Wal-Mart Stores, Inc

advertisement

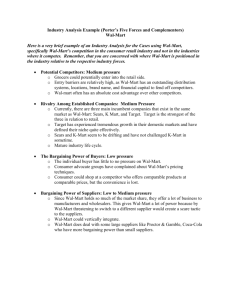

Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 1 Wal-Mart Stores, Inc. Jimmy D. Morgan Business Policy 421OL Thomas Edison State College Dr. Lawrence Ness Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 2 Introduction Wal-Mart’s journey from its humble beginnings in the 1960s as a discount retailer to a juggernaut in 2008 is a result of strategic management initiatives. A business culture has developed in which the management is always alert to solve issues or problems that arise by initiating rapid but effective initiatives. “This culture has enabled all stakeholders to contribute in the process of decision making and thus enhance collaborative efforts that drive the business towards achieving the company’s long and short term objectives” (Hayden, Lee, & Pereira, 2002, p. 2). This analysis will identify the issues leading to the current situation at Wal-Mart, Inc., identify its competitive advantage, examine the strategic efforts to combat Wal-Mart bashing, and make recommendations on how the company can improve its performance. An overview of Wal-Mart’s case Wal-Mart like many other successful corporations is faced with criticism from individuals, groups, and competitors about its business activities. As Sam Walton (CEO) states, “This is especially crucial in the future performance of the company” (Thompson, 2008, p. 3). The success of the business is an obstacle in changing the business with the changing environment as no one can foresee this need including the leadership team. The criticism is a clear evidence of a changing business environment, which can deny an organization a better position in the market, if the warnings are ignored. By initiating several plans within the stores, Wal-Mart has an opportunity to lead in the retail market in various aspects including ethical and environmentally friendly sourcing. “Wal-Mart’s strategy encompasses a number of tactics that ensure product differentiation and cost reduction initiatives” (Hayden, Lee, & Pereira, 2002, p. 1). It Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 3 focuses on cost-efficient operations, reduced prices, a mix of name-brand and private merchandise, wide selection, multiple store formats, customer friendly environment, limited advertising, astute merchandising, customer satisfaction, regulated expansion to new markets, and entering foreign markets through acquisitions. The firm has pursued a low-cost leadership strategy in building its customer base by winning their loyalty with extensive loyalty programs such as discounts. The multiple store formats ensures that the company meets its customer needs while acquisitions have paved the way for the company to increase its global market share. Unfortunately, Wal-Mart is faced with issues that compromise its future. Since 2003, the organization has been subjected to ceaseless criticism from restless individuals and groups about its cost efficiencies. The critics have raised issues about labor standards, substandard wages, insufficient medical benefits, irregularities, and political corruptness. “The organization has been facing legal charges on malpractices, women discriminations at work, and other incidents that have negatively affected the company’s public image” (Lal, 2005, p. 4). This in turn has affected not only the company’s growth rate but its expansion plans as well. Therefore, a major problem that has always faced Wal-Mart since the start of these issues is how to retain its image in the face of the criticisms leveled against it. Analysis: Determining Wal-Mart’s Financial Strength As depicted in Thompson and Gamble’s case study of Wal-Mart, “Wal-Mart store enjoys high liquidity ratios and working capital deficits” (p. C-368). The low quick ratios are a result of Wal-Mart being a retail store and having to maintain inventory levels. What this really means is most of Wal-Mart revenue is tied up in inventory. This is a Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 4 good sign because the company enjoys a small turnover ratio, meaning it effectively manages its inventory. The long-term Debt to Equity ratio is lower than the industry average showing that the company relies on equity financing more, rather than debt financing. This means that when and if the Company borrows money, it is mostly for short-term need; hence, they do not rely on long-term debt to fund their operations. Wal-Mart’s Return to Equity ratios and Net Profit Margin are within the industry average. According to Wal-Mart’s Company’s Website, “The organization is profitable as evidenced by the Price per Earning ratio for year 2007 and 2008” (p. 2). In view of the fact that this ratio is a measure of investors’ expectation from the company, WalMart proves to be a good investment. The Gross Profit Margin for 2007 and 2008 is 24.4% and 24.365 respectively, and Net Profit Margin for the same duration under consideration is 3.24% and 3.36 respectively. This indicates that the operating expenses of the company are very high, however quite normal for a retail industry. Such companies depend on voluminous sales and lower Net Profit Margins. The operating cycle is a representation of duration involved in buying raw materials, processing products, and selling or distributing the products. The cash conversion cycle is a representation of net interval of time between the collection of receipts from sales and the payments for different resources used by the company. The operating cycle