an attachment to an email message. A file with a virus will not be accepted, and the grade for this project will be discounted depending on the length of the delay. Wed Strategic Resources and Frameworks to Assess Strategic Position continued Eva Balanced Scorecard SWOT analysis 9/24 Required Reading Robert S. Kaplan and David P. Norton, “Using the Balanced Scorecard as a Strategic Management System,” Harvard Business Review, January-February 1996. Fri 9/26 Strategic Resources and Frameworks to Assess Strategic Position continued Corporate Culture and Core Competencies In January 2000 the $175 billion combination of AOL and Time Warner was announced. Three years later, AOL/Time Warner shares had lost two-thirds of their value since the merger closed and Steve Case, former CEO of AOL and chairman of the AOL/Time Warner had resigned. Do some research on AOL, Time Warner, and the events following the merger. What were the core competencies of these firms? What were the corporate cultures? Mon 9/29 Case Discussion and Case Briefing Chadwick, Inc: The Balanced Scorecard Division managers at Chadwick are unsatisfied with the continual pressure to meet short-term financial objectives. Mangers did not believe that using a single target, return on capital employed, linked current actions and efforts to longer term value creation. Case Briefing Prepare a two to three page typed report. Develop the Balanced Scorecard for the Norwalk Pharmaceutical Division of Chadwick, Inc. What parts of the business strategy that John Greenfield sketched out should be included? Are there any parts that should be excluded or cannot be made operational? What are the scorecard measures you would use to implement your scorecard in the Norwalk Pharmaceutical Division? What are the new measures that need to be developed, and how would you go about developing them? BUS 490 Fall 2003 Professor Alva Butcher 7 Wed 10/1 Competitive Strategy Required Reading Chapter 4: Formulating Business Unit Strategy Chapter 5: Business Unit Strategy-Context and Special Dimensions Note: We will be discussing various topics in these chapters over the next few weeks. Thus I recommend that you review these chapters several times in conjunction with the supplementary reading materials and cases. Fri 10/3 Mon 10/6 Competitive Strategy continued Case Discussion and Written Case Analysis Sunrise Medical Inc.’s Wheelchair Products Video: Product Demonstration The Sunrise case describes a strategic decision confronting CEO Richard H. Chandler in August of 1993. Should he approve a plan by one of Sunrise’s divisions to introduce a new lightweight standard wheelchair? The case is designed to illustrate basic principles of strategy and strategic decision-making. The case also provides detailed financial information at the divisional level. We will utilize this to perform some financial ratio analysis. Additional details will be presented in class. Wed 10/8 Case discussion continued Fri Executive Panel John Huddleston, Senior Vice President and CFO, Pacifica Bank Curt Nohavec, Chief Financial Officer, Connexion by Boeing Jan Willem A. Smeulers, Vice-President, KLM Executive OfficeNorth America and Mexico 10/10 Mon 10/13 Case Discussion and Case Briefing Walnut Venture Associates This case is designed to put you in the shoes of potential investors and to force you to really dig into a business plan/business model. Case Briefing Prepare a two to three page brief that evaluates the potential investment in RBS in terms of customer/market, competition, management team, and financials. Other Discussion Issues What critical issues do you see as requiring more investigation/due diligence on your part prior to investing, and how would you accomplish that? What level of comfort/certainty would you need prior to investing? Required Reading “How to Write a Great Business Plan”, by William A. Sahlman, Harvard Business Review, July-August 1997, pp. 98-108 BUS 490 Fall 2003 Professor Alva Butcher 8 Some Internet links for future reference 1. Small Business Administration http://www.sba.gov/starting/businessplan.html This site provides a forty-page business plan outline as well as other excellent material with regards to financing and stating a new business. 2. WSJ Startup http://wsj.mimiplan.com/ A mini business plan software that helps you to prepare and test your business plan for free. You have to register to use this free service. There are examples of business plans that you can access. 