FinalMayEdition.doc

advertisement

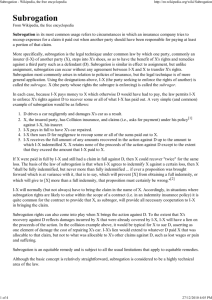

w In This Issue DHHS Proposes Privacy Rule Restraints DOL Finalizes Electronic Communication Rules Winn-Dixie COLI Decision Stands No Schedule F Required for Form 5500 Filings Reduction of DFVC Penalties Weight Loss Programs May be Tax Deductible Medical Savings Accounts Extended Hospitals Flex Muscle to Control Pricing California Law to Control SSN Usage Since You Asked — Changing Coverage in Anticipation of a QE Issue Spotlight — Right of Subrogation is Alive and Well DHHS Proposes Privacy Rule Restraints In April, President Bush announced that he would move ahead with the medical confidentiality regulation adopted by the Clinton administration — but with slightly relaxed rules. President Bush has now followed through and has proposed changing some of the federal rules governing medical privacy (scheduled to go into effect April, 2003). The Department of Health and Human Services (DHHS) had to issue the modification because Congress had failed to meet its own deadline for doing so. The initial set of rules went far beyond Congress’ intent for privacy by extending new privacy protections to all types of medical records and communications and imposing compliance requirements. The new rules will help scale back the scope of privacy protection in a manner designed to ease compliance and administration. Among the key changes, are: Changing the rule’s original requirement that patients give consent to the release of information before receiving treatment. Instead, although patients would have to be informed of their privacy rights, providers could treat them without first receiving a signed privacy consent form. May 2002 www.willis.com Restrictions similar to those imposed on financial records under the Gramm-Leach-Bliley Act on the use of medical records for marketing purposes. Keeping an April 14, 2003 deadline for most covered entities. However, the deadline requiring covered entities to replace existing contracts would be extended to April 14, 2004. The new rules would potentially leave state privacy laws in place. Unless a special rule is established for multi-state employers, they may have to meet separate requirements for each state in which they conduct business. American Benefits Council President Jim Klein issued a written statement calling on the DHHS, “to seek clear statutory authority from Congress to establish the final regulations on a single, nationally uniform basis, so conflicting or duplicative state laws would not apply to employer-sponsored health plans.” DOL Finalizes Electronic Communication Rules The Labor Department has published a final rule expanding the options available for employee benefit plans interested in using electronic communications. The rule also covers the use of electronic media to maintain employee benefit plan records. The final regulations apply on the first day of the first plan year beginning on or after October 9, 2002 (January 1, 2003 for calendar-year plans). The final regulations now permit electronic disclosure of all documents (under jurisdiction of the DOL) which are required to be disclosed under Title I of ERISA. The final rule covers electronic communications at work and generally allows electronic communications outside the workplace if certain conditions are met. Subject to additional rules and conditions, electronic disclosure must now satisfy the following: Plan sponsors must implement measures that are “reasonably calculated to ensure that the system for furnishing documents results in actual receipt of transmitted information and protects the confidentiality of personal information relating to the individual’s accounts and benefits.” This requirement may be satisfied, for example, by using an electronic return-receipt system. Plan sponsors’ electronic documents must be “prepared and furnished in a manner that is consistent with the style, format, and content requirements applicable to the particular document.” The fact that a document may be transmitted electronically does not change the fundamental requirements connected with the document. Plan sponsors must notify “each participant, beneficiary, or other individual, in electronic or nonelectronic form, at the time a document is furnished electronically, that apprises the individual of the significance of the document and of the right to request and obtain a paper version of such document.” Plan sponsors must, upon request, furnish the participants, beneficiaries, or other individuals receiving electronic documents paper versions of the electronically furnished documents. 