The Constitution

advertisement

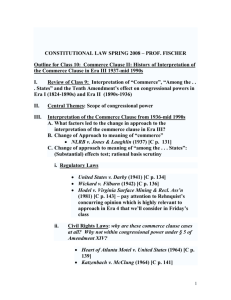

The Constitution: Focus on Application to Business Chapter 4 Articles of the Constitution • • • • • • I. Composition and powers of Congress II. Selection and powers of the President III. Creation and powers of the federal judiciary IV. Role of the states in the federal system V. Methods of amending the Constitution VI. Declaring the Constitution to be supreme law of the land • VII. Method for ratifying the Constitution Constitutional Amendments • Amendments began almost immediately after Constitution was ratified. • In 1791 the first 10 amendments were ratified by the States. These are called the Bill of Rights. • A proposed amendment must be passed by 2/3 vote in the House and Senate • Then ratified by 3/4 of state legislatures OR • May be proposed by 2/3 of state legislatures by calling for a constitutional convention – This must be ratified by 3/4 of state legislatures COMMERCE CLAUSE Art. I, Section 8 • Congress has power to: “Regulate Commerce with foreign Nations & among the several States, and with the Indian Tribes” • Deals with “interstate commerce” Necessary and Proper Clause (Clause 18, Article I, Section 8) • Constitution enumerates list of Congressional powers - AND • Power “to make all Laws which shall be necessary and proper for carrying into Execution the forgoing Powers…” • This power with the Commerce Clause provides BROAD Congressional control of commerce. • Most laws are necessary and proper! McCulloch v. Maryland (1819) • Can Congress establish a National Bank? • Yes, it is constitutional under the Necessary and Proper clause, which expands Congress’s powers • Constitutional federal actions take precedence over actions of other governments under the Supremacy clause • Maryland wanted to regulate the National Bank • NO. Violates Supremacy Clause Wickard v. Filburn (1942) • Federal controls on production of wheat • Small farm in Ohio produces 239 bushels more than farmer Filburn was allowed • He is fined $117 and ordered not to plant more • Filburn argues that production used to feed his chickens and cows and for making bread – all for consumption on farm • HELD: Although this appears “intrastate” & “trivial” • STILL, all small farmers together would impact “interstate” commerce and “market conditions” • Congress may regulate production • Note: Almost all commerce is defined as “interstate” Federal and State Regulatory Relations Versus • If states legislate on a matter on which Congress has legislated: • Federal regulation takes precedence over state regulation. • State regulations may not contradict federal law standards. • State may not enact laws that burden interstate commerce by imposing restrictions on business from other states. Katzenbach v. McClung (Use of Commerce Clause in a discrimination) 1964 Case • • • • Ollie’s Bar-B-Q Family-owned restaurant in Birmingham, AL 220 seats for white customers only New Title II of 1964 Civil Rights Act prohibits racial segregation in public accommodations if serving interstate travelers or if food moved in interstate commerce • Does Title II apply to a local business? • HELD: Yes, activity may “exert a substantial economic effect on interstate commerce.” When State Law Impedes Interstate Commerce • Southern Railway Co v. • Chemical Waste Arizona – Court struck Management v. Hunt – down Az law that required Violates Commerce clause to trains to be shortened for charge more for out-of-state safety reasons. generated hazardous waste than for in state waste • Rowe v. NH Motor Transport – S. Ct. struck • Wyoming v. Oklahoma – Ok down a ME law requiring law requiring coal-burning companies shipping power plants to burn at least tobacco products into 10% Ok-mined coal was state to confirm that discriminatory & interfered recipients are of legal age. with interstate commerce. U.S. Statutes specifically prohibit this state action. Hughes v. Oklahoma • Oklahoma prohibits shipping or selling minnows out of state to protect Oklahoma minnows. • Hughes bought minnows in Oklahoma and took them to Texas. Convicted of violating state law. • OK Supreme Court upheld statute as constitutional to protect OK natural resources. Hughes appealed. • U.S. Supreme Court: Reversed in favor of Hughes. • Three part test in such cases: 1) Does statute regulate evenhandedly with only “incidental” effects on interstate commerce? 2) Does statute serve a legitimate local purpose, and if so 3) Could alternative means promote this local purpose as well without discriminating against interstate commerce? • Fine to protect wildlife, but could be done in less discriminatory way by the state Taxing Power Art. I, Section 8, Clause 1 • “lay & collect taxes” • 16th Amendment gave federal government power to impose income taxes • Taxes used to raise revenue and /or deter/punish/encourage certain behavior • Supreme Court: “the power to tax includes the power to destroy” • Supreme Court: Upheld taxes on illegal gambling, narcotics & marijuana (illegal business activities) – If reported: evidence of illegal activity – If don’t report, violate tax laws State Taxation • State taxes cannot impede interstate commerce. • Baccus Imports v. Dias: Court struck down Hawaii’s 20% tax on all alcoholic beverages except for local products. • Davis v. Michigan Dept. of Treasury: Mich. exemption from state income on retirement