APS7 - Cornell

advertisement

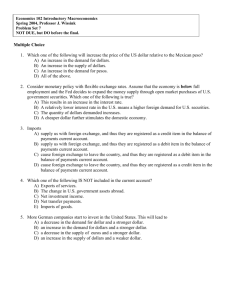

Economics 102 Introductory Macroeconomics Spring 2004, Professor J. Wissink Problem Set 7 NOT DUE, but DO before the final. Multiple Choice 1. Which one of the following will increase the price of the US dollar relative to the Mexican peso? A) An increase in the demand for dollars. B) An increase in the supply of dollars. C) An increase in the demand for pesos. D) All of the above. 2. Consider monetary policy with flexible exchange rates. Assume that the economy is below full employment and the Fed decides to expand the money supply through open market purchases of U.S. government securities. Which one of the following is true? A) This results in an increase in the interest rate. B) A relatively lower interest rate in the U.S. means a higher foreign demand for U.S. securities. C) The quantity of dollars demanded increases. D) A cheaper dollar further stimulates the domestic economy. 3. Imports A) supply us with foreign exchange, and thus they are registered as a credit item in the balance of payments current account. B) supply us with foreign exchange, and thus they are registered as a debit item in the balance of payments current account. C) cause foreign exchange to leave the country, and thus they are registered as a debit item in the balance of payments current account. D) cause foreign exchange to leave the country, and thus they are registered as a credit item in the balance of payments current account. 4. Which one of the following IS NOT included in the current account? A) Exports of services. B) The change in U.S. government assets abroad. C) Net investment income. D) Net transfer payments. E) Imports of goods. 5. More German companies start to invest in the United States. This will lead to A) a decrease in the demand for dollar and a stronger dollar. B) an increase in the demand for dollars and a stronger dollar. C) a decrease in the supply of euros and a stronger dollar. D) an increase in the supply of dollars and a weaker dollar. 6. A high rate of inflation in one country related to another puts pressure on the exchange rate between the two countries, and there is a general tendency for the A) demand schedule of the citizens of the low-inflation country for the high-inflation country’s currency to shift rightward. B) demand schedule of the citizens of the high-inflation country for the low-inflation country’s currency to shift leftward. C) currency of the relatively high-inflation country to appreciate. D) currency of the relatively high-inflation country to depreciate. Short Questions 1. Explain how the following situations affect the United States' balance of payments. a. b. c. d. A U.S. defense contractor sells its consulting services to a company in France. Your investment club decides to buy 100 shares of a promising Korean automobile manufacturer. A consortium of European investors decides to build a large manufacturing facility in Montana. You are from India and you and your parents decide to send you to Cornell. Ans: a. This would bring foreign exchange into the country, thus there would be a credit on the balance of payments current account and a debit on the capital account (since it would increase the amount of foreign exchange US citizens hold). b. Foreign exchange is used up here and there will be a debit in the capital account, as there will be an increase in US assets abroad. At the same time, there will be an increase in foreign assets in the US, which will be recorded as a credit in the capital account. c. Capital Account gets +$x000 in “Change in foreign assets in the United States” and Capital Account gets -$x000 “Change in U.S. assets abroad” because now some Americans own foreign currency due to the fact that the European investors sell their Euros in exchange for the dollars they need to build the facility. d. This will generate a credit in the current account and a debit in the capital account. 2. Identify whether each of the following would lead to an appreciation or depreciation of the dollar. In each case, explain why the currency either appreciates or depreciates. a. U.S. citizens switch from buying stock in British companies to buying stock in U.S. companies. b. The inflation rate in the United States increases relative to the inflation rate in England. c. The money supply is increased in the United States. d. Income in the United States increases. Ans: a. This decreases the demand for British pounds and will strengthen the dollar relative to the pound – the dollar appreciates relative to the pound. b. An increase in the inflation rate in the United States relative to England causes an increase in the demand for pounds and a decrease in the supply of pounds, weakening the dollar – the dollar depreciates. c. An increase in the money supply leads to relatively lower interest rates in the US, which leads to an increase in the demand for foreign currencies and a decrease in supply of foreign currencies, which will weaken the dollar against other currencies – the dollar depreciates. d. When income in the United States increases, we expect imports to increase which increases the demand for foreign exchange, weakening the dollar – the dollar depreciates. 3. Suppose an economy is represented by the following equations: C = 300 + 0.6Yd I = 400 G = 1,000 EX = 400 IM = 0.1Yd Yd = Y-T T = 1,000 a. b. c. d. Find Y* for this economy. Find the value of the government multiplier. What is the value of this economy’s current account in its balance of payments? Without using any explicit numbers, how would a sudden depreciation of the dollar alter Y*? Ans: a. AEd = C+ I + G + (EX – IM) = 300 + 0.6(Y- 1000) + 400 + 1000 + 400 – 0.1(Y – 1000) = 1600 + 0.5Y Invoke the equilibrium condition: Y* = AEd Y* = 1600 + 0.5Y* 0.5Y* = 1600 Y* = 3200 The equilibrium national income, Y* for this economy is 3,200. b. The government multiplier, Kg 1 1 mpc mpm 1 = 1 0.6 0.1 1 2 = 0.5 = c. The economy’s current account is defined as exports – imports of goods and services. At Y* = 3200, the value of imports is 0.1*[3200-1000] = 220. Hence, value of current account = 400 – 220 = 180. There is a trade surplus. d. Assume that this economy is the US economy. A depreciation of the dollar implies that the value of the dollar has fallen. Therefore the price of US exports to other countries will be relatively cheaper, and the price of imports from other countries to the US will be relatively more expensive. Therefore, the demand for US exports will increase, while the US demand for imports will decrease, and therefore the trade surplus will increase as we export more and import less. This will then cause AEd to increase, which will increase Y*. 4. During 1981 and 1982, the president and the Congress were pursuing a very expansionary fiscal policy. In 1980 and 1981, the Federal Reserve was pursuing a very restrictive monetary policy in an attempt to rid the economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange market. What do you think would happen to the value of the dollar under these circumstances? c. What impact was such a series of events likely to have on the trade balances in countries like Japan? Ans: a. The expansionary fiscal policy increased incomes and the demand for money. This in itself would cause U.S. interest rates to rise. In addition, the contractionary monetary policy caused interest rates to rise further. b. The US demand for foreign exchange would fall, i.e., shift to the left while the supply of foreign currency would rise, i.e., shift to the right. The value of the dollar would rise, i.e., appreciate. c. The rise in the value of the dollar (with no other change in the desire to buy more imports or exports) would make U.S. goods relatively more expensive. The U.S. trade deficit would worsen, and the trade balance of other countries with the United States would rise.