2 Other important requirements apply. Moreover, depending on an employer’s individual circumstances, electronic disclosure may not be the best method. As a result, careful planning will be required before adopting an electronic communications system that meets ERISA requirements. Winn-Dixie COLI Decision Stands A Supreme Court decision reminds employers to be wary of benefit transactions that seem “too good to be true.” Winn-Dixie, a large supermarket chain, entered into a broad-based corporate owned life insurance (COLI) transaction. It purchased whole life policies on the lives of substantially all of its 36,000 full time employees. The complicated scheme was engineered for tax purposes rather than for any legitimate benefit purpose. Specifically, the policies and their funding were designed so that they would produce a net loss for the company — but Winn-Dixie was simultaneously involved in a systematic practice of borrowing (at high rates) against the policies. This practice produced a sizeable tax deduction that, in turn, yielded a net benefit to Winn-Dixie. In other words, the Winn-Dixie COLI transaction was structured to turn an interest “loss” into a net gain, as the loans against the policies created valuable corporate tax deductions. Both the Tax Court and the Eleventh Circuit Court of Appeals held that even though the plan may have “technically” qualified for a tax deduction, based on Winn-Dixie’s facts and circumstances, the program had no economic benefit to the company except to serve as a tax deduction vehicle. In the end the court disallowed the company’s deductions when it determined that the COLI transaction had no substance other than to provide tax benefits. (The Eleventh Circuit includes Alabama, Florida and Georgia.) The Supreme Court refused to consider an appeal in this case. A front page article describing the COLI arrangement adopted by Winn-Dixie (and used by other employers as well) appeared in the April 19, 2002 edition of the Wall Street Journal. What does this case mean to benefit plan sponsors? The broadest implication may be that the judiciary seems increasingly willing to squelch transactions which, although they may satisfy “technical” legal requirements, are actually in place to serve an ulterior employer motive. As a result, the “sham transaction doctrine” should be considered before becoming involved with any benefit plan strategies that sound “too good to be true.” No Schedule F Required for Form 5500 Filings The IRS just issued a Notice (Notice 2002-24) which indefinitely suspends the requirement to file Schedule F along with the Form 5500. The Schedule F has long been an IRS filing requirement for cafeteria plans, adoption assistance programs, and educational assistance plans. This IRS Notice means that cafeteria programs, along with educational and adoption assistance plans, no longer face a direct filing obligation. Although the IRS filing requirement for cafeteria plans has been eliminated, the DOL requirement for welfare benefit plans remains in place. In other words, you must still file the Form 5500 for any welfare 3 benefit plans that you offer (e.g., medical, dental, life insurance, disability, and vision plans), unless your plan qualifies for a DOL recognized filing exemption. The IRS Notice is effective immediately (as of April 4, 2002) and applies to all plan years for which the Schedule F has not yet been filed, including filing years before 2001. Reduction of DFVC Penalties The Department of Labor (DOL) launched the Delinquent Filer Voluntary Compliance (DFVC) program in 1995 to encourage late- or non-filers to catch up on past filings at a significantly lower cost. Since 1995 there has been strong employer lobbying for a new penalty structure to reduce the fines and further promote compliance. The DOL listened and recently announced final rules governing DFVC penalties. As has been the case, the DFVC program is available only to plans that have not been notified in writing by the DOL of a failure to file a timely annual report. Employers who have delinquent filings should seriously consider availing themselves of this program. An outline of the new DFVC rules is listed below: Effective Date The new penalty amounts are effective on March 28, 2002 and apply for all plan years beginning on or after January 1, 1988. Penalty Amounts Daily penalty amount: $10 (previously up to $1,100 per day) Maximum penalty per late filing for large plans: $2,000 (was $5,000) Maximum penalty per late filing for small plans: $750 (was $2,500) New Maximum Penalty Introduced This means that if a plan has not filed for six years, the DOL will now assess a capped penalty for the combined late filings of that plan number. There is no “per administrator” or “per sponsor” cap. The capped per plan penalties are: For large plans: $4,000 For small plans: $1,500 4 New Small Plan Relief Introduced Special relief for small plans maintained by organizations that are tax exempt under Internal Revenue Code Section 501(c)(3) (including 403(b) plans). The penalty is $10 per day, not to exceed $750 per DFVC submission, regardless of the number of Form 5500s filed in a DFVC submission. Filing Procedure The government has relaxed rules regarding which form can be used for late filings. Now, filers may use either the form from the appropriate year, or the filer may use the most recent Form 5500. Also, the forms and the penalty check should no longer be labeled with red ink as “DFVC filings.” DFVC checks and the copy of the first page of each Form 5500 should now be sent to the following address: DFVC Program Pension and Welfare Benefits Administration P.O. Box 530292 Atlanta, GA 30353-0292 Weight Loss