CRUDE OIL PRICES RISE ON WEAK DOLLAR

advertisement

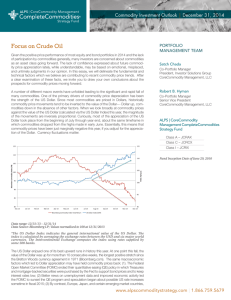

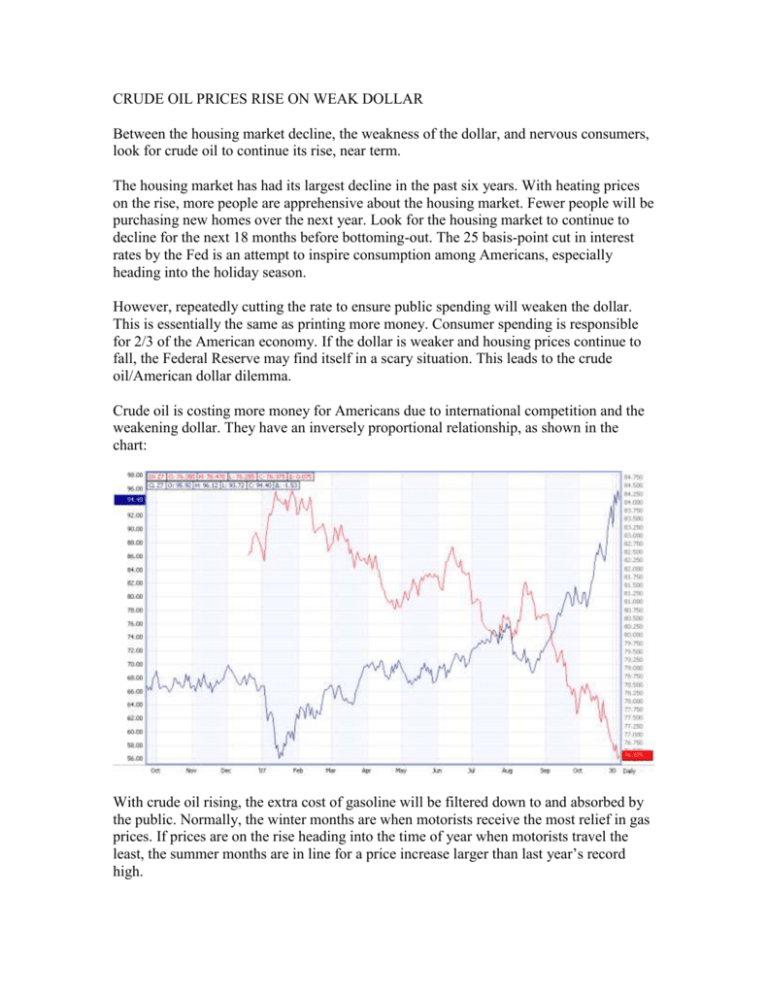

CRUDE OIL PRICES RISE ON WEAK DOLLAR Between the housing market decline, the weakness of the dollar, and nervous consumers, look for crude oil to continue its rise, near term. The housing market has had its largest decline in the past six years. With heating prices on the rise, more people are apprehensive about the housing market. Fewer people will be purchasing new homes over the next year. Look for the housing market to continue to decline for the next 18 months before bottoming-out. The 25 basis-point cut in interest rates by the Fed is an attempt to inspire consumption among Americans, especially heading into the holiday season. However, repeatedly cutting the rate to ensure public spending will weaken the dollar. This is essentially the same as printing more money. Consumer spending is responsible for 2/3 of the American economy. If the dollar is weaker and housing prices continue to fall, the Federal Reserve may find itself in a scary situation. This leads to the crude oil/American dollar dilemma. Crude oil is costing more money for Americans due to international competition and the weakening dollar. They have an inversely proportional relationship, as shown in the chart: With crude oil rising, the extra cost of gasoline will be filtered down to and absorbed by the public. Normally, the winter months are when motorists receive the most relief in gas prices. If prices are on the rise heading into the time of year when motorists travel the least, the summer months are in line for a price increase larger than last year’s record high. Another adverse affect of rising crude oil prices is that people will be less willing to spend money on gifts and travel during the holiday season. Without this stimulation to the economy at regular prices, major airline companies and retail stores will compete by lowering prices to inspire buying. The less money received for these products will cause major corporations to borrow more from banks. As the Fed continues to cut rates, banks will be able to offer more money on loan to both individuals and institutions. But this is the equivalent of putting a band-aid on a broken leg. By making more money available for banks to pass along to individuals and institutions, the consumers become unwilling to spend that money on things that are not necessary, such as toys, cars and travel. Because of the default on recent loans, banks are uneasy leaving themselves exposed to high-risk loans. Finally, the national debt as of October 17, 2007 is roughly 9 trillion dollars. With this staggering amount of debt, the government has little to no money to loan to the banks to stimulate the economy. It is a cycle that is dangerous and does not seem to have an end in the near future. Look for the dollar to continue its weak trend based on the uneasiness of the economy to spend and the national debt to continue its rise. The dollar will continue its downward trend over the following six months bottoming out around 73.500 – 74.500 (current Dollar is 76.575). Due to this, oil prices will continue to rise. I believe the top will be between $99-103 dollars/barrel and that this trend will continue until the end of the year. However, I believe OPEC will increase production in January, driving the price back $9 $13. This increase in production, coupled with warmer weather in March should bring the price back down to a manageable level. TRADE RECOMMENDATION Buy January Crude oil at 93.25. Hang onto crude to the target price range of $98.25 $100.45, a profit of $5,000 - $7,200. Hedge this with 86.00 March 08 puts, currently priced at $2,500.