equals the sum of the period spent in converting inventory and receivable conversion period. “The cash conversion cycle equals the operating cycle minus payable deferral period. Operating Cycle for Wal-Mart has decreased in 2007 and 2008 from 49.52 to 48.34 respectively. Additionally, this indicates an increase in sales higher than the growth rate” (Wal-Mart, Inc., 2008, p. 3). The two years cash Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 5 conversion cycle is negative indicating high liquidity indicating that the company is managing resources efficiently. From the analysis, it is clear that Wal-Mart represents a good investment although the return on equity averages that of the retail industry. The belief is that WalMart is a less risky investment, supported by high price earnings ratios and the expected growth rate that indicates the company’s financial strength. Investors have faith in Wal-Mart’s operations and management, which is also reflected in the high price earnings ratio. The company as evidenced by percentage increase in return on equity, which is coupled with percentage change in dividends per share over the same period, can easily achieve a steady growth rate. The company also manages its assets efficiently to provide an improved return on investment indicated by the turnover figures and working capital management. Figure 1. 2009/2010 Financial Performance Income statement 2010 2009 Net sales/revenues 405.05 401.09 Gross profits 100.39 97.03 Operating income 23.95 22.79 Total assets 170.41 163.23 Total liabilities 99.95 98.14 Shareholders’ equity 70.47 65.28 Balance sheet Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 6 Figure 2. Key ratios Company Industry Gross margin 24.7 24.9 Net profit margin 3.7 3.6 Debt/equity ratio 0.87 0.78 Current ratio 0.9 1.1 Quick ratio 0.3 0.4 ROE 22.6 20.8 Wal-Mart Resource Strengths and Competencies Wal-Mart’s success in initiating the cost leadership strategy has greatly been influenced by its management team starting from the CEO to the store managers. “The success flowed from Walton’s cheerleading management style, his persistent insistence on continuous improvement, his ability to inspire the principles and management philosophies that he preached into the company’s culture, and his habit to associate with both shoppers and stakeholders” (Thompson, 2008, p. 3). The management team has also been keen to develop focused plans that ensure that short term as well as long term goals has been met. However, the continued success of Wal-Mart has made the managers to become reluctant in addressing issues in a timely manner evidenced by Scott and other top executives’ ignorance to the bad publicity and criticism. Notably, they concentrated on running the business until company’s sales growth decreased and expansion plans were blocked. As Lal (2005) noted, “A focused plan has been developed targeting human resource management and development. Human resource is a key to Wal- Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 7 Mart’s business and the firm invests money and time in training, retaining, and developing them” (p. 5). Wal-Mart being a powerful retail brand has a reputation for value, convenience, low cost and a wide range of products, all in one store. This is perhaps the very factor that has made many customers become loyal to its products despite the current wave of criticism. The company has been able to customize its product depending on their customers needs. The multiple store formats employed by the firm has been able to attract and satisfy customer’s needs, which is a key ingredient for winning their loyalty. Nevertheless, the cost of producing such a wide variety of consumer products has significantly fallen due to low manufacturing costs. Many believe that these costs have fallen due to outsourcing to other low cost regions of the world. Unfortunately, this outsourcing has been one of the problems leading to the company’s current situation. The Wal-Mart store has a core competence in its use of information technology in supporting its international transport and logistics system. This has enhanced its speed and efficiency in delivering its products and services. With increased efficiency, the company has been able to establish a large supplier base, which in turn reduces their bargaining power and therefore low inventory cost. The company has been able to achieve its cost leadership strategy through a streamlined system of suppliers. However, the huge span of control has presented some weak areas despite the use of information technology. The Competitive Position of Wal-Mart Stores Despite the problems facing Wal-Mart, it is still presenting remarkable success, which is evidenced by the huge profits gains. The company’s strategy has enabled it to Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 8 be a leader in the retail market due to its focus on satisfying customer needs at low prices. However, the success of the strategy is restricted to business performance only. Thus, this leaves other people outside the firm to question its activities. “There are clear trends emerging in the business environments that must be confronted such as the aging of the world population, income inequality, a multi-polar balance of power, increased demand for energy, and disruptive power of technology” (Thompson, 2008, p. 4). My analysis reveals that these concerns in one way or the other have been left out during the implementation of its strategy and hence the issues witnessed. Wal-Mart is enjoying