benefits to state employees. – Taxes must apply equally to all retirement benefits. • Quill Corp. v. North Dakota: State sales taxes imposed on out-of-state firms doing mail-order business with ND residents were stricken – Must have a physical presence in the state to be taxed • Controversial area: States ability to tax internet businesses • Apportioning state tax burden: Supreme Court held business income may be taxed by states as long states use formulas that divide a company’s income fairly in portion attributable to each state. Business and Free Speech First Amendment Freedom of Speech • Commercial Speech (advertisements) • Political statements by corporations (public issues) • Usually allowed • UNLESS “compelling state interest” to prohibit • (For example: public safety or health) • Supreme Court struck down parts of McCainFeingold Act prohibiting for-profit and non-profit corporations & unions from broadcasting “electioneering communications” • See Consolidated Edison case (business & political speech) • See also Central Hudson case (business and commercial speech) Consolidated Edison Co. v. Public Service Commission of NY • Con Ed mailed statement supporting nuclear power in monthly billing • Public Service Comm. of NY said: Can’t do it as customers are captive audience and should not be subjected to Con Ed’s views • HELD: Supreme Court reversed in favor of Con Ed • Test: Was the state’s prohibition 1) reasonable as to time, place & manner of speech? 2) concerning a permissible subject matter? 3) “narrowly-tailored” to serve a “compelling state interest”? • This is not a captive audience. Customers may choose not to be exposed by not reading material or throwing away. S.Ct.: Business & Commercial Speech • Shapiro v. Kentucky Bar • Bigelow v. Virginia: Court Assn.: Held state bar reversed conviction of VA violated 1st Amendment by newspaper editor who restrictions on advertising published ads re: for professionals services availability of low-cost (e.g. lawyers or doctors) abortions in NYC • Trustees of the SUNY v. • Virginia State Bd. Of Fox: Standard for judging Pharmacy v. Virginia commercial speech Citizens Consumer regulation is one that is Council: Struck down VA “not necessarily perfect law prohibiting advertising but reasonable” and of prices of prescription “narrowly tailored to drugs. achieve the desired objective.” Central Hudson Gas & Electric v. Public Service Comm. of New York • The NY Public Service Commission ordered the end of advertising that promoted the use of electricity as contrary to public interest. • U.S. Supreme Court HELD: Although commercial speech does receive lesser protection than other guaranteed expressions – The ban more extensive than necessary to achieve the state’s objective, so unconstitutional. Test: 1. Is regulated speech lawful and truthful? 2. Is there a substantial government interest to advance? 3. Regulation directly advance government interest? 4. Regulation no more than is necessary to serve public interest? • Reversed for Central Hudson 2nd Amendment Right to Bear Arms • Restrictions government may place on gun ownership & possession – not settled area – Some jurisdictions (i.e. NYC) have very tight controls – Others do not • Some employers & business ban the possession of firearms anywhere on company property • State of Oklahoma: Passed statute prohibiting employers from preventing employees from storing firearms in their personal, locked vehicles on company property 4th Amendment – Unreasonable Search & Seizure “The right of the people to be secure in their persons, houses, papers and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue but upon probable cause….” • • • • • Does government (i.e. OSHA) need warrant? Usually yes Exception: closely regulated businesses However, business usually agrees to search Generally, closed places such as homes and businesses are not subject to random police searches Limits of Searches & Inspections • Government inspectors who come to business for a warrantless inspection • Marshall v. Barlow – OSHA inspector asks to search work areas. – Barlow refused admission unless inspector got a warrant. – HELD: Inspector must get a warrant. • Skinner v. Railway Labor Executives’ Assn. RR employees involved in train accidents or safety violations can be searched for alcohol or drugs – closely regulated industry 5th Amendment-Right Against Self Incrimination “No person shall be. . . compelled in any criminal case to be a witness against himself.” • Does self-reporting violate 5th Amendment? – Applies to PEOPLE, not Corporations – Braswell v. U.S.: President & sole stockholder must report, even if it incriminates him – But in practice business records tied to persons 5th Amendment – Just Compensation or Takings Clause “nor shall private property be taken for public use, without just compensation.” • Can government take property for public purposes – oil pipelines, military bases, highways, sidewalks? Yes. • Eminent domain – the right of governments to condemn private property for public uses • What is “just” compensation? Usually “fair market value”. • Destruction of property value through takings must be almost complete to receive compensation – i.e. 60% devaluation due to change in zoning laws does not require governmental compensation to affected owners. • Controversial economic development tactics: City uses