Programs May be Tax Deductible The IRS has released a new Revenue Ruling (Rev. Rul. 2002-19) recognizing certain unreimbursed expenses incurred in connection with participation in a weight-loss program as medical expenses under Code Section 213. Such expenses must be associated with a specific disease or ailment (such as obesity or hypertension) in order to be deductible. Although the ruling does not specifically address reimbursements from health care spending accounts, many employer sponsored flex plans are written to automatically recognize expenses as FSA reimbursable as long as Section 213 is satisfied. So, this ruling is expected to have an impact on flexible spending account administration. The ruling would also allow individuals to deduct these expenses from their personal income tax returns if total qualified medical expenses exceed 7.5% of adjusted gross income. The ruling notes that weight-loss for appearances or to maintain good health is not a qualified medical deduction, but if a specific medical condition is being addressed through weight loss treatment, the IRS will not object to recognizing treatment as a valid medical expense. Eligible expenses for reimbursement include fees to join and attend weight-loss programs and expenses for diet plans and books that are not paid by insurance. However, costs for diet foods are not reimbursable. Some plan administrators may not want to reimburse these claims because of the additional documentation needed to verify them. In that case, the plan document should specifically exclude these expenses. 5 If a plan administrator wishes to process these claims, the administrator should require a letter from a medical doctor to substantiate the expense before authorizing reimbursement to an FSA participant for costs associated with weight loss treatment. The letter should state the medical necessity and specific medical condition to be treated by the weight loss program. Medical Savings Accounts Extended Medical savings accounts (permitted on a temporary basis as part of HIPAA), will continue for an extra year under legislation (H.R. 3090) recently signed by President Bush. The bill extends the MSA project through December 31, 2003. The legislation also includes a provision extending tax penalties for noncompliance with the 1996 Mental Health Parity Act through December 31, 2003. The signing of the legislation marks the second extension of the MSA demonstration since their introduction. Excluded from the measure were subsidies for health insurance coverage for unemployed workers. An issue of contention throughout the debate over stimulus legislation had been whether to provide tax credits for the purchase of health insurance, or direct subsidies for the maintenance of group coverage under COBRA. As some studies show actual COBRA costs often run fifty percent more than paid premium costs — most employers were understandably opposed to the measure. Hospitals Flex Muscle to Control Pricing When clients ask us about the root of skyrocketing health coverage costs, we often discuss the powerful pricing clout that hospitals now enjoy. According to a front page Wall Street Journal article, hospitals across the nation have the upper hand in price setting. In some cities, dominant hospital groups are setting virtually unchallengeable increases as high as five times the inflation rate. The article notes that a relatively short time ago, insurers forced hospitals to forego price increases and reduce in-hospital stays. If the hospital objected, the insurer could threaten to go to a rival hospital down the street. Times have started to change with many hospitals merging into chains. Now if a hospital chain covers a major portion of the market, that group has the leverage to control pricing and leave insurers with few options. In turn, this phenomenon results in higher costs to employers seeking to offer its workforce meaningful hospital benefits. California Law to Control SSN Usage California has enacted a law (Senate Bill 168) to ensure the privacy of Social Security numbers (SSN). The law is intended to protect individual confidentiality and to serve as a safeguard against identity theft, but it has important implications for employers sponsoring group health plans. Among its more controversial provisions, the law prohibits the printed use of SSNs on group health insurance identification cards. SB 168 generally goes into effect on July 1, 2002, although delayed effective dates apply to HMOs, insurers, health care providers, and pharmacy benefit managers (PBMs). 