a number of competitive advantages, which is evidenced by its incredible success. “The company is the largest employer in the US and is one of the few places available for people to get a decent job regardless of their academic achievements” (Paikala, n.d, 2011, p. 3). The company has the second largest net sales globally. These huge sales are due to the company’s aggressive growth strategy and increased customer demand for supercenters has encouraged the company to add more and more stores. A significant competitive advantage for Wal-Mart is its remarkable logistic system (Paikala, n.d, 2011, p.5). The company is able to ship products from any of their many distribution centers in order to provide the most efficient and cheapest route. The firm even has its own distribution center for its online orders. The innovation of sharing sales information with suppliers via computer programs has enabled the company the advantage of consistently stocking its stores with popular items. Although Wal-Mart has been facing criticism for its low wages, the company is actually doing well for lower income earners. The company can beat out most of the Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 9 competitors with its aggressive pricing strategy. The company has been able to attract higher income earners by opening stores in more urban areas. Customer service offered at Wal-Mart stores is an advantage as well as they are creating a strong friendly image. The company is also paying close attention to environmental issues while pushing for higher wages. Therefore, Wal-Mart’s competitive position is growing stronger and stronger. The comprehensive transformation program initiated by Scott is expected to enable the company, to not only control the negative impacts of the lost reputation but also create a deeper relationship with the customers, employees, and the community at large. Conclusion This analysis indicates that the continuous success of Wal-Mart has restricted the management to focusing on the business alone regardless of the changing market environment. The company’s strategy has not obviously achieved satisfactory success, which is evidenced by the current issues. This analysis additionally shows the company is financially strong with many competitive advantages that it can exploit to better its position in the market, and meet the demands of the changing environment. However, continuous failure to do this will result in the company gradually loosing its face and eventually being unable to stop the bashing. Recommendations Wal-Mart has enjoyed tremendous success in the past, and still has a promising future in the retail market. Unfortunately, there always exists a negative side to success. Wal-Mart is faced with opposition from individuals who share the same interests as the “common man”. The mere fact that Wal-Mart has the resources and ability to be such a Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 10 big competitor scares some people in the retail industry. Both small retail stores in small communities and employees target Wal-Mart simply because such a large company has the resources at hand to defend itself. For Wal-Mart to improve its image in the face of these people, it must address these problems head on. The company has already taken big steps to increase the benefits of the employees and to be seen as an environment friendly company. The analysis indicates that the company needs to continue with this approach, probably even more publicly than other competitors in the retail industry do. The company could also start a campaign to assist the “common man”. With their global impact, the issues raised by the firm will obviously receive a great deal of attention. In such a campaign, the firm should focus on supporting other small stores in the community especially those, which specialize. They could additionally assist in advertising local retailers who do not sell competing products. The company could change their image to one that cares about the community, rather than taking sales past them. This analysis suggests that employee focus is very important. Giving employees benefits publicly will add to their morale as well as the company’s image. After investing on its image in United States, Wal-Mart could further focus on increasing its market share internationally. Other countries present greatest growth potential, and Wal-Mart needs to consider these areas seriously. Case Analysis: Wal-Mart Stores, Inc.: Management’s Efforts to Transform the Company Stop Ongoing Bashing 11 References Gamble, J., Strickland, A.J., Thompson, A. (2010), Wal-Mart Stores, Inc. in 2008: Management’s Initiative to Transform the Company and Curtail Wal-Mart Bashing, Crafting & Executing Strategy 17th Ed., McGraw-Hill Irwin, p. C-367 thru C-400. Hayden, P., Lee, S., & Pereira, M. (2002). Wal-Mart: staying on top of the fortune 500. Retrieved on 03/02/2011 from: http://allman.rhon.itam.mx/~oromero/Wal_Mart_CaseStudy.pdf. Lal, V. (2005). Wal-Mart story. Economic and Political Weekly, pp.2477-2478 Paikala, V. (n.d). Wal-Mart: the retail superpower. Retrieved on 03/02/2011 from: http://www.vinodp.com/documents/investing/WalmartValuation.pdf Thompson, A. A. (2008). Wal-Mart Stores Inc. in 2008: Management’s initiatives to transform the company and curtail Wal-Mart bashing. The University of Alabama Wal-Mart Company website, (2008). Wal-Mart 2008 financial review. Retrieved on 03/02/2011 from: http://walmartstores.com/sites/annualreport/2008/docs/full_financial_report.pdf.