power to get land desired by a private developer – legal in some states; illegal in others—”blight” barn door exemption. • See Kelo v. City of New London, Connecticut Kelo v. City of New London, Connecticut • City of New London worked on plan to piece together property along riverfront for upscale housing, a new shopping center, and a facility for Pfizer Company. • Some home owners refused to sell, including Suzette Kelo, who wanted to keep her water-front home, and Wilhemina Dery who was born in her home in 1918 and lived there all of her life. • City used power of eminent domain to buy property and sell to developers. • Homeowners claimed this was a 5th Amendment violation of “public use”. • Connecticut courts held the taking was proper and home owners appealed. (continued) Kelo v. City of New London, Connecticut • ISSUE Does the City’s development plan serve a “public purpose”? • This court favored giving legislatures broad latitude in determining the public needs through takings. • Court will defer to the city’s determination for the need for “economic rejuvenation.” • Look at benefits to the community, such as new jobs, increased tax revenue. • HELD: The takings that are challenged satisfy the Fifth Amendment requirements of takings for a public purpose. City wins. • IJ—Kelo v. New London 6th, 7th & 8th Amendments 6th Right to trial by jury in criminal cases 7th Right to trial by jury in common law cases 8th Limits cruel & unusual punishments and excessive fines 14th Amendment: Due Process Clause and Equal Protection Clause • “No state . . . shall deprive any person of life, liberty or property without due process of law; • “nor deny to any person within its jurisdiction the equal protection of the laws.” • 14th Amendment incorporates protections from the Bill of Rights & applies them to state governments. • Due process: violated when a state infringes on fundamental liberty interests without narrowly tailoring to meet the compelling state interest; is offended when state action shocks the conscience or offends judicial notions of fairness and human dignity • Equal protection: governments must treat people equally Pro’s Sports Bar & Grill v. City of Country Club Hills • Pro’s Sports Bar & Grill received a Class A liquor license from City of Country Club Hills (suburb of Chicago) – Allowed Pro’s to stay open until 2 AM Monday – Fridays – Open until 3:00 AM Saturdays and Sundays • Next year, owners reapplied for renewal. • City council decided (without hearing or vote) to change liquor license to require Pro’s to close at 11:30 PM on weekdays & 12:30 AM on the week-end. • Owners sued– would have terrible impact on business • District court issued a temporary injunction against City’s enforcement of new license • Court said there was a violation of due process. • City appealed. (Continued) . Pro’s Sports Bar & Grill v. City of Country Club Hills • Two questions – Whether plaintiffs were deprived of a protected liberty or property interest. – If so, whether deprivation occurred without due process. • When license granted, this is a form of property under “due process.” • Like a revocation of an existing license, nonrenewal requires cause and a hearing • Pro’s did not receive a pre-deprivation hearing or other protections of the revocation process. • Irreparable harm to Pro’s outweighs any interest in city. • HELD: Preliminary injunction against the City’s actions upheld. Reget v. City of La Crosse • Reget owned John’s Auto Body in La Cross, Wisconsin since 1975. • City ordinance: If you have 2 or more junked vehicles outdoors for more than 30 days, you are a junk dealer & need fence to hide vehicles. • He said that rule was unfair as it applied only to him. • In 1996, City wanted to rezone Reget’s property from “heavy industrial” to “commercial” – would force him to move his business. • Reget and City fought. City agreed that Reget could stay if he built a fence & complied w/ noise ordinance. • Reget again complained that City was selectively enforcing its ordinance. • City agreed to enforce its ordinances against any violators. • In 2003, no fence; city issued citation. • Reget agreed to let City install a fence and to repay city for the costs • In 2006, Reget sued City and officials for violating his equal-protection rights by selectively enforcing its ordinance him and by targeting him for rezoning. (Continued) Reget v. City of La Crosse • • • • • • • • • • • • District Court granted summary judgment for City. Reget appealed. HELD: Affirmed Summary judgment for City, and dismissed Reget’s claims Equal protection is violation even if there is so-called “class of one” Plaintiff must prove: 1) state intentionally treated him different than others similarly situated AND 2) there is no rational basis the difference in treatment. Reget’s argument fails with first step of analysis. Others compared to Reget must be similar in material aspects. Reget did not produce evidence that other businesses failed to comply with fence requirement. No evidence that other dealers were not cited. Three citations against Reget were dismissed – unlike other junk dealers. Reget volunteered to build fence with settlement of his rezoning dispute. This voluntary agreement cannot support a class-of-one claim. No evidence that City singled him out for rezoning. City rezoned more than 100 properties as part of rezoning project.