3. Bplans.com http://www.bplans.com/samples/index.cfm?affiliate=bplans This web site provides samples of various types of start-up plans, service plans, nonprofit plans, established plans and product plans. Wed 10/15 Case Discussion Webvan: Groceries on the Internet Can the age-old grocery business be conducted successfully in a web-based environment? Be prepared to discuss the following topics: 1. What do you see as the greatest strengths of the Webvan business model? What are its key weaknesses? 2. Who is the target market for Web ordering/home-delivery? Several business models of grocery services are described in the case. Which elements do you think have most appeal to the target customer? Which aspects are easily replicated, and which element will be hard to replicate? 3. As a consumer, would you adopt Webvan as your grocery “store”? What more should the firm be doing to convince you to become - and to remain – a loyal customer? 4. How much adoption does Webvan need in order to break even? 5. As a potential investor, would you invest in Webvan? Why or why not? Fri 10/17 Midterm Exam Mon 10/20 Fall Break Wed 10/22 Planning for the Long-term in a Dynamic and Uncertain Environment Economies of Scale Corporate Governance Growth Strategies Required Reading Chapter 6: The Dynamics of Corporate Strategy Chapter 7: Strategic Options at the Corporate Level Note: We will be discussing various topics in these chapters over the next few weeks. Thus I recommend that you review these chapters several times in conjunction with the supplementary reading materials and cases. Fri 10/24 Case Discussion Open Market Inc. Video: An Interview with Shidar Ghosh, CEO of Open Market BUS 490 Fall 2003 Professor Alva Butcher 9 Open Market, Inc, founded in 1994, had grown from 12 to 170 employees in just one year. The firm develops software tools and systems for doing business on the Internet. The CEO has called a meeting of his key management team to plan for a critical new phase. What recommendations do you have for the CEO? Be prepared to support your recommendations. How has the firm’s business plan evolved since it was founded in 1994? What were the key features of the industry in 1994-1995? What are the human resource considerations? How can management create an environment that fosters creativity and motivation while ensuring commitment and intensity of effort toward organizational goals? As the number of employees increases, what leadership and general management skills are required? What strategy should the firm adopt? Sell Store Builder software through retailers, licensed agents and other channels? Be an Internet service provider – provide marketing and payment services Target large customers and create custom end-to- end solutions. Exit the business. Other Mon 10/27 Case Discussion and Written Case Analysis Leadership Online:Barnes & Nobel vs. Amazon.com This case describes one of the classic battles between an Internet-based startup and a traditional retailer trying to leverage its resources and capabilities online. Prepare a three to four page written report that addresses the following issues: 1. Based on your own experience of traditional bookselling and your exploration of online bookselling, compare customers’ willingness-to-pay for books supplied by these two business models. 2. Substitution can be distinguished from imitation in the sense that it involves the threat of being displaced by different business models rather than being imitated by look-alikes. Access Barnes & Noble’s response to the substitution threat from Amazon. How did Amazon respond in turn, and to what net effect? Questions for class discussion: Who will be the online leader? This case is set in mid-1997. What has happened since then? Examine the forecasted long-run cost positions. Compare the costs of a successful online bookseller to Barnes & Noble’s traditional business model. (Assume that Exhibits 4 and 7 in the case reflect average discounts of 10% off list price for Barnes & Noble’s traditional bookstores and 25% off list for the online bookseller.) Wed 10/29 Retail and online competition continued Video: Amazon.com and the World of E-Commerce BUS 490 Fall 2003 Professor Alva Butcher 10 Fri 10/31 Draft of Capstone Project is due for editing Each student will edit the report of another student. You will meet for discussion on Wednesday, Nov 5th and Friday, Nov. 7th. Marketing Issues In the Leadership Online case, Barnes and Noble instituted an online price cut from a 10% discount structure to a 25% discount structure. How are price cuts, sales volumes, and profits related? Required Reading “Survival Strategy: Amazon Takes Page from Wal-Mart to Prosper on the Web,” Wall Street Journal, November 22, 2002, by Nick Wingfield. Mon 11/3 Case Discussion and Case Briefing Staples.com Staples, the office supply superstore, first entered the online marketspace in 1998. By January 2000, it had become a serious contender for leadership as an online retailer of office supplies and services to home offices and small businesses. However, it faces some critical strategy decisions. Prepare a two to three page case briefing that addresses any two from the set of questions 1 – 5 below. 