Guideline Phasing Out the Penny (July 2013)

advertisement

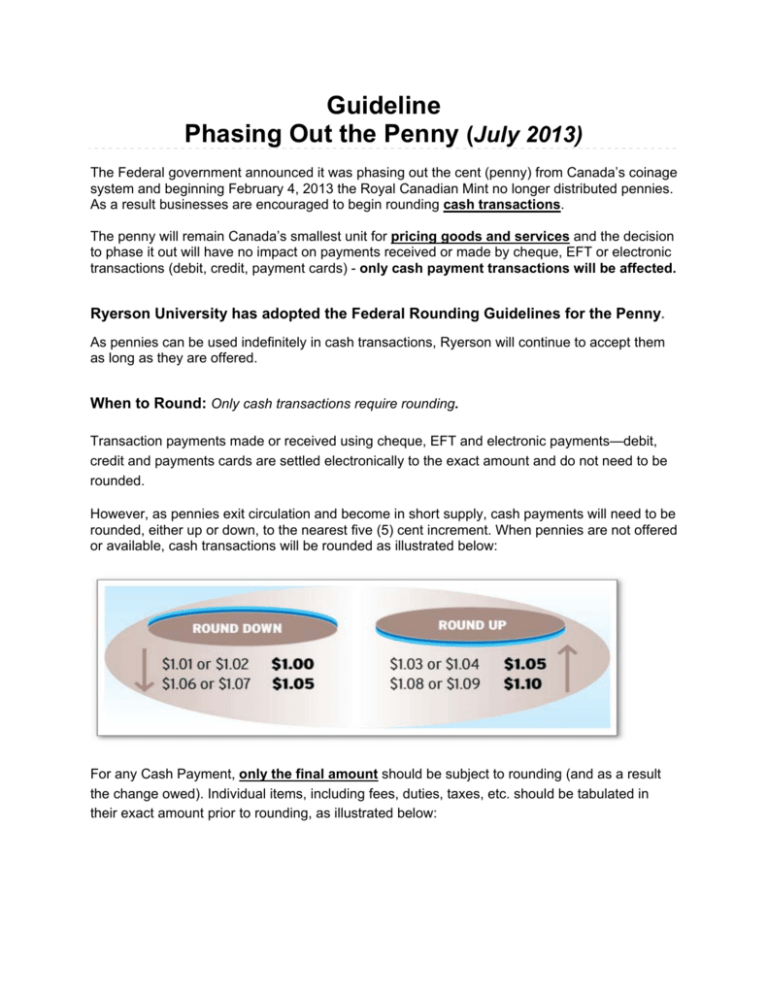

Guideline Phasing Out the Penny (July 2013) The Federal government announced it was phasing out the cent (penny) from Canada’s coinage system and beginning February 4, 2013 the Royal Canadian Mint no longer distributed pennies. As a result businesses are encouraged to begin rounding cash transactions. The penny will remain Canada’s smallest unit for pricing goods and services and the decision to phase it out will have no impact on payments received or made by cheque, EFT or electronic transactions (debit, credit, payment cards) - only cash payment transactions will be affected. Ryerson University has adopted the Federal Rounding Guidelines for the Penny. As pennies can be used indefinitely in cash transactions, Ryerson will continue to accept them as long as they are offered. When to Round: Only cash transactions require rounding. Transaction payments made or received using cheque, EFT and electronic payments—debit, credit and payments cards are settled electronically to the exact amount and do not need to be rounded. However, as pennies exit circulation and become in short supply, cash payments will need to be rounded, either up or down, to the nearest five (5) cent increment. When pennies are not offered or available, cash transactions will be rounded as illustrated below: For any Cash Payment, only the final amount should be subject to rounding (and as a result the change owed). Individual items, including fees, duties, taxes, etc. should be tabulated in their exact amount prior to rounding, as illustrated below: How Rounding will affect your Daily Cash Deposits When Cash is accepted as payment and pennies are not available, rounding as illustrated above will take place. This means that from a cashiering perspective, at the end of the day, your “Cash” will be either over or short by the cumulative amount of the rounding. This difference should be distributed (coded) to the following Ryerson account code - Overage /Shortage account code (7582). The Penny - Frequently Asked Questions 1. Why is the penny being phased out? The penny is being phased out due to the rising cost of production, the increased accumulation of pennies by households, environmental considerations, and the significant handling costs that the penny imposes on retailers, financial institutions and the economy in general. The estimated savings for taxpayers by phasing out the penny is $11 million a year. 2. When will the Government stop distributing the penny? The Royal Canadian Mint will cease the distribution of pennies to financial institutions on February 4, 2013. On this date, businesses will be encouraged to begin rounding cash transactions in a fair and transparent manner. Financial institutions will no longer be receiving pennies from the Mint after February 4. 3. Are businesses required to accept pennies after February 4, 2013? The penny will retain its value indefinitely and consumers can use pennies for cash transactions with businesses that choose to accept them. While businesses do not have a legal obligation to accept any particular Canadian coins or bank notes in a retail transaction, the penny will continue to be legal tender like all other Canadian coins, and businesses may accept the coin as a means of payment if they so choose. . If a customer offers pennies, Ryerson will continue to accept them. 4. After February 4, 2013, are businesses allowed to make change in pennies? If the pennies are available to make change then they should be used. Otherwise Ryerson departments will round the final amount (or the change owed) of any cash payment in a fair, consistent and transparent manner. Symmetrical rounding will be adopted by all Ryerson departments accepting cash transactions with the public 5. Do we round the prices of individual items? No. Only the final amount in a cash transaction should be subject to rounding. Individual items, as well as any duties, fees or taxes, should be tabulated in their exact amount prior to rounding. This includes the Goods and Services Tax/Harmonized Sales Tax (GST/HST). 6. Do we round the Amount due if the consumer has the exact change? No, if the exact amount is offered as payment Ryerson will accept the pennies. 