6 The law was drafted to achieve maximum applicability and therefore affects any “person or entity.” According to the statute, a “person” is defined as “any natural person, corporation, partnership, limited liability company, firm, or association.” (State or local agencies are not subject to the law.) The law specifically applies to HMOs, insurers, and pharmacy benefit managers (PBM). However, due to ERISA preemption, the law will not apply to self-insured benefit plans. Nevertheless, as is often the case, even a self-insured employer may find itself indirectly subject to the new law. For example if an employee benefit program includes an HMO (or other services) which must directly comply with the state law and consequently the HMO alters its administrative practices for all of its clients (insured and self-funded) it will affect the employer’s program regardless of ERISA preemption. In addition, to the extent that an employer uses a worker’s SSN for non-legally required purposes — such as for certain human resource functions — it may face compliance issues regarding SB 168. Although human resource uses of SSNs are beyond the scope of this discussion, California employers should consider implementing a comprehensive review of their current policies and practices to determine how SSNs are being used and whether any changes are needed to ensure compliance. Senate Bill 168 generally prohibits the following activities: Intentionally making public an individual’s SSN; Printing Social Security numbers on any cards used to access services (for example, benefit plan identification cards). Requiring an individual to transmit his or her SSN over the Internet unless the connection is secure or the SSN is encrypted; Requiring an individual to use his or her SSN to access a web site unless a password or other authentication method is also required; Printing an individual’s SSN on any materials that are mailed to the individual unless state or federal law requires the SSN to be on the document. (A special rule allows applications and forms sent by mail to include Social Security numbers.) The new California law does not prevent any uses of a Social Security number that may be required by state or federal law, or the use of a Social Security number for “internal verification” or “administrative purposes.” Interestingly, the legislature left these key terms undefined — thus at least raising the possibility that “internal verification” and “administrative purposes” may serve to provide important flexibility to employers as they gear up for compliance with the new law. Although many SB 168 provisions are primarily directed at insurers, employers should still consider reviewing their current uses of Social Security numbers and determine what changes in their administrative processes the new California law requires. In addition, employers operating outside California should determine whether changes required by the new law offer an opportunity to remove Social Security numbers from their routine work operations. California’s new law, and the on-going concerns raised by the federal government’s looming privacy regulations may make this an ideal time to examine alternate identification approaches. Even if not otherwise required, many employers have chosen alternate methods because of the favorable workforce reaction. 7 Since You Asked — Changing Coverage in Anticipation of a QE Dropping spousal coverage at open enrollment may look like a COBRA qualifying event, but it is not. (Voluntarily dropping the coverage is not a listed event connected with a loss of coverage that would trigger COBRA.) Nevertheless, what should employers do in such a situation? The COBRA regulations note that reduction or elimination of coverage in anticipation of a qualifying event does have COBRA implications when a COBRA event (such as a divorce) subsequently occurs. In such a case, the “voluntary” dropping of coverage at open enrollment is disregarded in determining whether a specified event results in a loss of coverage. This important rule prevents employers and employees from eliminating COBRA rights before an event, by applying COBRA rules as if the reduction or elimination had not occurred. This enables an individual whose coverage was reduced or eliminated to elect COBRA coverage identical to coverage in effect before the reduction or elimination. The rationale for this rule seems clear when an employer reduces or eliminates coverage to limit COBRA rights. This rule also applies, however, when an employee reduces or eliminates coverage in anticipation of a qualifying event. If an employee drops a spouse’s coverage at an annual enrollment period, that spouse is not a qualified beneficiary at that point because being voluntarily dropped from coverage is not one of the specified events. If the employee and spouse later divorce, under the “in anticipation” rule, COBRA must be offered to the ex-spouse if the covered employee dropped the spouse from coverage in anticipation of the divorce. When this rule applies, the divorce is treated as the qualifying event, and COBRA coverage runs from the date of the divorce. (Coverage is not reinstated for any period before the divorce.) This rule also extends to legal separations if the legal separation would cause a loss of coverage under the plan. This rule presents special challenges to plan administrators. A plan may need to provide coverage to an individual whose coverage terminated several months earlier. This may be extremely difficult for an insured plan. If a spouse is taken off the plan prior to a divorce, a carrier for the plan may resist reinstating the spouse’s coverage under COBRA when the divorce occurs several months later. In addition, nothing in available