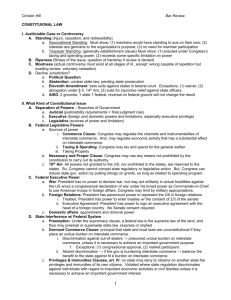

commerce power - Washington University School of Law

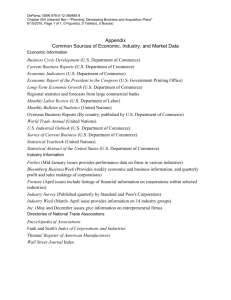

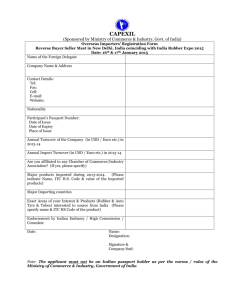

advertisement