Martin Wolf: A new gilded age

advertisement

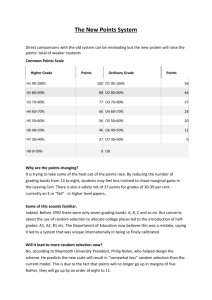

Martin Wolf: A new gilded age By Martin Wolf Published: April 25 2006 19:54 | Last updated: April 25 2006 19:54 Between 1997 and 2001, the top 10 per cent of US earners received 49 per cent of the growth in aggregate real wages and salaries, while the top 1 per cent received an astonishing 24 per cent. Meanwhile, the bottom 50 per cent received less than 13 per cent. Why is this happening? And should non-egalitarians care? The data I have cited come from a remarkable paper from two economists at Northwestern University.* The authors ask a simple, but telling, question: if the US economy is becoming more productive, why have most of its citizens not become better off? The answer, it turns out, is that the normal link between productivity and real earnings is broken. Thus, between 1966 and 2001, real median earnings (the earnings of those half way up the distribution) rose by only 11 per cent. Over the same period, the earnings of those at the 90th percentile (10 per cent from the top) rose by 58 per cent, of those at the 99th percentile by 121 per cent, of the top 0.1 per cent by 236 per cent and of the top 0.01 per cent by 617 per cent. Between 1997 and 2001, the top 0.1 per cent of earners received just under 8 per cent of the increase in aggregate wages and salaries and the top 0.01 per cent close to 4 per cent. The share of the latter group in the increased incomes was more than double the share of the worstpaid 20 per cent. The distribution of US earnings has, as a result, become significantly more unequal over the past four decades: the share of the top decile has gone from 27 per cent in 1966 to 38 per cent in 2001; that of the top 1 per cent has risen from 6 per cent to 12 per cent; and that of the top 0.1 per cent has jumped from 1 per cent to 5 per cent . These data are for wages and salaries alone. Yet the richest people in a market economy are owners of productive capital. This remains true: the top 1 per cent of income recipients received 34 per cent of non-wage income, but “only” 11 per cent of wages and salaries, in 2001. Here, too, inequality has risen: in 1966, this elite category had received just 24 per cent of non-wage income. Yet the share of non-wage income in the incomes of the top 1 per cent of income recipients has also been falling. In 2001, it was 50 per cent, down from 61 per cent in 1966. For the top 0.1 per cent, it fell from 72 per cent of incomes to 60 per cent. The rising importance of earned incomes to those at the top of the income distribution is also shown in an analysis of still longer-term shifts.** A paper published by the National Bureau of Economic Research shows that income inequality in the US is returning to where it was almost a century ago, after a steep decline in the mid-20th century (see chart). The share of the top 0.01 per cent in the US income distribution fell from close to 4.5 per cent in 1916 to around 0.5 per cent in 1971, before rising to 3 per cent in 1998. The greater part of the decline in the early part of the century was due to a collapse in income from capital. The greater part of the increase since 1971 is due to the rise in earned income. In consequence, conclude the authors, “top wage earners have replaced capital income earners at the top of the income distribution”. Moreover, this is also true of other English-speaking countries, though to a smaller extent, but not of Japan and continental European So why is this happening? The classic explanation is “skill-biased technical change”, reinforced by the impact of globalisation on incomes of the unskilled. Yet the pattern that emerges is hardly consistent with this, since there has been such a huge increase in the dispersion of earnings even among the already very skilled. More plausible answers are the “superstar” phenomenon in sports and entertainment and the ability of corporate bosses and investment bankers to extract vastly higher relative salaries than before. The authors from Northwestern university conclude that top corporate executives account for more than half of the incomes in the elite 0.01 per cent of the US income distribution. So are they worth it? That is a controversial question. I, for one, doubt it. The ratio of the pay of US chief executive officers to average wages rose from 27 in 1973 to 300 in 2000. But this jump is largely limited to the US. While average performance of US CEOs may well be better than anywhere else, it is easy to find non-US CEOs whose performance has vastly outshone that of their US peers, without close to commensurate rewards. Executive pay is, in fact, a game of leapfrog, in which every compensation committee tries to pay its CEO more than the average, with the inevitable results. This raises a bigger question: do these changes in the US distribution of incomes matter? I would suggest that they should do so even to non-egalitarians, for three reasons. First, income mobility does not offset the rising inequality. As the two Northwestern university authors note, “not only are half the penthouse dwellers still there a decade later, but the differential opulence of the penthouse keeps increasing relative to the basement”. The chances of leaving the basement are low. Moreover, intergenerational opportunity is also adversely affected. Second, the failure of an economy to generate rising incomes for a majority over decades causes frustration. US individualism may contain this reaction. Most cultures cannot. Third, politics inevitably become more populist: the US “right” has become “pluto-populist” – an alliance of free-marketeers, nationalists and social conservatives – and the “left” is increasingly “protecto-populist” – an alliance of protectionists, dirigistes, social liberals and anti-nationalists. This endangers both intellectual coherence and sensible policymaking. So long as the distribution of incremental incomes remains as skewed as it has been in recent decades, politics in the US are likely to remain at least as fractious as they are today. Moreover, so long as this trend continues, many other high-income countries will reject the US economic model. No simple solutions exist. But the return of the “gilded age” is a big event, for the US and the world. * Ian Dew-Becker and Robert Gordon, “Where did the productivity growth go?”, National Bureau of Economic Research working paper 11842, December 2005, www.nber.org; ** Thomas Piketty and Emmanuel Saez, “The evolution of top incomes”, NBER working paper 11955, January 2006 martin.wolf@ft.com Copyright The Financial Times Limited 2008