7. Are financial institutions required to accept pennies? Canadians can continue to deposit pennies at their financial institution. Some financial institutions may require large amounts of pennies to be rolled or wrapped for deposit as they have the discretion to decide whether pennies must be rolled or not. 8. How long do we have to turn in all pennies? The penny will retain its value indefinitely. There is no time limit for redeeming pennies. 9. How will the GST/HST be calculated without the penny? The GST/HST should be calculated in the exact same manner as it was before the penny was phased out. For any cash payment, only the final amount (or equivalently, the change owed) should be subject to rounding. Individual items, as well as any duties, fees or taxes, should be tabulated in their exact amount prior to rounding. Payments made using non-cash methods such as cheque, EFT and electronic payments do not need to be rounded, because they are settled electronically to the exact amount. 10. Will the rounding affect the Goods and Services Tax/Harmonized Sales Tax (GST/HST) that has to be paid? No. For any cash payment, only the final amount is subject to rounding. Individual items, as well as any fees, duties or taxes (including the GST/HST) should be tabulated in their exact amount prior to rounding. 11. How will accepting foreign currencies, government cheque, gift cards and split payments be affected by rounding? Payments made using non-cash methods such as cheque, EFT and electronic payments— debit, credit and other payments cards (i.e. gift cards and prepaid credit cards) do not need to be rounded because they are settled electronically to the exact amount. Charges are calculated in the same manner as before. For any cash payment, only the final amount (or the change owed) is subject to rounding. Individual items, as well as any duties, fees or taxes, should be tabulated in their exact amount prior to rounding. In all cases, we are expected to round final totals in a fair, consistent and transparent manner. 12. When a consumer requests a refund, is the amount subject to rounding? If a refund is paid out in cash and pennies are not used, departments are expected to round the final amount in a fair and transparent manner as illustrated above. 13. Will businesses need to update cash registers for rounding? Rounding for cash payments occurs after tabulation of duties, fees or taxes. Departments can choose to update their cash registers to automatically calculate rounding for cash transactions and to provide greater transparency and clarity to their customers by showing the rounding on receipts. 14. How can a charity like Ryerson benefit from the phase out of the penny? The redemption of pennies presents charities with a fundraising opportunity by getting involved in the process of withdrawing the coin from circulation. The Government encourages Canadians to consider donating pennies to charities. Charities are welcome to take advantage of the initiative to increase their fundraising through penny drives. Charities should consult their financial institutions before starting any fundraising campaigns relating to the phase out of the penny to determine best practices for collecting and redeeming the coins. This will ensure charities and financial institutions are well-prepared to manage a potentially large volume of pennies, and will ease the reimbursement once the campaign is complete. 15. How will the elimination of the penny affect my petty cash reimbursement request or my iExpense claim? As long as pennies are available, the reimbursement to the claimant should be made to the exact amount. However when pennies are no longer available, the claimed amount whether paid by cash, debit or credit card will be rounded as the Penny Guideline indicates. Custodians of a Petty Cash fund will record the NET overage /shortage from penny rounding when the fund is reimbursed. However, staff members seeking re-imbursement through iExpense will be reimbursed to the exact amount as the reimbursement payment is made by Cheque or EFT. 16. My question isn’t answered here. Who should I ask? General inquiries should be made to your Financial Advisor in Financial Services or Ms. Elizabeth Harte, Supervisor, Faculty and Staff Cash Office.