1. What is Staples’ competitive advantage in the online marketspace? 2. Do you agree with Staples.com’s growth strategy and timing? Why? Are they following a “Get Big Fast” strategy? Would you pursue wallet share or market share as the first priority? Or, like Staple.com, would you pursue both with vigor? 3. Do you think that Staples.com should expand into the SOHO services market? If so, should it ally with external service providers or create services internally? 4. What should Staples.com’s pricing strategy be relative to the competition? What should their pricing strategy be relative to Staples’s catalog and Staples’s retail stores? 5. Do you agree with the high level of organizational and operational integration between Staples.com and Staples Inc? What are the risks and/or disadvantages associated with the dotcom division being so closely allied to the parent? Do you think that Jeanne Lewis will be successful in creating a vibrant “dotcom” culture at Staples.com? Why or why not? If you were Kelly Mahoney, would you take this job Wed 11/5 & Fri 11/7 Editing of Capstone Projects Your project will be edited by one of your fellow students, and you will serve as an editor of a student project. You are expected to have carefully read the report and to have provided written editorial comments and suggestions. Editorial sessions will be scheduled in ten minute segments over these two class periods. Mon 11/10 Case Discussion and Case Briefing Charles Schwab Corporation(A) This case is the inside story of one of the most exciting business-to-consumer Ecommerce situations. BUS 490 Fall 2003 Professor Alva Butcher 11 Prepare a two to three page typed case briefing that addresses any two from the set of questions 1 – 4 below. 1. What kind of a company is Charles Schwab? 2. What are the industry conditions? 3. As David Pottruck, would you cut prices on January 15, 1998? 4. As Dawn Lepore, what are the key issues? 5. Do you see any parallels to the Amazon/Barnes & Noble story? Wed 11/12 Case Discussion Charles Schwab Corporation(B) (This will be distributed on Monday November 10th) Video: A Presentation by David Pottruck, CEO Fri 11/14 Global Issues Required Reading Chapter 8: Formulating a Global Strategy Mon 11/17 Global Issues continued Wed 11/19 Executive Speaker Kent Wheiler Strategic Planning Director Weyerhaeuser Fri 11/21 Case Discussion G.E.’s Two Decade Transformation: Jack Welch’s Leadership Required Reading Chapter 9: Strategy Implementation and Control The G.E. case focuses on the strategic, organizational and managerial levers that Welch used in his two-decade process of change. The case also documents the impact his actions have on the company’s sources of competitive advantage. Suggested discussion questions: 1. How difficult a challenge did Welch face in 1981? How effectively did he take charge? 2. What is Welch’s objective in the series of initiatives he launched in the late 1980s and early 1990s? What is he trying to achieve in the round of changes he put in motion in that period? Is there a logic or rationale supporting the change process? 3. How does such a large, complex, diversified conglomerate defy the critics and continue to grow so profitably? Have Welch’s various initiatives added value? If so, how? 4. What is your evaluation of Welch’s approach to leading change? How important is he to GE’s success? BUS 490 Fall 2003 Professor Alva Butcher 12 5. In the recent focus on corporate governance, Jack Welch has come under some criticism. Do some research on this. Do you agree with the criticisms? Why or why not? Video: An Interview with Jack Welch Mon 11/24 G.E. case discussion continued Wed 11/26 Marketing Issues Video: How to Build a Brand Fri Thanksgiving Holiday 11/28 Mon 12/1 Capstone Presentations Each student will have twenty minutes to present their research project. The research paper is due on the day of the presentation. Wed 12/3 Capstone Presentations, continued Fri 12/5 Capstone Presentations, continued Mon 12/8 Capstone Presentations, continued Wed 12/10 Capstone Presentations, continued BUS 490 Fall 2003 Professor Alva Butcher 13