COBRA guidance specifies how to determine whether an employee dropped a spouse’s coverage in anticipation of a qualifying event. In most cases, the only indication that the “in anticipation” rule may apply is the fact that a divorce occurs after the employee drops the spouse’s coverage. Because the “in anticipation of a qualifying event rule” looks so much like a COBRA triggering event, some clients find it helpful to send out a notice explaining that the individual has lost health coverage and that COBRA rights might emerge at a subsequent date. Providing this notice generally will trigger a response from a spouse who may be unaware of the termination, which will give the plan administrator a good indication whether the coverage was dropped in anticipation of a subsequent divorce. In that event, the plan administrator should contact any insurance carrier (including a stop-loss carrier) promptly to ensure that the carrier will provide any required COBRA coverage when/if the divorce occurs. 8 Issue Spotlight — Right of Subrogation is Alive and Well The Supreme Court recently issued a decision that generally limits an employer’s ability to enforce ERISA “right of reimbursement” provisions. (This is a legal concept similar to subrogation.) The court’s decision means that employers will need to review their plan rules and determine how to adjust plan provisions to maximize protections in the future. This case has drawn a lot of attention and, in some cases, practitioners have inaccurately characterized what this case means to employers. For example, if you contract with a third-party subrogation manager to handle your subrogation claims, you may receive a letter from your subrogation manager stating that the right of subrogation is unenforceable. What some subrogation managers fail to realize is that there are subtle differences between a “right of reimbursement” and a “right of subrogation.” In effect, the right of reimbursement allows the plan to wait until the end of a legal confrontation to get involved; the right of subrogation requires that the plan sponsor become an active partner with the plan participant from the beginning. Specifically, the Supreme Court said that, under ERISA, a plan sponsor could not argue that its right of reimbursement language is an enforceable contract; rather, the employer would have to pursue other types of remedies that are allowed under ERISA. Subrogation is a remedy allowed under ERISA and requires that an employer enforce its rights from the beginning, usually by hiring an attorney or sharing attorneys’ fees with the injured party, or at least asserting a lien against all recovered funds. Some third-party subrogation managers have misunderstood the Supreme Court decision and are encouraging plan sponsors to, among other things, lower the plan sponsor’s expectations about recovery in a subrogation action. This approach is not necessary in most cases. (Some managers are urging clients to extend the subrogation manager’s authority so the manager can settle claims for much lower percentages of recovery for the plan sponsor.) All employers should review their plan’s current subrogation language and be aware of the unavailability of right of reimbursement provisions. However, plan sponsors should be heartened to note that subrogation provisions will continue to serve as an important and viable tool to protect the financial integrity of their employee benefit plans. 9 U.S. Benefit Office Locations Anchorage, AK (907) 562-2266 Dallas, TX (972) 385-9800 Mobile, AL (334) 433-0441 Salt Lake City, UT (801) 453-0010 Atlanta, GA (770) 640-2940 Detroit, MI (248) 735-7580 Morris Plains, NJ (973) 538-7140 San Diego, CA (619) 297-7111 Baltimore, MD (410) 527-1200 Eugene, OR (541) 687-2222 Nashville, TN (615) 872-3700 San Francisco, CA (415) 981-0600 Birmingham, AL (205) 871-3871 Ft. Worth, TX (817) 335-2115 New Orleans, LA (504) 581-6151 San Jose, CA (408) 452-7555 Boston, MA (617) 437-6900 Greenville, SC (864) 232-9999 New York NY (212) 344-8888 Seattle, WA (206) 386-7400 Cary, NC (919) 968-4472 Charlotte, NC (704) 376-9161 Knoxville, TN (865) 588-8101 Lexington, KY (859) 223-1925 Philadelphia, PA (610) 964-8700 Phoenix, AZ (602) 787-6000 Tampa, FL (813) 281-2095 Washington, DC (301) 530-5050 Chattanooga, TN (423) 756-7821 Los Angeles, CA (818) 548-7500 Portland, OR (503) 224-4155 Wichita, KS (316) 264-5311 Chicago, IL (312) 621-4700 Louisville, KY (502) 499-1891 Raleigh, NC (919) 459-3000 Wilmington, DE (302) 477-9640 Cleveland, OH (216) 861-9100 Milwaukee, WI (414) 271-9800 Rochester, NH (603) 332-5800 Columbus, OH (614) 766-8900 Minneapolis, MN (763) 302-7100 St. Louis, MO (314) 721-8400 Other Willis Locations: Willis has offices in more than 20 other U.S. Cities and in 70 countries around the world, with a total of 260 offices worldwide. FOCUS is produced by National Benefits Resource of Willis: focusonbenefits@willis.com or 877-4WILLIS (toll-free). FOCUS is not intended to provide legal advice. Please consult your attorney regarding issues raised in this publication. Willis publications appear on the internet at: www.focusonbenefits.com. Copyright 2002 Willis 10